by Dorothy C. Lee | Jul 21, 2019

Eating healthy is not something that just happens by going on a particular diet. In fact, the best kind of diet is where the right choices are made, and it becomes a way of life. Sometimes we need to know some ways to change the bad habits we have developed. There is no ‘quick fix’.

Tune Up Your Lifestyle

Photo Source: UF/IFAS

With today’s fast-paced lifestyles sometimes we feel we don’t have the time to do the things we know we should. For instance, to get more exercise, do things like park a distance from the store when you go shopping, walk up and down the stairs instead of taking the elevator, walk to lunch, or even turn up the speed on regular activities you perform around the house.

When grocery shopping choose foods from the basic food groups (fruits, vegetables, whole grains, lean protein, and reduced-fat dairy products) to round out a healthy meal plan.

Convenience foods are a part of today’s lifestyle, but they often lack nutritional quality, texture, and flavor. Preparing foods at home can be healthy and economical. You can boost nutrition and flavor by adding fresh herbs, spices, and aromatic vegetables to the meal menu.

Foods and beverages high in sugar add empty calories to the diet and contribute no nutritional value. Read labels to determine the amount of added sugar in food products. Choose lower calorie beverages.

Experiment with new food items. Try adding different fruits, vegetables, or grains to your diet. For example, try tropical fruits such as mango, guava, papaya, or grains as quinoa, barley, or millet, to add vitamins, minerals and fiber to the diet.

Before you go out to eat, don’t starve yourself. Drink water before the meal to avoid overeating or eat a snack before dinner and you won’t be tempted to overeat.

When socializing don’t meet at eating places. When you do dine out, cut out fried main dishes or ones with heavy sauces and gravies. Eat smaller portions and don’t go back for seconds. Order low-fat foods when possible. However, keep in mind that you too need to allow for indulgence along the way.

Be active! Physical activity has health benefits. Being physically active not only burns calories, it aids in physical strength, and cardiovascular health. U.S. Dietary Guidelines recommend being physically active at least 150 minutes a week for adults. (https://health.gov/dietaryguidelines/).

Chances are, along with a healthy diet and regular physical activity, your tune up will result in living a healthy lifestyle.

https://www.freshfromflorida.com/Consumer-Resources/Buy-Fresh-From-Florida/Tropical-Fruit

https://www.tropicalfruitgrowers.com/

For further information, contact:

Dorothy C. Lee, C.F.C.S.

UF/IFAS Extension Escambia County

3740 Stefani Road

Cantonment, FL 32533-7792

(850) 475-5230

dclee@ufl.edu

by Melanie Taylor | May 6, 2019

Hanging with friends at 4-H Camp. Melanie Taylor as a 4-H Teen Counselor (right). Photo source: Melanie Taylor

Spring is upon us and 4-H Summer Camp preparations are in full swing. As a 4-H Agent preparing for our week of county 4-H camp, my days are busy with phone calls and emails from parents, teen counselor trainings, adult volunteer screenings, paperwork, paperwork, and more paperwork. Although this is a very busy time for me as a 4-H Agent, it also allows me to reflect on why I chose this career path and why there is a sense of nostalgia as I prepare for 4-H camp.

I attended 4-H camp in Virginia, where I grew up, every year from age 9-18. I was a camper who grew into a counselor-in-training and then a counselor. Those weeks of 4-H camp were filled with hot days and warm nights, but it was worth it all for the memories I will have for a lifetime. I can still smell the cafeteria food and hear the sounds in the gymnasium as kids played basketball and pounded at their leathercraft projects. I can feel the chills I would get as the entire camp sang around the campfire circle and patiently waited for the canoe to land on the lake’s edge; the camp staff would carry a flame as they entered the campfire circle and ceremoniously light the fire. Most importantly, I am still connected with my 4-H camp friends through social media and/or as close friends and we continue to share our old, blurry camp pictures from the 1990’s each year on Facebook.

Morning flag raising ceremony at Camp Timpoochee. Photo source: UF/IFAS Northwest District

So, as I work hard to prepare camp for my county campers and teen counselors, I want to create similar memories for them. In ten, twenty, and thirty years from now, I want them to think back on the fun moments they experienced in the Florida 4-H camping program. I also want them to form friendships and make camp connections for a lifetime, whether it is learning to kayak, fish, make arts and crafts, cook over a campfire, sing camp songs, etc.

With all of this said, I hope you as parents will consider giving your child(ren) these special moments. The days will be long, but fun, and their nights will be filled with campfires and hanging out with friends. When they arrive home on Friday, they will be exhausted, but so excited to share all of the camp songs with you (prepare yourself for lots of loud, enthusiastic singing). They will have new friends they want you to meet and they will tell you camp stories they will always cherish.

In Northwest Florida, there are two 4-H Camps, Camp Cherry Lake in Madison and Camp Timpoochee in Niceville. Each county in these camping districts has one county week of camp each summer. Contact your local UF/IFAS Extension Office now to find out the details and register your child for a week of fun and memories.

Northwest Florida 4-H Camp Dates 2019. Photo source: UF/IFAS Extension

by Heidi Copeland | Apr 30, 2019

The Consumer Financial Protection Bureau, (CFPB) has defined financial capacity as a the combination of attitude, knowledge, skills, and self-efficacy needed to make and exercise money management decisions that best fit the circumstances of one’s life, within an enabling environment that includes, but is not limited to, access to appropriate financial services.

Many of the attitudes, knowledge and skills needed to build financial capacity can be learned. People learn behavior through a variety of contexts. Children, in particular, learn through practices modeled by a parent or caregiver. In fact, research shows that parents and caregivers have the most influence on their children’s financial capability.

If you are like most parents, you probably recognize this—and you are interested in setting your kids on a good path toward financial well-being. However, many parents also say they do not always have time, tools, or personal confidence to start talking about money thinking their children will learn about it in school, later on, when they are old enough to understand.

This is most unfortunate. According to the Council for Economic Education 2018 Survey of the States, only 17 States require high school students to take a course in personal finance. So, if a parent isn’t teaching their children basic money/financial skills who is? Economical and financial literacy is a foundational element to achieving financial health and financial well-being. It is never too early (or too late) to start building this.

Talking to children about money, even in EARLY CHILDHOOD, helps children build the skills they need later in life. Early childhood education experts like to call this scaffolding. You are setting the framework…the support…the platform, encouraging financial capability milestones from early childhood into young adulthood. Children can learn the behaviors, knowledge, skills, and personal characteristics that support financial health and well-being.

Books can help start these critical early conversation. The CFPB has made it EASY! Parents can be their child’s first financial capability teacher! The University of Wisconsin-Extension Family Living Programs and the University of Wisconsin-Madison Center for Financial Security have selected books for the CFPB Money as you Grow Book Club. This program uses easy to read and understand children’s books to discuss money concepts. These books include many favorites:

- A Bargain for Frances, by Russell Hoban

- A Chair for My Mother, by Vera Williams

- Alexander, Who Used to Be Rich Last Sunday, by Judith Viorst

- Count on Pablo, by Barbara deRubertis

- Cuenta con Pablo, by Barbara deRubertis

- Curious George Saves His Pennies, by Margaret and H.AS. Rey

- Just Shopping With Mom, by Mercer Mayer

- Lemonade in Winter, by Emily Jenkins

- My Rows and Piles of Coins, by Tololwa M. Mollel

- Ox-Cart Man, by Donald Hall

- Sheep in a Shop, by Nancy Shaw

- The Berenstain Bears & Mama’s New Job, by Stan & Jan Berenstain

- The Berenstain Bears’ Trouble With Money by Stan and Jan Berenstain

- The Purse, by Kathy Caple

- The Rag Coat, by Lauren Mills

- Those Shoes, by Maribeth Boelts

- Tia Isa Wants a Car, by Meg Medina

- Tia Isa Quiere un Carro, by Meg Medina

Fortunately, many of the building blocks for good financial decision making – like self-regulation, patience, planning, and problem-solving – do not require a lot of financial know-how.

Reading books with children is a creative way to learn about the many sides of money management. Pick up a few of the titles at your local library and influence your children’s financial capability. Building good habits leads to a life of good financial health and well-being.

Example of key ideas from reading books:

| PLANNING |

How Children Show It |

| Making Decisions |

Can look at a few choices and select on what will bring the best results. |

| Setting Goals |

Can follow a multi–step plan. |

| Prioritizing |

Can prioritize choices when they want two or more things at once. |

| Solving problems

|

Can describe problems and come up with a few idea to make things better. |

| MONEY |

|

| Earning |

Can identify the different jobs people in the family and in the community do to earn money and keep it safe. |

| Spending |

Make spending choices with their own money – real or play. |

| Saving |

Keeps money in a safe place and keeps track of amount saved for future spending. |

| Sharing and borrowing |

Can explain the difference between lending and giving something away. |

| ME |

|

| Self-control |

Can talk about times when they were able to wait and how they were able to do it. |

| Follow-through |

Can identify who they can turn to for help reaching a goal, or what tools or tricks might help them stick with a plan. |

| Staying true to yourself |

Name one special thing they like about themselves and their loved ones. |

| Flexibility |

Can talk about a time when their plans did not turn out how they wanted and what they did instead. |

Resource: https://www.consumerfinance.gov/consumer-tools/money-as-you-grow/

by Angela Hinkle | Feb 11, 2019

Though not a widely publicized day on most calendars, Random Acts of Kindness Day, February 17th, is worth some attention. Random Acts of Kindness Day is a day when everybody gets the chance to do something nice for someone else.

A Little History

There’s a bit of debate over where and when it started. But it is generally believed to have started in Denver, Colorado in 1995. Then it spread to New Zealand in 2004. Since it apparently worked so well, it has since spread as an international holiday. So, now, we globally have a day dedicated to doing nice things for others.

Why Set Aside a Special Day?

Did someone recently cut you off in traffic? Are you tired of mean social media rants? Do too many of the people you encounter lately just seem rude? Does the only news you get seem to all be bad news? Then having one day to both offer and receive random acts of kindness just may give you the stop and reset buttons you need. You can plan out kind acts or just wing them spontaneously.

Giving and receiving brightens your day and makes you smile. Photo source: Angela Hinkle

Even the littlest kind thing you do for someone else can make a big difference in their day and yours. There’s the story I heard recently of a driver who brought a hamburger to a man living under a bridge at the beach. The homeless man said it was a perfect “surf and turf” lunch. The driver said that was one of the best days he ever had.

What Does the Research Say?

The effects of doing kind things for others is hard to scientifically pinpoint. However, multiple small case studies have shown that those practicing altruism live longer, healthier lives.* Kind deeds have been shown to reduce our stress levels and the negative physiological effects of stress on our bodies. “Happy” hormone levels increase as we care for others. There also is often a giddiness (not a scientific term) we feel when we do that nice unexpected thing for someone.

How to Celebrate

Doing nice for others can produce a ripple effect. You do something nice for someone. Then they do something nice for someone else. And so on, and so on, and so on. Your act of kindness does matter. Here are a few acts of kindness you may want to try:

- Pay for the person behind you at the drive thru.

- Give someone a compliment.

- Donate used business clothes to people who are going on job interviews.

- Let someone have that prime spot in the busy parking lot.

- Share your lunch.

- Clean up someone else’s mess.

- Leave a really big tip for your wait staff person.

- Donate blood.

Try a random act of kindness this February 17th. I think it will be worth it. And who knows, you may get so good at it, you start providing those random acts of kindness every day.

*Resource: The Science of Good Deeds: The ‘helper high’ could help you live a longer, healthier life. WebMD https://www.webmd.com/balance/features/science-good-deeds#1

by Melanie Taylor | Jan 18, 2019

Be mindful and enjoy the moment.

Photo source: UF/IFAS Northwest District

Now that the busy holiday season is over, it is time not only to reflect on the past, but to prepare and refocus for the New Year ahead. As we focus on the New Year, it is always refreshing to have a clean slate. As the year begins to unfold, there are tips to help you manage your day-to-day stress levels. It begins with mindfulness.

What is mindfulness? Mindfulness means paying attention in a particular way; on purpose, in the present moment, and nonjudgmentally.” –Dr. Jon Kabat-Zinn (1991)

Mindfulness is best thought of as a way of being rather than an activity in and of itself. Almost any activity can be carried out with mindful awareness.

Mindful awareness has three key features:

Purpose – mindfulness involves intentionally and purposefully directing your attention rather than letting it wander.

Presence – mindfulness involves being fully engaged with and attentive to the present moment. Thoughts about the past and future that arise are recognized simply as thoughts occurring in the present.

Acceptance – mindfulness involves being nonjudgmental toward whatever arises in the moment. This means that sensations, thoughts, and emotions are not judged as good or bad, pleasant or unpleasant; they are simply noticed as “happening,” and observed until they eventually pass (Naik, Harris, and Forthun 2016).

Mindfulness is a mind-body practice that has been found to benefit both psychological and physical health. The primary psychological change that occurs during mindfulness practice is an increased awareness of thoughts, feelings, and sensations in the present moment. Over time, mindfulness practice can help you to become aware of the space between noticing experiences and reacting to them by letting you slow down and observe the processes of your mind (Black 2010). The ultimate goal of mindfulness practice is for you to take advantage of this space so you can make more intentional decisions – to wake up from living life on autopilot, based on unproductive habits of mind (Black 2010; Walach et al. 2007).

According to the American Psychological Association, some empirically supported benefits of mindfulness include the following (Davis & Hayes 2011):

Psychological Benefits

Increased awareness of one’s mind

Significantly reduced stress, anxiety, and negative emotions

Increased control over ruminative thinking (a major cause and symptom of depression and anxiety)

Increased mental flexibility and focus

More working memory

Decreased distracting thoughts

Decreased emotional reactivity

Increased capacity for intentional, responsive behaviors

Increased empathy, compassion and conscientiousness of others’ emotions

Physiological Benefits

Enhanced immune system functioning

Increased brain density and neural integration in areas responsible for positive emotions, self-regulation, and long-term planning

Lowered blood pressure

Lowered levels of blood cortisol (a major stress hormone)

Greater resistance to stress-related illnesses such as heart disease

Spiritual Benefits

Increased self-insight and self-acceptance

Increased acceptance of others

Increased compassion and empathy

Increased sense of morality, intuition, and courage to change

Increased control over automatic behaviors

Increased self-discipline

The question is: how many of us would like to benefit from mindfulness if it provides these positive benefits? All of us should strive to lower our stress level and enjoy our daily lives with a more positive attitude and more attentiveness. So, how can we incorporate this into our lives? The majority of this practice is about familiarizing yourself with what it feels like to be mindful, and getting better at “remembering” to maintain mindful awareness.

Experiment with creating your own mindfulness practices throughout your day. Being mindful of the sensation on the soles of your feet as you walk to your car or the taste and texture of your morning coffee can transform routine moments into deeply satisfying practices. However, having a ritualized and structured practice can be beneficial. To find out more about practicing mindfulness and how to incorporate a more structured practice in your life visit http://edis.ifas.ufl.edu, Publication # FCS2335 – Mindfulness: An Introduction.

Source: Mindfulness: An Introduction. http://edis.ifas.ufl.edu. Publication # FCS2335.

by Samantha Kennedy | Jan 18, 2019

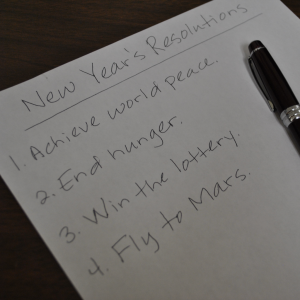

Every year, millions of us make New Year’s resolutions in the hope of implementing a few changes in our lives. We resolve to lose weight, eat healthier, save money, read more, or spend more time with our family.

Every year, millions of us make New Year’s resolutions in the hope of implementing a few changes in our lives. We resolve to lose weight, eat healthier, save money, read more, or spend more time with our family.

Unfortunately, research shows that only about 8% of New Year’s resolutions are actually kept, which begs the question: Why do so few of us stick to the goals we set for ourselves?

In many cases, the answer is simple. We set the bar too high and become discouraged. Instead of losing 5 pounds, we want to lose 50. Instead of saving $10, we want to save $1000. Many resolutions are created with the overall end goal in mind, when we really should be focusing on making incremental changes.

The trick to successful goal-setting is crafting realistic goals that have a better chance of being reached. For example, instead of making the goal to lose 50 pounds, how about setting smaller goals to lose 5 pounds at a time until the overall goal of 50 pounds is met? These smaller goals help reduce frustration and discouragement and are more likely to lead to success.

Setting smaller, realistic goals is one of the major characteristics of what are known as SMART goals. SMART goals are designed to be more specific and manageable, making them easier to achieve and leading to a better likelihood of success. The SMART acronym provides the five keys to creating better goals:

Specific. Goals should be targeted and specific. While it is great to want to “be healthier” in the upcoming year, what does that mean in specific terms? Does it mean reducing sodium intake? Cooking more meals at home? Losing 10 pounds? Implementing a walking routine? By setting specific goals, it will be easier to track progress.

Measurable. If there is no way to measure progress, then a goal is not very useful. Along with being specific, good goals need to be able to be tracked. Implementing a walking routine is one thing, but being able to set a distance or time goal will help make it more meaningful. If the goal is to walk 30 minutes a day five days a week, that is easily measured.

Achievable. The biggest key to any goal is not setting the bar too high. Too often, we want to set pie in the sky goals because we want to get to where we want to be right now. The problem with that, however, is that when we are not seeing the results we want, we get discouraged and give up. Setting smaller, more manageable goals will make them more achievable.

Relevant. We sometimes set goals for ourselves that get in the way of other, more important things. When setting goals, determine whether it is something that will really make a positive impact. Will working towards this goal prevent us from doing something else that requires our attention? If the goal will not ultimately work towards our overall endpoint, perhaps it is not worth pursuing.

Timed. Nebulous, open-ended goals are often ineffective because they leave too much time to achieve them. Consider this: If my goal is to lose 10 pounds, but I do not give myself a deadline by which to lose the weight, I am not holding myself accountable since I can just keep giving myself more and more time to reach my goal. However, if I set my goal to lose 10 pounds in 3 months, I am more likely to continue working towards my goal. Setting time limits can help increase the odds of success.

New Year’s goal setting is not a new concept. Neither is not achieving our New Year’s resolutions. However, by creating SMART goals for ourselves, we can help beat the odds and achieve our goals in 2019.

For more information, please call Samantha Kennedy at the UF/IFAS Wakulla County Extension office at (850) 926-3931.

Extension classes are open to everyone regardless of race, creed, color, religion, age, disability, sex, sexual orientation, marital status, national origin, political opinions or affiliations.