by Suzanne Holloway | Nov 21, 2025

Debt is money you owe to a person or business. While debt often carries a negative connotation, responsible borrowing and repayment can improve your credit history.

Debt & Credit

Debt becomes a problem when you can’t repay what you owe. Missed minimum payments, carrying high credit card balances, or skipping payments can all damage your credit. For more information about credit and credit history, you can read this previous blog.

Budgeting & Mindful Spending

Being thoughtful about spending and borrowing can help you avoid unnecessary debt and improve your financial well-being. Financial well-being means having control over your money and the ability to make choices that reflect your goals and values. It starts with planning, spending less than you earn, and setting aside savings each month, usually with the help of a budget.

Mindful spending is about making intentional choices, aligning your purchases with your personal goals instead of spending out of habit. This awareness can reveal habits that you may want to adjust to save more. Practicing mindful spending not only helps you spot areas to cut back but also reduces financial stress. When you have a plan and track your money, you gain more control, security, and peace of mind. To learn more about budgeting, click here.

Getting Out of Debt

© zimmytws / Adobe Stock

The first step to getting out of debt is creating a realistic budget. You might also look for ways to increase your income, such as finding a higher-paying job, taking on a side gig, or selling unused items. If you’re struggling to keep up, reach out to your creditors to discuss a new payment plan.

Debt Collection

A debt collector is an individual or company, like a collection agency or a law firm, that collects debts on behalf of others or for themselves after purchasing past-due accounts. If you’re contacted by a debt collector, speak with them at least once to gather information and confirm whether the debt is truly yours—but avoid sharing sensitive details unless you’re sure of their legitimacy, as scammers often pose as collectors. By law, debt collectors must tell you the exact amount you owe, the creditor’s name, how to obtain details about the original creditor, and what to do if you believe the debt isn’t yours.

Debt collectors have a limited time to sue you for unpaid debts—this “statute of limitations” starts after your first missed payment. Once expired, the debt becomes “time-barred,” and collectors can no longer sue or threaten to sue for payment. However, in some states, making a payment or acknowledging the debt can restart the statute of limitations, so proceed carefully.

If you would like a debt collector to stop contacting you immediately, send a letter by certified mail and ask for a return receipt. If a collector threatens you, hang up and report them to the Federal Trade Commission (FTC).

Debt Elimination Tools & Resources

A reputable credit counseling organization can help by offering expert advice on managing money and debts, developing a budget and a realistic debt repayment plan, and providing free educational materials and workshops. Most reputable counseling organizations are non-profits or universities, such as UF/IFAS Extension, that offer services in person, online, or by phone for little to no fee. Other available resources, such as mobile apps and online tools, include:

An Equal Opportunity Institution.

by Suzanne Holloway | Nov 21, 2025

When people talk about credit, they are referring to their credit history. Credit history describes how they have used money over time, which can significantly impact many aspects of life, including housing, employment, and finances, because landlords, lenders, insurance companies, and potential employers often review it when making decisions.

Three nationwide credit bureaus—TransUnion, Equifax, and Experian—collect credit history and additional information about individuals, such as names, addresses, Social Security numbers, credit cards, loans, and outstanding debts.

Credit Reports

© REDPIXEL / Adobe Stock

Credit bureaus provide credit reports to businesses that pay for this information to assess your reliability before working with you, like renting you an apartment or giving you a credit card. Whether your credit is considered “good” or “bad” depends on your history. People who pay bills on time and don’t borrow more than they can repay tend to have good credit, while those with late payments or debts they can’t afford may develop bad credit.

Each bureau gathers data from different sources, so your credit reports may vary slightly between them. Nonetheless, all three bureaus strive to keep their information accurate, but mistakes do happen, and checking your credit report for errors is important because inaccuracies can affect your opportunities. Accessing your credit report can also help spot signs of identity theft. You can order a free annual credit report from a centralized provider. To order your report, these are your options:

If you find errors in your report, you have the right to dispute them and seek corrections.

Credit Scores

A credit score is a number, usually between 300 and 850, that helps predict the likelihood and timeliness of loan repayment and other payments. Lenders, landlords, and other businesses use your credit score to decide whether to offer you credit and what terms, such as interest rates, you’ll receive.

In general, a higher score shows you have “good” credit, making you a lower financial risk, while a lower score signals “bad” credit, which can make it harder to get approved or result in higher interest rates. Credit scores are grouped into five ranges: poor (300–579), fair (580–669), good (670–739), very good (740–799), and exceptional (800–850). About 71% of Americans have a good FICO score or better. You can improve your credit score over time with consistent effort; it’s entirely possible.

Credit scoring systems are calculated in different ways. Most lenders use the Fair Isaac Corporation (FICO) score, which is based on five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%).

Credit Tools & Resources

Unlike credit reports, you usually have to pay to see your official credit score, although some mobile apps now offer it for free.

- Experian offers a free FICO 8 credit score, credit report, credit monitoring alerts, dark web surveillance, and a privacy scan, with additional features available on paid plans.

- Credit Karma provides free daily credit reports and VantageScores from Equifax and TransUnion, credit analysis and tips, and basic identity monitoring.

- Credit Sesame gives free daily VantageScore updates from TransUnion, insights into key credit factors, and a score simulator, with more features on paid plans.

Furthermore, some financial institutions also let you see your score; always verify whether any credit monitoring fees apply.

Additional Resources

Getting a Credit Card (FTC)

An Equal Opportunity Institution.

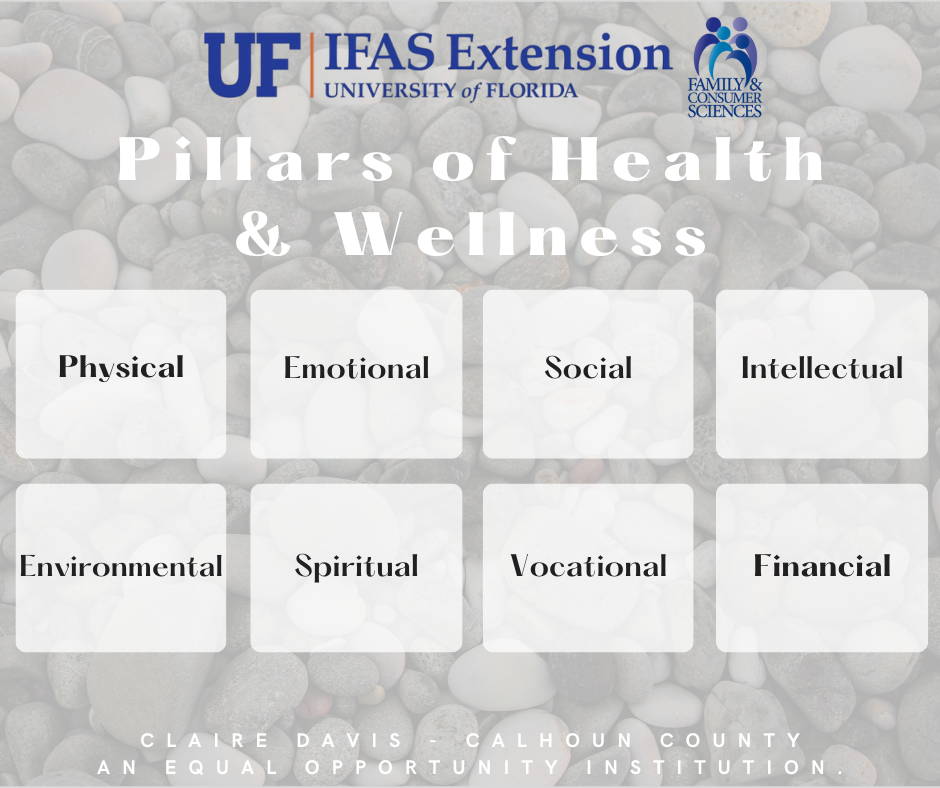

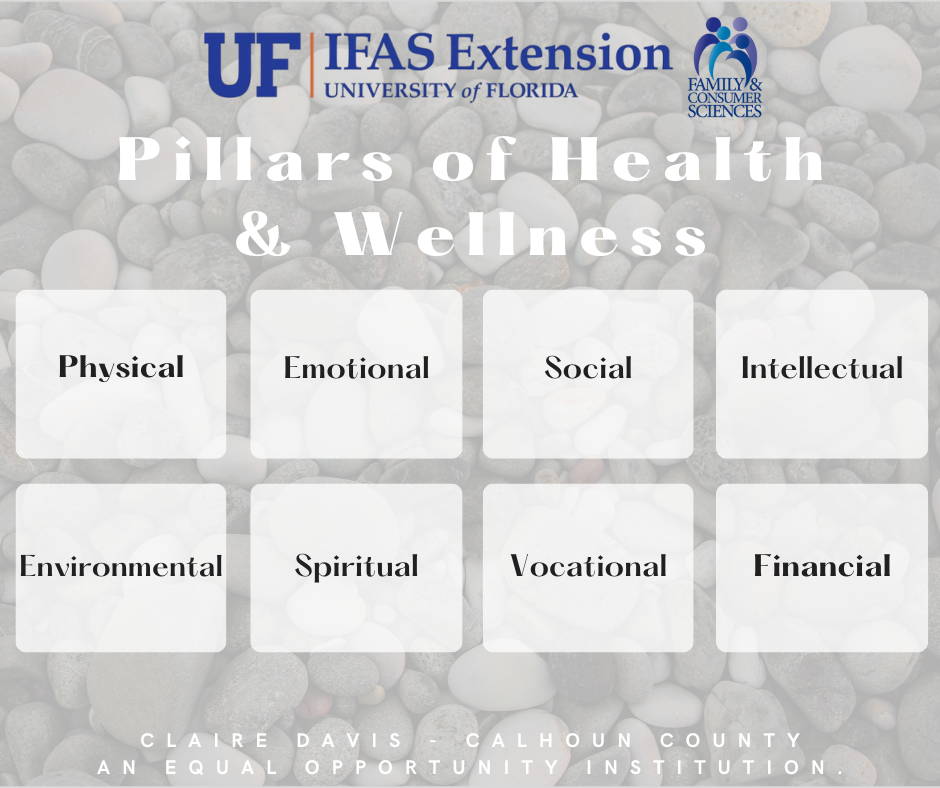

by Claire Davis | Nov 21, 2025

A few years ago, I found myself juggling too much, including: work, family, school, health, and everything in between. I was constantly exhausted, mentally foggy, and emotionally drained. I didn’t realize it at the time, but I was neglecting more than just my physical health. It wasn’t until I began exploring the idea of wellness in a broader sense that I started to feel whole again. I learned that wellness is about far more than eating right or exercising; it’s about nurturing every part of your life.

The most difficult thing for me to grasp was that wellness is not a destination, it’s an ongoing process and a lifelong journey. It’s about making intentional choices every day that contribute to your overall well-being, no matter where you are starting from. At its core, wellness is more than just physical health. It is the balance and integration of multiple interconnected dimensions that together form a strong foundation for a thriving life.

When we take a holistic approach to our health, we acknowledge that all aspects of our lives—mental, emotional, physical, social, and more—are connected. Focusing on the eight dimensions of wellness can not only improve your quality of life, but also contribute to longer life expectancy, better management of health conditions, and support in recovering from illness, injury, or addiction. It can even help prevent burnout, reduce stress, and increase life satisfaction.

The 8 Dimensions of Wellness

Each of the eight dimensions plays a vital role in your overall health and happiness, otherwise known as holistic health. When nurtured, they work together to create a more balanced and meaningful life. Here’s a look at what they are and how you can start integrating them into your life:

- Physical Wellness: Physical wellness involves taking care of your body through regular exercise, proper nutrition, adequate sleep, and preventive healthcare. Staying physically well boosts your energy, enhances your mood, and helps prevent chronic illness. To improve physical wellness, try this: Take a daily walk, drink more water, or schedule that overdue check-up. Start with one healthy habit and build from there.

- Emotional Wellness: Emotional wellness is the ability to understand, express, and manage your emotions in a healthy way. This includes recognizing stress, building resilience, and seeking support when needed. To improve emotional wellness, try this: Practice mindfulness, journal your feelings, or talk to a trusted friend or therapist when you’re feeling overwhelmed.

- Social Wellness: Social wellness is about creating and maintaining meaningful relationships and a strong support network. Connecting with others fosters a sense of belonging and can improve both mental and emotional health. To improve social wellness, try this: Reach out to a friend you haven’t spoken to in a while, join a community group, or attend a local event.

- Intellectual Wellness: Intellectual wellness encourages lifelong learning, critical thinking, and the pursuit of knowledge. Challenging your mind and staying curious can boost your confidence and creativity. To improve intellectual wellness, try this: Read a book, take an online class, learn a new hobby, or engage in thoughtful discussions.

- Environmental Wellness: Environmental wellness involves creating and sustaining a safe, healthy, and supportive space around you. This includes caring for your physical surroundings and being mindful of your impact on the planet. To improve environmental wellness, try this: Declutter your living space, spend time in nature, or reduce waste by recycling or using reusable products.

- Spiritual Wellness: Spiritual wellness is about finding purpose, meaning, and connection in life. Whether through religion, meditation, nature, or personal reflection, spiritual practices can offer clarity and inner peace. To improve spiritual wellness, try this: Start your day with a moment of gratitude, reflect in a journal, or explore practices that align with your values and beliefs.

- Vocational Wellness: Vocational wellness means pursuing work or academic paths that are fulfilling, align with your values, and make use of your strengths. It also involves finding a balance between work, school, and home life. To improve vocational wellness, try this: Reflect on your strengths and passions, set goals that align with your values, or find ways to bring more purpose into your daily tasks.

- Financial Wellness: Financial wellness involves understanding and managing your financial resources. It includes budgeting, saving, and planning for the future. Planning skills will help reduce stress and build long-term stability. To improve financial wellness, try this: Set a monthly budget, start a savings plan, or seek out resources to improve your financial literacy.

Take time to reflect on the different areas of wellness in your life.

Wellness Is for Everyone

Wellness is not reserved for a select few or those with perfect routines. It’s for everyone, no matter your age, background, or current circumstances. The beauty of wellness is that it’s highly personal, flexible, and does not have to be perfect. You don’t have to overhaul your entire life to make progress. You don’t have to address all eight areas at once. Even small, meaningful actions in one area can spark positive change in others. This can create a ripple effect across your entire holistic well-being.

Focus on progress, not perfection. Take time to reflect on what wellness means to you. Seek support when needed. And most importantly, be kind to yourself as you grow. Growth doesn’t happen overnight, but with intention and self-compassion, you can build a life of balance, vitality, and purpose.

by Samantha Kennedy | Oct 24, 2025

Taking the time to identify and plug spending leaks can help reduce stress and improve overall financial health. (Photo source: Adobe Stock)

When it comes to managing money, most people focus on the big-ticket items: rent or mortgage, car payments, or student loans. But it is often the small, unnoticed expenses – known as spending leaks – that can really make a big impact on overall financial health. These leaks may seem harmless on their own, but over time, they can add up to hundreds or even thousands of dollars lost each year.

What Are Spending Leaks?

Spending leaks are recurring or impulsive purchases that do not add significant value to your life but slowly drain your budget. Think of them as the financial equivalent of a dripping faucet – barely noticeable at first, but potentially becoming a flood over time. Common culprits include daily coffee runs, unused subscriptions (magazines, streaming services, etc.), frequent takeout, ATM fees, and impulse buys.

Costly Coffee

One of the most cited examples of a spending leak is the daily coffee habit. Spending $6-8 a day on specialty drinks may not seem like much, but over a year, that could add up to nearly $3,000. Brewing coffee at home or switching to a more affordable option can plug this leak without sacrificing your morning ritual.

Surplus Subscriptions

Streaming services, fitness apps, cloud storage, and digital magazines: many people are subscribed to more services than they actually use. According to a survey by Variety magazine, Americans spend an average of $69 a month on subscriptions, and many of those subscribers often lose track of all they are paying for. The same thing goes for magazine subscriptions. It is so easy to let those build up. Reviewing subscriptions quarterly and canceling unused ones can free up significant cash.

Expensive Eats

Grabbing lunch at work or ordering dinner a few times a week might feel like a convenience, but it is a major leak. Preparing meals at home – even just a few more times a week than you currently do – can save hundreds of dollars a month. Even with the higher cost of groceries, meal prepping and planning ahead can make home cooking more manageable and cost-effective. Frequent use of meal delivery apps is also an easy way to spend more than necessary on meals.

Convenience Costs

Using out-of-network ATMs or paying for convenience fees when paying bills online can seem minor, but they add up. Opt for fee-free banking options whenever possible, and plan ahead to avoid unnecessary charges. Even small fees of $2–$5 per transaction can total over $100 annually. Overspending can also lead to expensive late fees, overlimit fees, and overdraft fees.

Bargain Buys

Retailers are masters at encouraging unnecessary purchases – whether it is a tempting display at checkout or a flash sale online. One way to combat this is by implementing a 24-hour rule: wait a day before making any non-essential purchase. This simple habit can help you avoid buyer’s remorse and keep your budget intact. Even if something seems like a bargain, it is still a waste of money if it is something you do not need.

Spending leaks are sneaky, but they are also fixable. By identifying and addressing these small, recurring expenses, you can take control of your finances without making drastic lifestyle changes. A few mindful adjustments can lead to big savings—and a healthier financial future.

For more information about this and other money management topics, please call your local Family & Consumer Sciences (FCS) agent. You can find your nearest Florida FCS agent here.

An Equal Opportunity Institution.

by Melanie Southerland | Oct 24, 2025

Osteoporosis is a chronic condition that weakens bones. Weak bones are more likely to break. Osteoporosis is often called the “silent disease” because it can progress without symptoms until a fracture occurs, typically in the hip, spine, or wrist.

What Is Osteoporosis?

Strength training exercises help maintain bone density.

Image Source: Adobe Stock.

Osteoporosis occurs when bone density and quality are reduced. Bones become porous and brittle due to an imbalance between bone formation and bone resorption. While bone is a living tissue that constantly renews itself, this process slows with age, especially after 30, leading to gradual bone loss.

Who Is at Risk?

Osteoporosis affects over 50 million people in the U.S., with women—especially postmenopausal—being at higher risk. However, men are also vulnerable, particularly after age 70. Key risk factors include:

- Age: Risk increases after 50.

- Sex: Women are four times more likely to develop osteoporosis.

- Race: White and Asian individuals are at higher risk.

- Family history: Genetics play a significant role.

- Body size: Smaller, thinner individuals have less bone mass to lose.

- Hormonal changes: Low estrogen or testosterone levels accelerate bone loss.

- Lifestyle factors: Smoking, excessive alcohol, poor diet, and inactivity contribute to risk.

- Medical conditions and medications: Conditions like rheumatoid arthritis, celiac disease, and long-term use of corticosteroids or cancer treatments can increase susceptibility.

Symptoms and Signs

Osteoporosis often goes unnoticed until a fracture occurs. However, some signs may include:

- Loss of height

- Stooped posture

- Back pain from collapsed vertebrae

- Fractures from minor falls or stresses like coughing

Diagnosis

The primary diagnostic tool is a bone density test (DEXA scan), which measures bone mineral content. It’s recommended for:

- Women aged 65+

- Men aged 70+

- Postmenopausal women and men over 50 with risk factors

Prevention Strategies

Weight-bearing exercises like walking or running can help to keep bones strong.

Photo Source: Adobe Stock Images.

Preventing osteoporosis involves lifestyle and dietary changes:

- Nutrition: Adequate intake of calcium (1,000–1,200 mg/day) and vitamin D (600–800 IU/day) is essential.

- Exercise: Weight-bearing and resistance exercises like walking, dancing, and strength training help maintain bone density.

- Avoid harmful habits: Limit alcohol, quit smoking, and reduce caffeine and sodium intake.

- Fall prevention: Keep living spaces safe and use assistive devices if needed.

Treatment Options

Treatment aims to prevent fractures and slow bone loss. Options include:

- Medications: Talk with your healthcare provider for more information on medications for bone health.

- Supplements: Calcium and vitamin D are often prescribed to support bone health.

- Lifestyle adjustments: Continued exercise, balanced diet, and regular monitoring.

Living with Osteoporosis

Managing osteoporosis is a lifelong commitment. Regular checkups, bone density monitoring, and adherence to treatment plans are crucial. With proper care, individuals can maintain mobility, reduce fracture risk, and improve quality of life.

During the preparation of this work, the author used the AI tool, CoPilot

References

[1] Osteoporosis: Symptoms, Causes and Treatment – Cleveland Clinic

[2] Osteoporosis – Symptoms and causes – Mayo Clinic

[3] Osteoporosis Causes, Risk Factors, & Symptoms | NIAMS

[4] Osteoporosis – Johns Hopkins Medicine

by Suzanne Holloway | Oct 24, 2025

We’ve covered budgeting and saving as foundations of money management. Investing is another element: it means putting money into assets like stocks, bonds, or real estate to earn returns through capital gains, dividends, or interest.

Investing involves more risk than saving; your money is not federally insured, and you could lose the amount you deposited. That’s why, before investing, it’s crucial to have an emergency fund covering three to six months of expenses and to keep money for short-term needs—like a car or home down payment—safe and easily accessible in an insured bank or credit union account.

If you’re new to investing, consulting a qualified professional, such as a financial adviser, can help you build a strategy aligned with your goals. While investing carries greater risk than saving, it also offers the potential for larger long-term rewards.

Investment Products

The most common investment products are stocks, bonds, mutual funds, and exchange-traded products, often used for retirement or college savings. Other vehicles include real estate, precious metals, commodities, private equity, and cryptocurrencies.

© Freedomz / Adobe Stock

- Bonds are like IOUs commonly issued by governments, municipalities, or corporations to raise money. Investors who buy bonds lend money and receive interest over a specified period. Main types include corporate bonds, municipal bonds, and U.S. Treasuries securities.

- Stocks represent ownership in a company, or “equity.” Stocks come in two main forms: common stock and preferred stock.

- Mutual funds pool money from many investors and invest in a diversified mix of assets, such as stocks, bonds, and money market instruments. The overall mix is called the fund’s portfolio, and a professional adviser manages it. Exchange-traded products (ETPs), including exchange-traded funds (ETFs), combine aspects of mutual funds and conventional stocks.

- Hedge funds are private, unregistered investment funds that use pooled investor money to pursue more flexible investments and strategies.

- Commodities are basic goods and materials like precious metals, crude oil and natural gas, wheat, coffee, and livestock.

- Cryptocurrencies, or crypto assets, are digital assets built on blockchain technology.

Always research the risks, fees, and suitability of any investment before committing your money.

Investment Accounts

Investment accounts are used to hold your assets and cash. The right type depends on your goals, risk tolerance, and ownership needs.

- Brokerage accounts let you buy and sell stocks, bonds, and other types of investments. You can open a cash account (pay in full for purchases) or a margin account (borrow to invest).

- ABLE accounts, or 529A accounts (enabled by the 2014 Achieving a Better Life Experience Act), allow individuals with disabilities to save and invest with tax advantages, without risking eligibility for public benefits.

- College Savings accounts, like 529 plans and Coverdell ESAs, help parents or guardians invest in education expenses. Similar to college savings accounts, custodial accounts, established under the Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA), allow adults to invest for a child’s benefit.

- Saving for retirement may be the most important financial goal you’ll ever pursue. Building a nest egg of enough funds that can support you for twenty years or more requires proactive planning, steady saving, and disciplined investing. Common retirement accounts include 401K, 403(b) and 457(b), and Individual Retirement Accounts (IRAs).

Most financial institutions offer at least standard brokerage accounts and IRAs, and some may also provide college savings accounts and custodial accounts.

Investment Management

Investment management is the professional oversight of your investment portfolio. This service, also known as asset management, can be provided in different ways. Traditional investment advisors offer personalized guidance, helping you build and maintain a portfolio tailored to your financial goals. Alternatively, a “robo-advisor” refers to an automated digital investment advisory program; it creates and manages a portfolio for you, based on your goals and risk tolerance after answering an online questionnaire, often at a lower cost.

Investment Scams

Investment scams promise quick, easy money with little to no risk, often through financial markets, cryptocurrency, real estate, or precious metals/coins. These scammers attract you with infomercials, social media posts, or online ads that encourage you to attend a free seminar/training, order free materials, or watch free introductory videos learning about the secret of getting rich quickly.

- Investment training scams: Their “tested” or “secret” strategy will help you get rich and change your life, but these promises and so-called success stories are almost always fake or rare exceptions.

- Real estate investment scams may advertise “world-class” properties with luxury amenities, but these properties often take years to materialize, are never built, or lack the promised features. Reselling the land may also be impossible due to a lack of buyers.

- Real estate training scams market online or in-person programs by promising risk-free investments and quick profits with little effort or experience—claims that are rarely true and are designed to get you to pay for their courses.

- Precious metals and coin scams often feature individuals posing as “metal dealers” or “rare coin merchants” who gain your trust, falsely claim expertise, and then fail to deliver on their promises, pocketing your money. Before investing in bullion, coins, or precious metals, review the Commodity Futures Trading Commission’s (CFTC) precious metals fraud alert and research the market carefully.

- Cryptocurrency investment scammers often target victims via social media, texting, or dating apps, building trust through fake connections, then pitch fraudulent crypto investments. Cryptocurrency scammers will use fraudulent investment platforms and will often appear very lucrative, encouraging the victim to continue to invest; however, when they are ready to withdraw all their earnings, their account is usually “frozen” with “fees” needed to pay to unlock the funds. If you were a target of a cryptocurrency scam, you can file a complaint with the Internet Crime Complaint Center (IC3).

Red flags include guarantees of high returns, pressure to act fast, scarce investment details, or promises of wealth with little effort or risk. Always research independently before making decisions, resist pressure, and know the risks involved in investing. If you believe you have been a victim of fraud, report it to the Federal Trade Commission (FTC) or the U.S. Securities and Exchange Commission (SEC).

Investment Tools & Resources

There are many investing resources available, including apps, online tools, and real-life professionals. Some popular investment apps include:

No matter which resource you choose, always take time to research your options, understand the risks, and select tools that match your goals and level of experience.

Additional Resources

A Roadmap to Your Journey to Financial Security (SEC)

Cost of Retirement (Khan Academy)

An Equal Opportunity Institution.