Don Shurley, UGA Professor Emeritus of Cotton Economics

Don Shurley, UGA Professor Emeritus of Cotton Economics

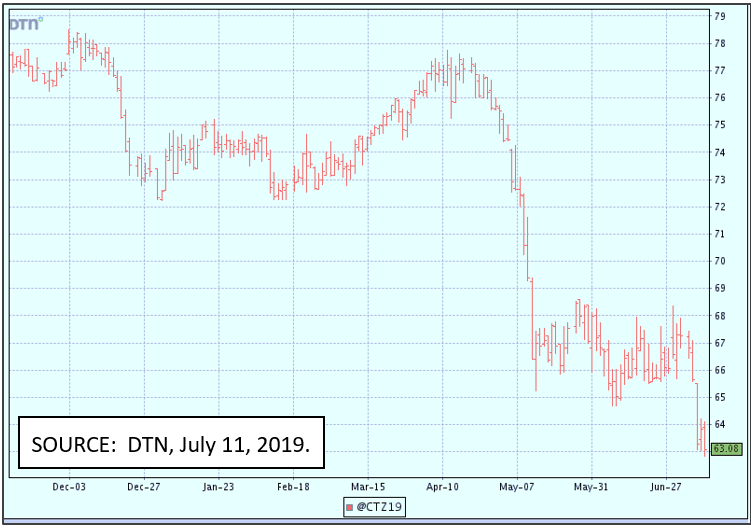

Cotton prices have been under attack. The meltdown started on Monday (July 8) and continued on Tuesday—new crop December 2019 futures lost 3 ½ cents over those 2 days. Prices tried to and did recover on Wednesday before losing more ground on Thursday. December futures closed on July 11 with its nose just barely above 63 cents.

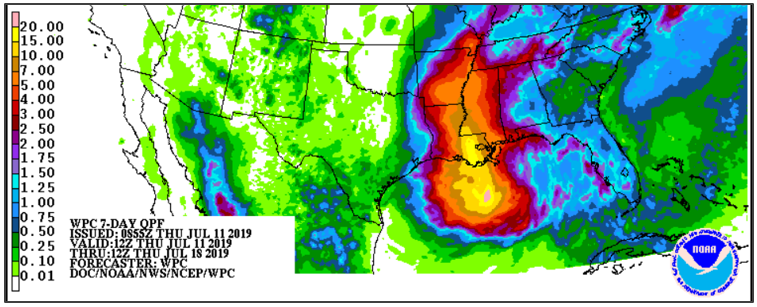

We have a major weather event moving into the Mid-South—the direction and impact of which is yet unknown. Further, today’s USDA monthly production and supply/demand numbers were not friendly—not all that unexpected really, but nevertheless not what we want to see as far as impacts on price are concerned.

This week’s meltdown, including today’s continued slide, can be attributed to what other analysts have termed “technical” considerations. But also, crop conditions continue to improve and export reports have been disappointing. I would argue that all that is not worthy of an over 4-cent drop in price, unless you want to also argue that the market was trading too high in the first place. Look for prices to find new support and work their way back up, but we’ve got a lot of negative forces to overcome.

July’s monthly USDA numbers were bearish:

- US production for 2019 was unchanged from the June estimate at 22 million bales. Next month will be the first of this season based on actual farmer surveys. There is still a lot of uncertainty about the US crop, so the August numbers should begin to clear things up a bit.

- Beginning stocks were raised 350,000 bales—we will enter the 2019 crop marketing season on August 1 with 350K more bales of cotton than we previously thought we would. This is because exports for the 2018 crop year were lowered 250,000 bales and US mill use lowered 100,000.

- The revision downward in exports for the 2018 crop year was expected. Shipments had been behind the needed pace for quite some time.

- World beginning stocks for the 2019 crop year were increased 1.74 million bales due to revisions for the 2018 crop year.

- The forecast for World production for 2019 was increased almost ½ million bales—attributed to an increase for India. The forecast for China was unchanged.

- World Use for the 2019 crop year was lowered 1 million bales. China was lowered ½ million bales and Bangladesh and Vietnam combined was lowered 800,000 bales. This monthly lowering of projected demand is not new but is disturbing.

- So, as a result of all this, stocks projected on hand at the end of the 2019 crop marketing year were raised by over 3 million bales from the June estimate. If realized, this would be an increase in stocks of over 1 million bales for the year.

Some of these revisions were expected, and thus were likely already factored into recent weakness. Still, the market has taken on a decidedly bearish tone. In addition to US crop uncertainties, foreign production is also in question, and we’re still waiting and hoping on something positive from the US-China trade talks. So, there are potential price-positive factors still out there.

Tropical Storm Barry looks to deposit a lot of rain on the Mid-South. The Mid-South has already been hampered by too much rain this season, which delayed planting. Most of the cotton belt looks to get 3 to 7 inches of rain. The 7-day outlook shows lesser amounts across much of Texas and the Southeast. The Mid-South is late, but I’m told in good shape. Parts of the Southeast are dry. Some areas may get more rain than desired, but overall Barry may add bales rather than subtract.