by Heidi Copeland | Mar 2, 2018

Photo credit: NW Extension District

Sustainability!

According to the Environmental Protection Agency (EPA), the term sustainability has emerged because of significant concerns about the unintended social, environmental, and economic consequences of our world’s rapid growth. Sustainability is based on the simple principle: Everything we need for our survival and well-being depends, either directly or indirectly, on our natural environment. Therefore, sustainability creates and maintains the conditions under which humans and nature can exist in harmony, fulfilling the social, economic, and other requirements of present and future generations.

WHEW! A mouthful, to be sure. Nevertheless, issues of sustainability are often overlooked on the individual level.

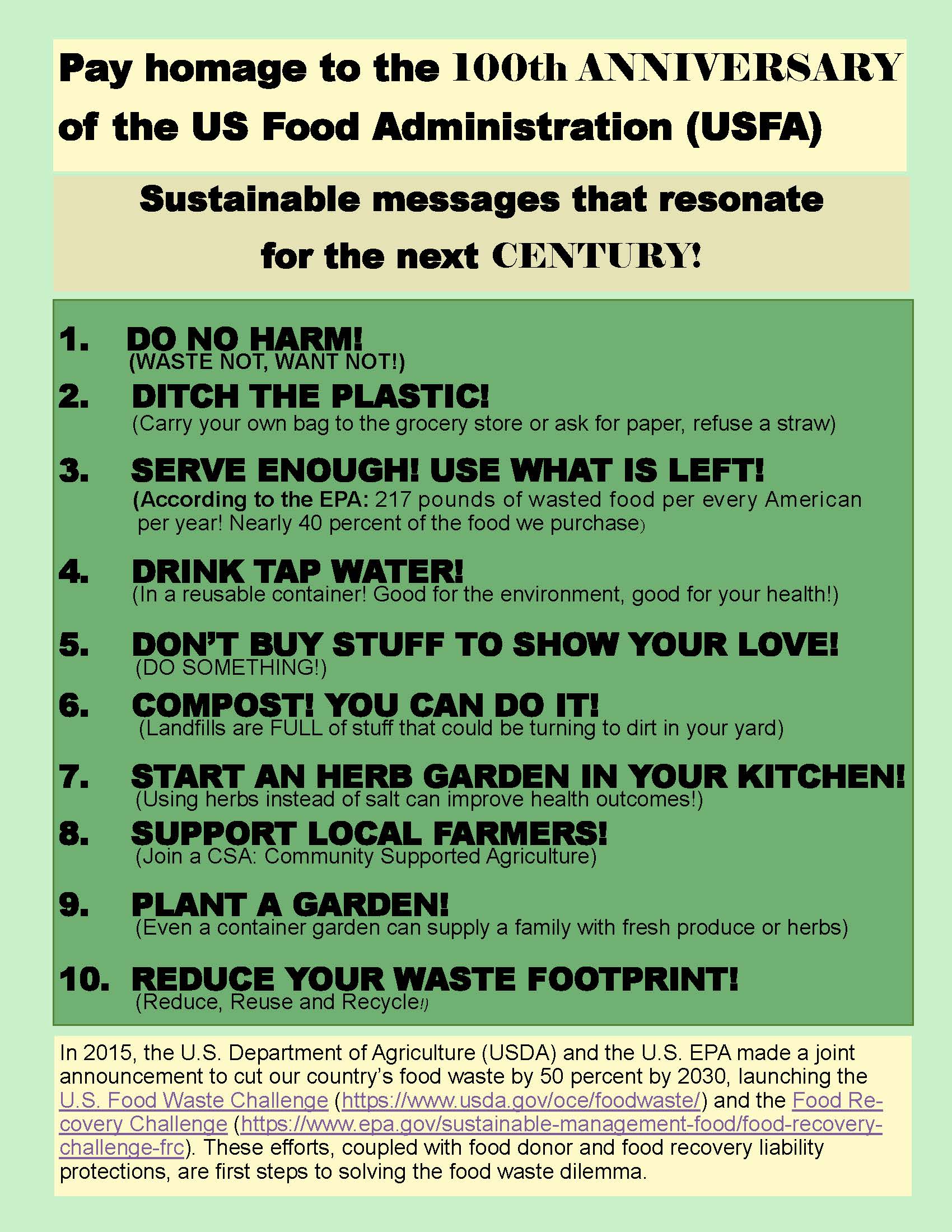

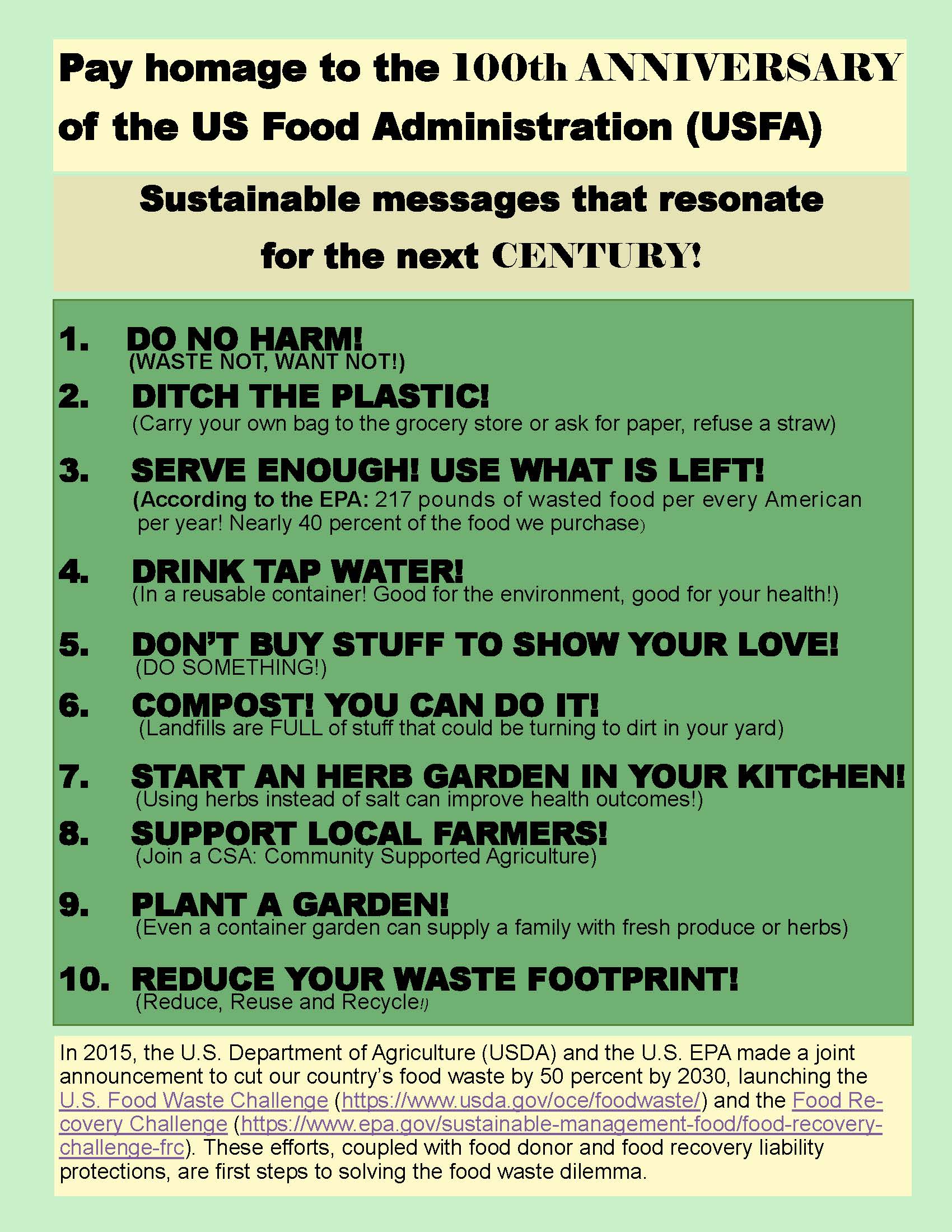

Did you know that during the United States’ (US) participation in World War I (from 1917 – 1918), the US had a US Food Administration (USFA) agency? This agency was responsible for food distribution to the US Army overseas and the Allies’ food reserves. This agency also organized a campaign to encourage Americans to support this effort through individual food conservation messages, media campaigns, and food education programs.

Now, 100 years later, this food conservation effort is still applicable.

Everyone can do his or her part in combating waste of all kinds. According to the USDA, reducing consumer-level loss is an important step toward reducing food waste in the United States. USDA estimates that almost 30 percent of the available U.S. food supply was lost from human consumption at the retail and consumer levels.

Every one of us can promote practices to strengthen our natural environment and quality of life. Even the EPA has some suggestions for reducing personal food waste:

- Shop your refrigerator first! Cook or eat what you already have at home before buying more.

- Plan your menu before you go shopping and buy only those things on your menu.

- Buy only what you realistically need and will use. Buying in bulk only saves money if you are able to use the food before it spoils.

- Be creative! If safe and healthy, use the edible parts of food that you normally do not eat. For example, stale bread can be used to make croutons and beet tops can be sautéed for a delicious side dish.

- Freeze, preserve, or can surplus fruits and vegetables – especially abundant seasonal produce.

- At restaurants, order only what you can finish by asking about portion sizes and be aware of side dishes included with entrees. Take home the leftovers and keep them for your next meal.

- At all-you-can-eat buffets, take only what you can eat.

Reducing food waste – a simple action of sustainability. Let’s give it a try! And pay homage to this 100-year-old sustainability campaign that can resonate for the next century.

For more information, visit https://www.usda.gov/oce/foodwaste/resources/consumers.htm and

http://edis.ifas.ufl.edu/fy1134

by Heidi Copeland | Jan 26, 2018

The Internal Revenue Service (IRS) announced recently the nation’s tax season begins Monday, January 29, 2018. The IRS also reminds taxpayers claiming certain tax credits to expect a longer wait for refunds.

The Internal Revenue Service (IRS) announced recently the nation’s tax season begins Monday, January 29, 2018. The IRS also reminds taxpayers claiming certain tax credits to expect a longer wait for refunds.

Nevertheless, many software companies and tax professionals accept tax returns before January 29, 2017. Be aware! These prepared returns cannot be submitted until the IRS system opens. Any money received prior to the opening of the Income Tax season may cost you! Early refunds are often charged processing fees as well as interest.

In 2017, under the change required by Congress in the Protecting Americans from Tax Hikes (PATH) Act, the IRS is to hold refunds claiming the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC). The IRS expects the earliest EITC/ACTC-related refunds to be available in taxpayer bank accounts or on debit cards starting February 27, 2018, if these taxpayers choose direct deposit and there are no other issues with their tax return.

For taxpayers not claiming the EITC/ACTC-related refunds, three weeks is the normal time it takes for a tax return to be processed, factoring in weekends and holidays. In fact, calling the IRS will not expedite your return/refund; typically, an IRS representative can only research the status of your refund 21 days after you file electronically and 6 weeks after you mail your paper return.

Nevertheless, it is your inherent right to both pay taxes and communicate with the IRS about the status of your taxes. You can start checking on your refund status electronically 24 hours after filing your taxes electronically or three weeks after mailing a paper return.

Note: The filing deadline to submit 2017 tax returns is Tuesday, April 17, 2018, rather than the traditional April 15 due date. This year, April 15 falls on a Sunday, and this usually would move the filing deadline to the following Monday – April 16. However, Emancipation Day – a legal holiday in the District of Columbia (DC) – will be observed on that Monday, which pushes the nation’s filing deadline to Tuesday, April 17. Under the tax law, legal holidays in the District of Columbia affect the filing deadline across the nation.

Choosing to both e-file and provide a means for directly depositing refunds remains the fastest and safest way to file an accurate income tax return and receive a refund.

Adapted from the IRS Website.

by Heidi Copeland | Dec 2, 2017

Recently, in what I thought would be a quick Saturday errand, I got stuck in traffic. It took me a moment to realize that the holidays are upon us.

Recently, in what I thought would be a quick Saturday errand, I got stuck in traffic. It took me a moment to realize that the holidays are upon us.

According to the National Retail Federation (NRF®), from Thanksgiving Day through Cyber Monday, more than 174 million Americans shopped in stores and online during the five-day holiday weekend, beating the 164 million estimated shoppers from an earlier survey. In fact, shoppers spent $1 million a minute on Black Friday and about $6.6 billion in total on Cyber Monday. The NRF® also found that consumers, both young and old, were spending more than last year, with both groups using the internet to browse for the best deals.

While it appears many consumers can spend unrestrained during the holidays, a lot of consumers find the holiday season stressful. Holidays require a lot of planning, and of course time and money.

A sensible way to approach the holiday season is to decide up-front what best fits the path you want to take. Come up with a plan, make a list (check it twice), and then stick to it. You will be amazed at how this simple list trick can relax you and make your holidays more enjoyable and less stressful.

The American Financial Services Association Education Foundation has some useful ideas for using a holiday spending plan. First, create a holiday budget that is feasible for you, and be sure to include all the incidentals from decorations to wrapping materials. Next, prepare your list(s), then do your homework. There is a lot of competition for the consumer’s money, and searching the web not only for information but also for the best deals can help you stick to your budget and save some money (Example: some stores honor other store’s pricing).

Other ideas to help stay within your budget this holiday include:

- Draw names with set limits on gift giving (Example: Aunt Marge – $15.00)

- Make a gift (Example: Cranberry muffins)

- Provide a service (Example: tackle a chore for a friend, neighbor, or loved one)

- Switch to giving gifts of experience (Example: tickets to an event) The gift of experience can be both practical and educational, and moreover, memories are worth more than stuff!

Try not to get bogged down by holiday spending this holiday season. I encourage you to create a plan, write up a list (check it twice) and stick to it. You will be glad you did!

The University of Florida Extension/IFAS – Leon County is an Equal Employment Opportunity Affirmative Action Institution.

by Heidi Copeland | Sep 12, 2017

For nearly 40 years, National Grandparents Day has been celebrated as an opportunity to express gratitude for all that grandparents do for families and communities. According to the U.S. Census Bureau Profile, America Facts for Features, in 1970, Marian McQuade initiated a campaign to establish a day to honor grandparents. In 1978, President Jimmy Carter signed a federal proclamation, declaring the first Sunday after Labor Day to be National Grandparents Day.

For nearly 40 years, National Grandparents Day has been celebrated as an opportunity to express gratitude for all that grandparents do for families and communities. According to the U.S. Census Bureau Profile, America Facts for Features, in 1970, Marian McQuade initiated a campaign to establish a day to honor grandparents. In 1978, President Jimmy Carter signed a federal proclamation, declaring the first Sunday after Labor Day to be National Grandparents Day.

Across the U.S., not only are grandparents appreciated for sharing their time, wisdom, and values, but they are currently stepping up to raise over 7.2 million children under the age of 18 whose biological parents are unable to do so, thus keeping the children out of the foster care system. In Florida, 11% of children live in homes where householders are grandparents or other relatives.

Locally, in Leon County, there are more than 2,000 grandparent-headed families, where:

- 13.1% of the grandparents are 60 years and older

- 39.8% of these families live below the poverty level

- Nearly 50% of these families have had the children for 5 or more years

The reasons as to why so many grandparents are raising grandchildren are many and varied. Nationally, substance abuse causes more than one third of this type of placement. Nevertheless, because of a grandparent’s selfless devotion and generosity to the needs of others, grandparents are, in fact, owed a great deal of thanks for their altruism.

As one grandmother exclaimed, “For my 50th birthday, I got a 2 year-old. My story isn’t unique.” In fact, grandparent roles in children’s lives are so significant that the Grandparents as Parents (GaP) Program of the Tallahassee Senior Foundation, funded by the Leon County Commission, grants, and donations, has a program and support group just for them! According to Karen Boebinger, GaP Program Coordinator, “The GaP program provides moral support and resource assistance to these grandfamilies who are trying to navigate through their new lifestyle.”

AARP® has streamlined the gathering of relevant information pertinent to this nationwide dilemma. The AARP® resource, Grand Families Fact Sheet, includes state-specific data and programs available, as well as information about public benefits, educational assistance, legal relationship options, and state laws. This fact sheet also contains many other resource tools such as the National Council on Aging’s questionnaire that helps grandparent caregivers and/or the children they are raising determine if they qualify for certain programs that pay for food, an increase in income, and/or home and healthcare costs. Once the questionnaire is completed, the website generates a list of eligible programs and contact information. (www.aarp.org/quicklink)

Take a moment today and every day to give thanks and appreciation for the thousands of grandparents in our community and around the country for the service they do for children. One thing is for certain: grandparents are more valuable to their grandchildren and communities than ever. Grandparents are indispensable and important people.

Want more information about supporting GaP or do you need support yourself? Contact Karen Boebinger, GaP Program Coordinator, at 850-891-4027 or karen.boebinger@talgov.com.

by Heidi Copeland | Aug 9, 2017

Will you be ready if disaster strikes? Disasters, or devastating events-natural or human-generated, certainly can disrupt daily life. National Preparedness Month, held annually in September and sponsored by the Federal Emergency Management Agency (FEMA), is a good reminder that we need to be ready to respond to emergencies. Adversity can strike at any time. There is no time like the present to prepare for emergencies.

Will you be ready if disaster strikes? Disasters, or devastating events-natural or human-generated, certainly can disrupt daily life. National Preparedness Month, held annually in September and sponsored by the Federal Emergency Management Agency (FEMA), is a good reminder that we need to be ready to respond to emergencies. Adversity can strike at any time. There is no time like the present to prepare for emergencies.

How? Focus on making a standing plan for family readiness! A standing plan is one that you and your family have developed in the event of disasters. For most people, the prime goal is knowing that all family members are safe and as secure as possible against harm.

Need some help? Ready.gov has information to help you with that critical “what do we do in case of an emergency” conversation with children as well as seniors or any family member with special needs. The Ready.gov website contains a wealth of information to get you started including downloadable checklists and other publications as well as printable posters. Anyone can download the materials for free!

For instance, some disasters strike without warning. Have you thought about supplies you would need the most? Ready.gov supports the use of checklists as a good way to help you make it through an immediate disaster period.

Are you a pet owner? Ready.Gov has a unique brochure containing information for pet owners and suggestions for proactive pet emergency preparedness. Have you ever considered evacuating in the car with your animals?

Additionally, inadequate insurance coverage on a family home or properties can lead to major financial losses. NOW is the time to plan, document, and insure your property as well as prepare digital copies of your important financial information. One thing to keep in mind: FLOOD INSURANCE is a pre-disaster insurance protection program. Flood damage is not usually covered by typical homeowners insurance. Check your policy. Do not make assumptions.

Be smart; take part in preparing before an emergency happens!

- Implement a standing plan

- Prepare in ADVANCE

- Stay informed

You can plan ahead for an emergency. Take action now.