by Melanie Southerland | Oct 1, 2025

The Power of Positive Thinking: How It Shapes Mental Health

In a world filled with daily stressors and uncertainties, the way we think can significantly influence how we feel. Positive thinking—more than just a feel-good phrase—has been shown to have profound effects on mental health, emotional resilience, and overall well-being.

Photo Source: Adobe Stock Images

What Is Positive Thinking?

Positive thinking doesn’t mean ignoring life’s challenges or pretending everything is perfect. Instead, it’s about approaching difficulties with a constructive mindset, focusing on solutions, and maintaining hope. It often begins with positive self-talk, the internal dialogue that shapes how we interpret and respond to events.

Mental Health Benefits of Positive Thinking

Research shows that cultivating a positive mindset can lead to:

- Reduced stress and anxiety: Optimists tend to view challenges as manageable, which lowers the body’s stress response.

- Lower risk of depression: Positive thinkers are less likely to ruminate on negative thoughts, a key factor in depression.

- Improved emotional resilience: A hopeful outlook helps people bounce back from setbacks more quickly.

- Better coping skills: Optimism encourages proactive problem-solving and seeking support when needed.

- Enhanced psychological well-being: Positive emotions like gratitude and joy contribute to a more balanced mental state[1][3].

The Science Behind It

Positive thinking influences the brain’s chemistry. It boosts the release of dopamine, serotonin, and endorphins—neurotransmitters that enhance mood and reduce pain. It also reduces levels of cortisol, the stress hormone linked to anxiety and inflammation. Over time, these changes can rewire the brain through neuroplasticity, making optimism a more natural response[4].

Physical Health Connection

Mental and physical health are deeply connected. Positive thinking has been linked to:

- Stronger immune function

- Lower blood pressure

- Better cardiovascular health

- Faster recovery from illness or surgery

- Longer life expectancy[1][4]

️ How to Cultivate Positive Thinking

Building a positive mindset takes practice. Here are some proven strategies:

- Practice gratitude: Keep a journal of things you’re thankful for.

- Reframe negative thoughts: Challenge pessimistic beliefs and replace them with more balanced ones.

- Surround yourself with positivity: Spend time with supportive, uplifting people.

- Set realistic goals: Achieving small wins builds confidence and optimism.

- Engage in mindfulness or meditation: These practices help you become aware of negative thought patterns and shift your focus[3].

Final Thoughts

Positive thinking isn’t about ignoring reality—it’s about choosing a mindset that supports mental strength, emotional balance, and healthier living. Whether you’re facing everyday stress or managing a mental health condition, cultivating optimism can be a powerful tool for healing and growth.

References

[1] Positive thinking: Reduce stress by eliminating negative self-talk …

[2] Positive Thinking: Benefits and How To Practice

[3] The Power of Positive Thinking and Mental Health | EmpathyHQ

[4] The Power of Positive Thinking on Health – sciencenewstoday.org

by Suzanne Holloway | Sep 26, 2025

In a previous blog, we explored budgeting as one of the elements of money management. But once you know where your money is going, the next step is making that money work for your future through saving.

Savings is the portion of your income set aside for future expenditures, whether it’s for emergencies, a down payment on a home, or retirement. In some cases, employers help with this through deferred compensation plans, which set aside part of your paycheck to be paid out later, often at retirement.

Most people have been told to follow the rule of saving 10–20% of their income, but that isn’t always realistic. Instead of getting discouraged, create a savings rule that works for your circumstances. Focus first on building your emergency fund and choose to save an amount—either a specific dollar figure or a percentage of your income—that feels manageable. The key is consistency. Even small, regular contributions add up over time and build the habit of saving. People who regularly track their expenses and savings often find themselves saving more, simply because they’re staying mindful and intentional about where their money goes.

Types of Saving Accounts

Save regularly toward your goals – it will add up quickly! Photo source: UF/IFAS Extension

Where should you keep your savings? The answer depends on your individual needs and the amount you have set aside. While piggy banks, jars, and other at-home containers can serve as temporary spots for small amounts, they aren’t secure for holding larger sums. Instead, consider moving your money to a depository like a bank, credit union, or another financial institution. These places not only offer services such as checking and savings accounts, loans, and investment options, but also keep your money safer: your funds can earn interest and are generally insured against loss from theft, fire, or other disasters—unlike the cash kept at home.

Keep in mind, not all savings accounts are the same. The right match(es) for you depend(s) on your financial goals, how easily you want to access your money, the interest rate, and any account fees or restrictions.

- Traditional savings accounts are common, easy to open, and generally fee-free, but they tend to offer low interest rates. Most brick-and-mortar banks and credit unions offer traditional accounts, often paired with convenient mobile apps.

- Student and kids’ savings accounts—available at many brick-and-mortar banks and credit unions—are specifically designed to help children, teens, and students (often up to age 25) build good financial habits, like budgeting and saving.

- A Health Savings Account (HSA) is a specialized savings account you can use to save for qualified out-of-pocket medical expenses, offering both tax incentives and flexibility for healthcare needs.

- High-yield savings accounts provide above-average interest rates (or APY). These are typically found at online banks, which can offer better rates and lower fees due to reduced operating costs. Some financial institutions also offer high-yield checking account options.

- Money market accounts blend features of both checking and savings. They earn interest, but also let you make limited withdrawals or debit purchases each month, making them a flexible but somewhat restricted option.

- Certificates of deposit (CDs) let you lock in your money for a fixed period, usually at a higher interest rate than standard savings. Early withdrawals are often penalized.

- Cash management accounts are a middle ground between saving and investing. These interest-bearing accounts securely hold your money while you decide on your next investment move.

By choosing the right account(s) based on your financial goals, you can make your money work smarter, not just harder.

Savings Tools & Resources

Generally speaking, most savings apps are also built into budgeting apps—something we covered in a previous blog—or are included with investment apps, which we’ll explore in an upcoming post.

Additional Resources

Save and Invest (MyMoney.gov)

Saving & Investing (Khan Academy)

An Equal Opportunity Institution.

by Samantha Kennedy | Sep 26, 2025

Today’s world can offer up a lot of stressors and as a result, many individuals face mounting pressures and mental health challenges. Recent studies reveal that pet ownership provides a unique sense of comfort and stability that can alleviate stress and anxiety. By inviting a pet into one’s home, people often experience immediate emotional support and a renewed sense of purpose. The presence of a loving animal can transform a lonely day into one filled with hope and connection.

Experts in psychology and human behavior have long noted the therapeutic benefits of caring for pets. Regular interactions with animals not only reduce cortisol levels but also increase oxytocin production, a hormone associated with happiness and bonding. Dog walks, playful cat moments, and even the calm companionship of a fish tank routine give structure to daily life. These activities encourage mindfulness, improve mood, and help many cope with depression.

Holding a pet can reduce stress and increase production of “feel-good” chemicals in the brain that can improve mood. (Photo source: Adobe Stock)

One of the biggest benefits of pet ownership is that pets offer unconditional emotional support without judgment. Caring for a pet refocuses negative thought patterns by providing individuals with a sense of responsibility. Additionally, the daily routines associated with pet care foster discipline and regularity, which are essential for maintaining mental balance. Patients who engage actively with their pets frequently report feeling less isolated and more optimistic about their futures.

Community connections can also blossom through pet ownership. Local pet events and dog parks bring together individuals from varied backgrounds, creating networks of support that extend beyond the pet’s company. Such encounters not only foster social interaction but also build trust and empathy among neighbors. In many cases, these casual relationships evolve into meaningful friendships that serve as additional layers of safety and emotional reassurance. Community events centered around pets underscore the social benefits that extend from personal well-being to societal harmony.

As mental health continues to be a focal point in discussions on overall wellness, owning a pet emerges as a natural remedy for many of modern society’s stressors. While pets require time, effort, and dedication, their rewards often surpass the challenges. A pet not only enhances an individual’s health by providing physical activity through daily routines but also nurtures mental and emotional strengths. In moments of grief or stress, the steady presence of a pet can remind owners that life’s simplest pleasures are often the most profound.

For those struggling with isolation or depression, the embrace of a pet might provide a much-needed bridge to a happier, healthier future. Amid the hustle of everyday life, the soft purr of a cat, the wag of a dog’s tail, or even the quiet flutter of a bird’s wings offers solace and hope. People who have adopted pets express an enriched sense of belonging and community, experiences that are increasingly recognized as integral to mental health. Research continues to delve deeper into the intricate link between animal companionship and psychological resilience. In the meantime, pet ownership can serve as a valuable complement to traditional mental health treatments such as therapy and medication.

For more information about this and other mental health topics, please call your local Family & Consumer Sciences (FCS) agent. You can find your nearest Florida FCS agent here.

An Equal Opportunity Institution

by Suzanne Holloway | Aug 1, 2025

The term “freshman 15” describes the widespread belief that college students gain fifteen pounds during their first year. This concept originated in the mid-to-late 1980s, with a 1985 peer-reviewed article reporting an average weight gain of 8.8 pounds in women. Later, in 1989, Seventeen magazine popularized the phrase by chronicling a student’s struggle with first-year weight gain. Despite its popularity, the evidence behind the “freshman 15” experience is limited. Furthermore, studies have been somewhat inconsistent, with some observing weight gain, others showing weight loss, and/or no change in weight. For example, a 2008 study found weight changes ranging from -5 to +20 pounds with an average of roughly +3 pounds.

For most students, the “freshman 15” is more accurately a “freshman 5.” Both numbers, though, are broad generalizations, and real experiences vary. Starting college marks a major life transition: the independence, new routines, and unique pressures involved can all influence well-being. As a result, some students may gain weight, others might lose weight, and some may see no change at all. Nonetheless, it is important to note that weight and body mass index (BMI) should not be used as sole indicators for health since they do not factor in lifestyle behaviors and body composition.

College Wellness Tips

Looking to build healthy habits in college? Here are some wellness tips and resources to help incoming and current college students.

Eating Habits

With limited access to kitchens, many freshmen rely on dining halls, restaurants, and convenience stores for food. The abundance of choices, particularly at dining halls, including many tempting comfort foods, can easily lead to mindless eating, especially during times of stress or homesickness. Just because your parents aren’t there to remind you doesn’t mean you should stop eating fruits and vegetables; they remain an essential part of a healthy diet and lifestyle. Practicing mindful eating by paying attention to hunger cues, savoring your food, and choosing a balanced meal can make it easier to nourish your body, avoid overeating, and feel your best.

© ActionGP / Adobe Stock

Sleeping Habits

Poor or inconsistent sleep can undermine both physical and mental health, impairing cognitive function and even increasing appetite (which can contribute to overeating and weight gain). Good sleep hygiene is vital—try to keep a regular bedtime, limit caffeine, nicotine, and alcohol late in the day, avoid screens before sleep, and wind down with relaxing activities like reading or meditation.

Stress Management

Stress triggers the release of cortisol, sometimes called the “stress hormone.” When stress is chronic (long-term), cortisol remains high and disrupts the body, slowing metabolism, increasing fat storage (especially in the abdomen), raising blood sugar, and fueling cravings for calorie-dense comforting foods. This can explain why people often “eat their feelings” and reach for familiar or sugary snacks during tough times. Chronic stress is also linked to conditions like depression, high blood pressure, metabolic disorders (e.g., obesity), and fatigue. Healthy ways to cope with stress include seeking social support, building a consistent sleep routine, practicing mindful eating, and staying physically active.

University Student Wellness Resources

If you’re struggling with your physical or mental health, don’t hesitate to reach out. Most universities offer support services for students, such as Florida Agricultural and Mechanical University, Florida State University, and the University of Florida.

Additional Sources

University of Georgia

University of Utah

by Amy Mullins, PhD, RDN | Aug 1, 2025

Good nutrition is important to cognitive function. (Adobe Stock Image)

The Connection Between Nutrition and Memory: How Food Affects Cognitive Function

Memory is a complex and multifaceted cognitive function that plays a vital role in our daily lives. From remembering important events and appointments to recalling learned skills and knowledge, memory is essential for our overall well-being and success. While genetics and lifestyle factors can influence memory, a growing body of research suggests that nutrition also plays a significant role in cognitive function and memory.

The Importance of Nutrition for Memory

A well-balanced diet that includes a variety of whole foods, such as fruits, vegetables, whole grains, lean proteins, and healthy fats, provides the necessary nutrients and building blocks for optimal brain function. The brain is a hungry organ, accounting for approximately 20% of the body’s total energy expenditure. Adequate nutrition is essential for maintaining healthy brain cells, facilitating communication between neurons, and supporting the growth and development of new neural connections.

Key Nutrients for Memory

Several nutrients have been identified as essential for supporting memory and cognitive function. These include:

- Omega-3 fatty acids: These healthy fats, particularly EPA and DHA, are found in fatty fish, nuts, and seeds. Omega-3s support brain cell membrane structure and function, promoting healthy communication between neurons.

- Vitamin D: This essential vitamin is obtained through sun exposure, dietary sources, and supplements. Vitamin D receptors are found in brain cells, and research suggests that vitamin D plays a role in regulating neurotransmitter function and protecting against age-related cognitive decline.

- B Vitamins: B vitamins, particularly B6, B9 (folate), and B12, are essential for synthesizing neurotransmitters and maintaining healthy brain cells. Foods rich in B vitamins include leafy greens, legumes, whole grains, and lean meats.

- Antioxidants: Antioxidants, such as vitamins C and E, and polyphenols found in fruits, vegetables, and tea, help protect brain cells from oxidative stress and inflammation, which can damage memory and cognitive function.

- Magnesium: This essential mineral supports neuronal function and synaptic plasticity, facilitating learning and memory. Foods rich in magnesium include dark leafy greens, nuts, and whole grains.

Dietary Patterns Associated with Better Memory

Research has identified several dietary patterns that are associated with improved memory and cognitive function. These include:

- Mediterranean diet: Characterized by high intake of fruits, vegetables, whole grains, lean proteins, and healthy fats, the Mediterranean diet has been shown to support cognitive function and reduce the risk of age-related cognitive decline.

- DASH diet: The DASH (Dietary Approaches to Stop Hypertension) diet, developed to reduce blood pressure, emphasizes whole grains, fruits, vegetables, lean proteins, and low-fat dairy products.

- Plant-based diet: A diet rich in plant-based foods, including fruits, vegetables, legumes, and whole grains, has been associated with improved cognitive function and a reduced risk of age-related cognitive decline.

Tips for Supporting Memory through Nutrition

- Eat a balanced diet: Focus on whole, unprocessed foods, including fruits, vegetables, whole grains, lean proteins, and healthy fats.

- Stay hydrated: Adequate hydration is essential for maintaining cognitive function and supporting memory.

- Limit processed and sugary foods: These foods can lead to inflammation and oxidative stress, which can damage brain cells and impair memory.

- Consider supplements: If you’re concerned about getting enough nutrients through diet alone, consider consulting with a healthcare professional about supplementing with omega-3s, vitamin D, and other essential nutrients.

Conclusion

While genetics and lifestyle factors can influence memory, nutrition plays a critical role in supporting cognitive function and memory. By incorporating a balanced diet rich in whole foods, essential nutrients, and healthy fats, you can support optimal brain function and reduce the risk of age-related cognitive decline.

References:

During the preparation of this work the author used the AI tool, NaviGator. After using this tool/service, the author reviewed and edited the content as needed and takes full responsibility for the content of the publication. Image source: Adobe Stock

by Judy Corbus | Jul 3, 2025

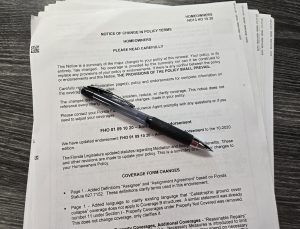

Check the terms of your homeowners or renters policy to make sure you have adequate coverage.

Photo credit: Judy Corbus, NW Extension District

Do you know what your home insurance covers? How about levels of coverage or exclusions? If you’re not sure, now is a good time to take a look at your homeowner’s or renter’s policy. Hurricane season potentially increases the likelihood of filing a claim and it’s wise to know your level of coverage, perils included (or excluded), and deductibles before the need arises.

How Much Insurance Should I Buy?

To be adequately covered, your home must be insured for the amount necessary to rebuild it at the current cost factoring in building material prices and labor costs. Also, depending on the age of your home, it may need to be repaired or rebuilt to meet current building codes. Law and Ordinance coverage will cover these additional costs so discuss your policy with your insurance agent. If your home is underinsured at the time of loss, there may be a penalty or reduction in the amount the insurance company will pay for the loss. Discuss both the limits and adequacy of types of coverage with your agent.

What Perils are Covered by My Policy?

Damage from rising water (flood) is not covered by most homeowners’ policies. You may purchase flood insurance through the National Flood Insurance Program (NFIP) or through private insurers. Flood insurance is available to cover your home and personal property. Usually, there is a 30-day waiting period before a flood insurance policy goes into effect with the NFIP, unless you purchase the policy at the same time you purchase or refinance your home. You may obtain flood insurance through your local agent.

You also should check for windstorm coverage, sinkholes and catastrophic ground cover collapse, and mold coverage.

Replacement Cost or Actual Cash Value?

These two settlement options are available when purchasing home insurance. Replacement Cost is the amount needed to repair or replace damaged property with materials of similar kind and quality without deducting for depreciation, which is the decrease in the value of your home or personal property due to normal wear and tear. Actual cash value is the amount needed to repair or replace an item, less depreciation. To receive replacement cost coverage, most homeowners’ insurance policies require the policyholder to insure the home for at least 80% of its replacement value.

What About the Hurricane Deductible?

The Hurricane Deductible is the deductible applied to loss caused by a hurricane. The deductible is the dollar amount paid by the policyholder before an insurance company pays anything. Typically, the hurricane deductible is $500 or two, five, or ten percent of the amount of insurance covering the dwelling at the time of loss. In Florida, you pay one hurricane deductible per calendar year as long as you are insured by the same insurer for the second or subsequent hurricanes for the same calendar year. The hurricane deductible applies from the time a hurricane watch or warning is issued for any part of Florida until 72 hours after the last hurricane watch or warning is terminated for any part of Florida.

Take a few moments to review your policy while the sun is shining and the waters are calm so you are prepared for hurricane season.

For more information on homeowners’ insurance, check out Homeowners Insurance A Toolkit for Consumers and Florida’s Hurricane Deductible.

Sources:

Homeowners Insurance A Toolkit for Consumers

Florida’s Hurricane Deductible