Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

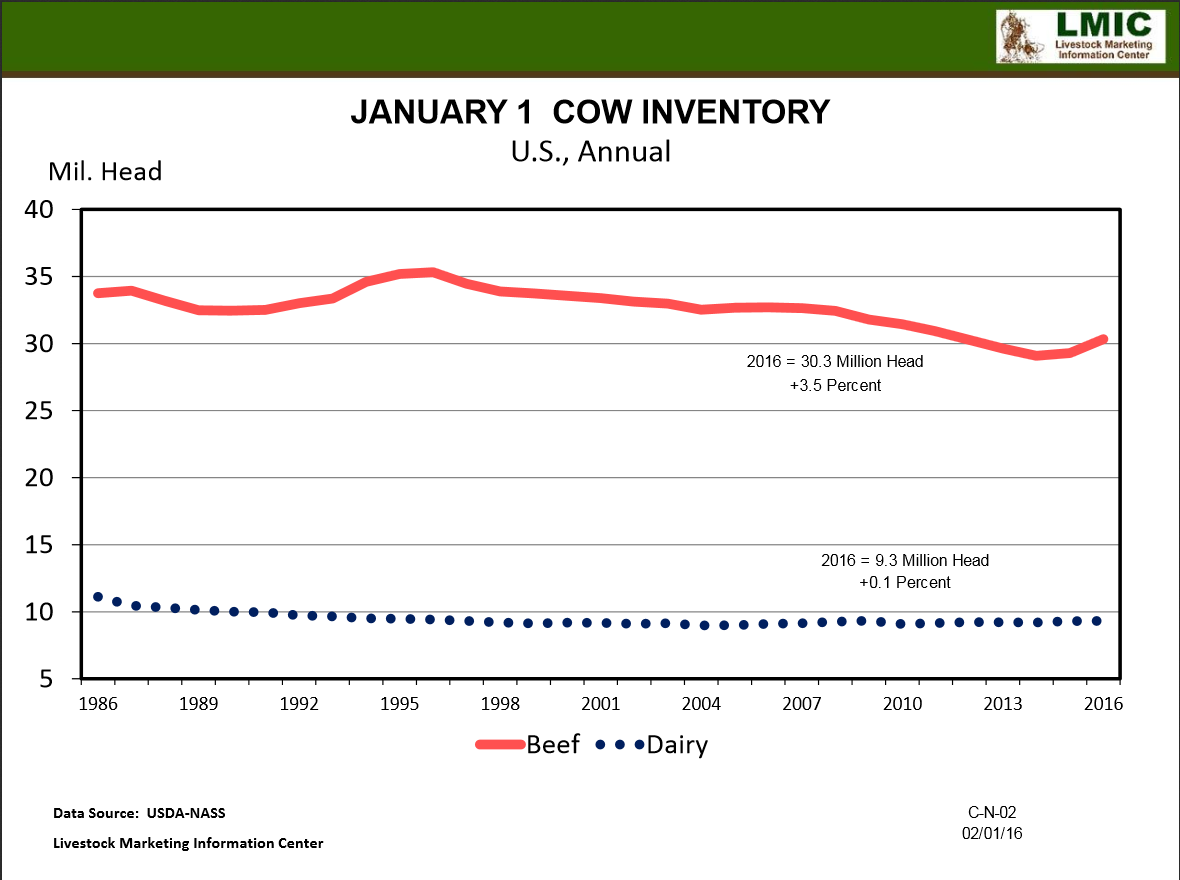

We are now two years into herd expansion and that leads to questions of how much more herd expansion is ahead and, to a lesser degree, questions about how fast remaining herd expansion will occur. Beginning with a January, 2014 low of 29.1 million head, the beef cow herd expanded (based on USDA-NASS revised 2015 numbers) 217 thousand head in 2014 and another 1.03 million head in 2015. The January 2016 total of 30.3 million beef cows represented a 3.5 percent year over year increase in the beef cow herd, an undeniably aggressive rate of herd expansion. The sharp adjustment in cattle prices in late 2015 has been viewed by some as a result of this large herd increase and the feeling that it was, perhaps, too much, too soon, and a sign that herd expansion is mostly over. I don’t believe that is the case. It looks now (with the benefit of hindsight) that the spike in feeder cattle prices from 2013 through 2014 was a market signal to ensure that herd expansion got an aggressive jump-start. Having succeeded in that, market prices have adjusted back to levels that allow the industry to follow through with what has been started. Therein lies the question of how much more expansion will occur.

In 1990-1996, the last complete herd expansion in the beef industry, the beef cow herd increased about 2.9 million head, from 32.5 million head in 1990 to 35.3 million head in 1996. This included one year of expansion of 3.7 percent, three years of growth in the range of one to two percent annually, spread out on either side of the big expansion year, and two years of very slow growth at the beginning and end of the expansion. The patterns we have seen so far in this herd expansion are similar and consistent with the 1990s. Should we expect something like 2.9 million head of herd increase this time? Probably not, after all, it’s really pounds that matters and we will not need that much increase in beef cows to increase beef production. Carcass weights are over 100 pounds heavier now compared to 20 years ago.

However, this expansion did not start when it intended to begin. The industry attempted herd expansion beginning in 2004 with a herd size of 32.5 million head – the same level at which the 1990 expansion started. After two years, with minimal herd growth (less than 200 thousand head), the herd continued liquidating in 2006 in the face of unprecedented cost shocks, a recession, etc. In 2011, the industry showed signs of herd expansion with an inventory of 30.9 million cows, but drought forced additional liquidation to the ultimate bottom of 29.1 million head in 2014. The current 30.3 million head is still smaller than pre-drought levels. The real question may be: where does recovery stop and where does expansion really begin? A moderate pace of herd growth in 2016, perhaps 1.5 – 2.5 percent year over year, might leave the herd inventory close to pre-drought levels going into 2017.

Ultimately, it is demand that will determine the size of the industry. Domestic and international markets will be the key to how big the beef cow herd will be. Beef carcass weights will also be important in determining how many animals are needed to meet that total market demand. It seems clear to me that expansion will continue in 2016 , albeit at a more moderate pace than 2015, and into 2017 as well. At this point, it seems likely that the herd will peak cyclically at an inventory somewhere between 31 and 33 million head. The ultimate total is a moving target that must be monitored along the way. Unfortunately, that will be more difficult given USDA’s recent announcement to suspend the July Cattle report. This means that there will be no indication of the size of the 2016 calf crop; the status of heifer retention; nor the estimated feeder supply until 2017.