Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

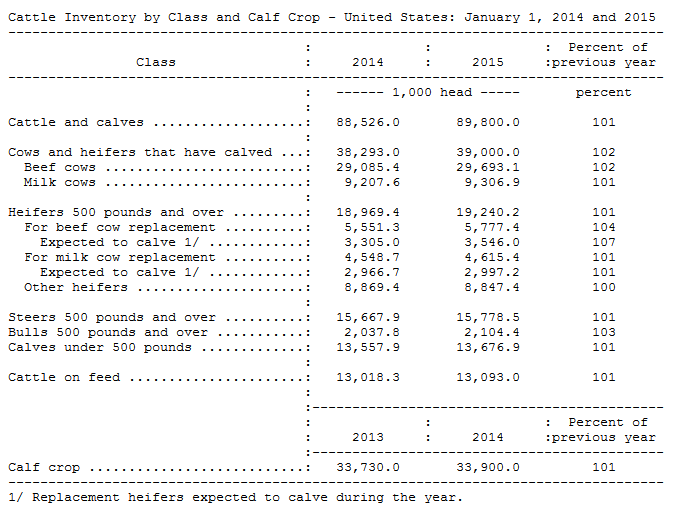

The inventory of all cattle and calves was 89.8 million head on January 1, 2015, up 1.4 percent from one year ago but, except for last year, still the smallest total herd inventory since 1952. The 2014 calf crop was up 0.5 percent from 2013 at 33.9 million head. The 2014 calf crop percentage (calf crop as a percent of all cows) was 88.5 percent, the highest percentage since 2006. Total U.S. cattle on feed on January 1 were 13.1 million head, up one percent from last year. The estimated supply of feeder cattle outside feedlots was up 0.5 percent as a result of one percent increases in the inventory of steers, 500 pounds and over and calves, under 500 pounds; along with a slight decrease in the inventory of other heifers. Dairy cows and dairy replacement heifers were up one percent from one year ago.

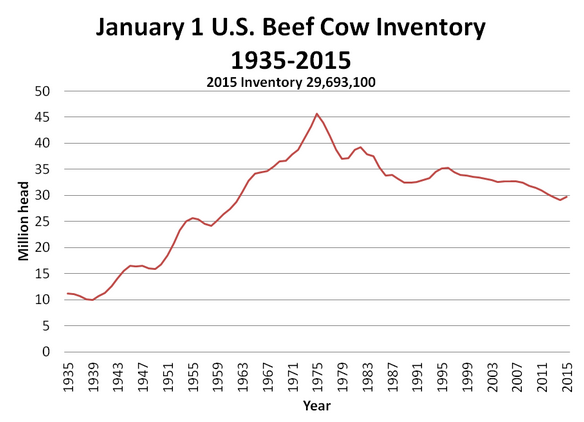

The U.S. beef cow herd grew by 2.1 percent in 2014 to 29.7 million head according to the January 2015 Cattle Report. Though beef cow herd expansion was anticipated, this was a larger than expected increase. The largest increases were in Texas, at 107 percent of last year; and Oklahoma, up 6 percent from one year ago. These two states accounted for 62 percent of the total increase in the beef cow herd. Kansas and Missouri each accounted for about 10 percent of the cow herd increase meaning that those four states accounted for 82 percent of the total increase in beef cows. The increase in Texas beef cow inventory was higher than expected because, despite improved conditions, significant areas of drought remain in the state. There were some other surprising data in the report including the fact that California beef cow inventories were unchanged despite the severe drought in 2014, along with Oregon, which also experienced significant drought but had a 1.7 percent increase in the beef cow herd in the state. The lack of growth in the Northern Plains was also somewhat surprising with decreased beef cow herds in North and South Dakota and a Nebraska beef cow herd unchanged from one year ago.

The inventory of beef replacement heifers was up 4 percent year over year indicating that further expansion is planned on the part of cow-calf producers. January 1 beef replacement heifers, as a percent of the beef cow herd was a record 19.5 percent, indicating intensive heifer retention. Moreover, the calculated percent of heifers entering the herd in 2014 jumped 23 percent year over year; with those heifers entering the herd representing 96 percent of NASS reported heifers expected to calve in 2014. Oklahoma beef replacement heifers were up 80,000 head, a 25 percent year over year increase, and accounted for 35 percent of the total increase in replacement heifers. The beef replacement heifer increase of 8 percent in Texas and the 12 percent increase in South Dakota, were the second and third largest increases in absolute numbers and, when combined with Oklahoma, represent 75 percent of the total increase in beef replacement heifers. Kansas also had an 8 percent year over year increase in beef replacement heifers.

Source: National Agricultural Statistics Service (NASS): http://usda.mannlib.cornell.edu/usda/current/Catt/Catt-01-30-2015.txt

This report does not change market fundamentals much, if any, in 2015. The fact that there are more cows than expected does not change the timing of beef production in 2015. The marginal increase in estimated feeder provides little relief to tight feeder numbers and may be offset with even more heifer retention and the possibility of smaller feeder cattle imports from Mexico and Canada this year. The jump-start to herd expansion could shave a year off of the time needed for herd rebuilding, depending on herd expansion in 2015 and beyond. In any event, herd expansion is expected to continue until late in the decade baring setbacks from drought.