Tired of renting and thinking about buying a house? Not sure where to start? Let’s talk about some of the first steps in the path to homeownership.

Many people don’t realize that making the decision to buy a home and the process to buy one isn’t a one-size-fits-all step. There are many emotions and considerations that go into it. Here are some of the first questions to consider.

Do you have a budget or spending plan that you can live on?

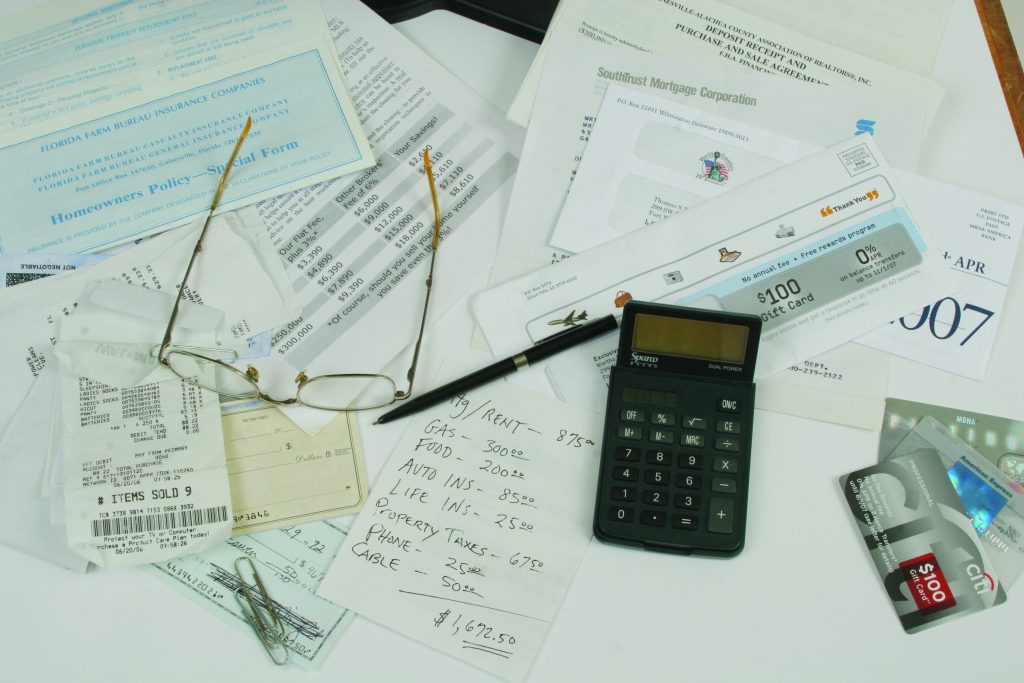

Having a spending plan or budget that you can live on means that you’ve reviewed your income and expenses and either have a balanced budget or one with money left over. You may adjust that budget each month as expenses and/or income change but you don’t end the month in the negative. If you’re just getting started, try checking out our Money Management Calendar. It will take you through the six steps of building a spending plan and serve as a tool to help track your money each month. Knowing your financial situation before you begin the process to buy a home is important, as there are out-of-pocket costs that you’ll encounter when buying a home such as appraisal fees and closing costs, in addition to costs associated with homeownership, like maintenance, repairs, and insurance.

How does your credit report and credit score look?

Lenders use your credit score to help determine whether or not to approve you for a mortgage loan and, if approved, at what interest rate. The higher your credit score, typically, the lower your interest rate and the less you’ll pay for your home. Different loan programs may also have a minimum credit score requirement you’ll have to meet. Start by checking your credit report at the three different credit reporting agencies: Experian, Equifax, and TransUnion. Look for any errors or mistakes that could negatively impact your score. The three national credit reporting agencies permanently extended a program allowing individuals to check their credit report for FREE once a week at each agency. Visit AnnualCreditReport.com access the free copies of your credit reports. Improving your credit score can take time so starting early is helpful.

How much debt do you have?

Debt is another factor that lenders consider when you apply for a mortgage loan. Having too much debt can cause you to be turned down for a mortgage loan. The amount of debt you have can also significantly impact how much a lender is willing to lend you toward a home purchase. You can calculate your debt-to-income (DTI) ratio by dividing your total monthly debt payments by your total gross monthly income and multiplying it by 100 to convert it to a percentage. For total monthly debt payments, you should include any loans, credit card payments, child support, alimony, medical payments, and similar items. Do not include things like groceries, utilities, etc.

Each lender and loan program will have a different maximum limit, but many are in the range of 35-41% of your income going for debt repayment.

These are just a few of the initial questions to consider if you’re thinking about buying a home (and can be ones to think about even if you’re not!). Saving money, paying down debt, and repairing or raising your credit score all take time. Starting today can help you to be in a better position when you are ready to take the next step. If you want to learn more, UF/IFAS Extension offers classes for first-time homebuyers (returning buyers are welcome, too!) that go more in-depth for each of these questions and much more. Contact your local Extension office to find out about class schedules.

Resources:

My Florida Home Book: A Guide for First-Time Homebuyers in Florida, University of Florida/IFAS Extension

- Are You Considering Homeownership? - May 24, 2024

- February is National Canned Food Month - February 21, 2021

- If Your New Year’s Resolution is to Eat Healthier, Do You Know Where to Start? - January 14, 2021