by Judy Corbus | Jul 3, 2025

Check the terms of your homeowners or renters policy to make sure you have adequate coverage.

Photo credit: Judy Corbus, NW Extension District

Do you know what your home insurance covers? How about levels of coverage or exclusions? If you’re not sure, now is a good time to take a look at your homeowner’s or renter’s policy. Hurricane season potentially increases the likelihood of filing a claim and it’s wise to know your level of coverage, perils included (or excluded), and deductibles before the need arises.

How Much Insurance Should I Buy?

To be adequately covered, your home must be insured for the amount necessary to rebuild it at the current cost factoring in building material prices and labor costs. Also, depending on the age of your home, it may need to be repaired or rebuilt to meet current building codes. Law and Ordinance coverage will cover these additional costs so discuss your policy with your insurance agent. If your home is underinsured at the time of loss, there may be a penalty or reduction in the amount the insurance company will pay for the loss. Discuss both the limits and adequacy of types of coverage with your agent.

What Perils are Covered by My Policy?

Damage from rising water (flood) is not covered by most homeowners’ policies. You may purchase flood insurance through the National Flood Insurance Program (NFIP) or through private insurers. Flood insurance is available to cover your home and personal property. Usually, there is a 30-day waiting period before a flood insurance policy goes into effect with the NFIP, unless you purchase the policy at the same time you purchase or refinance your home. You may obtain flood insurance through your local agent.

You also should check for windstorm coverage, sinkholes and catastrophic ground cover collapse, and mold coverage.

Replacement Cost or Actual Cash Value?

These two settlement options are available when purchasing home insurance. Replacement Cost is the amount needed to repair or replace damaged property with materials of similar kind and quality without deducting for depreciation, which is the decrease in the value of your home or personal property due to normal wear and tear. Actual cash value is the amount needed to repair or replace an item, less depreciation. To receive replacement cost coverage, most homeowners’ insurance policies require the policyholder to insure the home for at least 80% of its replacement value.

What About the Hurricane Deductible?

The Hurricane Deductible is the deductible applied to loss caused by a hurricane. The deductible is the dollar amount paid by the policyholder before an insurance company pays anything. Typically, the hurricane deductible is $500 or two, five, or ten percent of the amount of insurance covering the dwelling at the time of loss. In Florida, you pay one hurricane deductible per calendar year as long as you are insured by the same insurer for the second or subsequent hurricanes for the same calendar year. The hurricane deductible applies from the time a hurricane watch or warning is issued for any part of Florida until 72 hours after the last hurricane watch or warning is terminated for any part of Florida.

Take a few moments to review your policy while the sun is shining and the waters are calm so you are prepared for hurricane season.

For more information on homeowners’ insurance, check out Homeowners Insurance A Toolkit for Consumers and Florida’s Hurricane Deductible.

Sources:

Homeowners Insurance A Toolkit for Consumers

Florida’s Hurricane Deductible

by Judy Corbus | Apr 28, 2025

Spring has sprung and you may feel the urge to give your home a deep cleaning. The American Cleaning Institute finds that 80% of us are doing some type of deep cleaning this spring so you are not alone. Deep cleaning your home after winter gives a fresh restart and boosts your spirits.

Make your own household cleaners to save money and reduce container clutter. Photo credit: Judy Corbus

When choosing cleaning products, keep in mind that you can make your own from ingredients you already may have on hand. You will save money and reduce container clutter with products that can clean multiple surfaces. Here is a list of basic cleaning ingredients:

- Vinegar

- Rubbing alcohol

- Washing soda (can be found near the laundry detergent in most stores)

- Borax (also near the laundry section)

- Mild dish detergent

- Liquid bleach

- Baking soda

- Ammonia

- Water

Here are a few recipes to get you started:

Everyday Household Cleaner

- 2 tablespoons of liquid detergent/soap

- 2 tablespoons of ammonia

- 1 quart of water

Use for all general cleaning jobs.

Window Cleaner

- 1/4 cup rubbing alcohol

- 1/4 cup white vinegar

- 1 tablespoon cornstarch

- 2 cups warm water

Combine all ingredients together in an empty spray bottle and shake well. You will need to shake it a little with each use if you see cornstarch accumulating at the bottom of the bottle. Use crumpled-up newspaper to shine the windows.

Ceramic Tile Floor Cleaner

- 1/4 cup of white vinegar (or more depending on how dirty)

- 1 gallon of water

Typically requires little-to-no scrubbing to remove most dirt and doesn’t leave a film like soap sometimes does when using hard water.

With all cleaning products, remember:

- It is best to mix just what you need and use it all.

- Be sure the container has a label. If you make your own cleaner, always label it.

- Never put cleaners in food containers.

- Store cleaning solutions out of children’s reach.

Note: Use caution when making homemade cleaners! Mixing bleach with ammonia or vinegar will create toxic fumes that are very dangerous to your lungs and breathing!

For additional cleaner recipes, check out:

Reference: Homemade Household Cleaners

An Equal Opportunity Institution.

by Samantha Kennedy | Mar 28, 2025

In today’s credit-centric economy, maintaining a healthy credit score is more crucial than ever. One of the most effective ways to ensure good credit health is by regularly reviewing your annual credit reports from all three major credit reporting agencies: Equifax, Experian, and TransUnion. This practice not only helps you stay informed about your financial status but also protects you from potential fraud and errors that could negatively impact your credit score.

Understanding Your Credit Report

A credit report is a detailed record of your credit history, including information about credit accounts, payment history, and any public records such as bankruptcies or liens. Each of the three major credit reporting agencies collects and maintains this information independently, which means that your credit report from Equifax may differ slightly from the one provided by Experian or TransUnion. By reviewing all three reports, you get a comprehensive view of your credit history and can identify any discrepancies or inaccuracies.

Detecting Errors and Fraud

Errors on credit reports are more common than is often thought. According to a study by the Federal Trade Commission, one in five consumers has an error on at least one of their credit reports. These errors can range from incorrect personal information to inaccurate account details or even accounts that do not belong to you. By reviewing your credit reports annually, you can spot these errors early and take steps to correct them before they cause significant damage to your credit score.

In addition to errors, reviewing your credit reports can help you detect signs of identity theft. If you notice unfamiliar accounts or inquiries on your report, it could be a sign that someone has stolen your personal information and is using it to open credit accounts in your name. Early detection is key to minimizing the damage caused by identity theft, and regularly checking your credit reports is one of the best ways to catch fraudulent activity quickly.

Improving Your Credit Score

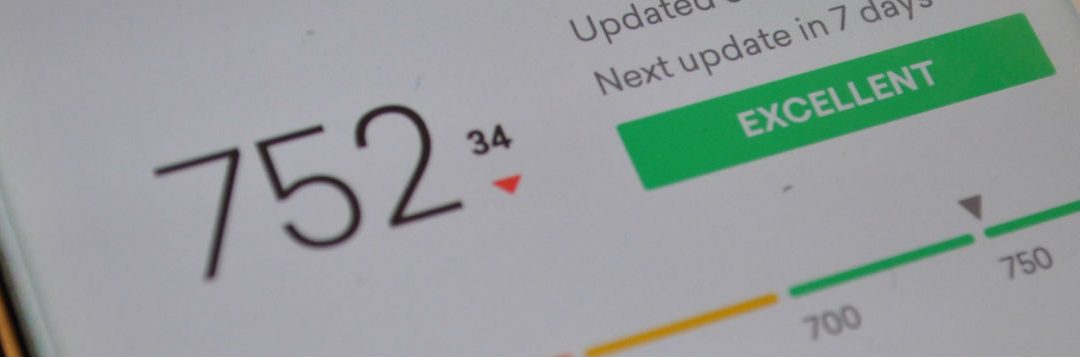

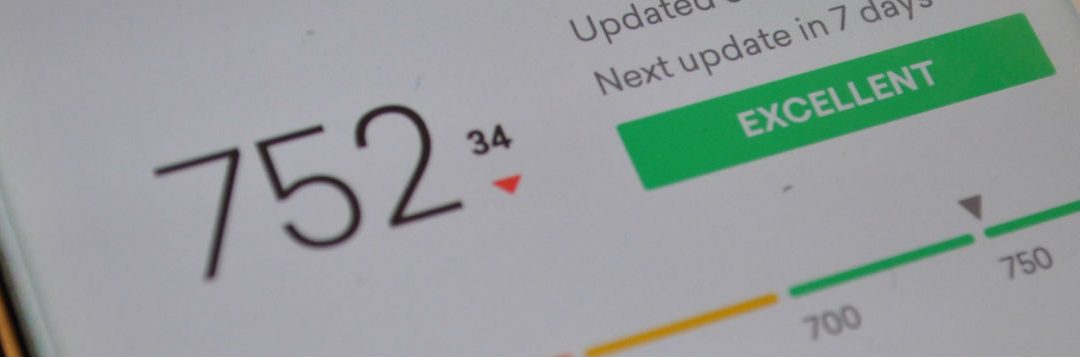

Your credit score is a numerical representation of your creditworthiness, and it plays a significant role in your ability to obtain loans, credit cards, and even housing. By reviewing your credit reports, you can identify areas where you can improve your credit score. For example, you might notice that you have high credit card balances or a history of late payments. By addressing these issues, you can work towards improving your credit score over time.

Reviewing a copy of your credit report from each credit reporting agency at least once a year is a great way to discover errors that may negatively impact your credit worthiness. (Adobe Stock photo)

Taking Advantage of Free Reports

Under the Fair Credit Reporting Act (FCRA), you are entitled to one free credit report from each of the three major credit reporting agencies every 12 months. In 2024, this changed to free weekly copies of your credit report from each agency. This means you can access your credit reports from Equifax, Experian, and TransUnion at no cost, giving you the opportunity to review your credit history without any financial burden. To obtain your free reports, you can visit AnnualCreditReport.com, the only authorized website for free credit reports. You will never be asked to pay for your credit report on this site. If you are, you are on the wrong site.

Reviewing your credit report from all three major credit reporting agencies is a vital step in maintaining your financial health. By staying informed about your credit history, detecting errors and fraud early, and taking steps to improve your credit score, you can ensure that you are in the best possible position to achieve your financial goals. Don’t wait until it’s too late—make reviewing your credit reports a regular part of your financial routine.

An Equal Opportunity Institution

by Sharlee Whiddon | Feb 27, 2025

Managing debt effectively involves setting clear, achievable goals and creating a structured plan. A good approach is using the SMART framework—ensuring that your debt repayment strategy is Specific, Measurable, Achievable, Relevant, and Time-bound. Here’s how you can apply SMART strategies:

Be Specific! Define the exact amount of debt you want to pay off. Instead of a vague goal like “reduce debt,” specify “pay off $5,000 in credit card debt.” List Your debts! Break down which debts need to be paid first, whether they are credit cards, loans, or other liabilities.

Make it Measurable! Identify a way to track your progress. Regularly check how much debt you’ve repaid. For example, you could track your debt in monthly statements or use budgeting apps. Also, set milestones. Break your larger goal into smaller, measurable targets – for example, paying off $1,000 of a $5,000 debt each month.

Is it Achievable? Set a realistic repayment plan. Consider your current financial situation—how much you can afford to pay each month. Make sure your goal is within reach given your income and expenses. Consider interest rates and prioritize high-interest debts first, such as credit cards, to reduce the overall amount paid in interest over time.

How Relevant is this? The debt repayment should tie into your broader financial goals, whether it’s improving your credit score, saving for a down payment, or achieving financial independence. Understand why paying off your debt is important to you. Whether it’s peace of mind, improving your financial health, or reducing stress, make sure your goal is personally meaningful.

It’s got to be Time-bound! Assign a target date for paying off your debt. For example, “Pay off $5,000 by the end of 2025.” Check in monthly or quarterly to ensure you’re on track and adjust as needed. This will help you stay focused on meeting your deadline.

By following these SMART principles, you’ll have a clearer, actionable plan that can help you stay on track with your debt management.

Using IFAS-generated budgeting tools, young people can learn to manage their money and begin saving and investing in the future. (UF/IFAS Photo: Tyler Jones. IFAS Extension calendar 2009)

Once you have taken the steps to build your SMART debt management plan, consider using the debt snowball or debt avalanche methods to aid in reaching your goal. These methods are popular strategies for debt repayment. Debt snowball involves paying off the smallest debt first, while Avalanche focuses on paying off the highest-interest debt first.

Find an accountability person that you can share your goal with and who will support you as you work to meet your goals. Planning regular check-ins with this person to monitor progress helps maintain positive energy and will lead to success.

It is a good idea to work on building a small emergency fund while paying off debt to avoid falling back into debt in case of unexpected expenses. Once you have eliminated your debt, grow your emergency fund even more.

It is important to celebrate your success of managing and erasing your debt. Just be sure the celebration doesn’t lead to finding yourself in debt again! A celebration might be a call to a friend or family member to share the great news or helping someone else use the SMART principles to set a goal they have.

For more information on managing your debt, contact your local UF IFAS County Extension Office.

Source: Forbes –The Ultimate Guide to S.M.A.R.T. Goals – Forbes Advisor

An Equal Opportunity Institution.

by Judy Corbus | Aug 28, 2024

With summer in full swing, you’ve probably noticed an uptick in your electricity bill. The hot temperatures and high humidity have been giving your air conditioner a real workout! Since your heating, ventilation, and cooling (HVAC) system uses the most electricity of any item in your home, taking steps to improve its efficiency will save energy and money. Try these five easy ways to stay cool for less:

Adjust the thermostat. Set the air conditioner thermostat to 78o F. For every degree setting below 78o F, you spend up to 4% more in cooling costs.

Use fans. Ceiling and floor fans move air to create a breeze, which can make a room feel up to four degrees cooler than the actual temperature. This allows you to set the thermostat higher and still be comfortable. Ceiling fan blades should move in a counterclockwise direction to create a downdraft – you can adjust the direction by moving the switch located on the side of the motor casing. Tip: Fans cool people, not rooms, so turn off the fan when you leave the room to save more money on your power bill.

Use window coverings to control sunlight. East- and west-facing windows catch the brunt of the sun’s heat, adding extra warmth to those sides of your home. Keep blinds and drapes closed to block out morning or afternoon sunlight so your air conditioner doesn’t have to work harder to cool those rooms.

A dirty filter forces your HVAC system to work harder, raising your power bill and shortening the lifespan of the unit.

(Photo source: Judy Corbus)

Change the air filter. Dirty air filters restrict airflow and may cause the HVAC system to run longer, increasing your energy bill and potentially shortening the life of the unit. Many newer HVAC systems shut down if the filter becomes too clogged for air to pass through the filter; this prevents the compressor motor from overheating. When this occurs, a service technician must inspect and reset the unit, resulting in a service charge. During periods of high use or if you live in a dusty area or have pets, check and change your filter monthly, even if the filter is labeled to last three months. Pick a day that’s easy to remember, like the first of the month or when you receive your power bill in the mail. Make sure you use the filter type and size recommended by the manufacturer for optimal efficiency. While you’re at it, dust your ceiling fan blades, too!

Have your HVAC system serviced at least annually. Schedule a maintenance check on your unit at least once a year. A trained technician will check the coolant level, drain line, and overall system to make sure everything is operating at peak efficiency. If you live in a manufactured home, it’s especially important to check the ductwork to ensure it has not separated at the seams, resulting in a loss of cool air inside and higher electricity bills. Routine maintenance will head off potential problems, extending the life of your unit and promoting efficient operation for reduced power bills. Tip: Prune back shrubs that may block airflow to your air conditioner compressor.

These simple tips will help to cool down your power bill while you stay cool!

For more energy-saving tips, visit the Florida Energy Systems Consortium.

An Equal Opportunity Institution.

by Sharlee Whiddon | Jul 19, 2024

You’ve heard the saying, “A penny saved is a penny earned,” but why, how, and where should you be saving?

Let’s begin with why you should be saving. While we hope that life goes smoothly and there are no unexpected emergencies, that’s just not realistic. It is important to begin saving so you will be prepared for emergencies that arise, things like when the dryer stops working or your car needs repairs or new tires. This can also be an account to help prepare for a planned vacation or a large, expected expense. Preparation is key!

Save regularly toward your goals – it will add up quickly! Photo source: UF/IFAS Extension

That leads us to the next pieces – how and where do you save? This all begins with taking the steps to open a savings account. These days, opening an account can be done from nearly anywhere. You might visit a financial institution’s local branch, make a phone call, or even go online. You will need to provide a few pieces of personal information for verification and often you are required to deposit a sum of money to activate the account. Once your account is open, you can decide how to add money into it. Perhaps you deposit a certain amount from a regular paycheck or funding source, maybe you would prefer to transfer funds from other accounts, or you can deposit cash or checks periodically.

One thing about a savings account is the money is typically not as accessible as money in a checking account. This is all by design – the funds you allot to your savings account should be left alone and not used frivolously. An advantage to a savings account is the interest earned on your money while you aren’t doing anything with it. It won’t be much in the beginning, but, over time, interest earned could be a bit of a boost to your savings, helping you reach your goals more quickly.

To reach goals, you need to plan them out – be SMART. SMART goals are Specific, Measurable, Attainable, Relevant, and Timed. Decide what you will be saving for and be specific. Will this account be for emergencies, vacation, or a vehicle? Your savings goal should also be measured in some way so you can track your progress. Ensure your savings goal will be attainable, set yourself up for success, and be realistic with the amount of money you are setting aside. Your savings goal also should be something you are excited to work towards to make it relevant to you. Lastly, give yourself a time frame for reaching your savings goal. Will this take a month, one year, five years? Whatever you decide, stick to your time frame. Being able to identify your goals will aid in your savings success.