Don Shurley, Cotton Economist, UGA Professor Emeritus

Don Shurley, Cotton Economist, UGA Professor Emeritus

The 2017 cotton market appears to be on increasingly stable and improved economic footing compared to 2016. Prices for the 2017 crop (Dec17 futures) have now (this week) edged above 74 cents and the highest level since early August. Prices are 14 cents per pound higher than last year at this time. Dec16 futures did not get above 70 cents until mid-July. With the move to the 74 cent area, prices have broken out of the previous 4-cent range of mostly 68 to 72 cents. Some producers may have already prices a portion of expected 2017 production at or near the 72-cent area on Dec17 futures. If so, and especially if not, the move to 74 cents provides another opportunity to add to or begin sales. Marketing is about both price and price risk management.

With the move to the 74 cent area, prices have broken out of the previous 4-cent range of mostly 68 to 72 cents. Some producers may have already prices a portion of expected 2017 production at or near the 72-cent area on Dec17 futures. If so, and especially if not, the move to 74 cents provides another opportunity to add to or begin sales. Marketing is about both price and price risk management.

Several factors have been in play to give us the gain in the market we’ve seen. The first has been very good export numbers. This is what actually keyed the breakout above 72 cents the week of February 2nd. Sales have been good and actual shipments, which have lagged behind and been a bit of a concern, have now started to pick up pace.

Last week (Feb 9th), USDA released its monthly supply and demand estimates. As expected, USDA raised 2016 crop year US exports. Exports are now projected to be 12.7 million bales—up 200K bales from the January estimate. As of February 2, sales have totaled 10.4 million bales (480-lb bale equivalent)—82% of the new USDA estimate. Shipments total 5.53 million bales—44% of the estimate.

Big buyers have been Vietnam, China, Mexico, Turkey, Indonesia, and Pakistan. Although China is still limiting imports in an effort to utilize its own stockpile, US 2016 crop year export sales to China total 1.655 million 480-lb bales. Shipments total 957,000 bales. This compares to only 857,000 bales shipped for all of the 2015 crop year.

It has recently been reported that due to higher prices, India cotton producers are delaying sales in expectation of higher prices and this has caused cancellation and delays in export shipments. This may further boost prospects for US exports.

Last week’s USDA report increased World cotton Use for the 2016 crop year by 760,000 bales. This is rather significant because until now, Use has been revised down slightly every month since the October estimate. Demand growth is essential. If realized, this would be only a 1.14% increase from last year but a move in the right direction. The increase in Use is accounted for by increases in India, Bangladesh, and Vietnam.

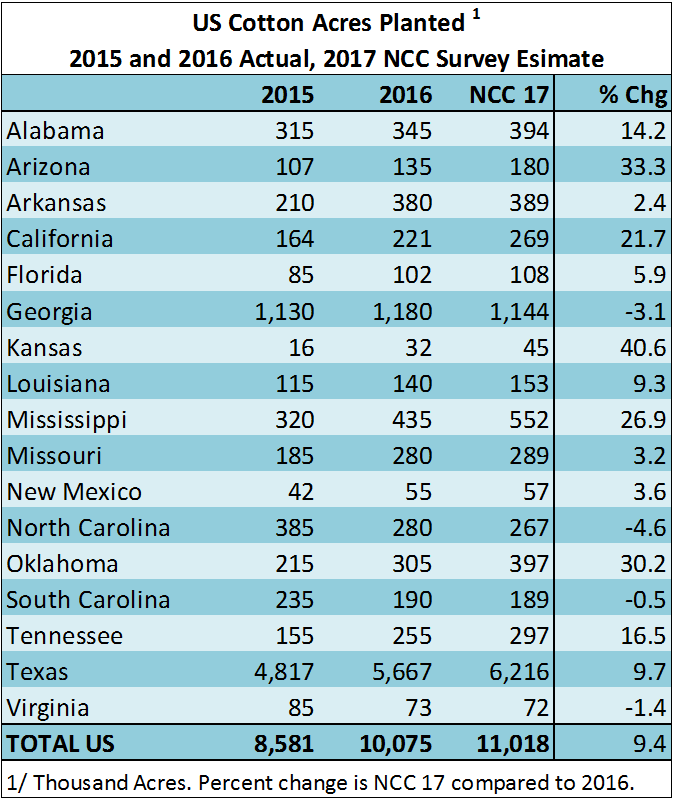

The National Cotton Council (NCC) has released its estimate of US cotton acres to be planted this year. The results are based on a survey conducted mid-December to mid-January. The results estimate that US growers will plant 11.02 million acres this year.  Increases are expected in all but four states. Acres are expected to decline in Georgia, North Carolina, South Carolina, and Virginia where competition from peanuts and soybeans and perhaps corn is expected to decrease cotton planting.

Increases are expected in all but four states. Acres are expected to decline in Georgia, North Carolina, South Carolina, and Virginia where competition from peanuts and soybeans and perhaps corn is expected to decrease cotton planting.

If realized, this would be an increase of 943,000 acres or 9.4%. Texas is expected up almost 10% and acreage in the Mid-South continues to rebound after several years of deep losses to corn and soybeans. California acreage is expected up—thought due to improved drought conditions.

Using an “Olympic Average” abandonment and yield for the last 5 years (dropping the high and low and averaging the remaining 3 years), this acreage planted would project a crop of 16.4 million bales compared to 16.96 million bales this year. As always, abandonment will be key. For both 2015 and 2016 crops, abandonment was less than 6%.

The NCC estimate of 11 million acres was on the north side of most pre-report expectations. But, prices have held—likely based on positives such as exports and Use. USDA’s Prospective Plantings report will be released March 31st. If cotton prices remain in the 72 to 74 cent range or higher, the USDA number may top the NCC number.

Actual US acreage and production, US exports, Use, and another round of Chinese government reserve sales will be key to which direction prices go from here.

- Northwest Florida Beef Cattle Conference & Trade Show – February 11 - December 19, 2025

- Friday Feature:The Sears Catalog –How Rural America Shopped before the Internet - December 19, 2025

- November 2025 Weather Summary & Winter Outlook - December 5, 2025