by Samantha Kennedy | Nov 10, 2020

It has often felt like time has dragged on in 2020, but despite all the challenges, time has continued to march on, and that means the holiday season is right around the corner. Thanksgiving is fast approaching; November 26th will be here before we know it. And while this year has been tough in many ways, we also have a lot for which to be thankful.

One of the ways we celebrate that gratitude is through a nice meal with friends and family. However, many of us have experienced financial difficulties over the last several months, which may put a damper on our traditional celebrations.

With that in mind, here are a few tips for saving money this Thanksgiving:

Keeping the sides simple and having guests contribute items to the meal are two ways to reduce the overall cost of a Thanksgiving meal. (Photo source: Tyler Jones, UF/IFAS)

Shop with a list. This is good advice for everyday shopping, too, but especially at the holidays, when there are just so many delicious seasonal goodies available and we might feel like splurging. Don’t get carried away, though! Stick to traditional favorites everyone enjoys and only get enough to feed the number of guests, not an army. And remember, if it’s not on the list, don’t buy it.

Shop early. Supermarkets often begin putting holiday food items on sale weeks before the main event. Planning ahead and purchasing ingredients early can save money in the long run. Also, think about purchasing canned and dry goods for next year’s festivities right after this Thanksgiving, as ingredient prices are reduced in order to sell them more quickly and make room for other items. Just remember to check the expiration/sell-by dates to make sure they do not expire before next year.

Choose one type of meat. Turkey is the traditional centerpiece to most American Thanksgiving meals, but it doesn’t have to be. Other popular meats include ham, lamb, roast, and prime rib. The key to saving money on the meat, however, is to choose just one. Meat is one of the most expensive items on a Thanksgiving menu, and, odds are, if there is an abundance of side dishes, there won’t be a need for as much meat.

Frozen over fresh. As for the turkey, go with a frozen store brand turkey. The savings could be significant over a name brand or fresh turkey. Just remember, frozen turkeys take time to thaw safely in the refrigerator. Plan for 24 hours of thawing time per five pounds of turkey. For example, a 15-pound turkey will take at least three days to thaw in the refrigerator. Remember to place the turkey in a pan to prevent juices from dripping onto other food in the refrigerator.

Make it a potluck. Ask guests to bring a dish to share with everyone else. This way, the expense is spread out over several people and everyone saves money. There are some really great free websites that allow people to sign up to bring certain items. Customizing the sign-up helps ensure that everything is accounted for and that there isn’t a pile of pumpkin pies but no side dishes.

For more information about holiday savings tips, contact Samantha Kennedy, Family and Consumer Sciences agent, at (850) 926-3931, or reach out to your local Extension office.

Additional Resources:

Five Steps to Seasonal Savings (UF/IFAS Extension)

Food Safety Tips for the Holiday Season (UF/IFAS Extension)

UF/IFAS is an Equal Opportunity Institution.

by Heidi Copeland | Oct 16, 2020

Fall is in the air! In addition to the crisp, cool weather comes the season of two of the top consumer spending events: Halloween and the winter holidays.

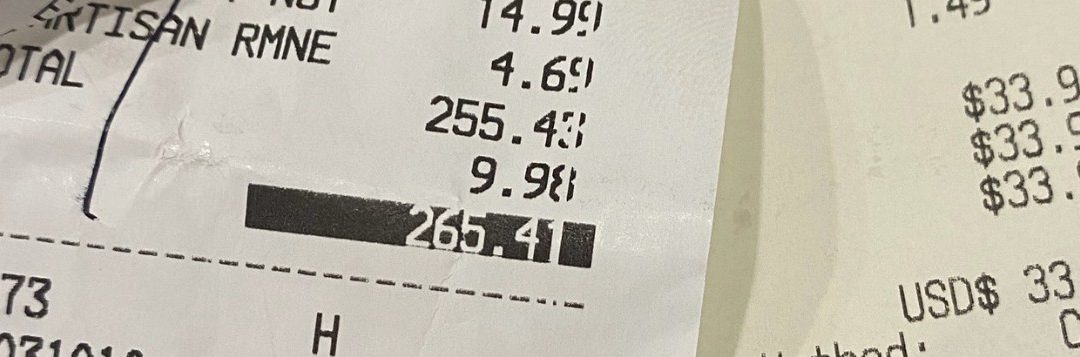

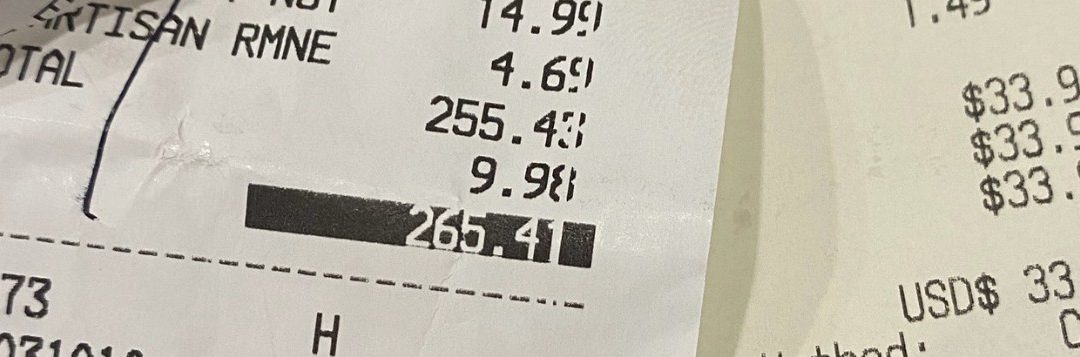

Receipts add up quickly

Photo Source: Heidi Copeland

In 2019, according to the National Retail Federation’s annual survey, U.S. consumers spent $2.6 billion on Halloween candy alone, about $25 per person. This does not even take into consideration all the other bits and pieces that can go into more elaborate Halloween celebrations: decorations, entertainment and activities, costumes (for kids, adults, and animals), cosmetics, food and drink, and even stationery such as cards and party invitations. Overall, Halloween retail spending was estimated at $8.8 billion in 2019.

Next in line are the winter holidays. These include Thanksgiving, Black Friday, Small Business Saturday, Cyber Monday, Super Saturday, and Christmas. Even with the Covid-19 quarantine, consumers are on track to start the 2020 seasonal spending spike. For many, Covid-19 has provided a state of anxiety, isolation and uncertainty. The upcoming seasonal events can be a big boost in providing a bit of nostalgia, normalcy and fun.

It is important, however, to heed the words of The Cat in the Hat: It’s fun to have fun, but you have to know how!

The truth is the US economy thrives on consumer spending! But, be honest, does derailing your budget for stuff you might have to pay for later really make you feel better? Seasonal spending is the type of spending that can lead families into the New Year with stress and anxiety. Be aware of spending temptations and triggers.

Wikipedia defines temptation as a desire to engage in short-term urges for enjoyment. Anything that promises pleasure can be tempting. Triggers are a stimulus that alerts your brain and body to an old, known experience, which makes it more likely that we will engage and buy something.

For example, a trigger could be a smell. You might think, “I smell cinnamon. Cinnamon reminds me of fall at grandma’s. Her house always smelled like cinnamon.” The temptation would then be: “Cinnamon brooms are at the check-out cashier. I think I will buy one.”

Recognize what sets you up – smells, prices, product placement, etc. There is a method behind the madness of marketing, all of which is geared to attract a consumer to make a purchase. This year especially, anything that offers nostalgia, normalcy, or fun will be a hot commodity.

Knowing your values and goals, and creating a plan for spending (budget), will help you organize your spending. Know, too, it is reasonable to spend money on fun stuff this season of spending. But also remember: happiness is a sense of well-being, joy, or contentment. It is very hard to buy that!

by Samantha Kennedy | Nov 27, 2018

Creating a holiday spending plan and sticking to it can help decrease stress and reduce debt in the new year. (Photo source: Samantha Kennedy)

The holidays are once again upon us. For many people, it can be a time of stress, frustration, and financial uncertainty as they drive themselves past their limits to try to make everyone happy and everything perfect.

One of the biggest seasonal stressors is spending too much on gifts, food, and home décor. While it may seem worth it at the time, buyer’s remorse may quickly set in after the New Year when the bills start rolling in.

The most important thing that can be done to help curb holiday spending is to set a budget.

Maybe going all out for Christmas is a family tradition. Great! If it is, however, the best thing to do is to make a plan to save the money over the preceding months so it will be available to spend when the time comes. Spending money that is not in the budget or overusing credit are surefire ways to increase debt and cause strife later.

The holidays should be about family, friends, and the joy of giving. It should not be a competition to see who can have the biggest, brightest, most fabulous home, gifts, etc.

Retailers and the media work hard to send the message to consumers that the latest this or the greatest that are needed to get the full holiday experience. However, it is important to resist their messaging and stick to the determined budget.

Including children in any discussions about holiday spending is important. Let them know that there is only a certain amount of money available to spend on gifts and help them understand the importance of sticking to the budget. While parents may feel pressured to get everything on their child’s wish list, focusing on a few special items will help families stay on financial track.

Cash and debit cards are the best ways to pay. If the money is coming directly out of pocket, consumers are more likely to be more cautious before spending. Use credit cards wisely. Choosing to purchase with credit in order to receive airline miles or rewards points is fine, but keep close track of all purchases and only charge as much as can comfortably be paid off in its entirety when the bill comes due. Avoid the pitfall of still paying off this year’s holiday spending next Christmas.

Some of the most meaningful and treasured gifts are those that come from the heart. Custom, handmade gifts really show a person they are valued.

One large gift for an entire family that everyone can enjoy can also save money over buying something for each individual. Many people also appreciate a donation in their name to a charity or cause that is near and dear to their hearts.

The holidays do not need to be stressful or break the bank. By adopting a few smart spending practices, you can enjoy the holidays without the added worry.

For more information on holiday spending and strategies for creating a smart holiday spending plan, please call Samantha Kennedy at (850) 926-3931.

Extension classes are open to everyone regardless of race, creed, color, religion, age, disability, sex, sexual orientation, marital status, national origin, political opinions or affiliations.

by Samantha Kennedy | Nov 18, 2017

By adopting a few smart spending strategies, you can help avoid overspending and decrease holiday stress. (UF/IFAS File Photo)

It’s that time again – the most wonderful time of the year! For many of us, though, it can be a time of stress, frustration, and financial uncertainty as we drive ourselves past our limits to try to make everyone happy and everything perfect.

But it doesn’t have to be that way!

First of all, perfect – the type of perfect reserved for TV and movie holidays – is an unrealistic goal. Focus on what will make you happy while working within your means. One of the biggest seasonal stressors is spending too much on gifts, food, and home décor. While it may look beautiful and idyllic at the time, you may suffer buyer’s remorse in the New Year when the bills start rolling in.

The most important thing you can do to help curb holiday spending is to set a budget. Maybe you love to go all out for Christmas. Great! But if this is what you enjoy, you need to make a plan to save the money over the preceding months so it will be available to spend when the time comes. Spending money you cannot really afford to spend or overusing credit is a surefire way to increase debt and cause strife later.

The holidays should be about family, friends, and the joy of giving. It should not be a competition to see who can have the biggest, brightest, most fabulous home, gifts, etc. Retailers and the media may try to convince you – or more to the point, your kids – that you must have the latest this or the greatest that in order to make your holiday complete. But resist their messaging and stick to your financial guns!

Including children in any discussions about holiday spending is important. Let them know that you have only a certain amount of money to spend on gifts and help them understand the importance of sticking to your budget. While you may feel pressured to get everything on your child’s wish list, focusing on a few special items may help you stay within budget.

Cash and debit cards are the best ways to pay. If the money is coming directly out of your pocket, you may give each purchase a second thought. Use credit cards wisely. If you choose to purchase with credit in order to receive airline miles or rewards points, keep close track of your purchases and only charge as much as you can comfortably pay off in its entirety when the bill comes due. The last thing you need or want is to still be paying off this year’s holiday spending next year.

Some of the most meaningful and treasured gifts are those that come from the heart. Custom, handmade gifts really show a person you know them well and you care about them. One large gift for an entire family that everyone can enjoy can also save money over buying something for each individual. Many people also appreciate a donation in their name to a charity or cause that is near and dear to their hearts.

The holidays do not need to be stressful or break the bank. By adopting a few smart spending practices, you can enjoy the holidays without the added worry.

For more information about this topic, please read the UF/IFAS publication “Five Steps to Seasonal Savings” at http://edis.ifas.ufl.edu/pdffiles/FY/FY140500.pdf.

by Shelley Swenson | Dec 9, 2014

©Feverpitched

Recently, UF/IFAS published Five Steps to Seasonal Savings, http://edis.ifas.ufl.edu/pdffiles/FY/FY140500.pdf, an EDIS brochure which reminds us of the stress that can result from holiday spending. I would encourage each of you to print or review the brochure and ponder its message TODAY. We are nearing the hustle and bustle of preparing for the season and it is timely information.

The five steps are:

- Recognize Your Seasonal Stressors

- Develop a Holiday Spending Plan – Make a Budget

- Develop a Holiday Spending Plan – Create a List

- Find Alternatives to Pricey Presents

- Fine-Tune Your Financials

It is already early December, the Thanksgiving shopping sale and Cyber Monday have passed but planning is still possible before the 2014 holiday rush if you will take some time to do so.

The section of this brochure that really spoke to me is the Fine-Tune Your Financials. As I do every day, I try to use cash and/or debit cards when possible. I need to see the money leave my account so the holidays don’t haunt me into the new year. There is too big of an allure for me to overspend when I buy gifts with credit. There is not as much reality with credit card spending. Paying interest on the credit debt is even more troubling, as the holiday spirit is long gone before the item is paid for.

Holidays are about spending time with family and friends. It does not need to center on gift giving. Consider your spending plan in the next few weeks for a more financially comfortable 2015.