Hurricane Irma made landfall on September 10, 2017 and caused significant damage to agriculture across much of the state of Florida.

Source: U.S. Department of Agriculture (USDA)

Agriculture Secretary Sonny Perdue announced on Monday, July 16, 2018 that agricultural producers affected by hurricanes and wildfires in 2017 now may apply for assistance to help recover and rebuild their farming operations. Signup began July 16, 2018, and continues through November 16, 2018.

“Hurricanes and wildfires caused billions of dollars in losses to America’s farmers last year. Our objective is to get relief funds into the hands of eligible producers as quickly as possible,” said Secretary Perdue. “We are making immediate, initial payments of up to 50 percent of the calculated assistance, so producers can pay their bills.”

Additional payments will be issued, if funds remain available, later in the year.

The program, known as the 2017 Wildfires and Hurricanes Indemnity Program (2017 WHIP) was authorized by Congress earlier this year by the Bipartisan Budget Act of 2018.

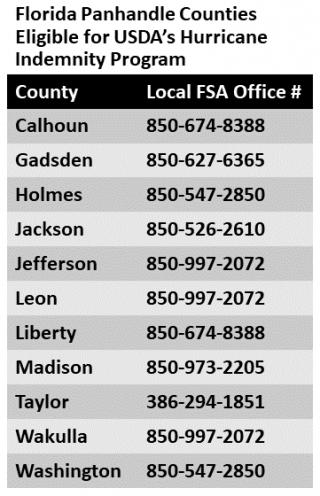

Due to the large number of eligible producers, it is advisable to call your local FSA office to set an appointment time to discuss the WHIP Program.

Eligible crops, trees, bushes, or vines, located in a county declared in a Presidential Emergency Disaster Declaration or Secretarial Disaster Designation as a primary county are eligible for assistance if the producer suffered a loss as a result of a 2017 hurricane. Also, losses located in a county not designated as a primary county may be eligible, if the producer provides documentation showing that the loss was due to a hurricane or wildfire in 2017. A list of counties that received qualifying hurricane declarations and designations is available at www.fsa.usda.gov/programs-and-services/disaster-assistance-program/wildfires-and-hurricanes-indemnity-program/index. Eligibility is determined by Farm Service Agency (FSA) county committees.

Agricultural production losses due to conditions caused by last year’s wildfires and hurricanes, including excessive rain, high winds, flooding, mudslides, fire, and heavy smoke, could qualify for assistance through the program. Typically, 2017 WHIP is only designed to provide assistance for production losses, however, if quality was taken into consideration under the insurance or Noninsured Crop Disaster Assistance Program (NAP) policy, where production was further adjusted, the adjusted production will be used in calculating assistance under this program.

Eligible crops include those for which federal crop insurance or NAP coverage is available, excluding crops intended for grazing. A list of crops covered by crop insurance is available through the U.S. Department of Agriculture’s (USDA) Actuarial Information Browser at webapp.rma.usda.gov/apps/actuarialinformationbrowser.

Eligibility will be determined for each producer based on the size of the loss and the level of insurance coverage elected by the producer. A WHIP factor will be determined for each crop based on the producer’s coverage level. Producers who elected higher coverage levels will receive a higher WHIP factor.

The 2017 WHIP payment factor ranges from 65 percent to 95 percent, depending upon the level of crop insurance coverage or NAP coverage that a producer obtained for the crop. Producers who did not insure their crops in 2017 will receive 65 percent of the expected value of the crop. Insured producers will receive between 70 percent and 95 percent of expected value; those who purchased the highest levels of coverage will receive 95-percent coverage.

Each eligible producer requesting 2017 WHIP benefits will be subject to a payment limitation of either $125,000 or $900,000, depending upon their average adjusted gross income, which will be verified. The payment limit is $125,000 if less than 75 percent of the person or legal entity’s average adjusted gross income is average adjusted gross farm income. The payment limit is $900,000, if 75 percent or more of the average adjusted gross income of the person or legal entity is average adjusted gross farm income.

Both insured and uninsured producers are eligible to apply for 2017 WHIP. However, all producers receiving 2017 WHIP payments will be required to purchase crop insurance and/or NAP, at the 60 percent coverage level or higher, for the next two available crop years to meet statutory requirements. Producers who fail to purchase crop insurance for the next two applicable years will be required to pay back the 2017 WHIP payment.

To help expedite payments, a producer who does not have records established at the local USDA service center are encouraged to do so early in the process. To establish a record for a farm, a producer needs:

- Proof of identity: driver’s license and Social Security number/card;

- Copy of recorder deed, survey plat, rental, or lease agreement of the land. A producer does not have to own property to participate in FSA programs;

- Corporation, estate, or trust documents, if applicable

Once signup begins, a producer will be asked to provide verifiable and reliable production records. If a producer is unable to provide production records, USDA will calculate the yield based on the county average yield. A producer with this information on file does not need to provide the information again.

For more information on FSA disaster assistance programs, please contact your local USDA service center or visit www.farmers.gov/recover/whip, or use the following link for the 2017 WHIP Fact Sheet.