by Heidi Copeland | Nov 23, 2021

Since I can recall, I’ve liked to read cookbooks. Old cookbooks, famous cookbooks, church cookbooks, regional and seasonal cookbooks, and cookbooks hot off the press! I read the forward and the preface (… if there is one). I don’t just look at the pictures, but I read the recipe for yield (number of servings), ingredients and amounts, and the way the ingredients are combined. I read about the equipment required to prepare the recipe and the amount of time it takes to complete the task.

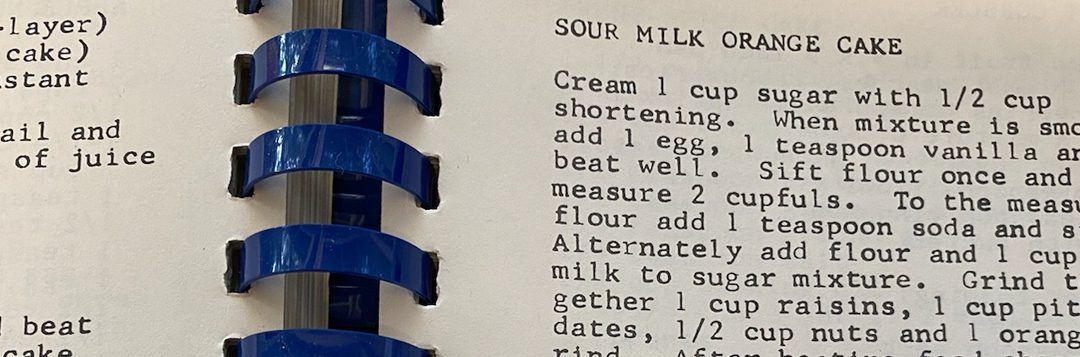

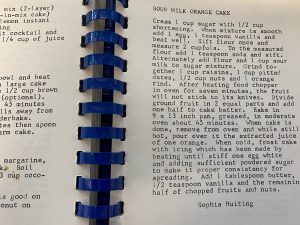

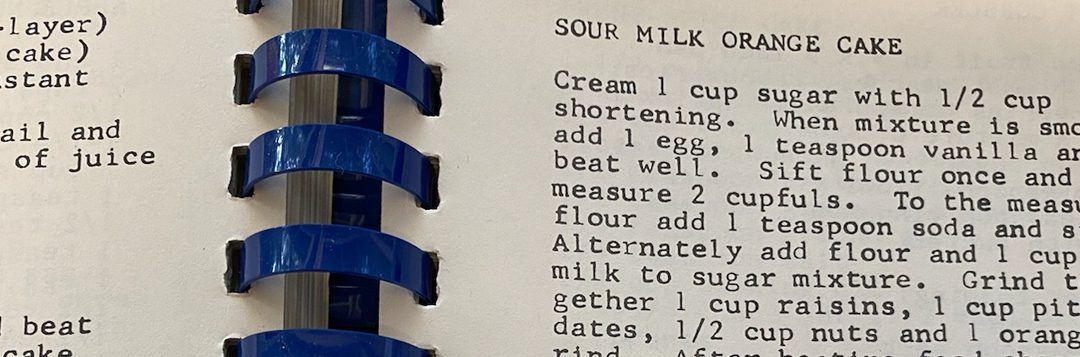

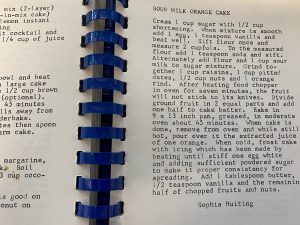

A narrative format is common with many older or handwritten recipes.

Photo credit: Heidi Copeland

Generally, I have found that old cookbook recipes often seem different and that handwritten, handed-down recipes tend to be vague. I also have found that the product does not always turn out like the picture. Yields – the amount a recipe feeds – has certainly changed over time and recipe ingredients have become more and more varied, as has their use. Who knew toasting spices completely changes their flavor profile and that umami is important?

It used to be that people learned to cook by watching someone else. However, that seriously changed as more and more folks became literate. In fact, the first cookbook published in the United States, American Cookery (Hartford Connecticut 1796), has been designated by The Library of Congress as one of the 88 books that shaped America. This first cookbook used uniquely American ingredients of the time and provided American cooks with quite a litany of receipts, the old-world way of documenting what we now call a recipe.

Recently, I listened to a radio interview with Adrien Miller, a cookbook author who has been on a quest to document uniquely African American cooking histories.

I chuckled to hear Adrien Miller describe a handwritten recipe from a friend or a relative as a lesserpe… his terminology for the unexacting nature of a recipe given from someone who really doesn’t need an exact rendition because they know what they are doing and assume you do, too.

Recipes are a great way to hand down our own historical traditions. However, having been charged with giving out a lesserpe…, I find it is critically important to be as exacting as possible when sharing recipes with friends or family.

A good, standard format for a recipe includes:

- Name of product

- Yield of product (how many it serves)

- Ingredients in exact amounts (in order of use is helpful)

- Step-by-step instructions, in detail

- Time and temperature specifics

- Important information about pan size, etc.

Remember, too, that a recipe is a history. History evolves. Aunt Margaret might have written a narrative format (paragraph) recipe but today that form might be seen as hard to follow.

Here is an example from Aunt Margaret:

Apple Pie (2 crust)

Preheat oven to 425 degrees. Line a 9-inch pie pan with your favorite crust. Combine and sift together 1/2 – 2/3 cup white sugar, 1 1/2 tablespoons cornstarch, 1/4 teaspoon nutmeg, 1/2 teaspoon cinnamon. Combine and sift over apples (about 3#, cut up). Stir apples gently until well coated. Place in pie shell and dot with butter. Cover pie, slit or prick crust. Bake at 425 degrees for about 15 minutes then reduce heat to 375 degrees. Bake until done.

The typically formatted recipe:

Apple Pie (Aunt Margaret)

Serves 8 to 10

2 pie crusts, purchased or homemade

3 pounds Granny Smith apples, approximately 8 large apples

1/2 cup white sugar, more if you like it sweeter

1 1/2 tablespoons cornstarch

1/4 teaspoon nutmeg

1/2 teaspoon cinnamon

2 tablespoons butter, firm, sliced thin

1 egg yolk

2 tablespoons cream

- Preheat oven to 425°F.

- Wash, peel, core, and slice the apples thinly.

- In a large bowl, toss sliced apples with sugar, cornstarch, nutmeg, and cinnamon.

- Line 9” pie pan with 1 piecrust

- Mound the apple mixture in the center of the pie crust.

- Dot the apple mixture with sliced butter.

- Cover apples with 2nd pie crust.

- Crimp edges of the pie crust. (Press the top and bottom dough rounds together as you flute edges using thumb and forefinger or press with a fork.)

- Mix egg yolk and cream, brush all over the pie crust top.

- Stick with fork tines in a dozen places or vent with small knife-made slits.

- Bake 15 minutes in the preheated 425°oven.

- Reduce the temperature to 375°. Continue baking for 35 to 45 minutes, until apples are soft and the crust is golden brown.

- Transfer the apple pie to a rack to cool for at least 1 hour.

- Serve warm or cold.

Notes:

- Place the pie on a baking sheet to catch any drips before you bake it.

- At any point during the baking, if the top of the pie begins to brown too much, just tent it with aluminum foil.

- Your dad does not like nutmeg. I add a splash of vanilla, a bit more cinnamon, and omit the nutmeg.

- Don’t forget the vanilla bean ice-cream. It adds a nice touch!

This holiday season, don’t be blamed for sharing less than the whole recipe. Recipes can be a valuable tool for passing on important family food traditions, now and into the distant future. Learn to write a good recipe with details. You might just be the talk of the table for eons.

Library of Congress: American Cookery

by Heidi Copeland | Aug 27, 2021

Can you believe it? Here we go, again! The Covid-19 delta variant case surge is an unwelcome visitor for sure!

What works? What doesn’t work? I have always liked to err on the side of caution. Sound science is both prudent and responsible. Sound science says masks are necessary for our personal safety and the safety of those around us. In fact, with the dramatic rise in the number of Covid-19 delta variant cases, masks are being seen as necessary – in the workplace, in public, and at home in the event there is a contagious individual. The delta variant transmission rate is more easily spread than the original strain of Coronavirus. In fact, the Covid-19 delta variant:

- Is more contagious

- Might cause more severe illness than previous strains in unvaccinated persons

A protective face mask can help to reduce the spread of the COVID-19 virus.

Photo credit: Heidi Copeland

Public health experts advise mask protection. Wearing a mask works. What kind of mask? A mask that is protective. Protective masks fit (your glasses do not fog), protective masks have a high filtration efficiency (materials, plus fit), protective masks have an extra layer of protection, and protective masks are large enough to cover both the nose and mouth at the same time and small enough to ensure large gaps do not occur. Protective masks should be comfortable enough for extended wear.

An efficient way to use what we already have is to double up – layer prevention strategies. Layering means wearing a cloth mask on top of a surgical mask or wear two cloth masks. Adding a filter also can extend the life of what we already own.

I’ve recently seen a few good mask hacks. One such hack involves using hair clips to hold the loops of the mask tightly at the back of the head and the other hacks tie the loops in such a way as to minimize any gaps on the side of your cheek, nose, and chin.

Although we are not quite back to square one, the ugly Covid-19 virus and its variants continue to rear their hideous head primarily through the air. If indoor space is shared – EVERYONE should be wearing a mask.

Let’s face it, we are relying on the decisions other people make. If everyone makes good decisions, we can bask in the glory that we did our part to help ourself and our neighbor.

Mask’s work.

For more information, visit: https://www.cdc.gov/coronavirus/2019-ncov/variants/delta-variant.html

by Heidi Copeland | Aug 24, 2021

Yes, that’s right, the expanded, Advance Child Tax Credit is NOT stimulus money. The Child Tax Credit is an ADVANCE payment of next year’s Child Tax Credit. Taxpayers with qualifying children are entitled to claim qualifying children for an income tax credit.

With that said, there are two types of credit: refundable credit and nonrefundable credit. Although both kinds of credit can reduce your tax liability, only a refundable credit can give you a tax refund even when you do not owe taxes.

The expanded, Advance Child Tax Credit is a refundable credit for the 2021 income tax year. This refundable tax credit is being given in ADVANCE to taxpayers with qualifying children. The amount of the expanded, Advance Child Tax Credit payments that you receive during 2021 is based on the IRS’s estimate of the Child Tax Credit amount that you appropriately would be allowed for the 2021 tax year. The law requires this estimate to be based on two primary sources of information:

- Your 2020 tax year return or, if that return is not available, your 2019 tax year return

- Any updated information you provide to the IRS in 2021, including information provided through the Child Tax Credit Update Portal (CTC UP), which will allow you to update with the IRS your Child Tax Credit information throughout 2021, including any changes in the number of your qualifying children, changes in your income, and changes in your filing status.

In fact, the IRS began paying the Advance Child Tax Credit on July 15, 2021. The Internal Revenue Service will issue half the total credit amount, in advance, the middle of every month, from July 15 to December 15, 2021. You will claim the other half when you file your 2021 income tax return in 2022. As of now, these tax law changes apply to tax year 2021 only.

The maximum credit is available to taxpayers with a modified adjusted gross income of:

- $75,000 or less for single filers and married persons filing separate returns

- $112,500 or less for heads of household

- $150,000 or less for married couples filing a joint return and qualifying widows and widowers.

For tax year 2021, qualifying families claiming the Child Tax Credit will receive:

- Up to $3,000 per qualifying child between the ages of 6 and 17 at the end of 2021

- Up to $3,600 per qualifying child under age 6 at the end of 2021

The Child Tax Credit begins to be reduced to $2,000 per child if your modified AGI in 2021 exceeds the amounts listed above:

- Phase One: Reduces the Child Tax Credit by $50 for each $1,000 (or fraction thereof) by which your modified AGI exceeds the income threshold described above that is applicable to you.

- Phase Two: The Child Tax Credit will not begin to be reduced below $2,000 per child until your modified AGI in 2021 exceeds:

- $400,000 if married and filing a joint return OR

-

- $200,000 for all other filing statuses

The second phase reduces the Child Tax Credit by $50 for each $1,000 (or fraction thereof) by which your modified AGI exceeds the income threshold described above that is applicable to you.

The IRS has an eligibility assistance site to help you check if you might be eligible for advance payments of the Advanced Child Tax Credit https://www.irs.gov/credits-deductions/advance-child-tax-credit-eligibility-assistant

For the 2021 income tax filing season, a qualifying child is under age 18 at the end of 2021. This differs from the 2020 income tax filing season as a qualifying child was under age 17 at the end of 2020. Other general rules from income tax year 2020 in regards to the Child Tax Credit do not apply in 2021.

American Rescue Plan: Enhanced Child Tax Credit – While millions of American families view the expanded, Advance Child Tax Credit (money) as a lifeline needed to pay basic expenses, others view it as a windfall. Do you need to take the Advance Child Tax Credit? That is entirely up to you. However, it is important to think ahead. Do you have a plan for spending or not spending the money? (You have an opportunity every month through December to unenroll before the next payment lands. The deadline is three days before the first Thursday of every month)

If you feel certain you will not owe money come income tax time AND spend the Advanced Child Tax Credit (money) responsibly … why not? The premise of the expanded, Advance Child Tax Credit, as part of the American Rescue Plan Act of 2021, is to help families and to help stimulate the economy. But that does not mean the advanced credit (money) should be spent thoughtlessly. Being sensible and responsible can help set you up for future success for years to come.

Financial literacy is an understanding of the skills and knowledge that allows an individual to make informed and effective decisions with all their financial resources, including taxes! Make time to learn about the expanded, Advanced Child Tax Credit. Strong financial knowledge and decision-making skills help people weigh their options and make informed choices for their financial situations, such as deciding how and when to save and spend, comparing costs before a big purchase, and planning for retirement or other long-term savings. Be prepared, research your options, and have a plan. You will be glad you did!

The IRS doesn’t initiate contact with people by email, text messages or social media channels to request personal or financial information. People should watch out for websites and social media attempts that request money or personal information and for schemes tied to Advance Child Tax Credit payments, Economic Impact Payments, or other tax topics. Be careful of SCAMS. Report these scams to the IRS.

by Heidi Copeland | Jun 24, 2021

“

I’m BORED!” is not a statement a parent/caregiver wants to hear just days into summer break! Boredom is a feeling. The feeling of being unsatisfied or uninterested can lead to boredom. Boredom can also result from too much time on your hands. Boredom may occur when you do the same thing over and over again. Boredom can affect both physical and mental health and, let’s face it, it is not just kids who get bored!

Nevertheless, boredom, like any feeling, is important to recognize and manage. In fact, people who are good at noticing how they feel and adjusting (self-regulating) their behavior are more likely to do well in school and life, have healthy relationships, and manage difficulties and setbacks – boredom included.

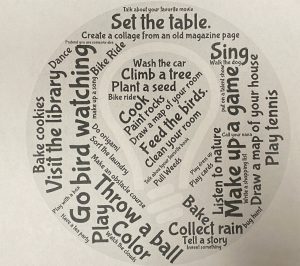

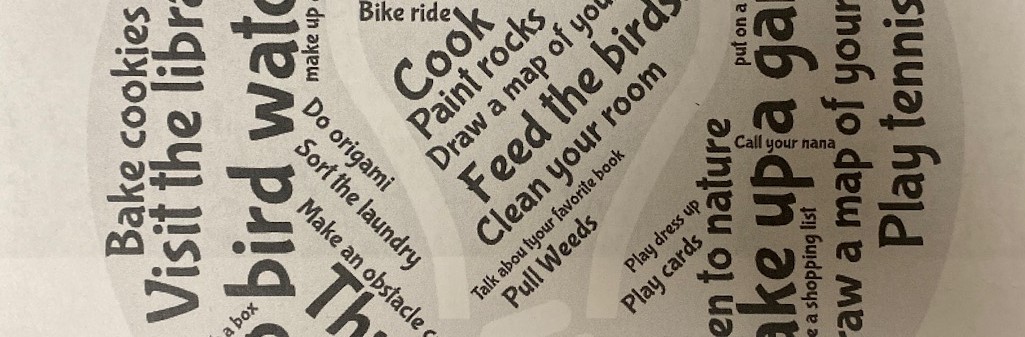

How can we combat boredom? We can counter boredom with constructive activities. Constructive activities are those that require a bit of personal output, or something one actually has to do.

Therefore, before your summer vacation takes a nosedive, think of ways to ward off the doldrums. Know, too, that watching too much screen time can only make boredom worse because screen time, for the most part, is a passive type of activity/entertainment. While there is certainly a place for passive engagement (watching a movie, for instance, or reading a book), you do not have to do anything! Moreover, when the body and mind are not actively engaged for hours on end, things can go downhill… quickly. Many find actively or constructively doing something satisfying can enlighten your body, your mind, and your soul.

Think about it… while reading a book is passive, your mind is 100% active; the same goes for a movie or your favorite show. However, being engaged, like talking to someone about what you are watching or reading, takes the passive activity to a new level; talking about the activity makes it more constructive because you get really involved in it by sharing. It’s the non-participatory part repeated hour upon hour that can cause the negative effect. The body needs a balanced diet of both passive and constructive activities.

Constructive activities help activate your body, mind, and soul. So, before boredom happens, take a proactive approach to finding a solution before the problem starts. Of course, the internet is full of ideas; some of them are quite good! Personally, I like the approach where the set up requires a few easy to use resources that can quickly engage the user.

Parents and caregivers should help model the behavior they want their charges to follow. Knowing a few tricks to turn passive activities into constructive ones will help the long, hot summer be the best one yet.

by Heidi Copeland | Jun 2, 2021

A dent can lead to food spoilage in canned products.

Photo source: Heidi Copeland

It started with a visible dark line running down the pantry wall. My eye traced the dark line up to an upper shelf, only to realize a can of food was leaking. My first reaction was, “Oh, no! Botulism!” then I quickly recognized that the guilty can contained a highly acidic food, which hinders the growth of Clostridium botulinum, the bacterium that causes botulism.

A yeast more likely caused the line creeping along the wall. However, it still made for a fun afternoon of cleaning and inspecting every remaining can in the pantry.

As the photo illustrates, the can was leaking from a tiny, indecipherable breach. Perhaps there was a small dent in the can when it was purchased. Maybe it was dropped and the damage went unnoticed. However, one thing that is certain is that purchasing and storing a damaged can is cause for concern. Dents, punctures, or even rough handling can compromise the integrity of a can, which can lead to leaks and contamination.

The Food and Drug Administration (FDA) monitors the safety and integrity of canned foods. The incidence of spoilage in canned foods is low, but when it occurs, it is important to know what to do. In most cases, the best actions to take are to discard the food immediately and thoroughly clean any contaminated areas. NEVER open a bulging or leaking can. Wear protective equipment, especially gloves, when handling damaged and leaking cans.

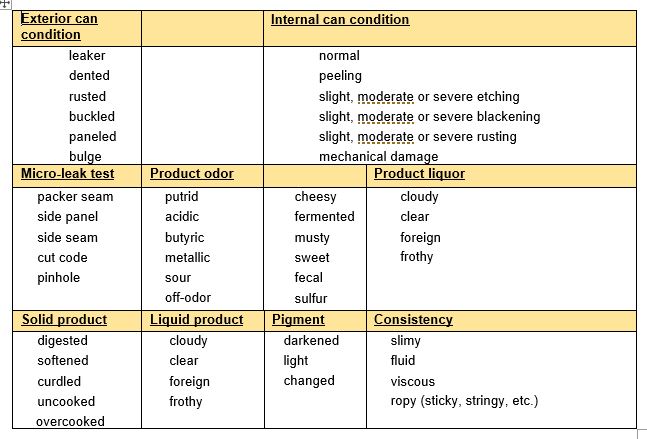

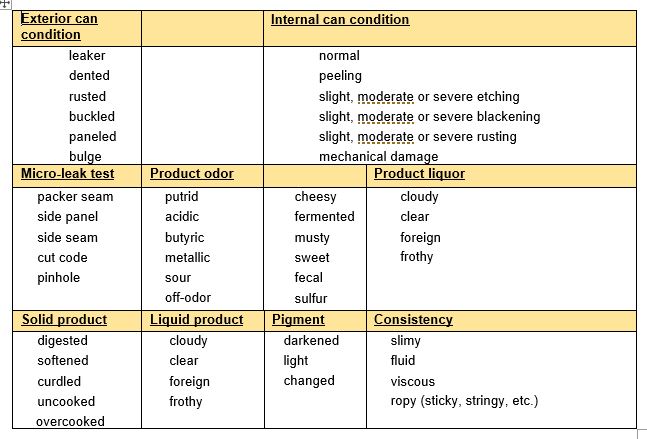

The table below includes useful descriptive terms used in the canned food industry – it is a helpful tool for the consumer, too.

Photo source: www.fda.gov

From a cursory glance, I learned externally, my can was a leaker. The can was ever so slightly dented; perhaps the dent caused a weakness, the can rusted, and the liquid started to drain out.

Because of this canned food misadventure, my pantry got an early spring-cleaning. All the items around the offending can were removed, inspected, and thoroughly cleaned. The shelves and walls were also cleaned to remove any residue.

Cleaning the pantry should not just be done when something leaks, however. The cans and boxes in the pantry should be regularly rotated (first in, first out: FIFO) as well as inspected for pests and/or damage, and the shelves and walls should be periodically cleaned to help prevent any cross-contamination.

Other than leakage, mold, or other obvious clues that canned food is spoiled, there are other signs as well, some of which may not be noticeable until after the can is opened. Some of these include:

- The can lid does not seem attached correctly: it moves when touched or is bulging.

- The food spurts out when the can is opened.

- The can is rusting or corroded. Both rust and corrosion will eventually create tiny holes that let both air and bacteria into the food can.

- Dents: dents compromise the integrity of metal, causing a breach. Even the smallest breach in the can may lead to contamination and spoilage.

- Sound: an unnatural, loud hiss when the can is opened can be a sign of unwanted fermentation or other biological processes.

- Unpleasant smells are a good way to detect possible spoilage, even if the food still looks good.

Visual inspections are important in the food world. Do not wait until there is a mess in the pantry before taking an inventory and weeding out the old and damaged products. It is important to rotate even canned food to keep it from sitting too long. Store newer items behind older ones to ensure items are used before their expiration dates.

Resource: https://www.fda.gov/food/laboratory-methods-food/bam-chapter-21a-examination-canned-foods

For more information about food safety and proper food storage, please contact:

Heidi Copeland, Leon County Extension Office, 850.606.5229.

Samantha Kennedy, Wakulla County Extension Office, 850.926.3931