by Kendra Hughson | Jul 9, 2019

It’s still the dog days of summer so it’s hard to believe that the first day of school is right around the corner. Soon, the kids will be wrapping up the lazy days of summer and the fun of summer camps and family vacations to prepare for the back to school routine. Making school supply shopping a special event helps children get excited and ready for the new school year. Back to school costs can add up so be sure to have a plan.

Plan ahead for back to school savings. Photo Credit: Kendra Zamojski

- Create a list of back to school supplies and clothes. Check with your local school for a current list of required school supplies. Remember to include clothes, shoes, sports equipment, extracurricular activity supplies, and other school fees. Inventory items that you may already have from the last school year. Identify what items might be outgrown or need to be replaced and note what items are still usable.

- Determine a budget and stick to it. Involve children in creating a budget and making purchasing decisions to help them learn financial management skills. Shopping with children is great time to talk about needs versus wants and how to make buying decisions to stay within a budget. Children might be able to contribute some of their own earned money to buy school supplies or clothing.

- Take advantage of the Back to School Sales Tax Holiday. The State of Florida has declared August 2 – 6, 2019 as a Back to School Tax Holiday. Eligible items include: Clothing, footwear, and certain accessories selling for $60 or less per item, certain school supplies selling for $15 or less per item, and Personal computers and certain computer-related accessories selling for $1,000 or less per item, when purchased for noncommercial home or personal use. For a complete list of eligible items visit the Back to School Tax Holiday site: https://revenuelaw.floridarevenue.com/LawLibraryDocuments/2019/06/TIP-122444_TIP_19A01-03_FINAL_RLL.pdf

- Many stores offer back to school sales and deals. Grab sales flyers and shop around for the best deals. Thrift stores and consignment shops are some other alternatives.

For more information, contact your local UF/IFAS Extension office: https://sfyl.ifas.ufl.edu/find-your-local-office/

For more information on back to school topics:

http://blogs.ifas.ufl.edu/franklinco/2018/08/02/back-to-school-survival-tips/

https://fyi.extension.wisc.edu/news/2015/08/05/planning-for-back-to-school-shopping/

by Kendra Hughson | Apr 10, 2019

Just like your home, finances need regular “cleaning” and maintenance. Plan time this spring to focus on financial tasks. A little time spent getting organized and reviewing your financial habits helps keep your financial goals on track.

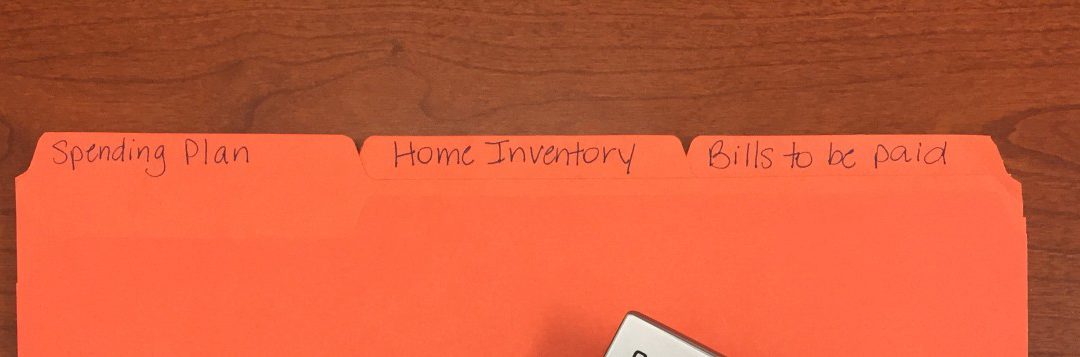

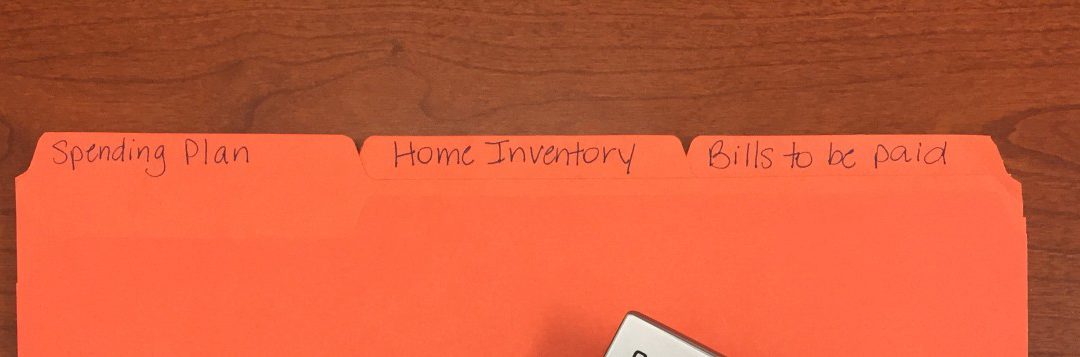

Spring clean your finances by getting organized. Photo Credit: Kendra Zamojski

Get Organized

A good spring cleaning starts with getting organized. Sort through important papers. Decide what you need to keep and what can be shredded or tossed. File your important papers. If you don’t have a home filing system, now is a great time to set one up. With an organized filing system, you can locate important documents quickly and easily when needed. Use UF/IFAS Extension’s Financial Recordkeeping resource to know what to keep and what to toss.

Track Your Spending

Update your spending plan by reviewing your financial goals. Check your financial progress by tracking your spending. Where is your money going? Is your money going toward your goals? Get the whole family involved in recording expenditures for a month. Track expenses by writing down every expenditure on a piece of paper. Alternatively, find a box and place all your receipts in it, being sure to include any money spent even if you didn’t receive a receipt. At the end of the month, review your spending record and look for places where you can cut back. UF/IFAS Extension’s Building a Spending Plan: All Six Steps is a great tool to create or update your spending plan.

Review Your Credit Report

A good credit history saves money through lower interest rates and makes it easier to get credit when needed. Annually, review your credit report from each of the three major credit bureaus. By law, consumers are entitled to one free copy of their credit report every 12 months from Equifax, Experian, and TransUnion. Get free copies of your credit reports at www.annualcreditreport.com. Consider rotating through the three bureaus every few months so you can check your credit report throughout the year. Review your credit report for errors and fraudulent activity. Also, review any negative information that could impact your credit and credit score.

Credit scores are based on the information contained in your credit report. You can obtain your credit score from www.myfico.com for a fee. Many credit card companies offer free FICO scores through their online billing websites. Companies like Credit Karma and Credit Sesame offer free credit score estimates but these sites also include advertisements for financial and other products. Check out UF/IFAS Extension’s You and Your Credit Series.

Make your finances a part of your springtime cleaning routine. A little time spent getting organized and reviewing your spending plan and credit reports will go a long way toward keeping you on track toward your financial goals.

by Ricki McWilliams | Oct 30, 2013

Last year, the Consumer Federation of America (CFA) and the Credit Union National Association (CUNA) found that 12 percent of people said they were planning to spend more during the holidays than in the previous year. That number was up from 2011, where only 8 percent planned on spending more than in the previous year. This year, help reverse this trend and plan on spending less and saving more. Remember, it’s the thought that counts, not the amount you spend. Helpful tips for spending less and saving more:

Last year, the Consumer Federation of America (CFA) and the Credit Union National Association (CUNA) found that 12 percent of people said they were planning to spend more during the holidays than in the previous year. That number was up from 2011, where only 8 percent planned on spending more than in the previous year. This year, help reverse this trend and plan on spending less and saving more. Remember, it’s the thought that counts, not the amount you spend. Helpful tips for spending less and saving more:

- Make a Budget and a List: Decide how much you can afford to spend and stay within that budget. Make a price list of all gifts and other holiday items you plan to purchase. Take the list with you shopping to avoid overspending and impulse buys.

- Comparison Shop: You can easily save more than 10 percent on most items, sometimes considerably more, by comparing prices at different stores. The Internet and smart phones have made comparison shopping that much easier. But when shopping online, shop wisely. Be sure you are purchasing from a secure site and review emailed statements for accuracy as you receive them.

- Make Time Your Ally: The reason to start sooner rather than later is that when you delay, you pay. At the last minute, you have to settle for something, and it might cost more than you had wanted or planned to pay. Another benefit to starting early: It gives you more time to find the “right” gift and avoid impulsive decisions, which too often leave you less happy with your purchase.

- See what’s in your supply drawer: You may have more wrapping paper, ribbons, unused cards, and gift boxes stored away from last season than you realize. Use up those holiday supplies first to trim down the amount you’ll have to buy this season.

- Find Some Low- or No-Cost Ways to Celebrate: Adding a few changes can ease the strain on your spending budget. For example, draw names to reduce the number of people you have to purchase gifts for; give homemade items; make your own gift wrap; or organize a potluck rather than trying to make, and pay for, the entire holiday meal yourself.

With the money you save on gifts, you can give yourself the gift of financial freedom by paying down debt or building your emergency savings fund.

Need help finding ways to save? Take the America Saves pledge to make a commitment to yourself to save and to receive emails and/or text messages to keep you motivated. (America Saves, managed by the Consumer Federation of America (CFA), is a non-profit research‐based social marketing campaign that seeks to motivate, support, and encourage low- to moderate-income households to save money and build wealth. Learn more at americasaves.org.

Source: Katie Bryan, America Saves Communications Director

Additional ways to make a difference in YOUR financial future:

FREE ON-LINE CLASSES: Participate from your office, home, or web-enabled device. It is easy! Visit the registration link to reserve your spot. Then log on the day of the webinar to participate. All webinars are scheduled 11:30am – 12:30pm (CST).

• Credit Use and PowerPay Debt Reduction Tool – October 30

This webinar will cover strategies for wise credit use, factors that impact credit scores, and methods to pay off debt using a free, self-directed debt reduction program called PowerPay. Registration link: http://bit.ly/PowerPayToday

• The Cost of False Health & Nutrition Promises – November 1

This webinar will cover some of the myths and misleading claims that induce consumers to spend time and money on health products & supplements that have not had enough scientific scrutiny. Registration link: http://bit.ly/FHCCost

• 5 Simple Steps to Seasonal Savings – November 13

This webinar will cover seasonal stressors, developing a holiday spending plan, alternatives to pricey gifts, and fine-tuning your financial plan for the holidays. Registration link: http://bit.ly/ssss2103

To view archived webinars, please click here.