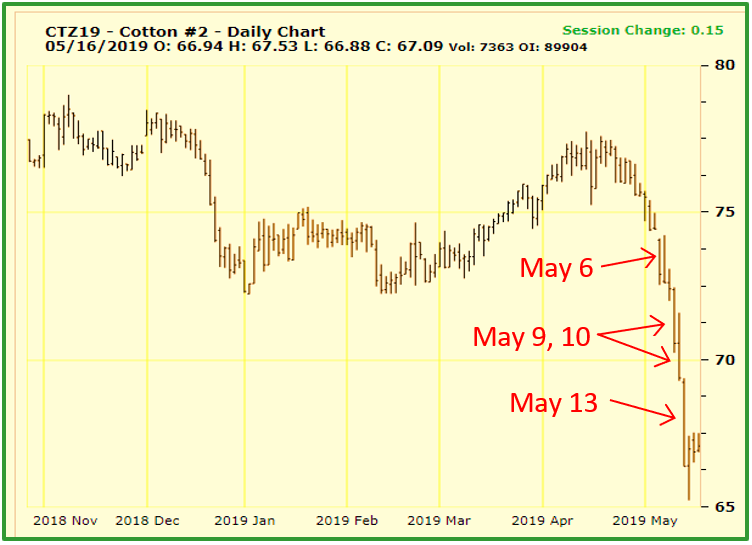

New crop December futures had solid support at 72 cents. Having earlier reached the 77-cent area, prices had begun to decline in mid-April but the 72 cent area was expected to hold and provide a safety net for producers looking for prices to eventually rebound and provide additional pricing opportunities.

Support did not hold. The bearish tone due to continuing and mounting trade concerns has simply been too much. As mentioned in this space last time, support was expected to hold and prices show some recovery provided that positive progress be made in the on-going US-China trade dispute.

New crop December19 futures have declined roughly 10 cents per lb. since mid-April with 6 cents of that coming in 3 trading days—May 9, 10, and 13 before showing some degree of stabilizing the past few days. After venturing all the way down to 65 cents, Dec19 is back in the 67-cent area. Certainly nothing to shout about, but stability can be the foundation for recovery. If there is to be recovery, it has to start by stopping the bleeding.

Has the market overreacted? Possibly. But we are in uncharted waters and there are valid fears and uncertainty about where US and China relations are headed both near-term and longer term, and what that means for the global economy.

President Trump announced on Sunday, May 5th the increase in tariff rate from 10% to 25% on $200 billion in Chinese goods effective May 10th. Cotton futures broke down. Prices continued to fall, closing down a total of 3 cents on May 9 and 10. On Monday, the 13th, China announced retaliation by increasing tariff rates on $60 billion of imports from the US effective June 1. Prices dropped the limit of 3 cents for the day.

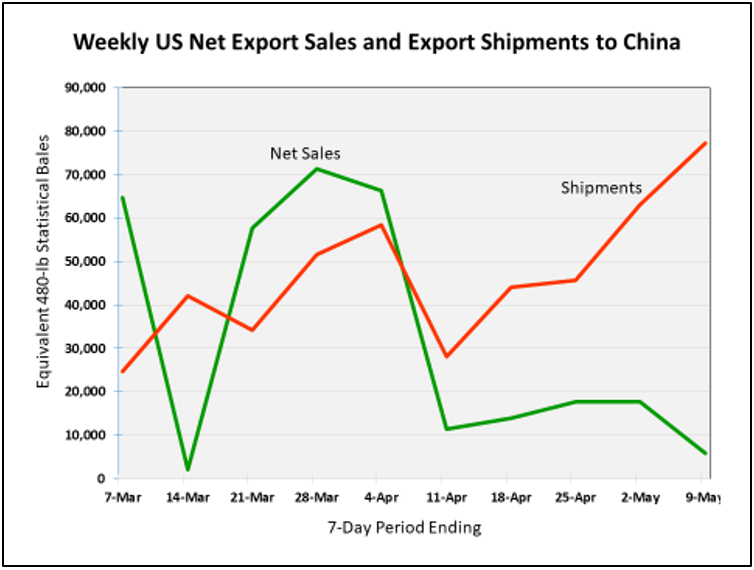

China has “total commitments” or total purchases of US cotton to date of approximately 1.975 million bales. Exports (actual shipments) to date total approximately 1.215 million bales or 62% of “total commitments” with 12 weeks remaining in the 2018 crop marketing year.

Data shows the pace of new sales has fallen off. Shipments of previous sales has trended up. Prices will continue to be impacted by the trade situation and the pace of sales and shipments. Having already fallen to the mid to upper 60’s, further downside is possible but should be relatively limited. The trade situation, however, does seem to increasingly be on rocky ground.

Any recovery will also depend on the US crop situation. USDA’s May numbers show:

- 2019 US crop of 22 million bales. Crop will likely be larger than this but planting delay in the Mid-South is a concern.

- US exports for 2019 crop forecast at 17 million bales compared to 14.75 for the 2018 crop (exports for the ’18 crop year were lowered 250K bales). This increase is interesting given the trade and market uncertainties.

- World use for the ’19 crop year is pegged at 125.93 million bales—a record and 3.2 million bales more than this year.

- China is expected to import 11 million bales compared to 8.5 million this year.