by Laurie Osgood | Apr 1, 2021

April is designated as National Financial Literacy Month to increase awareness about financial literacy, especially with the Coronavirus (COVID-19) causing economic worry for families across the United States. When it comes to financial literacy, knowledge is power!

April is designated as National Financial Literacy Month to increase awareness about financial literacy, especially with the Coronavirus (COVID-19) causing economic worry for families across the United States. When it comes to financial literacy, knowledge is power!

Consumer debt has become a major challenge for families. If you owe money to multiple creditors, managing this debt can be overwhelming. Many Americans have more debt than they can afford to pay. Developing strategies for overcoming this challenge is essential. These strategies should include building financial knowledge, developing a budget, and setting savings goals to improve your financial outlook.

Financial literacy means understanding how to save, borrow, invest, and care for your money, leading to greater financial well-being. Research has shown that our physical health and well-being are directly linked to our financial health and well-being.

Florida Saves is a statewide initiative that helps inspire Florida families to set savings goals, lower debt, and build personal wealth. The Florida Saves pledge, located on the Florida Saves website, can help us establish personal financial goals. With this pledge, you’re making a commitment to work toward a savings goal, such as college tuition, an emergency fund, or down payment on your first home. Visit the Florida Saves Initiative website to learn more about financial literacy.

Whatever your savings goals are, becoming financially literate can help you achieve those goals. For more information about financial literacy and management, please contact your local UF/IFAS Extension Agent.

Extension classes are open to everyone regardless of race, creed, color, religion, age, disability, sex, sexual orientation, marital status, national origin, political opinions, or affiliations.

by Laurie Osgood | Jul 16, 2020

Lately, scammers have gotten more sophisticated. So it’s worth reminding everyone that if you receive an unsolicited email, text, or phone call, DO NOT give out any of your personal information! Scammers often update their tactics, using any way they can to trick you into handing over your precious personal information.

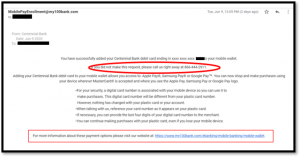

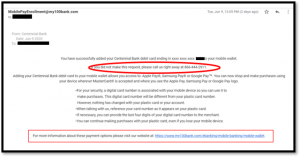

Earlier this week, I received an email (see below) telling me I had successfully set up a mobile wallet using my bank account. Since I had not signed up for this service, I was tempted to call the phone number listed in the email to dispute it. I hesitated, and for good reason. If I had contacted them, they would have tried to get my personal identification information, and then used that information to steal my identity or bank funds. I called my bank directly and learned this scam was recently perpetrated against 40,000 debit card users.

Phishing emails and text messages often appear to be legitimate and from a company you know or trust (like my own bank). These phishing emails and text messages often describe a problem with your billing, to trick you into clicking on a link or an attachment.

REMEMBER, if you receive this kind of message, by email or text, do not click on any attachments or call the phone number that is listed.

The Federal Trade Commission’s (FTC) Consumer Information page offers these tips for consumers to recognize and avoid phishing scams. View their website for more information. https://www.consumer.ftc.gov/topics/privacy-identity-online-security.

- Protect your computer by using security software.

- Protect your mobile phone by setting software to update automatically

- Protect your accounts by using multi-factor authentication

- Protect your data by backing it up

Lesson learned? Protect yourself and don’t believe anything that doesn’t feel right!

For more information about protecting yourself and your finances, contact your local UF/IFAS Extension Agent.

Extension classes are open to everyone regardless of race, creed, color, religion, age, disability, sex, sexual orientation, marital status, national origin, political opinions or affiliations.

by Laurie Osgood | Feb 6, 2019

Regular vehicle maintenance can help you avoid expensive repairs. Photo credit: UF/IFAS Northwest District

A car is one of the biggest investments we will make. With proper car maintenance, you can increase safety, improve performance, and save money in the long run. According to AAA, big improvements in powertrain technology, lubricant, and rust prevention have led to improvements in automobile reliability, longevity, and durability. With proper care, almost any car can make it well past the 100,000-mile mark.

TIPS FOR PROLONGING THE LIFE OF YOUR CAR

• Do some research and purchase a safe, reliable vehicle

• Stick to the recommended car maintenance schedule

• Buy high quality parts: engine oil, battery, tires, etc.

• Keep your car clean, inside and out

• Know what to look for if your car is beginning to show signs of trouble

WARNING SIGNS THAT YOUR CAR MAY BE HEADED FOR TROUBLE

You know your car, and, therefore, you are the best judge of when it’s acting differently. There are signs your car may exhibit that will warn you of a potential problem. It could be a light, a sound, or an unusual smell. Consumer Reports recommends at the first sign of trouble, you should take your car to a reliable mechanic.

WARNING LIGHTS

Lights that appear on your dashboard are connected to sensors that monitor everything your car does. If your car senses that something isn’t quite right, the computer will use these lights to tell you what it is. If any of these lights appear, your mechanic will be able to hook up your vehicle to a diagnostic scan tool to identify the trouble and find out exactly what’s prompting the light to turn on.

Pay attention to these warning lights, as they could indicate a problem with your vehicle:

• Check Engine

• Check Oil/Oil Level Low

• Oil Pressure Low

UNUSUAL SOUNDS

You know your car and the sounds it normally makes, but new or different sounds can be a sign of trouble. These sounds can be a clue to what’s going on under the hood. GEICO Insurance offers a list of these sounds and their possible causes.

Sounds and Possible Causes

- A sound like a coin rattling inside a tin can: Could be a loose lug nut inside the hub cap.

- Brakes squealing or grinding: Your brake pads or shoes might need to be replaced. Pads may be worn, and the sound is metal on metal.

- A snapping, popping, or clicking sound when you turn a corner: One or both of the constant velocity (CV) joints on your front axle could need to be replaced.

- A rhythmic squeak that speeds up as you accelerate: This could indicate a problem with the universal joints (U-joints) in the driveshaft.

- A howling, whining, or even “singing” sound: Bearings, which are small metal balls that help parts rotate smoothly, may not be properly working.

- A rhythmic clunking, tapping, or banging from under the hood: This could indicate a problem with valves, pistons, or connecting rods. Rough, bumpy motions could be caused by faulty spark plugs, clogged fuel lines, or a bad fuel filter.

- A squealing sound from under the hood at start-up or when accelerating: This sound could be caused by worn or loose accessory belts for the power steering pump, air conditioner compressor, alternator, or the serpentine belt.

FOUL SMELLS

Toxic gases such as carbon monoxide are contained in a car’s exhaust system. If you smell a foul or strong smell while inside your car, this may be a sign of a serious problem. You should have it checked by a mechanic as soon as possible. If oil or coolant is leaking, this may mean hazardous exhaust gases are entering the interior of your car.

The smell of rubber burning could be a signal that your car’s drive belts or accessory belts underneath the hood are damaged, worn, or loose. These belts will need to be replaced as soon as possible to prevent more problems.

SMOKE

Smoke can come from the front or back of your car. Smoke coming from beneath the car’s hood most likely means your engine is overheating, and you should bring it to a mechanic right away. The color of the smoke coming out of your exhaust pipe can give you a clue about what may be going on inside your engine.

Blue Smoke: This could mean oil is escaping from somewhere within the engine and is being burned along with the gasoline. If you see blue smoke, your mechanic should look for damaged or worn seals in the engine.

White Smoke: May mean antifreeze or water condensation may have mixed in with the gasoline. You should have it checked out as soon as possible.

Mechanics agree that preventive maintenance, including regular oil changes and belt replacement, can help to extend the life of your car. Car maintenance can be an inconvenience that requires time, planning, and effort. But, in the long run, the benefits of driving a safe car outweigh the cost and aggravation.

For more information on how to save money by properly maintaining your car, contact your local UF/IFAS Extension Office.

Sources:

AAA: https://magazine.northeast.aaa.com/daily/life/cars-trucks/benefits-maintaining-vehicle/

Consumer Reports: https://www.consumerreports.org/car-repair-maintenance/make-your-car-last-200-000-miles/

GEICO: https://www.geico.com/more/driving/auto/auto-care/car-noises/?utm_source=geico&utm_medium=email&utm_content=newsletter&utm_campaign=feb2018

by Judy Corbus | Feb 27, 2018

Photo Source: University of Florida

It’s tax time, and many of us will be seeing refund checks soon—time to celebrate!

Now, what are you going to do with all that extra cash?

Maybe you have some bills to take care of, and it’s certainly a good idea to get those off your plate. But after that, let’s say you have some money left over. What then?

Think about putting those extra dollars in a savings account. Or, if you don’t have a savings account, open one. Even if it’s just $100, that first deposit could be the start of a lifelong savings habit.

Which brings us to another question: Why is it important to save?

Let me answer that question with another question: If you had to cover a $1,000 unexpected expense today, could you do it?

These little emergencies come up all the time. Your car needs repairs. You get sick and miss work. You have to travel out of state unexpectedly. These challenges are just part of life, but you can be prepared to meet them.

That $100 you tuck away is not much now, but consider this: If you saved $100 each month for a year, you’d have $1,200 in your bank account. That’s a good financial cushion that can keep you afloat when the unexpected happens.

Need a little encouragement to stick to the savings habit? The Florida Saves Pledge (floridasaves.org) is a great tool for setting financial goals. With this pledge, you’re making a commitment to work toward some type of savings objective, such as an emergency fund, a down payment on a house, or even retirement.

As a Family and Consumer Sciences Agent in Washington and Holmes Counties, part of my job is to help our community members learn to take charge of their money. In fact, there are people like me all over the state helping their neighbors with everything from horticulture to nutrition and youth development. We’re a network of experts who make up the University of Florida’s Institute of Food and Agricultural Sciences Extension. And we’re here to help, today.

For more information, contact your local Extension Office.

by Elizabeth | Aug 29, 2015

Large Screen TV

Very few of us have money ready to cover an emergency, never mind the money for the larger purchases we’d like to make. This is why it’s so important to prioritize savings to cover both the items you need as well as those you want.

Whether you’re saving for a new computer or a car, the security deposit for an apartment or a house down payment, a little planning and an easy-to-maintain budget will be instrumental in making your big ticket purchase a savings reality. With these direct and easy steps, big ticket items don’t have to be limited to big dreams:

Set Your Goal. It’s easy to keep dreaming of the things you want or even things you might need, but making it a point to establish your big ticket item as an actual savings goal is a necessary first step in making the goal a reality.

- Do Your Research. Start with the most important question: how much is your large purchase going to cost? Some items, like a computer or a security deposit, will have a set dollar amount that you’ll need to save for, while other items, like a car or a home, will need to include associated costs for maintenance, insurance, and taxes/fees.

- Make a Plan. Once you know your goal and all of the costs associated with that goal, it’s time to dig into your BUDGET to determine how much you’ll be able to save each month. You might need to make some changes to your spending to make savings (or additional savings) happen. Dividing your goal’s costs by the amount you’ll be able to save will also let you know how long you’ll need to save. When you know these two items, head over to AmericaSaves.org to take the pledge and put your savings plan into action.

- Automate Your Savings. Start a good saving habit by automatically moving the predetermined amount into your savings account each month. Employer-based direct deposit can move the amount straight from your paycheck into your savings account or you can set up an automatic transfer through your banking institution. Regardless of which method you choose, be sure to keep your savings in a separate savings account to watch your money accumulate with interest (and the harder to access those funds, the better).

- Earmark windfall income. Depending on how long you’ve determined it will take to reach your savings goals, you may want to plan to move any additional unbudgeted income directly into savings. Receiving an end of year bonus? How about a tax refund? Since those funds aren’t a part of your established budget, you won’t miss the additional income by moving a portion of it into savings – plus, you’ll cut the time it takes to reach your goal!

To learn more about saving for a large purchase and take the America Saves pledge, visit AmericaSaves.org. Article adapted from AmericaSaves.org Saving for large purchases.

April is designated as National Financial Literacy Month to increase awareness about financial literacy, especially with the Coronavirus (COVID-19) causing economic worry for families across the United States. When it comes to financial literacy, knowledge is power!

April is designated as National Financial Literacy Month to increase awareness about financial literacy, especially with the Coronavirus (COVID-19) causing economic worry for families across the United States. When it comes to financial literacy, knowledge is power!