by Ricki McWilliams | Jan 27, 2015

America Saves Week 2015 ~ February 23 – February 28

America Saves Week 2015 ~ February 23 – February 28

America Saves Week is coordinated by America Saves and the American Savings Education Council. Started in 2007, the Week is an annual opportunity for organizations to promote good savings behavior and for individuals to assess their own savings status. Typically, thousands of organizations participate in the Week, reaching millions of people. This campaign encourages individuals and families to save money and build personal wealth.

The 2014 Annual National Survey Assessing Household Savings (released during America Saves Week) revealed that while most Americans are meeting immediate financial needs, they are worse off than several years ago.

- Only about one-third of Americans feel prepared for their long-term financial future.

- 68 percent reported they are spending less than their income and saving the difference – down from 73 percent in 2010.

- Nearly two-thirds of respondents (64%) said they “have sufficient emergency savings to pay for unexpected expenses like car repairs or a doctor visit” – down from 71 percent in 2010.

- 76 percent said they are reducing their consumer debt or are consumer debt-free – down from 79 percent in 2010.

To learn more about America Saves Week and Pledge to Save, visit: www.AmericaSavesWeek.org

Set a Goal. Make a Plan. Save Automatically.

Get Involved! Events during America Saves Week include:

Ag Save$ Summit

February 23 – 9:00am CST/10:00am EST

Jackson County Extension Office, 2741 Pennsylvania Avenue, Marianna, FL 32448

(view registration link for additional locations)

FREE to register: bit.ly/AgSavesSummit

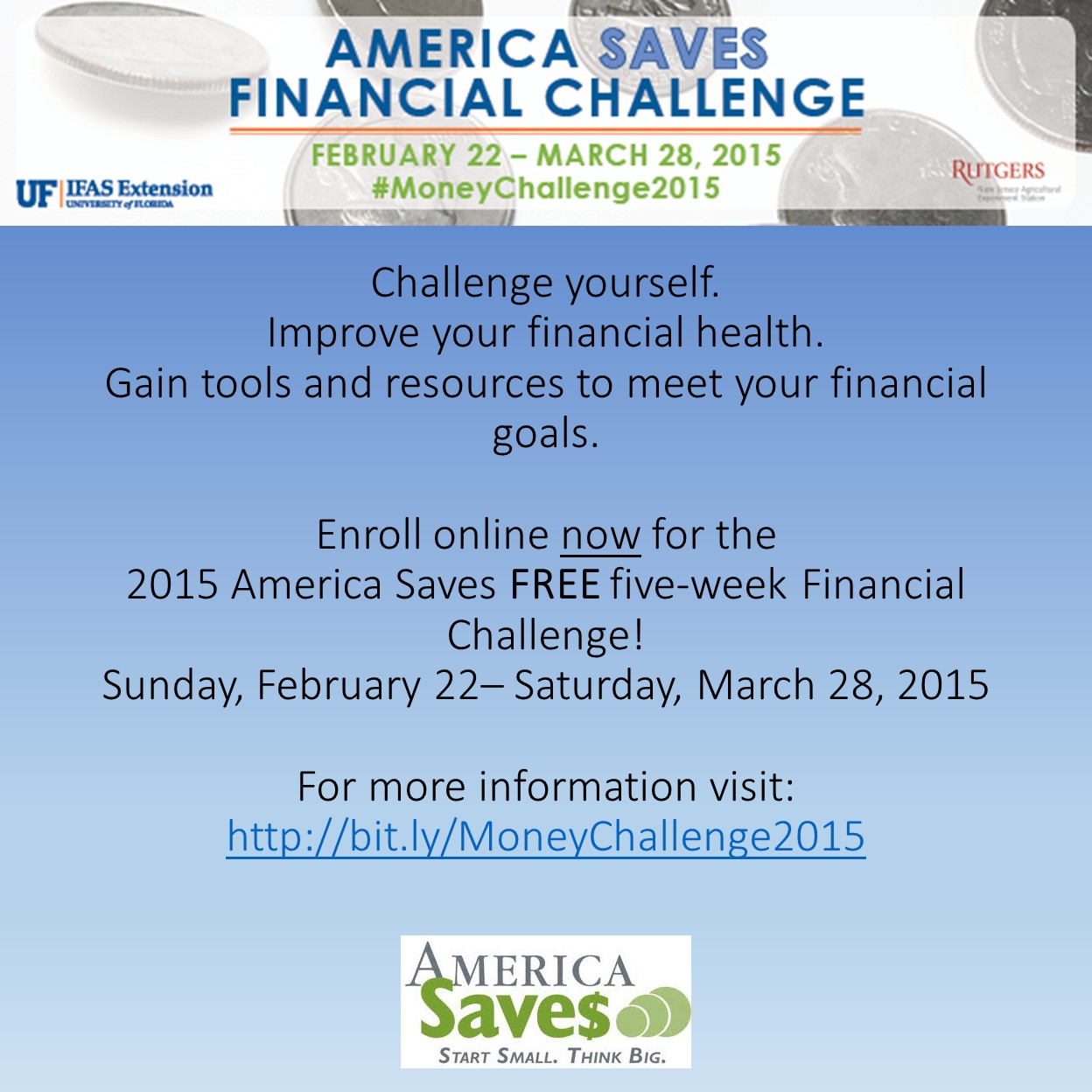

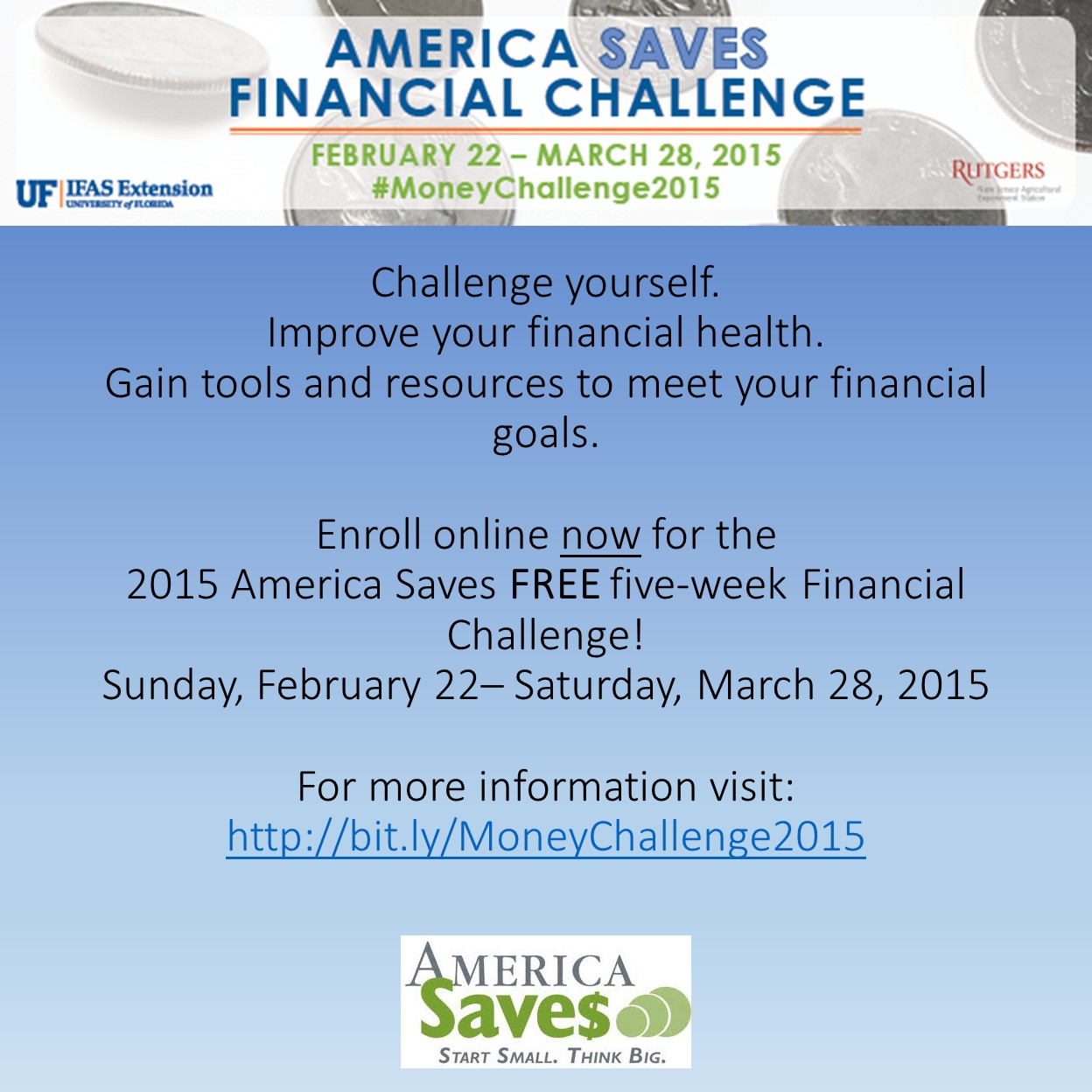

America Saves Financial Challenge – Online

February 22 – March 23

FREE to enroll: http://bit.ly/MoneyChallenge2015

Challenge Yourself to Save Money – America Saves Challenge Twitter Chat (#eXASchat)

February 24 – 2:00pm CST/3:00pm EST

Log in to Tchat.io at http://www.tchat.io/ and insert #eXASchat into the textbox that pops up so you can tweet easily and view the live Twitter stream

Where to Turn for Financial Advice – Webinar

February 25 – 11:00am CST/12:00pm EST

Free Registration: http://bit.ly/finpro2015

Personal Finance Questions – Realities & Myths – Webinar

February 26 – 11:00am CST/12:00pm EST

Free Registration: http://bit.ly/faq2015

by Ricki McWilliams | Jan 21, 2015

Ag Save$

Ag Save$

Ag Save$ is a new initiative to bring personal finance education such as wealth building, estate planning, succession planning, asset protection, and other financial topics to agricultural producers in Florida.

Have you ever asked yourself:

How do I become financially stable?

How do I retire well?

What do I need to do to secure the future of my farm?

Let us help you find the answers.

Ag Save$, a component of the nonprofit America Saves and a partner with the University of Florida’s Institute of Food and Agricultural Sciences financial teaching and education, seeks to motivate, support, and encourage farmers and agricultural producers to save money, reduce debt, build wealth, protect assets, and plan for succession. The research-based campaign uses the principles of behavioral economics and social marketing to change behavior. Ag Save$ encourages all agricultural producers and their families to join us in a kick-off event on Monday, February 23, 2015 as well as our workshop series that starts March 24, 2015.

Ag Save$ Summit:

February 23, 2015

Registration: 8:30 a.m. (Central) 9:30 a.m. (Eastern)

Program 9:00 a.m. – 1:00 p.m. (Central); 10:00 a.m. – 2:00 p.m. (Eastern)

Locations

|

Jackson County Extension Office (host site)

2741 Pennsylvania Avenue

Marianna, FL 32448

850-482-9620

Doug Mayo: demayo@ufl.edu

|

Jay Community Center (satellite location)

5259 Booker Lane

Jay, FL 32566

850-623-3868

Blake Thaxton: bthaxton@ufl.edu |

Jefferson County Extension Office (satellite location)

2729 W. Washington Hwy.

Monticello, FL 32344

850-342-0187

Jed Dillard: dillardjed@ufl.edu |

Register Online: bit.ly/AgSavesSummit

Registration deadline: February 19, 2015

This session is complimentary

All family members are encouraged and welcomed to participate

For more information, click: Ag Saves Summit Flyer

Ag Save$ Series of Workshops:

| March 24th |

June 23rd |

July 21st |

August 18th |

| Preparing for Retirement and Other Goals |

Trimming the fat, How to manage and reduce your debt |

Securing Your Family’s and Your Farm’s Future-Part 1 |

Securing Your Family’s and Your Farm’s Future-Part 2 |

Register Online: bit.ly/AgSavesSeries

Registration deadline: March 10, 2015

For more information click: Ag Saves Program Flyer 2015

by Elizabeth | Jan 17, 2015

The Merriam-Webster Dictionary defines “resolution” as “the act of finding an answer or solution to a conflict, problem, etc.; the act of resolving something.” Now that 2015 is here, what are you seeking to resolve this year?

The Merriam-Webster Dictionary defines “resolution” as “the act of finding an answer or solution to a conflict, problem, etc.; the act of resolving something.” Now that 2015 is here, what are you seeking to resolve this year?

If you read Living Well in the Panhandle articles, you probably have noticed a theme. The theme is information on Living Well – not just for one day or one month but for the whole year. With that in mind, what do you resolve to do this year to live well? While identifying your resolutions, it is important to note that, unless your chosen resolution becomes a habit, you may fail to achieve it. However, regardless of what your resolution is this year, here are a few things to consider to help you with your resolve.

Join an organization that supports people with the same resolve. For instance, many people resolve to save more money each year. From personal experience, it is tough to change spending habits without moral support. However, organizations like America Saves motivate people who want to save for different goals. Pledge to save during America Saves Week – February 23- 28 (www.americasaves.org) or any time before then. This is one avenue many people across the country have used to stick with their resolution to save. The resolution becomes a habit because, on the America Saves website (www.americasaves.org), you can find motivation from other savers or prospective savers like yourself. You also can sign up to receive a free newsletter with information on how to maximize your effort.

Judging by the number of weight loss commercials in the media, the other most common resolutions include eating right, exercising, and losing weight. There are several web sites you can visit that provide unbiased information as you work your way toward living well. At Small Steps to Health and Wealth (http://njaes.rutgers.edu/sshw/), you can sign up for the Online Challenge that will help you make small daily changes to improve your health and personal finances.

A good resolution should focus on improving one’s life. That said, choose to read Living Well in the Panhandle and live well not just for a day or a month but for the rest of your life. For more information on Living Well in the Panhandle, contact your local UF/ IFAS Extension Agent. Happy New Year!

by Ricki McWilliams | Oct 30, 2013

Last year, the Consumer Federation of America (CFA) and the Credit Union National Association (CUNA) found that 12 percent of people said they were planning to spend more during the holidays than in the previous year. That number was up from 2011, where only 8 percent planned on spending more than in the previous year. This year, help reverse this trend and plan on spending less and saving more. Remember, it’s the thought that counts, not the amount you spend. Helpful tips for spending less and saving more:

Last year, the Consumer Federation of America (CFA) and the Credit Union National Association (CUNA) found that 12 percent of people said they were planning to spend more during the holidays than in the previous year. That number was up from 2011, where only 8 percent planned on spending more than in the previous year. This year, help reverse this trend and plan on spending less and saving more. Remember, it’s the thought that counts, not the amount you spend. Helpful tips for spending less and saving more:

- Make a Budget and a List: Decide how much you can afford to spend and stay within that budget. Make a price list of all gifts and other holiday items you plan to purchase. Take the list with you shopping to avoid overspending and impulse buys.

- Comparison Shop: You can easily save more than 10 percent on most items, sometimes considerably more, by comparing prices at different stores. The Internet and smart phones have made comparison shopping that much easier. But when shopping online, shop wisely. Be sure you are purchasing from a secure site and review emailed statements for accuracy as you receive them.

- Make Time Your Ally: The reason to start sooner rather than later is that when you delay, you pay. At the last minute, you have to settle for something, and it might cost more than you had wanted or planned to pay. Another benefit to starting early: It gives you more time to find the “right” gift and avoid impulsive decisions, which too often leave you less happy with your purchase.

- See what’s in your supply drawer: You may have more wrapping paper, ribbons, unused cards, and gift boxes stored away from last season than you realize. Use up those holiday supplies first to trim down the amount you’ll have to buy this season.

- Find Some Low- or No-Cost Ways to Celebrate: Adding a few changes can ease the strain on your spending budget. For example, draw names to reduce the number of people you have to purchase gifts for; give homemade items; make your own gift wrap; or organize a potluck rather than trying to make, and pay for, the entire holiday meal yourself.

With the money you save on gifts, you can give yourself the gift of financial freedom by paying down debt or building your emergency savings fund.

Need help finding ways to save? Take the America Saves pledge to make a commitment to yourself to save and to receive emails and/or text messages to keep you motivated. (America Saves, managed by the Consumer Federation of America (CFA), is a non-profit research‐based social marketing campaign that seeks to motivate, support, and encourage low- to moderate-income households to save money and build wealth. Learn more at americasaves.org.

Source: Katie Bryan, America Saves Communications Director

Additional ways to make a difference in YOUR financial future:

FREE ON-LINE CLASSES: Participate from your office, home, or web-enabled device. It is easy! Visit the registration link to reserve your spot. Then log on the day of the webinar to participate. All webinars are scheduled 11:30am – 12:30pm (CST).

• Credit Use and PowerPay Debt Reduction Tool – October 30

This webinar will cover strategies for wise credit use, factors that impact credit scores, and methods to pay off debt using a free, self-directed debt reduction program called PowerPay. Registration link: http://bit.ly/PowerPayToday

• The Cost of False Health & Nutrition Promises – November 1

This webinar will cover some of the myths and misleading claims that induce consumers to spend time and money on health products & supplements that have not had enough scientific scrutiny. Registration link: http://bit.ly/FHCCost

• 5 Simple Steps to Seasonal Savings – November 13

This webinar will cover seasonal stressors, developing a holiday spending plan, alternatives to pricey gifts, and fine-tuning your financial plan for the holidays. Registration link: http://bit.ly/ssss2103

To view archived webinars, please click here.

by Elaine Courtney | Feb 18, 2013

Saving money can be easy or it can be extremely difficult. Why should you save? To set aside money you could spend today…so you can spend it tomorrow! Ask yourself some hard questions:

What would happen if…

- You lost your job?

- You got sick?

- You had an emergency?

How will you pay for big purchases? Will you be able to retire?

What makes the difference? Understanding the Keys to Successful Savings! The theme for Saves Week focuses on these three key components of savings: Set a Goal, Make a Plan, Save Automatically.

What makes the difference? Understanding the Keys to Successful Savings! The theme for Saves Week focuses on these three key components of savings: Set a Goal, Make a Plan, Save Automatically.

Today let’s focus on the first part of Successful Saving–Set a Goal.

What do you want? Are you searching for ways to save money to pay off late bills or keep up with this month? Do you need to go to the dentist, buy or fix things for your home and family, pay for day care, or train for a better job? Do you want to buy a bicycle for your kids and/or send them to college? Without clear goals, you don’t know where you’re going.

Financial goals identify what you want to do with your money. Goals give you direction. They give you a purpose for the way you spend your money

What constitutes a goal? A statement such as “I want to save money” is too vague. It becomes a realistic financial goal by adding a dollar amount, and a time frame. For instance, “I want to save $25 a week for 12 months”. An actual goal, however, would depend on an individual’s or family’s income and values.

What constitutes a goal? A statement such as “I want to save money” is too vague. It becomes a realistic financial goal by adding a dollar amount, and a time frame. For instance, “I want to save $25 a week for 12 months”. An actual goal, however, would depend on an individual’s or family’s income and values.

Make your goals SMART! Creating SMART goals gives us an action plan for reaching the goals we set.

Specific -Write down exactly what it is you want to accomplish. For example, instead of writing “I want to pay off credit card debt,” write, “I want to pay off the $5000 balance on my Visa Card.” Instead of writing, “I want to start an emergency fund,” write, “I want to save $1000 in an emergency fund.

Measurable –Financial goals are measured by a dollar amount, and you want to be able to see the progress you are making toward your goal. In the example we used before, if I want to pay off $5000 in credit card debt, I need to figure out how much money I need to pay per month, based on my deadline (this is the Time-Bound part- we’ll get to it shortly). If I wanted to pay it off in 12 months, I would need to pay around $420 per month (plus a little extra to cover interest and fees). Each month, I will see measurable progress toward my goal as my balance decreases.

Adaptable –With finances, we always need to be adaptable. Things change, life happens, emergencies come up, and we have to change our plans. Make sure that your goals are adaptable for changes in your financial situation. For instance, if you figure out that you want to pay $300 per month toward paying down your credit card debt, but then you have some unexpected expenses one month, you may have to pay less this month and either make up for it next month or stretch out your timeline.

Realistic –One of the biggest reasons we do not reach our financial goals is because we set the bar too high. If I only have $100 extra dollars in my budget, but I commit to paying $300 toward my credit card bill, I am setting myself up for failure. I could make this goal more realistic by 1) lowering the amount I plan to pay toward my credit card bill and stretching out the time I will be paying it down or 2) looking for other places in my budget where I can cut expenses in order to make this payment possible.

Time-Bound –Set deadlines for your financial goals! If you are anything like me, tasks without deadlines get pushed farther and farther down my to-do list. If you are serious about meeting your financial goals, set deadlines by which you want to accomplish them. This will also help you to determine how to measure your goals (see making your goals measurable above.

The second key to successful savings is to MAKE A PLAN. No matter what your financial goals are, it is important to map out a plan for achieving success.

The final key is to SAVE AUTOMATICALLY. Have part of your paycheck deposited into savings or transferred from checking to savings. You can also participate in retirement accounts that have automatic deposits made each pay period. This makes it easy to save and removes the temptation of having that money easily accessible.

As part of SAVES WEEK, there will be an on-line presentation and discussion about the Keys to Successful Saving on Tuesday, February 26, 11:30-12:30 CST. This might be just the motivation you need to get started saving!

February 26

3 Keys to Successful Savings –Create SMART goals, find money to save, make a savings plan, and choose the right savings accounts to reach your goals. http://bit.ly/3KeySaves. Participating is easy and free! We will send you a reminder email and the login instructions! Hope you’ll join me!

Don’t forget to join other savers…Become an Okaloosa Saver http://bit.ly/Al9BuH or Florida Saver at http://fycs.ifas.ufl.edu/Extension/FinancialManagement/FloridaSaves/Florida_Saves_Enrollment_Form.pdf.

Additional webinars will be held during Saves Week (all times are 11:30-12:30 CST):

February 27

Goal – Based Investing – Learn how to use a goal-based investment strategy to achieve financial goals. Learn to effectively develop a financial plan and choose investment accounts that work for particular goals. http://bit.ly/UFINVest

February 28

Tips for Tax Preparation & Filing – Review options for free tax filing, tax credits & tax deductions. Tips to analyze returns to help with financial decisions. http://bit.ly/TaxFil

Prepared by: Elaine A. Courtney

Family & Consumer Sciences Extension Agent

UF/IFAS Extension-Okaloosa County

850-683-8431

ecourtne@ufl.edu

America Saves Week 2015 ~ February 23 – February 28

America Saves Week 2015 ~ February 23 – February 28