by Shelley Swenson | Jan 30, 2015

“Oh where does all my money go?”

Do you need help managing your finances so that your family can realize more of their needs and wants? Family members of all ages must learn to communicate and understand what their financial situation is. Open discussions among family members often results in greater cooperation when deciding what the best things upon which to spend. Family members need to understand the difference between a need and a want. Then an open discussion can set priorities for the money available.

Your family may decide to reduce spending so that more needs and wants of each family member can be made. Here are a few suggestions:

- Categorize your expenses in two categories: wants and needs. Make everyone aware of the difference and how important it is to consider each purchase through this categorization. Needs include housing, basic utilities, childcare, etc. Wants could include going out to eat, high fashion, newest electronics, etc. Everyone has to understand that a want purchase can be spaced over time.

- Do not let your impulse determine purchases. Postpone unplanned purchases at least 24 hours so you can rethink your plan.

- Before purchasing an item, ask yourself, “Why?” Many people are now wearing a plastic bracelet that reads “Do I really need this?” It helps them make decisions based on wants and needs.

- Save on food by planning meals with abundant seasonal items and based on supermarket specials. Check the store ads and utilize coupons to buy what is on your list but don’t let the coupon result in your buying items you would not buy without a coupon. Make a list before going to the supermarket and then work your list.

- If you have debts, accelerate repayment. There is little reason to retain savings that earn 3% interest while you still owe installment debts and loans that carry true interest rates of 12%-22%. Yes, everyone needs an emergency fund but after it is secured, repay your loans.

Want additional suggestions on how to cut expenses and save money? Go to www.edis.ifas.ufl.edu and request the bulletin FCS7009.

by Heidi Copeland | Jan 30, 2015

In the early ’70s, Gary Iskowitz was doing graduate work as well as teaching tax law while working for the Internal Revenue Service (IRS). Mr. Iskowitz saw a growing problem with questionable tax preparers who were scamming low-income people in his area. He did not like what he saw! Consequently, he proposed training a few like-minded student volunteers to go into the community to prepare free tax returns for under-served residents.

In the early ’70s, Gary Iskowitz was doing graduate work as well as teaching tax law while working for the Internal Revenue Service (IRS). Mr. Iskowitz saw a growing problem with questionable tax preparers who were scamming low-income people in his area. He did not like what he saw! Consequently, he proposed training a few like-minded student volunteers to go into the community to prepare free tax returns for under-served residents.

The rest, they say, is history! Starting with this volunteer effort, 40 years later, the Volunteer Income Tax Assistance (VITA) Program is still going strong.

VITA still is designed to promote and support free tax preparation service for the under-served in both urban and non-urban locations. Service is targeted to low-to moderate- income individuals, persons with disabilities, the elderly, and limited English-speaking individuals.

Why? Just as in Gary Iskowitz’ time, this program is an effort to provide both a valuable community service and a powerful learning experience for the participants. Not only does a tax payer get their taxes done for free, the local community benefits from the monies spent by the tax payer. Plus, the IRS is pleased because citizens are in compliance with federal law.

Check out your local VITA sites this year. Around North Florida, there are numerous volunteer sites being readied for the 2014 tax year. Some of these sites are traditional, where taxes are done in person; some sites prepare taxes via SKYPE – the telecommunications application software that specializes in providing video chat and voice calls from computers. Using SKYPE as an application to accessing VITA has been well received, especially in rural locations.

If you plan to take advantage of any of the VITA programs this year, be sure to bring the proper documentation. A return cannot be prepared without the appropriate documentation. For a complete list of documentation needed for a VITA-prepared tax return, contact your local VITA tax preparation site. Where are these sites? Call your local helpline 2-1-1 or visit http://irs.treasury.gov/freetaxprep/.

by Ricki McWilliams | Jan 27, 2015

America Saves Week 2015 ~ February 23 – February 28

America Saves Week 2015 ~ February 23 – February 28

America Saves Week is coordinated by America Saves and the American Savings Education Council. Started in 2007, the Week is an annual opportunity for organizations to promote good savings behavior and for individuals to assess their own savings status. Typically, thousands of organizations participate in the Week, reaching millions of people. This campaign encourages individuals and families to save money and build personal wealth.

The 2014 Annual National Survey Assessing Household Savings (released during America Saves Week) revealed that while most Americans are meeting immediate financial needs, they are worse off than several years ago.

- Only about one-third of Americans feel prepared for their long-term financial future.

- 68 percent reported they are spending less than their income and saving the difference – down from 73 percent in 2010.

- Nearly two-thirds of respondents (64%) said they “have sufficient emergency savings to pay for unexpected expenses like car repairs or a doctor visit” – down from 71 percent in 2010.

- 76 percent said they are reducing their consumer debt or are consumer debt-free – down from 79 percent in 2010.

To learn more about America Saves Week and Pledge to Save, visit: www.AmericaSavesWeek.org

Set a Goal. Make a Plan. Save Automatically.

Get Involved! Events during America Saves Week include:

Ag Save$ Summit

February 23 – 9:00am CST/10:00am EST

Jackson County Extension Office, 2741 Pennsylvania Avenue, Marianna, FL 32448

(view registration link for additional locations)

FREE to register: bit.ly/AgSavesSummit

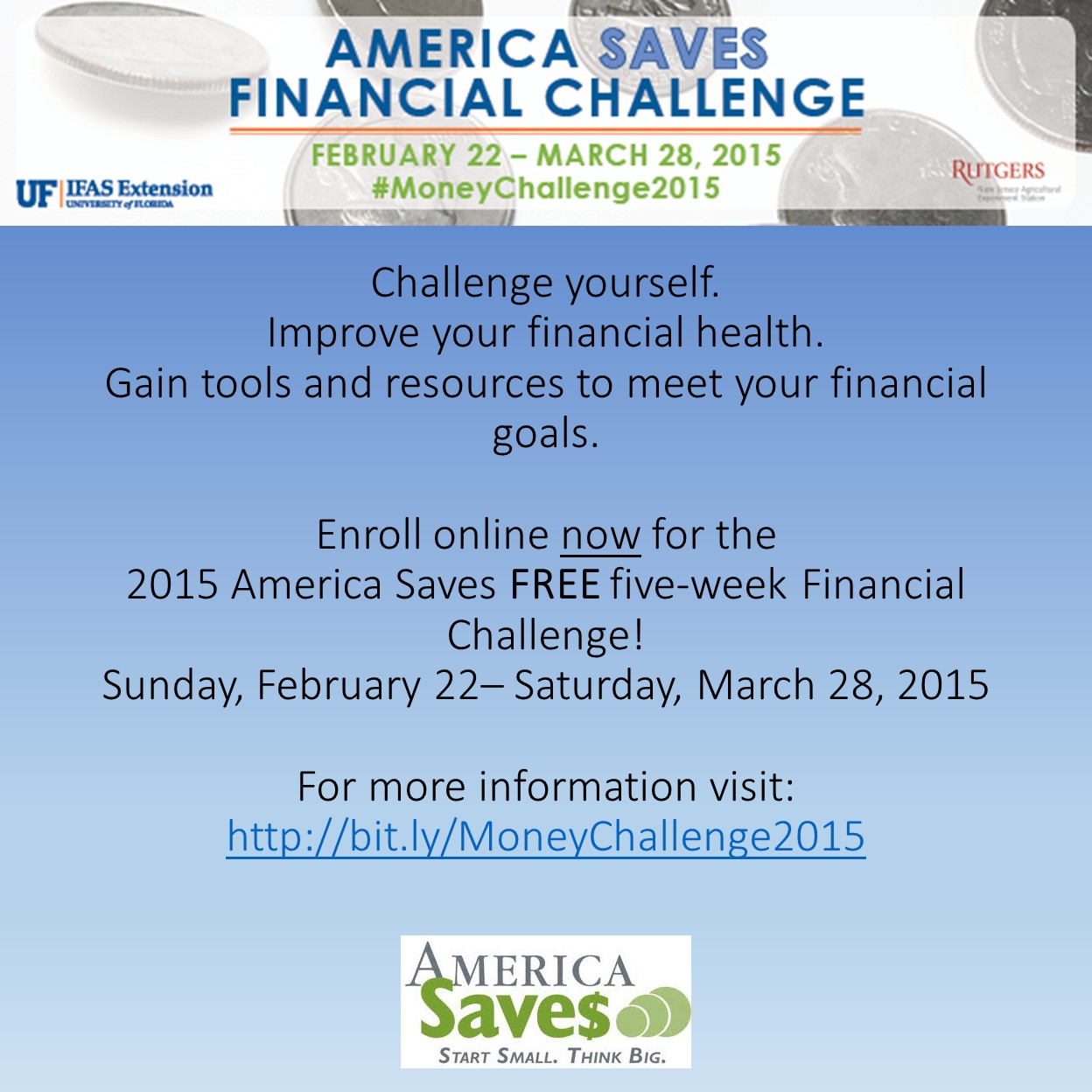

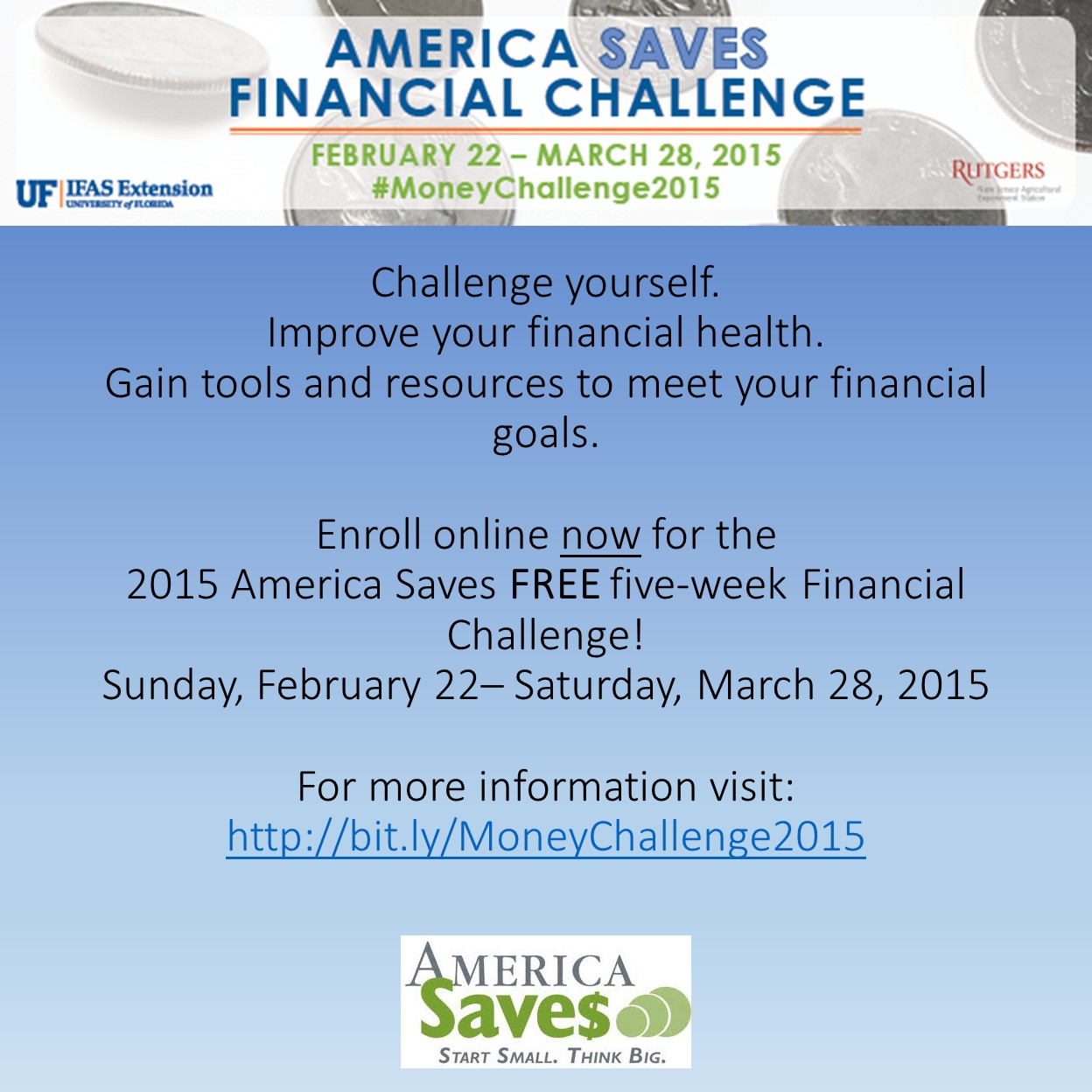

America Saves Financial Challenge – Online

February 22 – March 23

FREE to enroll: http://bit.ly/MoneyChallenge2015

Challenge Yourself to Save Money – America Saves Challenge Twitter Chat (#eXASchat)

February 24 – 2:00pm CST/3:00pm EST

Log in to Tchat.io at http://www.tchat.io/ and insert #eXASchat into the textbox that pops up so you can tweet easily and view the live Twitter stream

Where to Turn for Financial Advice – Webinar

February 25 – 11:00am CST/12:00pm EST

Free Registration: http://bit.ly/finpro2015

Personal Finance Questions – Realities & Myths – Webinar

February 26 – 11:00am CST/12:00pm EST

Free Registration: http://bit.ly/faq2015

by Ricki McWilliams | Jan 21, 2015

Ag Save$

Ag Save$

Ag Save$ is a new initiative to bring personal finance education such as wealth building, estate planning, succession planning, asset protection, and other financial topics to agricultural producers in Florida.

Have you ever asked yourself:

How do I become financially stable?

How do I retire well?

What do I need to do to secure the future of my farm?

Let us help you find the answers.

Ag Save$, a component of the nonprofit America Saves and a partner with the University of Florida’s Institute of Food and Agricultural Sciences financial teaching and education, seeks to motivate, support, and encourage farmers and agricultural producers to save money, reduce debt, build wealth, protect assets, and plan for succession. The research-based campaign uses the principles of behavioral economics and social marketing to change behavior. Ag Save$ encourages all agricultural producers and their families to join us in a kick-off event on Monday, February 23, 2015 as well as our workshop series that starts March 24, 2015.

Ag Save$ Summit:

February 23, 2015

Registration: 8:30 a.m. (Central) 9:30 a.m. (Eastern)

Program 9:00 a.m. – 1:00 p.m. (Central); 10:00 a.m. – 2:00 p.m. (Eastern)

Locations

|

Jackson County Extension Office (host site)

2741 Pennsylvania Avenue

Marianna, FL 32448

850-482-9620

Doug Mayo: demayo@ufl.edu

|

Jay Community Center (satellite location)

5259 Booker Lane

Jay, FL 32566

850-623-3868

Blake Thaxton: bthaxton@ufl.edu |

Jefferson County Extension Office (satellite location)

2729 W. Washington Hwy.

Monticello, FL 32344

850-342-0187

Jed Dillard: dillardjed@ufl.edu |

Register Online: bit.ly/AgSavesSummit

Registration deadline: February 19, 2015

This session is complimentary

All family members are encouraged and welcomed to participate

For more information, click: Ag Saves Summit Flyer

Ag Save$ Series of Workshops:

| March 24th |

June 23rd |

July 21st |

August 18th |

| Preparing for Retirement and Other Goals |

Trimming the fat, How to manage and reduce your debt |

Securing Your Family’s and Your Farm’s Future-Part 1 |

Securing Your Family’s and Your Farm’s Future-Part 2 |

Register Online: bit.ly/AgSavesSeries

Registration deadline: March 10, 2015

For more information click: Ag Saves Program Flyer 2015

by Elizabeth | Jan 17, 2015

The Merriam-Webster Dictionary defines “resolution” as “the act of finding an answer or solution to a conflict, problem, etc.; the act of resolving something.” Now that 2015 is here, what are you seeking to resolve this year?

The Merriam-Webster Dictionary defines “resolution” as “the act of finding an answer or solution to a conflict, problem, etc.; the act of resolving something.” Now that 2015 is here, what are you seeking to resolve this year?

If you read Living Well in the Panhandle articles, you probably have noticed a theme. The theme is information on Living Well – not just for one day or one month but for the whole year. With that in mind, what do you resolve to do this year to live well? While identifying your resolutions, it is important to note that, unless your chosen resolution becomes a habit, you may fail to achieve it. However, regardless of what your resolution is this year, here are a few things to consider to help you with your resolve.

Join an organization that supports people with the same resolve. For instance, many people resolve to save more money each year. From personal experience, it is tough to change spending habits without moral support. However, organizations like America Saves motivate people who want to save for different goals. Pledge to save during America Saves Week – February 23- 28 (www.americasaves.org) or any time before then. This is one avenue many people across the country have used to stick with their resolution to save. The resolution becomes a habit because, on the America Saves website (www.americasaves.org), you can find motivation from other savers or prospective savers like yourself. You also can sign up to receive a free newsletter with information on how to maximize your effort.

Judging by the number of weight loss commercials in the media, the other most common resolutions include eating right, exercising, and losing weight. There are several web sites you can visit that provide unbiased information as you work your way toward living well. At Small Steps to Health and Wealth (http://njaes.rutgers.edu/sshw/), you can sign up for the Online Challenge that will help you make small daily changes to improve your health and personal finances.

A good resolution should focus on improving one’s life. That said, choose to read Living Well in the Panhandle and live well not just for a day or a month but for the rest of your life. For more information on Living Well in the Panhandle, contact your local UF/ IFAS Extension Agent. Happy New Year!

by Shelley Swenson | Dec 9, 2014

©Feverpitched

Recently, UF/IFAS published Five Steps to Seasonal Savings, http://edis.ifas.ufl.edu/pdffiles/FY/FY140500.pdf, an EDIS brochure which reminds us of the stress that can result from holiday spending. I would encourage each of you to print or review the brochure and ponder its message TODAY. We are nearing the hustle and bustle of preparing for the season and it is timely information.

The five steps are:

- Recognize Your Seasonal Stressors

- Develop a Holiday Spending Plan – Make a Budget

- Develop a Holiday Spending Plan – Create a List

- Find Alternatives to Pricey Presents

- Fine-Tune Your Financials

It is already early December, the Thanksgiving shopping sale and Cyber Monday have passed but planning is still possible before the 2014 holiday rush if you will take some time to do so.

The section of this brochure that really spoke to me is the Fine-Tune Your Financials. As I do every day, I try to use cash and/or debit cards when possible. I need to see the money leave my account so the holidays don’t haunt me into the new year. There is too big of an allure for me to overspend when I buy gifts with credit. There is not as much reality with credit card spending. Paying interest on the credit debt is even more troubling, as the holiday spirit is long gone before the item is paid for.

Holidays are about spending time with family and friends. It does not need to center on gift giving. Consider your spending plan in the next few weeks for a more financially comfortable 2015.