John VanSickle, Rod Clouser, Marina Arouca, UF/IFAS Food and Resource Economics Department

John VanSickle, Rod Clouser, Marina Arouca, UF/IFAS Food and Resource Economics Department

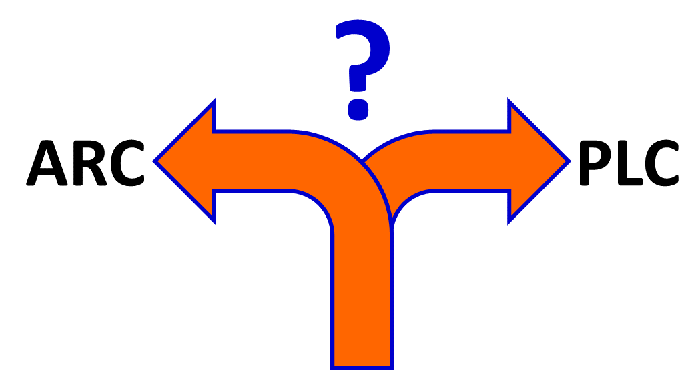

The 2014 Farm Bill introduced changes to farm commodity programs. The safety net is now composed of two new programs, Price Loss Coverage (PLC) and Agricultural Risk Coverage (ARC). The Direct and Counter-Cyclical Program (DCP), the Supplemental Revenue Assistance Program (SURE), and the Average Crop Revenue Election Program (ACRE) were all repealed in the 2014 legislation.

Agriculture producers with established base acres in farm programs were given until March 31 (only 7 business days left) to complete paperwork dealing with program choice. This election will be binding for the life of the 2014 Farm Bill. Those who fail to elect a program will be excluded from program benefits in the 2014 crop year and their farms will be automatically enrolled into PLC starting in 2015.

If you are an agriculture producer on a farm with base acres you have to make a one‐time decision for each farm and select one of the choices available:

- PLC or ARC-County (ARC-‐CO) on a covered commodity‐by-covered commodity basis or;

- ARC-‐Individual (ARC-‐IC), which will include all covered commodities on the farm.

For example, a farm can have corn base acres participating in ARC-CO and soybean base acres participating in PLC; but if ARC‐IC is elected for any crop, then all the crops on that farm must exclusively participate in the ARC‐IC program. If producers elect PLC/ARC-CO, they must also make a one-time election for those covered crops enrolled in PLC and those enrolled in ARC-CO.

PLC offers price protection while the two types of ARC coverage offer revenue protection:

- Price Loss Coverage (PLC) Payments are issued when the Effective Price of a covered commodity on a market year basis is lower than the respective Reference Price as written into the Farm Bill. In essence, PLC is similar to the repealed Counter-Cyclical Payments program in previous legislation.

- Payment = 85% of Base Acres of commodity (not planted) x (Reference ‐ Effective Price) x Program Payment Yield

- Agricultural Risk Coverage – County (ARC‐CO) Payments are made when the actual county crop revenue for a covered commodity is less than the ARC‐CO guarantee for the covered commodity. ARC-CO provides revenue loss coverage at the county level.

- Payment = 85% of Base Acres of commodity (not planted) x (County guarantee – Actual county crop revenue)

- Agricultural Risk Coverage -Individual Coverage (ARC-‐IC) Provides revenue loss coverage at a farm level. Payments are issued when the current year revenue for all covered commodities planted on the farm falls below 86% of the farm benchmark revenue. All ARC-IC farms the producer operates in Florida are included in a single ARC-IC revenue calculation to determine the payment rate.

- Payment = ARC-IC payment rate x 65% of total base acres of the farm(s)

More information can be found for the details of each program in companion notes. Visit the USDA FSA website for online tools to aid in the decision process, such as:

- USDA/NAAFP Decision Aid, “FAPRI Model” (https://usda.afpc.tamu.edu/)

- FarmDoc Farm Bill Toolbox, “Illinois Model” (http://farmbilltoolbox.farmdoc.illinois.edu/)

The covered commodities eligible for program payments include barley, canola, chickpeas, corn, crambe, flaxseed, grain sorghum, lentils, mustard seed, oats, peanuts, dry peas, rapeseed, rice, safflower, sesame seed, soybeans, sunflower seed, and wheat. Upland cotton is no longer a covered commodity and 2013 base acres of cotton are converted to generic acres that can receive program payments only if program crops are planted.

Time is running short for action. Make an appointment with your local Farm Service Agency (FSA) to select the coverage programs you want for your farm. If you need more information, or help with these decisions contact your local agriculture extension agent . They have had training on use of the computer models and on the changes to the Farm Bill programs.