by Shelley Swenson | Apr 7, 2014

April 26, 2014

9 a.m. to 2 p.m.

Crawfordville, Florida

TCC Wakulla Center and Hudson Park

Come one, come all to the Green Living Expo offered to all citizens of the Big Bend area. I love the adopted tagline… Experience a simpler, more sustainable life. Learn ways to save money and reduce your impact on the Earth.

Those of you who have attended a previous Expo will remember this event is a gathering of all kinds of people who are like-minded in that resource management is a life goal. The event is offered to allow people to share ideas on how to incorporate these sustainable practices into their lives.

The Green Living Expo provides an opportunity for the entire family to attend and spend time as a family in addition to pursuing independent activities based on age and interest.

Activities to be offered:

- Sustainability Workshops

- Bicycle Events

- Green Flea Market

- Green Exhibitors and Products

- Children’s Activities

- Food

- Raffles

Go to www.sustainablebigbend.org or call Wakulla County Extension at 850-926-3931 for more information.

by Elizabeth | Mar 31, 2014

As you are clearing out clutter, sprucing up, and getting ready for summer, you also should start your financial spring cleaning by figuring out where you stand financially. Here are a few tips to help you get started:

As you are clearing out clutter, sprucing up, and getting ready for summer, you also should start your financial spring cleaning by figuring out where you stand financially. Here are a few tips to help you get started:

1. Get organized.

Build a personal financial filing system; get out your financial paperwork and file it in order of importance. Separate bills – that way, you can track them as they come in, reducing the chance of missed or late payments.

Use a plastic tote for a filing cabinet – these keep your files dry and are easy to carry from one room to the next should you need to.

2. Create a budget.

How much money do you have? Are you spending more than you earn? If you don’t have a spending record, start one. You can still get on with your financial spring cleaning today. If you haven’t been keeping a record, just make a deliberate effort to start now. Try to note all your spending for the next month, right down to the candy bar. Then, in a month’s time, you’ll be able to see where your money is going and, hopefully, see some areas where you can cut back.

3. Pay off Debt

Now, let’s discuss what most people agonize over, but is a very important subject: debt. If you have any debt beyond a mortgage, you should try to focus on paying off this debt as quickly as possible. It’s also important to try to negotiate your interest rates down with your credit card company if you can. Although this option may not be available to everyone, especially if your credit is not good, it’s worth trying.

If you are not successful, you can use these steps to reduce debt:

- Stop using credit; charging new items increases the balances on what you already owe.

- Do not open new lines of credit.

- Request a free copy of your credit report from www.annualcreditreport.com and honestly assess the problem. Understanding your situation helps when trying to resolve debt issues. Stop denying that you have a debt problem and work on it. You can analyze your debts using Powerpay®. This website gives you a personalized report and plan to reduce your debt based on your input.

- Break your debt load into manageable chunks; define your goal and focus on reducing manageable amounts.

For more information on financial education and tools to help you get out of debt; contact your local county Family & Consumer Sciences Agent.

by Kristin Jackson | Mar 17, 2014

Your credit score is the most frequently and widely used method for determining your credit worthiness, but what if a 700 credit score was not just a 700 credit anymore? What if there was a way to try to predict consumer debt delinquency behavior even among those individuals that have 700 credit score? Recent research by Xiao and Yao suggests that where you are in your family life cycle could also be another predictor. Xiao and Yao reviewed 15 different life cycle stages

Check your credit report at annualcreditreport.com

and found the following groups were most likely to be delinquent:

- Young couples with children aged seven

- Middle-aged singles with children age 15 or older

- Middle-aged singles with children under 15

- Middle-aged couples with children under 15

- Older couples with financial dependents

What does this mean for the consumers that fall into these groups? It means that financial institutions, bank and credit unions or alternate financial service providers such as payday lenders, cashing services or high interest lenders may profile you for targeted marketing campaigns. What can you do be proactive and avoid negative or sub par offers as a result of being profiled?

- Check your credit report at https://www.annualcreditreport.com/. (It is the only official government authorized free credit reporting site.)

- Before making a major purchase requiring the use of credit, you may want to know your actual score (Often times this is not free).

- Make sure you understand your credit report and/or score. To learn more, contact the Family and Consumer Sciences Agent in your local UF/IFAS Extension Office.

- Research financial institutions or alternate service providers to insure you are getting the best offer base on your score

Don’t be a victim of profiling any longer. Take action now. For more information on credit scoring, contact your Family Consumer Science Agent.

Read the following publications for more information:

References:

Jing Jian Xiao, Rui Yao, (2014) “Consumer debt delinquency by family lifecycle categories”, International Journal of Bank Marketing, Vol. 32 Iss: 1, pp.43 – 59

by Kristin Jackson | Mar 17, 2014

The deadline to enroll in health insurance through healthcare.gov is March 31, 2014

UF IFAS Extension Northwest District cares about you having all the facts necessary to use research based information to make informed choices for you and/or your family. One important choice coming up for almost 70,000 uninsured adults in the Big Bend (Gadsden, Franklin, Jefferson, Leon, Liberty, Madison, Wakulla, Taylor and Dixie Counties) is the decision to obtain health insurance coverage. The deadline to enroll in health insurance through healthcare.gov is March 31, 2014.

Research estimates that the majority of the uninsured are working families with low to moderate incomes, so some individuals and families are unable to pay for health care insurance. The Affordable Care Act gives individuals that are uninsured or underinsured the chance to obtain health insurance or to obtain better insurance. Due to the cost of insurance some low to moderate income individuals may qualify for an exemption, but there are still financial implications for not having health insurance coverage. Five important financial implications of not having insurance are:

1) Out of pocket and are often billed at a higher rate than insured.

2) Financial strain from medical bills and out-of-pocket cost.

3) Inability to pay for their or their family member’s medical care.

4) Compromised credit score.

5) Inability to obtain assets (such as a car or house)

Individuals and families without insurance and who do not have an exemption, will have to pay a penalty. The fine in 2014 will be the greater of $95 or 1% of your yearly household income. The penalty is expected to increase in 2015 and beyond.

If you have additional questions about the Affordable Care Act and would like free research based information contact your local UF/IFAS County Extension Office. Many local UF/IFAS County Extension offices offer information on the Affordable Care Act. You can find your local UF/FAS Extension Office by visiting http://solutionsforyourlife.ufl.edu/map/ or by calling the United Way’s 211 number.

References:

Kaiser Family Foundation. (2013). Key Facts about the Uninsured Population. Retrieved 3 March 2014 from http://kff.org/uninsured/fact-sheet/key-facts-about-the-uninsured-population/

Robert Wood Johnson Foundation. (2013). County Health Rankings & Roadmaps Health Factors Uninsured. ? Retrieved 3 March 2014 from http://www.countyhealthrankings.org/app#/florida/2013/measure/factors/85/data/sort-0

U.S. Centers for Medicare & Medicaid Services. (N.D.) What if Someone Doesn’t Have Health Coverage in 2014? Retrieved 3 March 2014 from https://www.healthcare.gov/what-if-someone-doesnt-have-health-coverage-in-2014/

by Ginny Hinton | Mar 17, 2014

Moderation is the key with both sugar and sugar substitutes.

Do you use sugar, honey, artificial sweetener, or some combination of them all? Which are better to use? The internet is flooded with myths about sweeteners – both nutritive and low- or no-calorie. Because it’s often difficult to sift through the claims, here’s a quick primer on sweeteners:

There are two types of sugar in American diets. Naturally occurring sugars are found in milk and fruit. Added sugars include any sweeteners with calories that are added to foods or beverages during preparation. One of today’s biggest culprits for added sugar is carbonated soda. Because added sugars contribute extra calories with zero nutrients, the American Heart Association recommends that everyone try to limit the amount of added sugars in their diet. One way to do that is by using artificial sweeteners.

Artificial or non-nutritive sweeteners are often used for weight control or diabetes management. Because they aren’t carbohydrates, these sweeteners don’t raise blood sugar levels. Approved non-nutritive sweeteners have to pass rigorous government safety assessments before being accepted for sale. They can be safely consumed by the general public and do not cause or increase the risk of cancer or other health conditions. They may help with weight management when used as part of a sensible meal plan. Many rigorous studies support the safety of various non-nutritive sweeteners, including over 200 studies on aspartame alone.

High fructose corn syrup is a sweetener made from corn starch. It has the same calories per tablespoon and very similar effects on blood levels as sugar. Honey is a caloric, or nutritive, sweetener that is often promoted as a healthier option than table sugar or sugar substitutes. Its vitamin and mineral content is actually very similar to sugar and both sugar and honey end up in the body as glucose and fructose.

The bottom line is that moderation is the key with both sugar and sugar substitutes. It’s important with sweeteners to look beyond the hype. In the end any processed foods, with or without sugar substitutes, generally don’t offer the same health benefits you get from foods like fruits and vegetables.

References:

Mayo Clinic Staff, Artificial Sweeteners and Other Sugar Substitutes (October 9, 2012). http://www.mayoclinic.com/health/artificial-sweeteners?MY00073

Junod, Suzanne W., Sugar: A Cautionary Tale (May 21,2009). http://www.fda.gov.

CFSAN/Office of Food Additive Safety, FDA Statement on European Aspartame Study (April 20, 2007). http://www.fda.gov

International Food Information Council Foundation, Facts About Low-Calorie Sweeteners, (August 2012). www.foodinsight.org.

American Diabetes Association, Artificial Sweeteners (February 16, 2011). www.diabetes.org/food-and-fitness/

Food and Drug Administration, High Fructose Corn Syrup: Questions and Answers (April 17, 2013). http://www.fda.gov

Hirsch, Larissa, Are Artificial Sweeteners OK to Consume During Pregnancy? (August 2009). http://kidshealth.org

Low Calorie Sweeteners Webinar powerpoint (2011). https://connect.extension.iastate.edu/fffcop?launcher=false.

American Heart Organization, Non-Nutritive Sweeteners (Artificial Sweeteners) (December 13, 2012). http://www.heart.org?HEARTORG

by Dorothy C. Lee | Mar 3, 2014

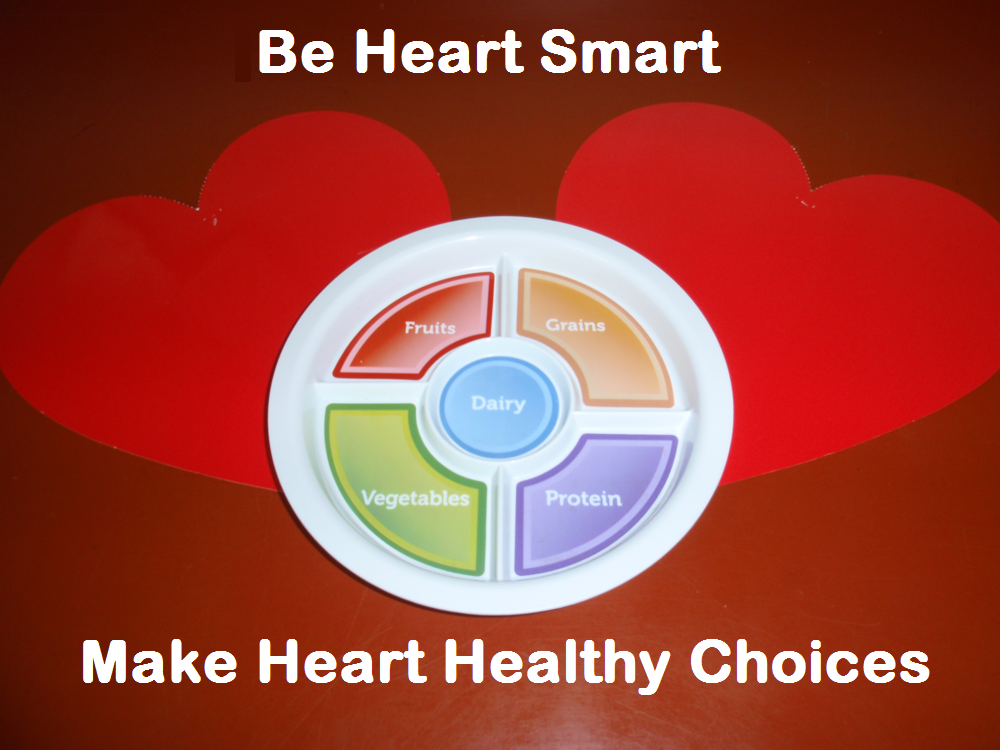

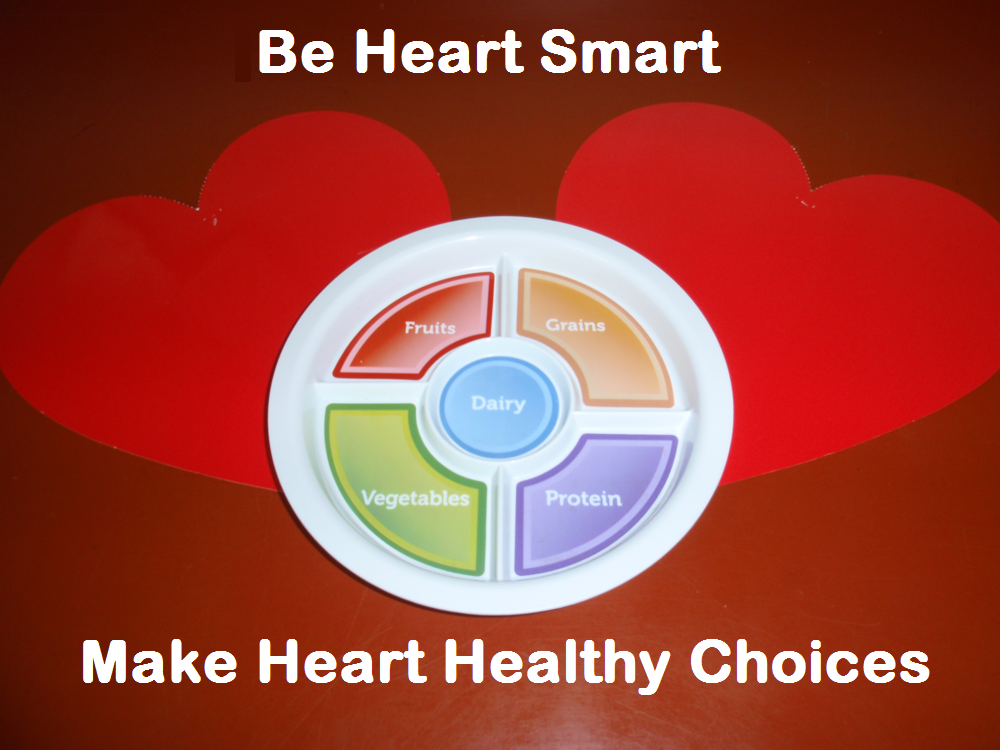

Be Heart Smart – Make Heart-Healthy Choices

The Centers for Disease Control and Prevention estimate that about 600,000 people die of heart disease in the United States each year. Heart disease is the leading cause of death for both men and women in the United States.

Eating habits are something we acquire as we grow up. Over the years, family eating habits have changed drastically. There is less emphasis given to well-planned family meals. American food habits are leaning more toward meals eaten away from home, and more reliance on fast food, convenience foods, and high-sugar, high-salt snacks.

The food choices we make today are important to our nutritional well-being tomorrow. A diet low in saturated fat and cholesterol and high in fruits and vegetables and grain products that contain some type of dietary fiber may reduce the risk of heart disease.

Be Heart Smart. Make heart-healthy choices at every meal. Basic steps to a heart smart diet are simple and easy:

- Select whole grains and cereals

- Eat a wide variety of fruits and vegetables

- Limit sodium intake

- Use oil products made from unsaturated vegetable oils instead of saturated oils like coconut and palm kernel

- Select cooking methods that are lower-fat alternatives to frying, such as grilling, baking, broiling, or microwaving

- Choose lean meat, poultry, and fish

Your health is your most precious possession. A healthy diet is only one part of a heart-healthy lifestyle. Physical activity is another important component. The American Heart Association physical activity guidelines recommend some type of aerobic exercise daily, and walking, dancing, biking, swimming, or gardening are good examples. Be sure to consult your physician before starting any exercise program.

We are all concerned about maintaining good health. Developing good eating habits based on moderation and variety, plus physical activity, can help keep, and even improve, your health.

For more information, visit the University of Florida Solutions for Your Life website, http://www.SolutionsForYourLife.com.

Reference: http://www.heart.org