by Heidi Copeland | May 15, 2021

American Rescue Plan: Enhanced Child Tax Credit

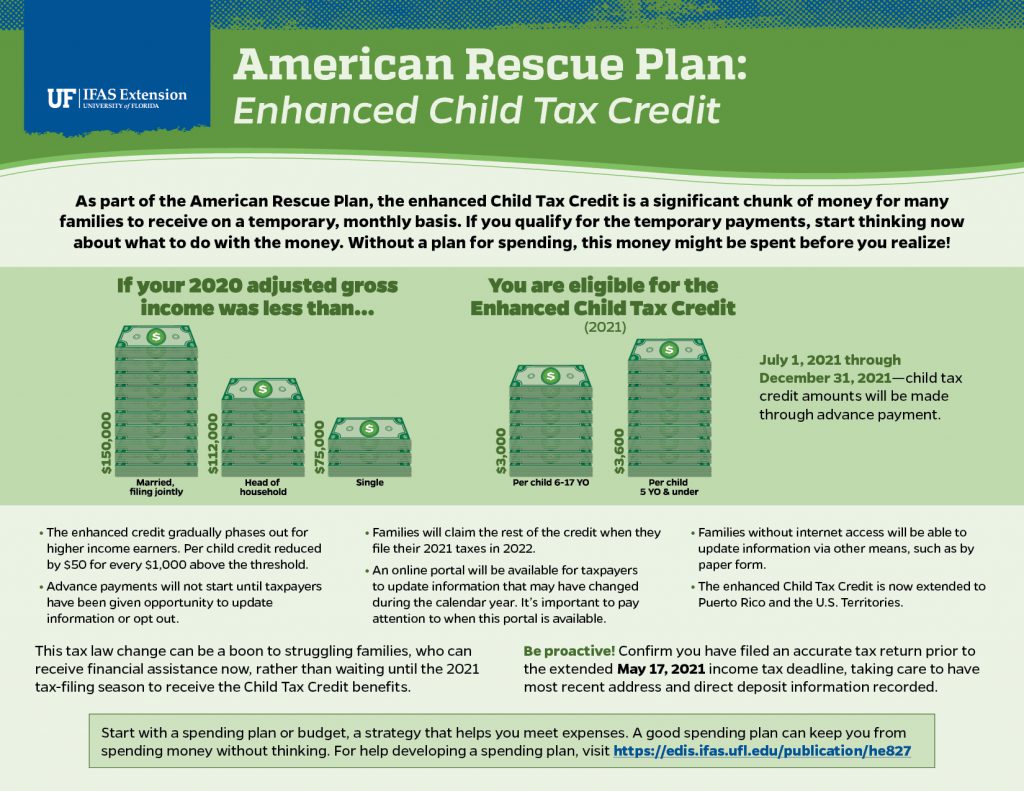

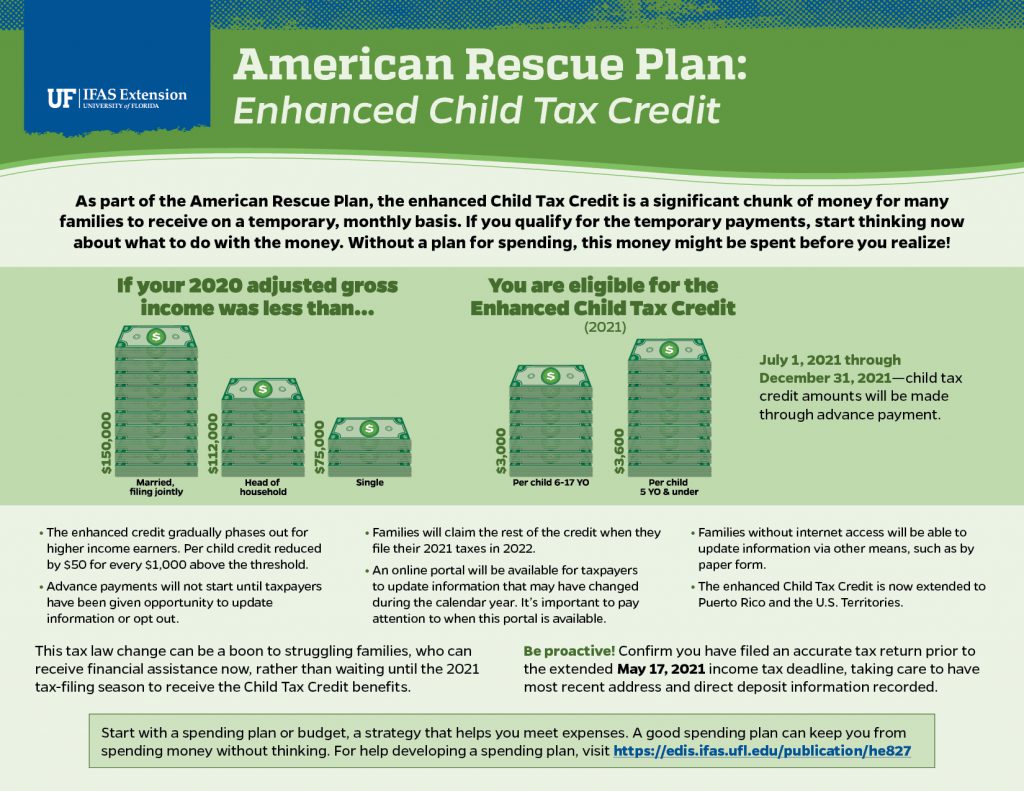

It is not often (or ever) that working families receive a windfall. Nevertheless, that is exactly what the enhanced, Child Tax Credit as part of the American Rescue Plan is. Moreover, it is a significant chunk of money for many families to receive on a monthly basis. If you qualify for the payments start thinking now about what to do with the money. Without a plan for spending, this money might be spent before you realize it!

The credit amount will be made through advance payment starting July1, 2021 ending December 31, 2021. This tax law change can be a boon to struggling families. Families can receive financial assistance now, rather than waiting until the 2022 tax filing season to receive the Child Tax Credit benefits. Please try to be mindful of this money. Start with a plan. A spending plan, also called a budget, is simply a strategy you create that helps you meet expenses. A good spending plan can keep you from spending money without thinking.

The credit is now extended to Puerto Rico and the U.S. Territories. For the first time, families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment

Leon County Child Tax Credit Infographic

by Heidi Copeland | Apr 7, 2021

Carrots

Photo source: Heidi Copeland

According to industry standards, some of these carrots could not be sold because of “Serious damage” or any defect which seriously affects the general appearance of the

carrots in the container.

Waste less, save money is a great creed to live by. Really, it is that simple. One excellent example of this is food. Research indicates that 40% of all food in America is wasted yet, one in eight Americans does not have enough access to affordable, nutritious food. In other words, they are “food insecure.”

Wasted food is a MASSIVE problem at the commercial, institutional and residential levels. In fact, the Environmental Protection Agency (EPA) estimates there is more food than any other single material in our everyday trash and that approximately one-third of all food produced for human consumption worldwide is lost or wasted. In fact, in 2015, the USDA joined with the U.S. Environmental Protection Agency to set a goal to cut our nation’s food waste by 50 percent by the year 2030.

The sad fact is, most people do not realize how much impact food and food waste has on the earth and its issues of sustainability. Food waste occurs at every level of involvement. Examples of food waste include growing, processing (by-products too), transporting, point of sale, plate waste and uneaten prepared foods, and kitchen trimmings and their eventual disposal. Preventing food waste at all these levels can make a difference in addressing this issue.

However, preventing food waste it is not as easy as it seems. Many consumer factors also contribute to the problem.

- Food date labels confuse people. Use by/sell by dates are not always about food safety but about peak quality. Many foods are still safe to eat after their dates. Inspect “expired” foods closely via sight and smell before consuming – find ways to use up food past its prime.

- Households overbuy – do you really need super sizes? Buying in bulk is not always less expensive if much of it is discarded. Only purchase what you know you will use and do not get lured in by the “more for less” deals.

- Massive portions are often served – share or learn to love leftovers. Split enormous portions into multiple meals.

- Grocery stores overstock their shelves to maintain an image of abundance.

- People demand “perfect” produce. Farmers have a hard time selling less than stellar items. “Ugly” fruits and vegetables are just as delicious and nutritious as their more photogenic counterparts. Places such as farmers’ markets and community gardens are good places to find imperfect produce that would otherwise go to waste.

This Earth Day, (an event first celebrated on April 22, 1970 in the United States and is now a globally coordinated event in more than 193 countries) commit yourself to taking an action. As the late Neil Armstrong famously quoted as he stepped on to the moon… “This is one small step for a man, one giant leap for mankind!” If each of us considered and implemented our own practical or creative approaches to preventing food from going to waste what would our collective actions mean for mankind?

Fresh Carrots

Photo Source: Heidi Copeland

The best way to reduce food loss at home is not to create it in the first place. Not only would we individually save money, our collective efforts could conserve resources for future generations. The best method is the one you use.

- Reduce wasted food – shop smart, plan what you purchase, and use it, ALL of it!

- Maximize the efficiency of your refrigerator based on science. Read your refrigerator manual to learn where the coldest spots in the refrigerator are and what foods benefit from refrigerator location.

- Maximize the efficacy of canned products… use the FIFO (first in first out) method of rotation to use the oldest product before the newest on the shelf.

- Donate what you cannot use to others.

- Divert food scraps to animal food (chickens anyone?)

- Compost

- Landfill as the last resort.

Common causes of personal food waste include overbuying, over preparing and spoilage. The basic tenets of sustainability – reduce, reuse, recycle and refuse, work to reduce food waste too! Pay attention to purchases, eat what is prepared, store food properly, and refuse to waste. We can all do our part! Let’s start today.

https://savethefood.com/recipes/

by Heidi Copeland | Mar 23, 2021

Do you quality for the Earned Income Tax Credit (EITC), or Earned Income Credit (EIC)?

Do you quality for the Earned Income Tax Credit (EITC), or Earned Income Credit (EIC)?

The Earned Income Tax Credit (EITC), or Earned Income Credit (EIC), is a refundable tax credit targeted to working people with low to moderate income.

EIC is a refundable credit. You can take advantage of the credit even if you do not owe any taxes. (https://www.irs.gov/pub/irs-prior/p596–2020.pdf)

Plus, there is a new feature… the LOOKBACK rule for Earned Income Credit (EIC).

As part of the Consolidated Appropriations Act of 2021, passed in December of 2020, you can use your 2019 earned income to determine your EIC and the Additional Child Tax Credit if your 2020 earned income is lower than your 2019 earned income. This is an especially important rule. You can use whichever income gets you the larger credit.

To qualify for the EIC:

- You must have at least $1 of earned income: wages, salary, tips, net self-employment earnings (income less expenses), or disability benefits up to a certain threshold

- You file a federal income tax return for the tax year even if you do not owe any tax or are not required to file a tax return

- Taxpayer (and spouse) and any qualifying child must each have a valid Social Security number issued before the due date of your return

- Taxpayer must be a U.S. citizen or resident alien for the entire year

- Filing status can be married filing jointly, head of household, qualifying widow(er), or single. (You can’t claim the EITC if your filing status is married filing separately)

- Your tax year investment income must be $3,650 or less for the year

- Cannot file form 2555 relating to foreign earned income

- Rules for qualifying children:

- Child(ren) must be under age 19—age 18 or younger—at the end of the tax year and younger than you or your spouse (if you file jointly) OR under age 24 and a full-time student and younger than you or your spouse (if you file jointly) OR any age if permanently and totally disabled

- The child must either be your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, or a descendant of any of these individuals, which includes your grandchild, niece, or nephew

- The child must have lived with you for more than half of the tax year (some exceptions apply)

- Only one person can claim the same child for the same tax year

The EIC may be disallowed if the taxpayer incorrectly files for the credit but does not meet these requirements.

by Heidi Copeland | Mar 23, 2021

Friday, February 12, 2021 opens the 2021 income tax filing season. Getting your income tax information together will help you file a complete, correct, and timely income tax return.

Friday, February 12, 2021 opens the 2021 income tax filing season. Getting your income tax information together will help you file a complete, correct, and timely income tax return.

Things to know:

- 2020 return is filed in 2021

- As of now, April 15, 2021 is still the filing deadline

- File on time or file for an extension to avoid paying a penalty for failing to file on time.

- If you are owed a refund, you have up to 3 years to file and receive the money.

Coronavirus and Taxes

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) authorized the IRS to issue Economic Impact Payments (EIPs)

- EIP1: $1,200 to most U.S. citizens and residents and up to $2,400 for married couples who file a joint return plus $500 per qualifying child.

- EIP2: $600 for individuals or $1,200 for married couples and up to $600 for each qualifying child.

- Generally, if you have an adjusted gross income for 2019 up to $75,000 for individuals and up to $150,000 for married couples filing joint returns and surviving spouses, you will receive the full amount of the second payment. For filers with income above these amounts, the payment amount is reduced.

On the 2020 Form 1040 (individual income tax return), taxpayers are asked about these monies. Did you get them and how much? Be aware that these funds were disbursed in different ways: paper check, direct deposit, and debit cards. Many people also received a notice 1444 A or B explaining these monies; many did not. It is important to familiarize yourself about the Economic Impact Payments (EIPs) and know the exact amount you received. (If you didn’t receive the funds, ask yourself these questions: Have you filed an individual income tax return in previous years? Have you moved/changed bank accounts since filing last?)

Remember, putting incorrect information on the tax return might mean a lengthy delay or alter the size of refunds/payments!

Know, too, that after October 15, 2020, the only way to claim your EIP will be to file a federal income tax return. If you did not file a 2019 tax return in 2020, you may instead be able to claim a recovery rebate credit when you file your 2020 federal income tax return in 2021.

People can check the status of both their first and second payments by using the Get My Payment tool, available in English and Spanish only, on IRS.gov or calling the IRS hotline @ 800-919-9835.

by Heidi Copeland | Jan 22, 2021

Taxes, without a doubt, conjure up emotions from elation to dread! Do you owe? Are you getting a refund? Are you uncertain?

doubt, conjure up emotions from elation to dread! Do you owe? Are you getting a refund? Are you uncertain?

This is a significant statement because income tax returns cannot be filed electronically or by mail until the IRS has opened the season.

Please, do not be influenced to apply for a tax refund loan, typically known as a RAL (refund anticipation loan), if you are not in a crisis for the money. An RAL is a loan based on the anticipated amount of your federal income tax refund. Many tax filing services will offer you a RAL if… you file with their service. Your loan amount will be the value of your anticipated refund minus fees and/or interest charges.

Know, too, that your loan will go directly to the lender once the IRS processes your income tax return.

Be VERY careful with refund anticipation loans. An obvious positive attribute of the loan is you get money quickly – before the season even opens. Another, once the lender receives your refund, the loan is paid. But, what happens if your tax refund is smaller than the anticipated income tax return? You now will have an outstanding loan that will need to be paid back.

The Earned Income Tax Credit (EIC or EITC) is a refundable tax credit for low- and moderate-income workers. For 2020, the earned income tax credit ranges from $538 to $6,660. The amount depends on income and number of children; people without kids can qualify, too.

If you qualify for the EITC, you need to know, by law, the IRS cannot issue refunds for people claiming the EITC or the Additional Child Tax Credit (ACTC) before mid-February. The IRS cannot release these refunds before February 15, but the IRS is saying to expect your refund by the first week of March. Note, too, the law requires the IRS to hold the entire refund − even the portion not associated with the EITC or ACTC. This law change, which took effect in 2017, helps ensure that taxpayers receive the refund they are due by giving the IRS more time to detect and prevent fraud.

Now, while waiting for the tax filing season to open, is a great time to get income tax documents together. Once the filing season opens, being organized and prepared will help facilitate a seamless transition to filing your income tax return. The IRS recommends that taxpayers file their returns electronically to reduce errors and receive refunds more quickly.

Filing an average income tax form is also easy. There are many FREE income tax filing sites.

Income $72,000 and below: Contact your local UF/IFAS Extension office and they can help you by:

- Finding FREE federal tax filing on an IRS partner site

- Finding guided preparation – simply answer questions

- Providing a link to a FREE Facilitated Self-Assisted (FSA) service with electronic forms you fill out and file yourself

Income above $72,000: Contact your local UF/IFAS Extension office and they can help you by:

- Providing a link to a FREE Facilitated Self-Assisted (FSA) service with electronic forms you fill out and file yourself

- Helping you learn how to prepare papers for meeting with a tax professional

- Providing you with basic tax preparation information

Be careful in your decision making when it comes to filing income taxes. Choosing e-file and direct deposit for refunds remains the fastest and safest way to file an accurate income tax return and receive a timely refund. It is amazing to know the IRS issues more than 9 out of 10 refunds in less than 21 days.

Source: https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free#what