by Laurie Osgood | Jul 16, 2020

Lately, scammers have gotten more sophisticated. So it’s worth reminding everyone that if you receive an unsolicited email, text, or phone call, DO NOT give out any of your personal information! Scammers often update their tactics, using any way they can to trick you into handing over your precious personal information.

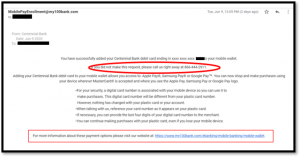

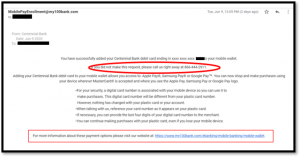

Earlier this week, I received an email (see below) telling me I had successfully set up a mobile wallet using my bank account. Since I had not signed up for this service, I was tempted to call the phone number listed in the email to dispute it. I hesitated, and for good reason. If I had contacted them, they would have tried to get my personal identification information, and then used that information to steal my identity or bank funds. I called my bank directly and learned this scam was recently perpetrated against 40,000 debit card users.

Phishing emails and text messages often appear to be legitimate and from a company you know or trust (like my own bank). These phishing emails and text messages often describe a problem with your billing, to trick you into clicking on a link or an attachment.

REMEMBER, if you receive this kind of message, by email or text, do not click on any attachments or call the phone number that is listed.

The Federal Trade Commission’s (FTC) Consumer Information page offers these tips for consumers to recognize and avoid phishing scams. View their website for more information. https://www.consumer.ftc.gov/topics/privacy-identity-online-security.

- Protect your computer by using security software.

- Protect your mobile phone by setting software to update automatically

- Protect your accounts by using multi-factor authentication

- Protect your data by backing it up

Lesson learned? Protect yourself and don’t believe anything that doesn’t feel right!

For more information about protecting yourself and your finances, contact your local UF/IFAS Extension Agent.

Extension classes are open to everyone regardless of race, creed, color, religion, age, disability, sex, sexual orientation, marital status, national origin, political opinions or affiliations.

by Laurie Osgood | Feb 6, 2019

Regular vehicle maintenance can help you avoid expensive repairs. Photo credit: UF/IFAS Northwest District

A car is one of the biggest investments we will make. With proper car maintenance, you can increase safety, improve performance, and save money in the long run. According to AAA, big improvements in powertrain technology, lubricant, and rust prevention have led to improvements in automobile reliability, longevity, and durability. With proper care, almost any car can make it well past the 100,000-mile mark.

TIPS FOR PROLONGING THE LIFE OF YOUR CAR

• Do some research and purchase a safe, reliable vehicle

• Stick to the recommended car maintenance schedule

• Buy high quality parts: engine oil, battery, tires, etc.

• Keep your car clean, inside and out

• Know what to look for if your car is beginning to show signs of trouble

WARNING SIGNS THAT YOUR CAR MAY BE HEADED FOR TROUBLE

You know your car, and, therefore, you are the best judge of when it’s acting differently. There are signs your car may exhibit that will warn you of a potential problem. It could be a light, a sound, or an unusual smell. Consumer Reports recommends at the first sign of trouble, you should take your car to a reliable mechanic.

WARNING LIGHTS

Lights that appear on your dashboard are connected to sensors that monitor everything your car does. If your car senses that something isn’t quite right, the computer will use these lights to tell you what it is. If any of these lights appear, your mechanic will be able to hook up your vehicle to a diagnostic scan tool to identify the trouble and find out exactly what’s prompting the light to turn on.

Pay attention to these warning lights, as they could indicate a problem with your vehicle:

• Check Engine

• Check Oil/Oil Level Low

• Oil Pressure Low

UNUSUAL SOUNDS

You know your car and the sounds it normally makes, but new or different sounds can be a sign of trouble. These sounds can be a clue to what’s going on under the hood. GEICO Insurance offers a list of these sounds and their possible causes.

Sounds and Possible Causes

- A sound like a coin rattling inside a tin can: Could be a loose lug nut inside the hub cap.

- Brakes squealing or grinding: Your brake pads or shoes might need to be replaced. Pads may be worn, and the sound is metal on metal.

- A snapping, popping, or clicking sound when you turn a corner: One or both of the constant velocity (CV) joints on your front axle could need to be replaced.

- A rhythmic squeak that speeds up as you accelerate: This could indicate a problem with the universal joints (U-joints) in the driveshaft.

- A howling, whining, or even “singing” sound: Bearings, which are small metal balls that help parts rotate smoothly, may not be properly working.

- A rhythmic clunking, tapping, or banging from under the hood: This could indicate a problem with valves, pistons, or connecting rods. Rough, bumpy motions could be caused by faulty spark plugs, clogged fuel lines, or a bad fuel filter.

- A squealing sound from under the hood at start-up or when accelerating: This sound could be caused by worn or loose accessory belts for the power steering pump, air conditioner compressor, alternator, or the serpentine belt.

FOUL SMELLS

Toxic gases such as carbon monoxide are contained in a car’s exhaust system. If you smell a foul or strong smell while inside your car, this may be a sign of a serious problem. You should have it checked by a mechanic as soon as possible. If oil or coolant is leaking, this may mean hazardous exhaust gases are entering the interior of your car.

The smell of rubber burning could be a signal that your car’s drive belts or accessory belts underneath the hood are damaged, worn, or loose. These belts will need to be replaced as soon as possible to prevent more problems.

SMOKE

Smoke can come from the front or back of your car. Smoke coming from beneath the car’s hood most likely means your engine is overheating, and you should bring it to a mechanic right away. The color of the smoke coming out of your exhaust pipe can give you a clue about what may be going on inside your engine.

Blue Smoke: This could mean oil is escaping from somewhere within the engine and is being burned along with the gasoline. If you see blue smoke, your mechanic should look for damaged or worn seals in the engine.

White Smoke: May mean antifreeze or water condensation may have mixed in with the gasoline. You should have it checked out as soon as possible.

Mechanics agree that preventive maintenance, including regular oil changes and belt replacement, can help to extend the life of your car. Car maintenance can be an inconvenience that requires time, planning, and effort. But, in the long run, the benefits of driving a safe car outweigh the cost and aggravation.

For more information on how to save money by properly maintaining your car, contact your local UF/IFAS Extension Office.

Sources:

AAA: https://magazine.northeast.aaa.com/daily/life/cars-trucks/benefits-maintaining-vehicle/

Consumer Reports: https://www.consumerreports.org/car-repair-maintenance/make-your-car-last-200-000-miles/

GEICO: https://www.geico.com/more/driving/auto/auto-care/car-noises/?utm_source=geico&utm_medium=email&utm_content=newsletter&utm_campaign=feb2018

by Laurie Osgood | Dec 1, 2018

It’s the Most Wonderful Time of the Year… for Criminals, Thieves and Scammers

Photo source: UF/IFAS Northwest District

This holiday season scammers and identity thieves are hoping to take advantage of shoppers who may be too preoccupied with travel, gift-buying, and festivities to notice. Therefore, during the holidays, it is even more important to remain vigilant while shopping in stores or online.

More people are turning to online shopping for their holiday gifts. The National Retail Federation forecasts consumers to spend about $721 billion this holiday season. However, this increase in online spending comes with a greater risk for thieves to steal your money or your identity.

Here are some common holiday scams and how to protect yourself from becoming a victim:

Deals That Are Too Good to Be True –while shopping online keep the old adage in mind, “If it sounds too good to be true, it probably is”. During the holidays, shoppers are looking for huge deals, and scammers know it. These thieves often set up websites that appear to be legitimate, just to steal your personal information and/or to download a virus onto your computer.

It is important to make sure any site in which you shop contains an HTTPS security designation. Another simple way to know if the website is authentic is to look for the padlock symbol that appears in the address bar of the retailer. Here is an example of an Amazon online address bar.

Holiday Phishing Scams – Around the holidays, beware of emails pretending to be sent from familiar companies like FedEx or UPS. These emails claim to provide links for package tracking information. These links, once clicked on, will either steal your personal information or download a virus onto your computer. Remember, if you receive an email from someone you don’t know or weren’t expecting an email from, you should never click on links. Also, make sure you are using current antivirus software on your computer.

Identity Theft and ATM Skimmers –

In Store Shopping:

-

- Being vigilant is key to protecting yourself during the holiday season. Thieves target shoppers who are either struggling with packages and bags or those who are unaware of their surroundings. Thieves see this as an opportunity to steal your wallet or credit card numbers.

- When using an ATM or other key pads, make sure to check for skimming devices that thieves install on ATMs and other card readers. These skimmers are placed over the existing key pad in order to access your account. It is also advised to cover the keypad when entering your pin number while purchasing items or getting money from an ATM

- After each purchase, take time to put your credit card back into your wallet. Also, it may be worthwhile to purchase an RFID-blocking wallet. These wallets are designed to shield your credit card information from RFID readers and skimmers..

Online Shopping:

- When shopping online, experts advise consumers to use credit cards instead of debit cards. In case of fraud, both payments types can be disputed, however debit card payments are automatically deducted from your bank account. Therefore, it may take longer to get your money back.

Gift Cards– Gift cards are a great idea for people on our shopping list. However, a record number of retail stores are closing their doors, so you should consider the retailer’s financial situation before buying a gift card. If the retailer closes or declares bankruptcy, the recipient may not be able to use the gift card.

Package Delivery Theft- Having packages delivered to our homes makes us a target for thieves who case neighborhoods and even follow delivery trucks looking for packages sitting on porches. There are ways to prevent this from happening to you. You can have your packages delivered to their office, a local pick-up area, like a UPS Store or try to schedule delivery times when someone will be home, if possible. Online shoppers can also set up tracking notifications, to know when an item is delivered.

Charitable Giving Tips – Give to charities wisely. At this time of year, we all want to give to charities that pull on our heart strings. But beware of giving money to charities that are fake or irresponsible. Do your research to make sure to support the many legitimate and deserving charities that can use our help during the holidays.

The 2018 Consumer Protection Guide – This guide provides more information about protecting yourself as a consumer, including online identity theft, charity scams, item recalls and more.

The holiday season brings out the best and worst in people. Therefore, you should be vigilant because the holidays are a lucrative time of year for thieves and scammers who are trying their hardest to get into your bank account.

For more tips on how to keep your identity safe and avoid holiday scams, contact Laurie Osgood, UF/IFAS Extension, Gadsden County at Osgoodlb@ufl.edu or call (850) 875-7255.

by Melanie Taylor | Feb 26, 2018

Based on information provided by the American Frozen Food Institute, on average, 40% of all food in the United States goes uneaten and wasted, which is an annual loss of $165 million. Fresh fruit and vegetable waste makes up nearly one-third of this number. With these discouraging numbers and financial losses, how can the frozen food industry help to solve this problem? Frozen food and beverage companies work hard to create the safest and best freezing techniques to keep food safe by preventing microorganisms from growing and by slowing down the enzyme activity that causes food to spoil. Modern freezing techniques have been designed to preserve food at its peak freshness and nutrient content. Frozen food makers continue to work with the U.S. Department of Agriculture (USDA) and the U.S. Food and Drug Administration (FDA) to keep America’s food supply the safest in the world.

Based on information provided by the American Frozen Food Institute, on average, 40% of all food in the United States goes uneaten and wasted, which is an annual loss of $165 million. Fresh fruit and vegetable waste makes up nearly one-third of this number. With these discouraging numbers and financial losses, how can the frozen food industry help to solve this problem? Frozen food and beverage companies work hard to create the safest and best freezing techniques to keep food safe by preventing microorganisms from growing and by slowing down the enzyme activity that causes food to spoil. Modern freezing techniques have been designed to preserve food at its peak freshness and nutrient content. Frozen food makers continue to work with the U.S. Department of Agriculture (USDA) and the U.S. Food and Drug Administration (FDA) to keep America’s food supply the safest in the world.

Freezing means less wasted food and easier access to well-balanced, portion-controlled nutritious foods during every season and in every community. Many times, frozen foods cost less per serving, but most importantly, they have a longer shelf life than fresh or refrigerated foods.

How do frozen foods play such an integral part in the well-balanced, nutritious diets of Americans? The frozen food aisle offers a large variety of vegetables, fruits, and other prepared foods at reasonable prices year ’round. Freezing reduces the need for additives and preservatives. Frozen foods also provide nutritious options that fit into all of the food groups suggested by Choose MyPlate.gov (fruits, vegetables, whole grains, protein, and dairy). They also are a sensible choice when trying to control calories and fat, sugar, saturated fat, and sodium intake. In addition, unused products can be placed back in the freezer for later use.

If you have concerns about frozen foods, it’s time to rethink them. Let’s BUST those crazy frozen food myths swirling around out there!!!

FROZEN FOOD MYTHS VS. FACTS

MYTH: FROZEN FRUITS AND VEGGIES AREN’T AS NUTRITIOUS AS FRESH

FACT: Recent studies found there is no difference in nutrition between frozen and fresh produce.

MYTH: FROZEN FOODS ARE READY TO EAT

FACT: Frozen foods are ready to cook, not ready to eat. As their name suggests, ready-to-cook foods must be cooked or baked according to package instructions.

MYTH: FROZEN MEALS DON’T USE REAL INGREDIENTS

FACT: The freezer aisles of your supermarket are filled with meals made with the highest quality ingredients and prepared the way you would prepare them (if you had the time).

MYTH: FROZEN MEALS AREN’T ENVIRONMENTALLY FRIENDLY

FACT: Actually, frozen foods minimize the amount of spoiled food we throw away because they are already portioned out, so we can take what we need and save the rest.

MYTH: FROZEN MEALS ARE MORE EXPENSIVE THAN RESTAURANT TAKE-OUT MEALS

FACT: Restaurant-inspired entrees like seafood scampi, sesame chicken, and Monterey chicken cost under $4 each. You do the math.

MYTH: FROZEN MEALS ARE NOT A GOOD CHOICE FOR HEALTH-CONSCIOUS CONSUMERS

FACT: “Better-for-you” options are available in the frozen food aisle to make it easier for consumers to control intake of calories, fat, saturated fat, and sodium.

For more information on the frozen food and beverage industry, please visit www.affi.org.

For more information on incorporating frozen foods into your healthy lifestyle, please visit: http://edis.ifas.ufl.edu/fs186.

by Heidi Copeland | Dec 2, 2017

Recently, in what I thought would be a quick Saturday errand, I got stuck in traffic. It took me a moment to realize that the holidays are upon us.

Recently, in what I thought would be a quick Saturday errand, I got stuck in traffic. It took me a moment to realize that the holidays are upon us.

According to the National Retail Federation (NRF®), from Thanksgiving Day through Cyber Monday, more than 174 million Americans shopped in stores and online during the five-day holiday weekend, beating the 164 million estimated shoppers from an earlier survey. In fact, shoppers spent $1 million a minute on Black Friday and about $6.6 billion in total on Cyber Monday. The NRF® also found that consumers, both young and old, were spending more than last year, with both groups using the internet to browse for the best deals.

While it appears many consumers can spend unrestrained during the holidays, a lot of consumers find the holiday season stressful. Holidays require a lot of planning, and of course time and money.

A sensible way to approach the holiday season is to decide up-front what best fits the path you want to take. Come up with a plan, make a list (check it twice), and then stick to it. You will be amazed at how this simple list trick can relax you and make your holidays more enjoyable and less stressful.

The American Financial Services Association Education Foundation has some useful ideas for using a holiday spending plan. First, create a holiday budget that is feasible for you, and be sure to include all the incidentals from decorations to wrapping materials. Next, prepare your list(s), then do your homework. There is a lot of competition for the consumer’s money, and searching the web not only for information but also for the best deals can help you stick to your budget and save some money (Example: some stores honor other store’s pricing).

Other ideas to help stay within your budget this holiday include:

- Draw names with set limits on gift giving (Example: Aunt Marge – $15.00)

- Make a gift (Example: Cranberry muffins)

- Provide a service (Example: tackle a chore for a friend, neighbor, or loved one)

- Switch to giving gifts of experience (Example: tickets to an event) The gift of experience can be both practical and educational, and moreover, memories are worth more than stuff!

Try not to get bogged down by holiday spending this holiday season. I encourage you to create a plan, write up a list (check it twice) and stick to it. You will be glad you did!

The University of Florida Extension/IFAS – Leon County is an Equal Employment Opportunity Affirmative Action Institution.