by Pam Allen | Nov 18, 2017

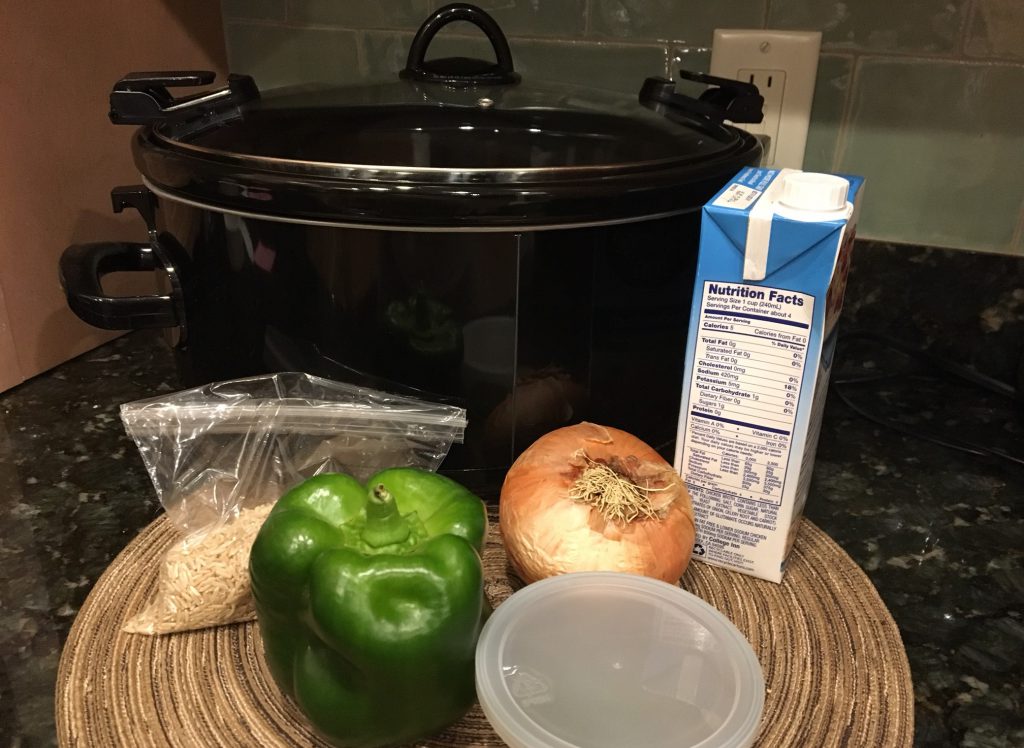

Pantry Staples

Photo credit: Pamela Allen

With fall around the corner and school starting back, it is time to take inventory of your pantry. You should really dig in and see what is lurking in the dark reaches of your back shelves. This task should be done on a regular basis to help keep foods rotated and use products that are close to expiration. It is also a good idea to refresh items that are low and you use often. Many times we are caught in the middle of preparing our favorite dish and find we are out of an ingredient. By planning and taking stock of what is in your pantry, it will be easier to plan quick and easy meals and hopefully avoid that trip to a fast food establishment to pick up something quick.

Having basic supplies on hand will keep you prepared to put together a family-friendly meal or a last-minute dinner for friends. Try to write down 4 or 5 favorites that your family likes and then keep these items on hand by keeping an inventory of your most used items. A well-stocked and organized pantry will streamline menu planning and save time on your daily food preparation. Your family will thank you for making this easy to use and find items that they most often like to eat. Here are some tips to get started:

- Decide where you will house your pantry. It can be a designated cabinet, standalone structure or a built-in pantry. The idea is to define where you will keep these supplies for easy access and organization.

Pantry – use containers you have on hand.

Photo credit: Pamela Allen

- Inventory what you currently have and use these items first. There are many good inventory ideas you can find online. Keep a clipboard handy with your inventory list so that you can quickly see what you have on hand and what you need to add to the grocery list. Look for sales that are cost saving to stretch your food budget. Many local stores are advertising BOGOs (buy one get one) so capitalize on these items as they are on sale.

- Menu planning should be a weekly task to save time and money at the grocery store. As you plan out a weeks’ worth of meals, make a shopping list you have checked against items you have on hand. Meal planning should be centered around seasonal availability and the preferences of your family.

- Use storage containers that you have on hand. Glass containers like canning jars make great storage units for staples. The glass also allows you to see what is in the jars quickly. Remember to label items with stickers and in some cases you may need to put the purchased date.

Whatever you decide to toss in your shopping cart, you can rest happy knowing you won’t ever again have to call spaghetti with butter dinner — unless that’s exactly what you’re in the mood for.

This Healthy Eating Food Storage Guide can assist you http://edis.ifas.ufl.edu/pdffiles/FY/FY69900.pdf

Pantry items are considered dry goods or staples, things you always have on hand. Ideally, they will keep for a long time in storage, or are fresh, perishable foods regularly used up before they spoil. The idea is to subvert the need to go grocery shopping every time you cook — a major hurdle when getting food on the table.

You don’t have to buy everything at once; just buy what you think you’ll eat fairly often, and in small quantities so foods stay fresh. Build up your pantry gradually. Of course, not all ingredients work as pantry staples — fresh fruits, vegetables, meats, and other foods are perishable.

by Samantha Kennedy | Nov 18, 2017

By adopting a few smart spending strategies, you can help avoid overspending and decrease holiday stress. (UF/IFAS File Photo)

It’s that time again – the most wonderful time of the year! For many of us, though, it can be a time of stress, frustration, and financial uncertainty as we drive ourselves past our limits to try to make everyone happy and everything perfect.

But it doesn’t have to be that way!

First of all, perfect – the type of perfect reserved for TV and movie holidays – is an unrealistic goal. Focus on what will make you happy while working within your means. One of the biggest seasonal stressors is spending too much on gifts, food, and home décor. While it may look beautiful and idyllic at the time, you may suffer buyer’s remorse in the New Year when the bills start rolling in.

The most important thing you can do to help curb holiday spending is to set a budget. Maybe you love to go all out for Christmas. Great! But if this is what you enjoy, you need to make a plan to save the money over the preceding months so it will be available to spend when the time comes. Spending money you cannot really afford to spend or overusing credit is a surefire way to increase debt and cause strife later.

The holidays should be about family, friends, and the joy of giving. It should not be a competition to see who can have the biggest, brightest, most fabulous home, gifts, etc. Retailers and the media may try to convince you – or more to the point, your kids – that you must have the latest this or the greatest that in order to make your holiday complete. But resist their messaging and stick to your financial guns!

Including children in any discussions about holiday spending is important. Let them know that you have only a certain amount of money to spend on gifts and help them understand the importance of sticking to your budget. While you may feel pressured to get everything on your child’s wish list, focusing on a few special items may help you stay within budget.

Cash and debit cards are the best ways to pay. If the money is coming directly out of your pocket, you may give each purchase a second thought. Use credit cards wisely. If you choose to purchase with credit in order to receive airline miles or rewards points, keep close track of your purchases and only charge as much as you can comfortably pay off in its entirety when the bill comes due. The last thing you need or want is to still be paying off this year’s holiday spending next year.

Some of the most meaningful and treasured gifts are those that come from the heart. Custom, handmade gifts really show a person you know them well and you care about them. One large gift for an entire family that everyone can enjoy can also save money over buying something for each individual. Many people also appreciate a donation in their name to a charity or cause that is near and dear to their hearts.

The holidays do not need to be stressful or break the bank. By adopting a few smart spending practices, you can enjoy the holidays without the added worry.

For more information about this topic, please read the UF/IFAS publication “Five Steps to Seasonal Savings” at http://edis.ifas.ufl.edu/pdffiles/FY/FY140500.pdf.

by Pam Allen | Nov 18, 2017

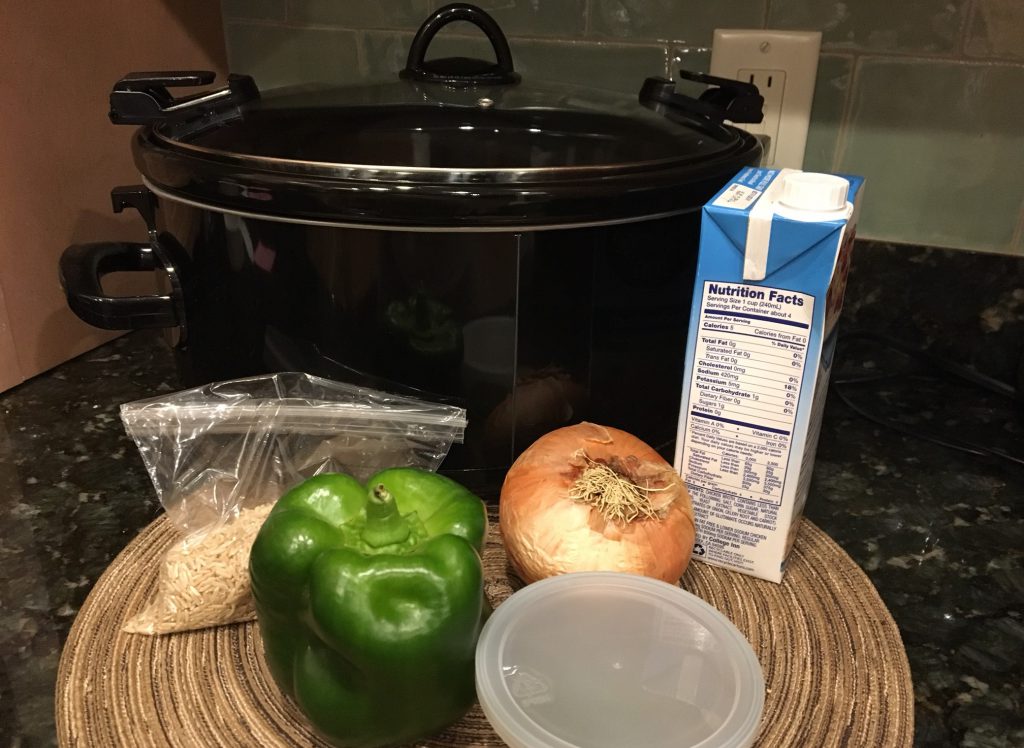

Slow Cooking

Photo credit: Pamela Allen

With the weather changing and cooler temperatures on the way, get out the slow cooker for simmering soups and stews that will be waiting for you when you get home. Slow cookers are popular and allow us the convenience of prepping ahead of time and having a hot cooked dish when we get home from a long day of work. The advantage of slow cooking is to set it and then forget it. Stirring is not usually required and remember to keep the lid on as the food simmers. Today’s slow cookers are food safe and keep food at a safe temperature of 170˚F to 280˚F. The low heat allows use of less expensive and leaner cuts of meat as the slow cooking will tenderize and shrink less.

Cooking with a slow cooker means planning ahead but the payoff is a great meal. You can prepare all the ingredients the night before like chopping of vegetables, cutting up the meat and gathering the other items and have them handy for the next morning. Remember to refrigerate all items needing refrigerating until it is time to place in the slow cooker.

Here are some tips or using your slow cooker safely and economically.

- Start with a clean cooker and utensils. Always use a clean work area and make sure to wash your hands during the preparation.

- Keep perishables refrigerated until ready to use. Store meat and vegetables separately if preparing ahead of time.

- Always thaw meat or poultry before putting it into a slow cooker. If frozen pieces are used, they will not reach 140° quick enough and could possibly result in a foodborne illness.

- Keep in mind to not lift the lid unnecessarily during the cooking cycle. Each time the lid is raised, the internal temperature drops 10 to 15 degrees and the cooking process is slowed by 30 minutes.

- After enjoying your meal, do not leave cooked food to cool down in the cooker. Store leftovers in shallow containers and refrigerate immediately.

- Do not overload the slow cooker. Fill to a minimum of 1/2 full and a maximum of 2/3 full.

Try some of these favorite recipes to get you started:

Hamburger Soup

2 pounds lean ground beef, browned and drained

2 teaspoons dried basil

2 teaspoons dried oregano

2 teaspoons garlic powder

5-6 cups tomato juice

1 cup stewed tomatoes

1 large onion, chopped

2 cups chopped celery

1 cup sliced carrots

2 cups sliced green beans, fresh or frozen

1 tablespoon Worcestershire sauce

salt & pepper to taste

Place browned meat in slow cooker. Add all remaining ingredients and stir to mix well. Cover and cook on LOW for at least 5 hours. Makes 6 servings.

Old-Fashioned Chicken & Rice

2½ cups chicken broth

1½ pounds boneless, skinless chicken breast meat, cut into 1-inch pieces or strips

1½ cups long grain rice, uncooked

¼ cup fresh parsley, minced or

1 tablespoon dried parsley

1 cup chopped onion

6 garlic cloves, minced

1 small red bell pepper, cut into thin strips

1 (6-ounce) jar sliced mushrooms, undrained

¼ teaspoon poultry seasoning

Combine all ingredients in slow cooker. Cover and cook on HIGH for 3-4 hours, or until chicken is no longer pink and rice is plumped tender.

Favorite Beef Stew

3 carrots, sliced

3 potatoes, cut in 1-inch cubes

2 pounds beef stew meat, cut in 1-inch cubes

1 cup beef broth

1 teaspoon Worcestershire sauce

1 clove garlic, minced

1 bay leaf

salt to taste

Combine all ingredients in slow cooker in order listed. Stir just enough to mix seasonings throughout. Cover and cook on LOW for 10-12 hours, or on HIGH for 5-6 hours. Makes 6-8 servings.

by Judy Corbus | Oct 10, 2017

Photo credit: Judy Corbus

The recent security breach at Equifax from mid-May through July 2017 exposed the personal information of 143 million people; this included Social Security numbers, birth dates, addresses, and driver license numbers. You may be wondering, “Am I affected?” and, if so, “What should I do now?”

First, find out if your information was exposed at https://www.equifaxsecurity2017.com/potential-impact/. Make sure you are on a secure computer and an encrypted network connection. Even if your information was not exposed, U.S. consumers can get a year of free credit monitoring and other services. The site will give you a date when you can come back to enroll. Write down the date and return to the site and click “Enroll” on that date. You have until November 21, 2017 to enroll.

Order your free credit reports annually through the federally authorized web site www.annualcreditreport.com. You are allowed one free report every 12 months from each of the three major credit reporting agencies: Equifax, TransUnion, and Experian. Your credit reports will provide a detailed history that may better alert you to credit fraud.

Consider a credit freeze. A credit security freeze prevents credit reporting agencies from releasing your credit report or information from it, with a few exceptions, unless you lift the freeze. A credit freeze prevents identity thieves from opening new accounts in your name but it won’t prevent a thief from making charges to your existing accounts. It also does not prevent non-credit related frauds, such as tax refund identity theft and health insurance fraud. For these, consumers are advised to “be vigilant.”

You must request a credit freeze with each agency. In Florida, the fee to place a freeze is $10 with each agency for persons under age 65. If you are 65 or older or have been a victim of identity theft, the fee is waived. Currently, Equifax is waiving fees. You will need to lift the freeze if you want to open a new account, change insurance policies, rent housing, or sign up for new utilities or phone service – any transaction requiring a credit check. The fee to lift the freeze, either temporarily or permanently, is $10 per agency and it may take up to three business days for the lift to take effect.

Credit freeze requests may be made online, by phone, or by certified U.S. mail. Be patient and persistent, as many consumers are filing requests; websites often get overloaded temporarily. Below is the contact information for each credit reporting agency for each contact method:

Online

Equifax: https://www.freeze.equifax.com/Freeze/jsp/SFF_PersonalIDInfo.jsp

Experian: https://www.experian.com/freeze/center.html

TransUnion: https://www.transunion.com/credit-freeze/place-credit-freeze

Telephone

Equifax: 800-685-1111

Experian: 888-397-3742

TransUnion: 888-909-8872

U.S. Mail

Equifax: Equifax Security Freeze, P.O. Box 105788, Atlanta, GA 30348

Experian: Experian, P.O. Box 9554, Allen, TX 75013

TransUnion: TransUnion LLC, P.O. Box 2000, Chester, PA 19016

For mailed security freeze requests, include the following information in a cover letter format:

- Full name (with middle initial) and former name, if applicable

- Current address and former addresses within the last five years

- Social Security number

- Full date of birth (month, day, year)

- Signature

- Photocopies of two forms of identification, such as a government-issued identity card and proof of residence such as phone bill or utility company bill.

For more information, visit: http://www.freshfromflorida.com/Consumer-Resources/Scams-and-Fraud/Identity-Theft/Security-Freeze-Credit-Report

Federal Trade Commission – steps to take to protect your information:

https://www.consumer.ftc.gov/blog/2017/09/equifax-data-breach-what-do

Adapted from:

The Equifax Data Breach: What to Do, Federal Trade Commission

Equifax Security Breach: Steps to Protect Yourself, UF/IFAS Extension Hillsborough County

To Freeze or Not to Freeze My Credit Report?, University of Illinois Extension

Credit Freeze Information in the Wake of the Equifax Hack, Rutgers University Extension

by Judy Corbus | Oct 10, 2017

Photo credit: Judy Corbus

If you have been affected by the recent Equifax data breach, you may be exploring your options as to what to do next. All three major credit reporting agencies, Equifax, TransUnion, and Experian, give you the option of placing a fraud alert or a credit freeze on your file. So, what is the difference between a fraud alert and a credit freeze?

Fraud Alert

When you activate an initial fraud alert on your report, a business must verify your identity before it issues credit, so it may try to contact you. This can make it more difficult for an identity thief to open new accounts in your name. The initial fraud alert stays on your report for 90 days and you can renew it at the end of the 90-day period. Fraud alerts are free and the credit reporting agency you call must tell the other agencies about your alert. It also allows you to order a free copy of your credit report from each of the three credit reporting agencies. Be sure the credit reporting agencies have your current contact information so they can reach you.

You can place an extended fraud alert on your credit file if you have created an Identity Theft Report. With an extended alert, you can get two free credit reports within 12 months from each of the three credit reporting agencies, and the agencies must take your name off marketing lists for pre-screened credit offers for five years, unless you request to be added back to the lists. The extended alert lasts for seven years.

Credit Freeze

A credit freeze generally stops all access to your credit report. If you wish to open a new account, apply for a job, rent an apartment, buy insurance, refinance your mortgage – any transaction requiring a credit check – you must contact the credit reporting agency to lift the freeze, either temporarily or permanently. You will get a PIN to use each time you wish to freeze or unfreeze your account. In most states, there is a fee to activate a freeze as well as to lift it – usually around $10 for each and per credit reporting agency. There also is a lead time before the freeze is lifted so you would need to arrange for it in advance or be prepared to wait a few days if you planned to apply for credit. Cost and freeze lift lead times may vary so you may wish to check your state’s law or contact the credit reporting agency in advance. In most states, a credit freeze lasts until you lift it; in a few states, it expires after seven years. Click here for the Florida Statute regarding consumer security freezes.

A credit freeze may not prevent misuse of your current accounts or other types of identity theft, such as tax refund identity theft and health insurance fraud. Also, companies with whom you do business still would have access to your credit report for some purposes.

So, fraud alert or credit freeze? It depends a lot on what you have coming up in the near future. If you’re planning to apply for a loan or mortgage, you will have to unfreeze and freeze with each application – consider the cost and time involved. If you are not planning to apply for new credit, then a credit freeze may be a good option for you.

For more information on credit fraud alerts and freezes, visit:

Place a Fraud Alert and Extended Fraud Alerts and Credit Freezes

Sources:

Federal Trade Commission – Place a Fraud Alert

Federal Trade Commission – Extended Fraud Alerts and Credit Freezes

Federal Trade Commission – Fraud Alert or Credit Freeze – Which is Right for You?

UF/IFAS Extension Hillsborough County – Equifax Security Breach: Steps to Protect Yourself

by jbreslawski | Feb 24, 2017

Nationally, America Saves Week is an annual opportunity to promote good personal savings behavior!

Nationally, America Saves Week is an annual opportunity to promote good personal savings behavior!

More locally, the University of Florida Institute of Food and Agricultural Sciences (UF/IFAS) is collaborating with America Saves in a campaign to help Floridians build wealth, not debt! The Florida Saves, (floridasaves.org) statewide initiative has been officially endorsed by Jeff Atwater chief financial officer for the state of Florida. Why? Because research shows that, too many households with an unexpected expense of just $400 could be thrown into a financial crisis! This means a clog in the sink or a broken freezer could easily send a family into debt.

During Florida Saves Week, February 27 to March 4, 2017 UF/IFAS is urging residents to pledge to set a goal and start saving! Like our Florida Saves Facebook page to keep up with the latest info.

Saving money for an emergency makes good sense. Families with money saved for an emergency are less likely to face financial stress, less likely to fall behind on their bills, and less likely to deal with subprime alternative money sources that have higher costs than conventional options.

Make a commitment to yourself and take the Florida Saves pledge to help you reach your savings and debt reduction goals. Additionally, Florida Saves will motivate you with periodic information, advice, tips and reminders sent by email or text message to help you reach your savings goal. Paying yourself first, saving your tax refund, and saving automatically are just a few ways that Florida Saves encourages you to build wealth and reduce debt.

Plus, this year Floridians who pledge to become a saver can enter to win $50 to be put toward reaching their financial goals by completing a short survey after setting a goal and signing the Florida Saves pledge.

Want to win more? Take a video or photo to share your savings story and follow the link to enter to win a national prize of $1,000 in theAmerica Saves http://www.americasavesweek.org/imsavingfor/ contest.

Take the pledge at floridasaves.org Set a goal and make a plan!