Don Shurley, UGA Professor Emeritus of Cotton Economics

Don Shurley, UGA Professor Emeritus of Cotton Economics

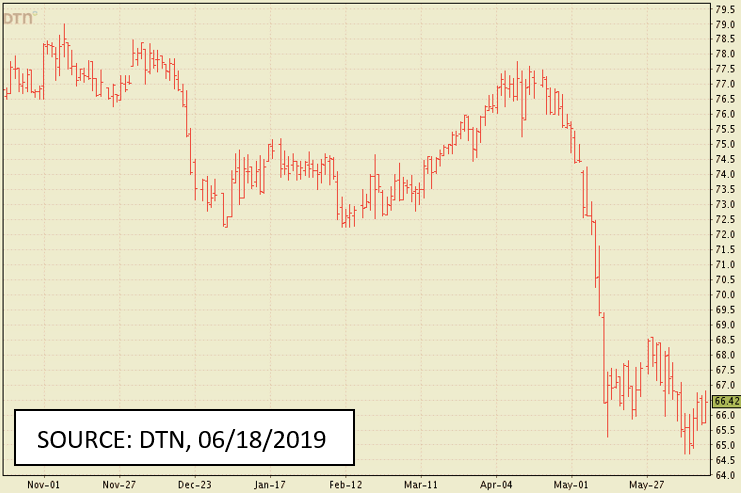

New crop December futures have rallied from the recent new low below 65 cents. December futures are currently at 66+ and are likely to track in the 65 to 69 cent range in the near term, unless a major unforeseen factor arises.

Prices previously had “support” at 66 cents and had rallied back to over 68 cents, before losing ground and eventually moving below 65 cents last week.

There are many production uncertainties as we look ahead:

- The first USDA estimate of actual acres planted will be published on June 29. Given all the rain and delayed planting in the Mid-South and the drought in the Southeast, will the June number capture the extent of prevented planting acres and shift to other crops?

- The Southeast has finally received much needed rainfall. Has this rescued that portion of the crop? Will conditions continue to be favorable for the remainder of the season?

- Texas is an even bigger than normal wildcard. There are late plantings, prevented planting acres, acres switched to other crops, etc.—a mix of everything.

USDA released its June crop production and supply/demand estimates last week. I consider the numbers neutral to bearish. A quick summary includes:

- US production for 2019 is unchanged from the May estimate at 22 million bales. This will very likely change with next month’s report. Higher or lower is the big question?

- Projected US exports for the 2019 crop marketing year remain at 17 million bales. This compares to 14.75 million bales projected for the 2018 marketing year.

- World beginning stocks for the 2019 crop year were increased due to supply and demand revisions for 2018.

- 2019 World production was lowered slightly

- World Use was lowered 660,000 bales; 500,000 of that for China

- Chinese imports for the 2019 crop year were lowered 500,000 bales

- Imports for Vietnam and Bangladesh were lowered 100,000 bales for each

It seems to me that the current market (Dec19 futures in the mid-60’s neighborhood) is based on a rather optimistic combination of scenarios for the degree of uncertainty out there. But, I’ve been wrong before. In addition to uncertainties about the US crop, the USDA projection of 17 million in exports is a question mark given the on-going US-China trade situation. Use must also stay strong.

US cotton export sales and shipments have been good. Shipments as of June 6 totaled 11.5 million bales. To reach USDA’s projection of 14.75 million bales for the 2018 marketing year ending July 31, export shipments must average approximately 400,000 bales per week. Shipments for the last 4 weeks have averaged approximately 388,000 bales.

The 2019 crop has gotten off to a rough start for many producers. Prices have tumbled while weather conditions have made planting and early season production very challenging. We are still waiting on a resolution to the US-China trade and tariff situation, and also on ratification of the USMCA (US-Mexico-Canada) trade agreement. We are just starting to get information and some details on disaster assistance (WHIP) and trade assistance (MFP) payments. However, questions still exist on how disaster assistance (WHIP) payments will be determined? Likewise, there are questions on how MFP payments will be determined – on a per acre amount by county or on a fixed per unit of production basis, like last year? All this causes uncertainty in cash flow for farm businesses.

The seed cotton PLC and ARC payments for the 2018 crop will be received in October. Based on the final 2018 production estimates and the currently projected 2018 market average prices, the seed cotton PLC payment rate is currently projected to be 2.38 cents per lb (36.7 reference price – 34.32 MYA price = 2.38 PLC rate).