March futures have improved. January has thus far been a good month. The big question and the uncertainty is whether or not this will last. No one can be sure. So if you’re a producer and have been looking for an opportunity to sell a portion of remaining 2016 crop, January has thus far provided a good window of opportunity.

March futures have improved. January has thus far been a good month. The big question and the uncertainty is whether or not this will last. No one can be sure. So if you’re a producer and have been looking for an opportunity to sell a portion of remaining 2016 crop, January has thus far provided a good window of opportunity.

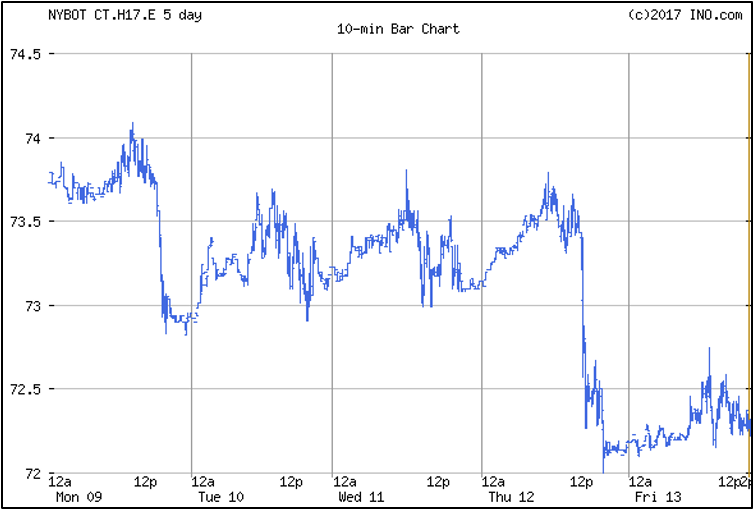

By late December, prices (March futures) had weakened to around the 70-cent area. Prices then improved and stood at around 74 cents last week. Prices trended down somewhat this week, however, and closed today at 72.27 cents per lb.

Several things seem worth noting because the outlook picture has shifted somewhat.

- The previous “resistance” or ceiling at around 73 cents has been broken through. This could now maybe become a new “floor.” This week’s retreat and close near 72 will provide an early test to whether this happens or not.

- A new “ceiling” or resistance could be set at 75 to 77 cents. Some folks have already jumped on the 80-cent train. That train hasn’t even arrived at the station yet much less being ready to board. This week, prices couldn’t hold 75 cents much less move to 80. Let’s not get ahead of ourselves.

- We now have a nice uptrend established. This could help solidify the bottom from here on out, but we can’t rule out the possibility of prices dipping to the 68 to 70-cent area, if the 72-cent area can’t hold.

This week, USDA released its January estimates/revisions of production and supply/demand. I feel the numbers are neutral to somewhat supportive of prices at best. It should be mentioned and noted that the market (March futures) dropped 100 to 150 points immediately after the release of the report on Thursday and did not recover on Friday.

The US crop was raised 440,000 bales from the December estimate. This is partially offset by a 300,000 bale increase in expected US exports for the 2016 crop year. Exports have been doing very well and ahead of the pace for the previous estimate, so as expected, the export projection was revised upward. Greater exports may also reflect the increase in the crop and greater available supply.

The Chinese crop was raised 1 million bales. Foreign production was raised a net 670,000 bales. China’s mill use was raised ½ million bales. So, China’s ending stocks were raised ½ million bales as a result.

World mill use was lowered 150,000 bales from the December estimate. That may not sound like much and it isn’t, but World usage has been revised down for 3 straight months—not by much each month, but down nonetheless.

Exports have been doing well. This grabs everyone’s attention and rightfully so. But the lack of growth in usage is disturbing. Early signs and prognostications are that US cotton acreage will be up for 2017. Even higher exports and, hopefully, growth in World mill usage will also increase and give support to 2017 prices. Dec17 is at roughly 71 cents currently.