Don Shurley, UGA Professor Emeritus of Cotton Economics

–

There’s been a different tone to the market the past couple of weeks. Have we seen the pre-plant peak? Has the trajectory changed?

New crop December futures peaked at 87.66 cents, back on February 24, and then marked another near-peak close at 86.79 on March 1. Since the peak on February 24, prices have trended down—closing down 7 of the 12 trading days since, and is looking lower again today after closing at 84.2 cents last Friday.

I do not necessarily see this as reason for alarm. However, it is clear that the market felt a need for adjustment. The run to 90-cent cotton is not dead, but it’s been wounded. Hopefully, many, if not most, growers took advantage of that earlier run. If so, you should feel comforted by that, and hopefully you’ll get additional chances near those levels or higher.

We have a long way to go—haven’t even planted the crop yet. There are plenty of unknowns and time yet to recover. Prices (Dec futures) have support at 80 to 82 cents. Void of any major news, good or bad, new crop should be comfortable at 83 to 86 cents.

Highlights from last week’s USDA monthly supply and demand estimates include:

- The US 2020 crop was lowered 250,000 bales.

- US 2020 crop ending stocks were lowered 100,000 bales.

- In a bit of a surprise, US 2020 crop exports were left unchanged.

- World production was lowered roughly 800,000 bales and Use was increased 250,000 bales.

- Use was increased for Turkey, Pakistan, Vietnam, and Bangladesh. China was unchanged from the February estimate.

The key price indicator is World Use. The price run we’ve experienced is due largely to optimism and improved outlook for cotton demand. The monthly Use number needs to support that.

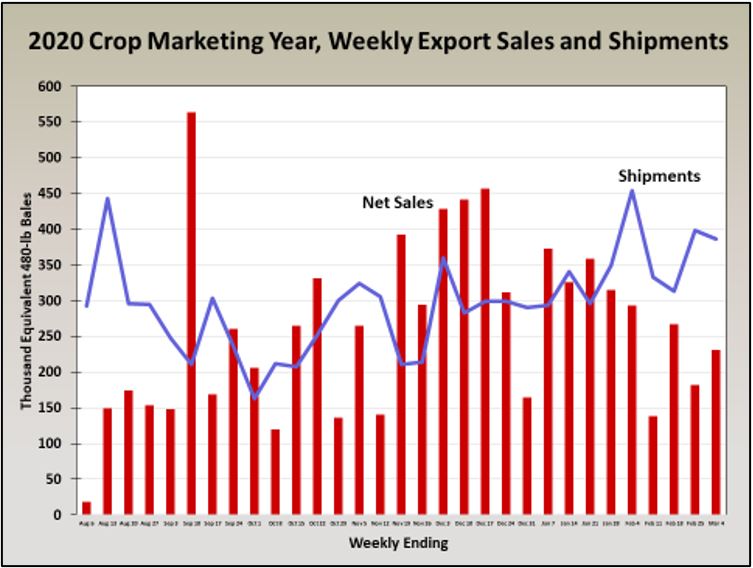

Weekly export numbers are also key, as this helps confirm the short-term direction of the market. Last week’s export report (for the week ending March 4th) showed net sales of 231,200 bales—up 27% from the prior week, but still low compared to the average over the past 4-6 weeks. Top sales destinations were Vietnam and China. Shipments were 386,600 bales—a good number, but down 3% from the prior week. Top destinations were China, Vietnam, and Pakistan.

Despite the optimism in demand and numbers to support that optimism, the market is already proving to be sensitive to US acres, weather, and other US and World factors on the supply side.

In other words, even stronger demand and/or supply shocks may be necessary to give another run at 90 cents. Another way to look at it—if demand signals continue strong, and if there are supply concerns here or elsewhere, prices could yet make a run higher.

The USDA early estimate is 12 million acres planted. The official Prospective Plantings number will be out on March 31. Most analyst projections I’ve seen say 12.0 to 12.5 million acres. There is room for a somewhat larger US crop, because beginning stocks will be down and demand has improved. The question remains—at what level of US production does it begin to hamper price?

=