by Marjorie Moore | Feb 11, 2015

Photo taken by: Marjorie Moore

February is heart month, a time to consider including foods in your diet that will benefit your heart. Much has been in the media during the last few years about the positive heart health benefits of blueberries, red wine and dark chocolate. According to research, the compounds responsible for the positive effects are called flavonoids, which occur naturally in food.

Flavonoids that promote heart health fall into six major categories. One category is flavonols and those are found in small amounts in some fruits and vegetables. This is another good reason to consume these foods. An example of a good food source for flavonols is one cup of kale, which contains 62 milligrams of flavonols.

Another category, anthocyanindins, gives fruits and vegetables their red, blue or purple color and protects the body from free radicals. To get the most benefit from anthocyanindins, it is best to consume fruits and vegetables in their raw or fresh state. One cup of fresh cranberries contain 101 milligrams of anthocyanindins. Cranberry sauce has a much lower amount of anthocyanindins.

To learn more about flavonols and anthocyanindins and the remaining four flavonoids, click on this link http://edis.ifas.ufl.edu/pdffiles/FS/FS24400.pdf

Source: Facts about Flavonoids, EDIS Publication FSHN14-04

by Kristin Jackson | Feb 9, 2015

Photo by: White,T. (N.D.) Identity Theft Protection. Retrieved 9 February 2015 from http://goo.gl/46HkDp

While the commercials about identity theft maybe funny, identity theft is no laughing matter. Identity theft occurs when someone’s personal information is used to access money. According to the national crime and victimization survey it is estimated that identity theft cost Americans approximately twenty-four billion dollars in 2012. In fact, in the time it will take the average person to read this first paragraph, research estimates there will be fourteen new identity theft cases or one victim every two seconds (Javelin Strategy & Research in 2013).

In 2013, the Federal Trade Commission ranked Florida as number one with regard to fraud complaints in the United Sates. The top reason for fraud in Florida was listed as stealing social security numbers to collect phony tax returns or to collect another government benefit. UF IFAS Extension Family & Consumer Sciences has some tips to help you be proactive when it comes to protecting your identity during tax time.

- Choose a reputable tax preparer or consider visiting a Volunteer Income Tax Assistance (VITA) Site.

- Only carry your social security card and tax documents to and from the tax site. When you are not using these documents, put them in a safe place at home.

- Check your credit report frequently. You can obtain one free report from each of the three credit bureaus every 12 months.

Identity theft is no laughing matter. Use the steps above to help protect your personal information. If you believe that you have been a victim of identity theft report incidents to the Federal Trade Commission at 877-738-7338. For more information on identity theft or for help reading your credit report contact your local UF IFAS Extension Family & Consumer Sciences agent.

Additional Resources:

Federal Trade Commission (2008). Building a Better Credit Report

Federal Trade Commission (N.D.). Identity Theft. Retrieved

Gutter, Elemore, Mountain (2015). You and Your Credit: Credit Reports

References:

Fuchs,E. (2013). Identity Theft Now Costs Far More Than All Other Property Crimes Combined. Retrieved 9 February 2015 from http://www.businessinsider.com/bureau-of-justice-statistics-identity-theft-report-2013-12

Frohlich, T. (2014). Top state with the most fraud complaints. Retrieved 9 February 2015 from http://www.usatoday.com/story/money/business/2014/03/08/states-with-most-fraud-complaints/6173855/

Javelin Strategy & Research (2014). 2014 Identity Fraud Report. Retrieved 9 February 2015 from https://www.javelinstrategy.com/uploads/web_brochure/1405.R_2014IdentityFraudReportBrochure.pdf

by Shelley Swenson | Jan 30, 2015

“Oh where does all my money go?”

Do you need help managing your finances so that your family can realize more of their needs and wants? Family members of all ages must learn to communicate and understand what their financial situation is. Open discussions among family members often results in greater cooperation when deciding what the best things upon which to spend. Family members need to understand the difference between a need and a want. Then an open discussion can set priorities for the money available.

Your family may decide to reduce spending so that more needs and wants of each family member can be made. Here are a few suggestions:

- Categorize your expenses in two categories: wants and needs. Make everyone aware of the difference and how important it is to consider each purchase through this categorization. Needs include housing, basic utilities, childcare, etc. Wants could include going out to eat, high fashion, newest electronics, etc. Everyone has to understand that a want purchase can be spaced over time.

- Do not let your impulse determine purchases. Postpone unplanned purchases at least 24 hours so you can rethink your plan.

- Before purchasing an item, ask yourself, “Why?” Many people are now wearing a plastic bracelet that reads “Do I really need this?” It helps them make decisions based on wants and needs.

- Save on food by planning meals with abundant seasonal items and based on supermarket specials. Check the store ads and utilize coupons to buy what is on your list but don’t let the coupon result in your buying items you would not buy without a coupon. Make a list before going to the supermarket and then work your list.

- If you have debts, accelerate repayment. There is little reason to retain savings that earn 3% interest while you still owe installment debts and loans that carry true interest rates of 12%-22%. Yes, everyone needs an emergency fund but after it is secured, repay your loans.

Want additional suggestions on how to cut expenses and save money? Go to www.edis.ifas.ufl.edu and request the bulletin FCS7009.

by Ginny Hinton | Jan 30, 2015

There’s a new law in Florida – and although it’s far from comprehensive, it’s designed to better protect our kids. As of January 1, 2015, Florida law requires that all children riding in vehicles must use a safety seat until their 6th birthday. This means that kids who are 4- or 5-years-old and were previously restrained using just a seat belt must now ride in a car seat or booster seat.

Although much of the publicity about the new law also has reinforced the guideline that children under age 13 are much safer in the back seat, the law itself applies only to children who are not yet six. The law is not a “booster seat” law, because children under age 6 are still safer in a 5-point harness. Once your child is at least 4-years-old, weighs at least 40 pounds, and can sit in position for an entire car trip, you may make the decision to move that child to a booster seat. The fact remains, however, that the child is still much safer in a 5-point harness until he/she reaches the upper height or weight limit of that seat (typically 40-65 pounds). Even though your child may beg to differ, keeping him/her in a harnessed seat longer is one of the best gifts you can offer as a parent!

Want to make sure you’re using the best type of restraint for your child? You can find a nationally certified child passenger safety technician near you at http://cert.safekids.org. Click on “Find a Tech” and search by location.

by Shelley Swenson | Jan 30, 2015

School Lunchtime

(SNAP Education Photo Gallery)

Do you have a child or grandchild who eats meals at school? Do they come home hungry and complain about the meals they are served? Have you taken any time to explain how the lunchroom food choices are made? If not, it may be time to have that conversation.

The 2012 school year brought major changes to the meals children eat at school. The new standards are major components of the Healthy, Hunger-Free Kids Act of 2010 and they were the first major changes to school nutrition in 15 years. You know the statistics….one-third of America’s school-age children are overweight or obese and at higher risk for diabetes, high blood pressure, depression, poor academic performance, and behavioral problems before they reach adulthood. These risks increase for low-income children who do not participate in federally-funded nutrition programs because they have to rely on their family’s limited resources. All of these conditions reflect in the food choices youth are making. The new school lunch meal standards may be the first step in reducing these statistics.

Take some time to remind your children or grandchildren there is a reason they are fed what they are offered in the cafeteria and the staff serves items that are nutritionally balanced and, if eaten, should provide for growth and a sharp attitude in the classroom.

Here are some key points to share. School meals are:

- High in nutrients and adequate in calories

- An appropriate balance between food groups

- Based on the latest nutritional science

- Intended to provide one-fourth of students’ daily calorie needs for breakfast and 1/3 for lunch

- Reflective of the different nutritional requirements for each age

- More nutritious foods because they consist of fruits, vegetables, and whole grains and fewer foods containing sodium and fat

- Providing fat-free milk (unflavored or flavored), 1% low-fat milk (unflavored), or a milk alternative. When did children decide that milk had to be flavored to be tasty? We need to turn this idea around; there is a great deal of sugar in flavored milk!

- Offering students options to eliminate waste

The best way to lessen waste is to not have any of the food thrown away. UF/IFAS programs in many schools (Family Nutrition Program (FNP) and Expanded Food and Nutrition Education Program (EFNEP)) offer food samples of unfamiliar foods and discussions of their value to increase student acceptance. This also is a parent’s job. Look over the school lunch menu, discuss it with your children, encourage them to try everything served, and request second servings if they remain hungry. Offer taste tests at home. Improving the way students view the food being served can make a big difference.

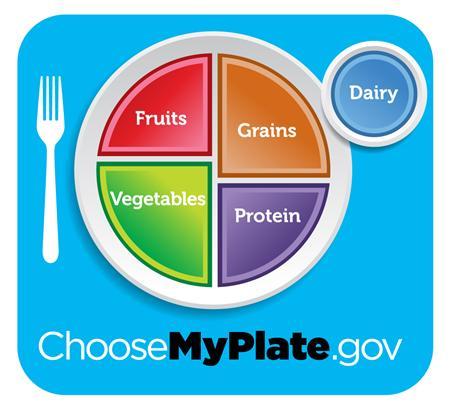

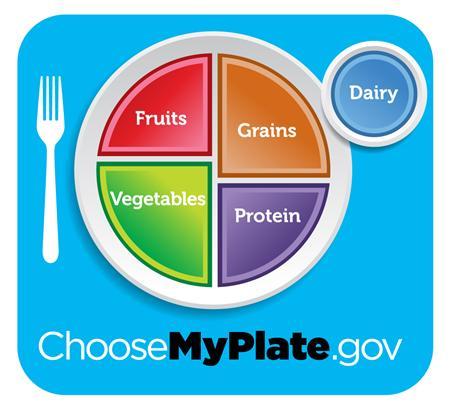

Are you familiar with MyPlate? Your children might be. Review it with them and contact your county Extension office if you need clarification on any aspect of it.

Encourage your children’s nutritional health. Remember, the goal of the changes in the school cafeteria is to improve children’s health; when followed correctly, the new meal standards make school meals healthier with the potential to improve children’s health. As a parent, you share in the responsibility to make this happen. Thanks for assisting us in ensuring the positive nutritional status of our children!!

by Heidi Copeland | Jan 30, 2015

In the early ’70s, Gary Iskowitz was doing graduate work as well as teaching tax law while working for the Internal Revenue Service (IRS). Mr. Iskowitz saw a growing problem with questionable tax preparers who were scamming low-income people in his area. He did not like what he saw! Consequently, he proposed training a few like-minded student volunteers to go into the community to prepare free tax returns for under-served residents.

In the early ’70s, Gary Iskowitz was doing graduate work as well as teaching tax law while working for the Internal Revenue Service (IRS). Mr. Iskowitz saw a growing problem with questionable tax preparers who were scamming low-income people in his area. He did not like what he saw! Consequently, he proposed training a few like-minded student volunteers to go into the community to prepare free tax returns for under-served residents.

The rest, they say, is history! Starting with this volunteer effort, 40 years later, the Volunteer Income Tax Assistance (VITA) Program is still going strong.

VITA still is designed to promote and support free tax preparation service for the under-served in both urban and non-urban locations. Service is targeted to low-to moderate- income individuals, persons with disabilities, the elderly, and limited English-speaking individuals.

Why? Just as in Gary Iskowitz’ time, this program is an effort to provide both a valuable community service and a powerful learning experience for the participants. Not only does a tax payer get their taxes done for free, the local community benefits from the monies spent by the tax payer. Plus, the IRS is pleased because citizens are in compliance with federal law.

Check out your local VITA sites this year. Around North Florida, there are numerous volunteer sites being readied for the 2014 tax year. Some of these sites are traditional, where taxes are done in person; some sites prepare taxes via SKYPE – the telecommunications application software that specializes in providing video chat and voice calls from computers. Using SKYPE as an application to accessing VITA has been well received, especially in rural locations.

If you plan to take advantage of any of the VITA programs this year, be sure to bring the proper documentation. A return cannot be prepared without the appropriate documentation. For a complete list of documentation needed for a VITA-prepared tax return, contact your local VITA tax preparation site. Where are these sites? Call your local helpline 2-1-1 or visit http://irs.treasury.gov/freetaxprep/.