Don Shurley, UGA Professor Emeritus of Cotton Economics

–

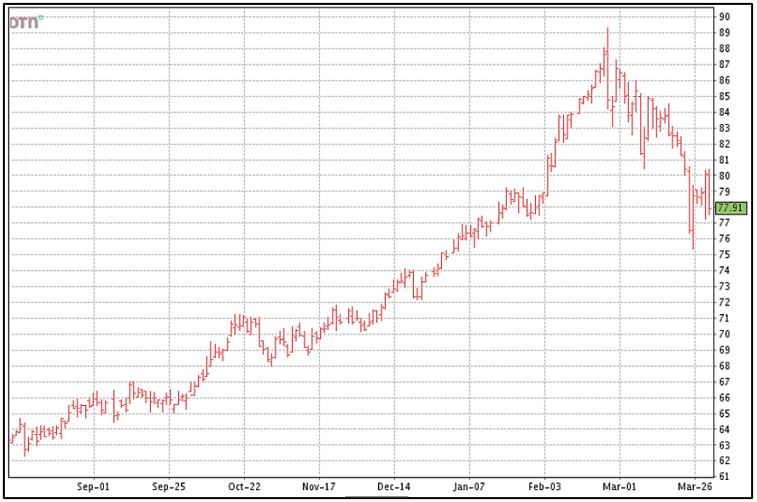

The hopeful return to the upper 80’s has stalled. The market (new crop December futures) was in a downtrend for the month of March, and April isn’t starting out any better.

There’s no reason to panic – we could still see a return to higher prices. But amid all the previous optimism and hype, the market now shows it has no problem moving in the opposite direction instead.

Thanks to a strong day on March 31 (up 118 points), December was up 136 points for the week — but then lost 219 points yesterday to close the week down 83 points. New crop Dec futures now stands at roughly 78 cents.

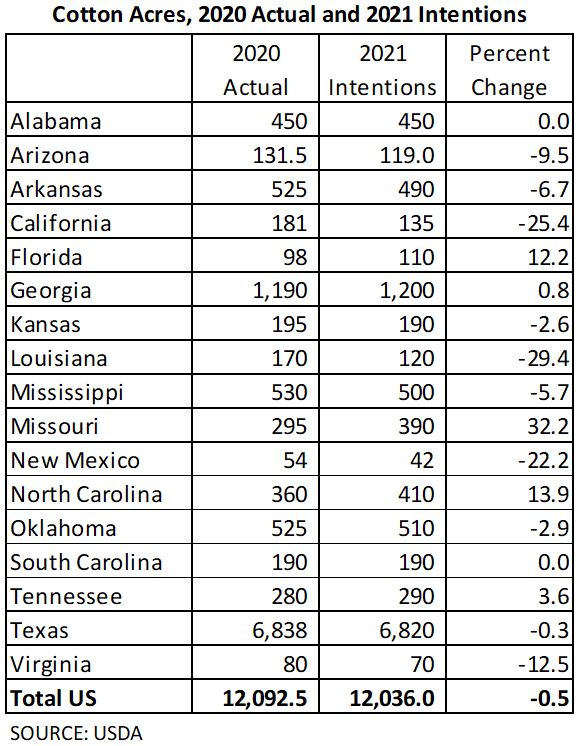

USDA’s Prospective Plantings report was “middle of the road”. The report said that farmers intend to plant 12 million acres of cotton this year — 0.5% less or essentially the same as last year. Pre-report industry expectations were mostly 11.5 to 12.5 million acres. USDA’s earlier unofficial estimate from its Outlook Forum was 12 million acres.

This report is based on surveys conducted the first two weeks of March. During this period, prices were mostly 5 to 7 cents higher than now. Given the decline in prices since, it remains an issue as to how accurate the 12 million acre number will be. Can and will farmers’ earlier intentions be altered because of decline in price? Because the survey results are from when prices were quite a bit higher, and because intentions were not higher than last year, this could be interpreted as supportive of the market.

So, 12 million acres will be the number the market deals with until USDA’s June 30 Acreage Report. An observation worth noting—ELS acres are expected to be down 60,500 acres, while upland is up 4,000 acres.

BUT….. this week’s export report was not good. We have said in this space previously that demand optimism has eroded somewhat and weekly exports are seen as a barometer. Higher prices will require strong demand. The market will balance demand with the outlook for the US crop. USDA’s next monthly supply/demand estimates will be out next week on April 9th.

Net export sales for the week ending March 25 were only 85,200 bales, due to 165,500 bales in cancellations of previous sales, mostly by Indonesia. Shipments were 349,200 bales—a decent level. Largest destinations included Vietnam, China, and Pakistan.

–