by Kendra Hughson | Jan 26, 2018

Family picking blueberries at a u-pick farm. Credit: UF/IFAS Tyler Jones

The question of what happens to the family farm is often riddled with many emotional opinions. So much so that families may not communicate effectively about their wishes or plans. Many life events can change the dynamics of a family farm. Whether marriage, children, divorce, illness, retirement or death, significant events can require a plan or a change in the transition plan. Planning in advance of a crisis or significant life event increases the chances that the family farm will successfully transition to someone who is ready to carry on the family business. Having a plan also can lead to clear communication that reduces the likelihood of family conflict and stress. Yet, four out of five Florida farmers do not have written estate plans.

You can take steps to protect your family and your family farm by attending the University of Florida IFAS Extension workshop, “Ag Saves: Preparing for Later Life Farming.” This workshop will help you ensure that your wishes are honored when the time comes.

You and your partners are invited to learn together how to:

- Discuss the future of the farm

- Assess your future financial needs

- Talk with local experts in financial planning, estate planning, and taxes

Join us for this complimentary program on Wednesday, February 21, 2018. Lunch and materials will be provided. Program sponsors include UF/IFAS Extension, U.S. Trust, Pacific Life, and Merrill Lynch.

Registration will begin at 8:30 a.m. Central Time/9:30 a.m. Eastern Time.

Program will begin at 9:00 a.m. Central/10:00 a.m. Eastern and conclude at 1:00 p.m. Central/ 2:00 pm. Eastern.

Register Online: http://bit.ly/2AOv0JC

Registration deadline: February 14, 2018. Choose from 3 Locations in Northwest Florida:

Okaloosa County Extension Office (host site)

3098 Airport Road

Crestview, FL

850-689-5850

Jennifer Bearden: bearden@ufl.edu

Jefferson County Extension Office (satellite site)

2729 W Washington Hwy.

Monticello, FL

850-342-0187

Julianne Shoup: juliannes@ufl.edu

Gadsden County Extension Office (satellite site)

2140 West Jefferson Street

Quincy, FL

850-875-7255

Laurie Osgood: osgoodlb@ufl.edu

Register online or contact Kendra Zamojski at hughson@ufl.edu for more info.

by Samantha Kennedy | Jan 26, 2018

Convenient prepackaged snacks such as these can add extra salt, fat, and sugar to your diet. (Photo credit: Lyon Duong, UF/IFAS)

Snacks are an important part of a healthy, balanced diet. But not all snacks are created equal. All too often, we reach for the salty, sugary, prepackaged snacks like chips, cookies, and other sweets because they’re convenient and easy to grab and go. But be careful! Even if the portion size is small, these types of snacks can contain a lot of unnecessary calories. Even snacks marketed as healthy, such as trail mix, granola bars, and protein bars can contain added sugars and fats.

The Nutrition Facts label contains a wealth of information…if you know what you’re looking for. The number of total calories and calories from fat are listed at the top of the label. Ideally, snacks should contain less than 200 calories. Also, if the number of calories from fat is greater than 30 percent of the total calories, it may not be the best choice.

One of the biggest pitfalls when it comes to snacking is overeating. Snacks are meant to provide sustained energy to help keep blood sugar levels even throughout the day and to supplement calories and nutrients not provided by meals. They are not meant to be mini meals, so be careful of portion size. Check the label for what constitutes one serving and stick to it.

Prepare your own snacks instead of buying prepackaged convenience foods. Cut up fruits and vegetables and store them in snack bags that can be easily toted in your purse or bag. Keep small containers of nuts – preferably unsalted or lightly salted – in your desk or car for a high-protein on-the-go snack.

There are plenty of easy, delicious, and healthy snack choices from each food group. Here are a few examples:

Fruits: Bananas, melon chunks, apple slices, and orange wedges

Vegetables: Broccoli florets, carrot sticks, sugar snap peas, and zucchini sticks

Grains: Mini rice cakes, whole grain crackers, plain popcorn, and unsalted pretzels

Proteins: Nuts (e.g. walnuts, almonds, and pistachios), hard-boiled eggs, peanut butter, and pumpkin seeds

Dairy: Low-fat yogurt, string cheese, milk, and cottage cheese

Need more help with snacking healthy? Here are some terrific resources from the University of Florida IFAS:

“Healthy Eating: Sixteen Savory Snacks” – https://edis.ifas.ufl.edu/pdffiles/FY/FY70500.pdf

“Healthy Eating: Smart Snacking” – http://edis.ifas.ufl.edu/pdffiles/FY/FY70800.pdf

“Healthy Snacking” – http://edis.ifas.ufl.edu/pdffiles/FM/FM43900.pdf

“Raising Healthy Children: Promoting a Positive Feeding Experience” – http://edis.ifas.ufl.edu/pdffiles/FY/FY139700.pdf

by Heidi Copeland | Jan 26, 2018

The Internal Revenue Service (IRS) announced recently the nation’s tax season begins Monday, January 29, 2018. The IRS also reminds taxpayers claiming certain tax credits to expect a longer wait for refunds.

The Internal Revenue Service (IRS) announced recently the nation’s tax season begins Monday, January 29, 2018. The IRS also reminds taxpayers claiming certain tax credits to expect a longer wait for refunds.

Nevertheless, many software companies and tax professionals accept tax returns before January 29, 2017. Be aware! These prepared returns cannot be submitted until the IRS system opens. Any money received prior to the opening of the Income Tax season may cost you! Early refunds are often charged processing fees as well as interest.

In 2017, under the change required by Congress in the Protecting Americans from Tax Hikes (PATH) Act, the IRS is to hold refunds claiming the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC). The IRS expects the earliest EITC/ACTC-related refunds to be available in taxpayer bank accounts or on debit cards starting February 27, 2018, if these taxpayers choose direct deposit and there are no other issues with their tax return.

For taxpayers not claiming the EITC/ACTC-related refunds, three weeks is the normal time it takes for a tax return to be processed, factoring in weekends and holidays. In fact, calling the IRS will not expedite your return/refund; typically, an IRS representative can only research the status of your refund 21 days after you file electronically and 6 weeks after you mail your paper return.

Nevertheless, it is your inherent right to both pay taxes and communicate with the IRS about the status of your taxes. You can start checking on your refund status electronically 24 hours after filing your taxes electronically or three weeks after mailing a paper return.

Note: The filing deadline to submit 2017 tax returns is Tuesday, April 17, 2018, rather than the traditional April 15 due date. This year, April 15 falls on a Sunday, and this usually would move the filing deadline to the following Monday – April 16. However, Emancipation Day – a legal holiday in the District of Columbia (DC) – will be observed on that Monday, which pushes the nation’s filing deadline to Tuesday, April 17. Under the tax law, legal holidays in the District of Columbia affect the filing deadline across the nation.

Choosing to both e-file and provide a means for directly depositing refunds remains the fastest and safest way to file an accurate income tax return and receive a refund.

Adapted from the IRS Website.

by Kendra Hughson | Jan 19, 2018

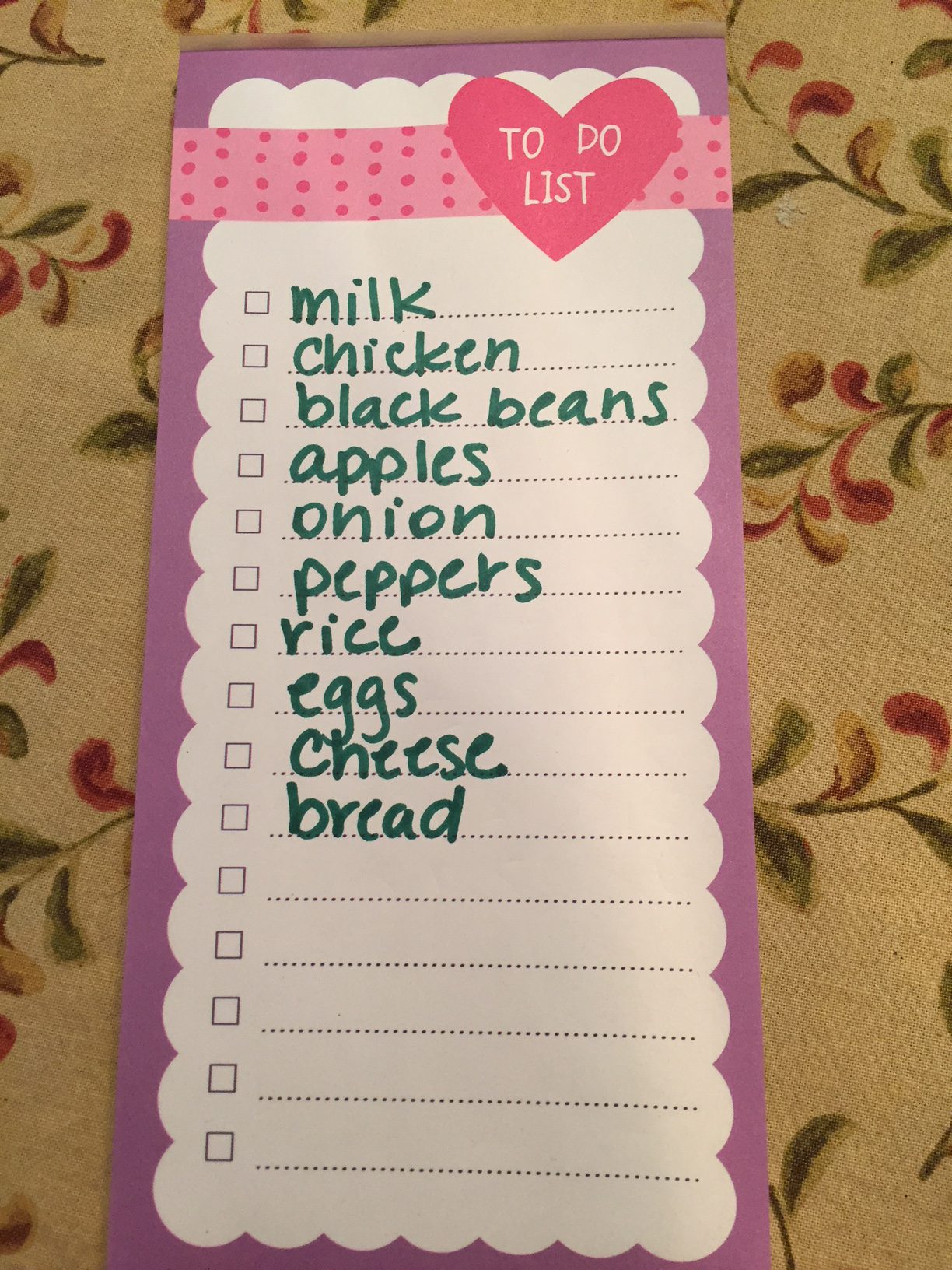

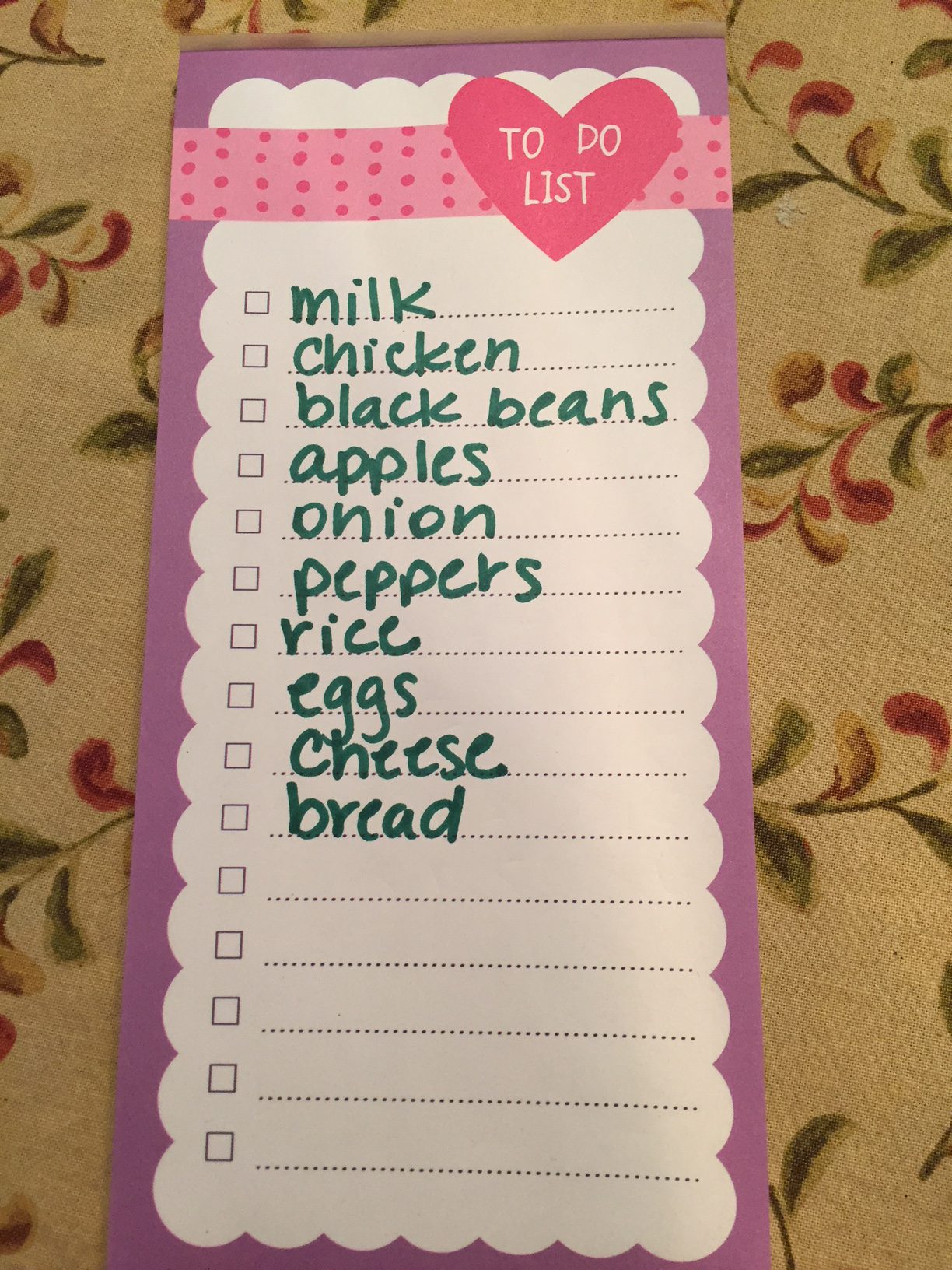

Create a shopping list using a weekly meal plan and what you already have on hand. Photo credit: Kendra Zamojski

Grocery shopping is probably one of my least favorite weekly chores. I have a family of picky eaters and it’s difficult to find healthy meals that please everyone. I can think of a million ways I’d rather spend my time than navigating the aisles of a crowded grocery store and standing in a long check-out line surrounded by countless “closed” registers. Why aren’t there ever enough open check-out lines?

I must not be alone. I hear more and more friends choosing stores with curbside pick-up service or online grocery shopping services. Many of the major grocery store chains are testing curbside pick-up service; you’ll need to check with your local store to see if this option is available in your area. Online delivery services like Shipt and Instacart may be available if curbside service isn’t an option at your local grocery store.

If you choose to do your grocery shopping online, be sure to shop around and pay attention to and compare item prices, delivery or pick up fees, membership fees, shopper or delivery tips, and other convenience fees. Regardless of your selected service, there is an extra cost for this convenience.

No matter how you choose to buy your groceries, all of the old rules apply:

Plan your weekly meals. Write some weekly meal plans with your schedule in mind. Choose some meals using recipes that are quick and easy to prepare for busy days. Use the USDA Game Plan to help you.

Find easy to prepare, healthy recipes. Use the USDA What’s Cooking website to find healthy recipes.

Know your food budget. Planning and cooking meals at home saves money over eating out. Meals prepared at home often are healthier, especially if you are preparing recipes low in fat and sodium. Track your food dollars to see how much you are spending and saving.

Plan to use leftovers. Make double batches of soups and stews, setting aside some to freeze for later use. Freeze leftovers in single portions to use for lunch or your own ready-to-eat freezer meals throughout the week.

Pack your meals with fruits and vegetables. Plan ahead to make half of your plate fruits and vegetables. Buy fresh fruits and vegetables in season. Buying canned and frozen fruits and vegetables can save money but watch for added fat, sugar, or sodium. Bananas, carrots, greens, potatoes, and apples are low-cost options year ’round.

Create your shopping list – and stick to it! Use your meal plan to create a shopping list. Remember to check what you already have on hand. Avoid impulse items and convenience items, which can add to your food costs. A list helps you organize the items you need to buy and helps you avoid impulse buys or unneeded items that can add to your food costs.

For more information on creating healthy meals, contact your local Extension office. UF/IFAS Extension also has this great publication on Healthy Meal Plans.