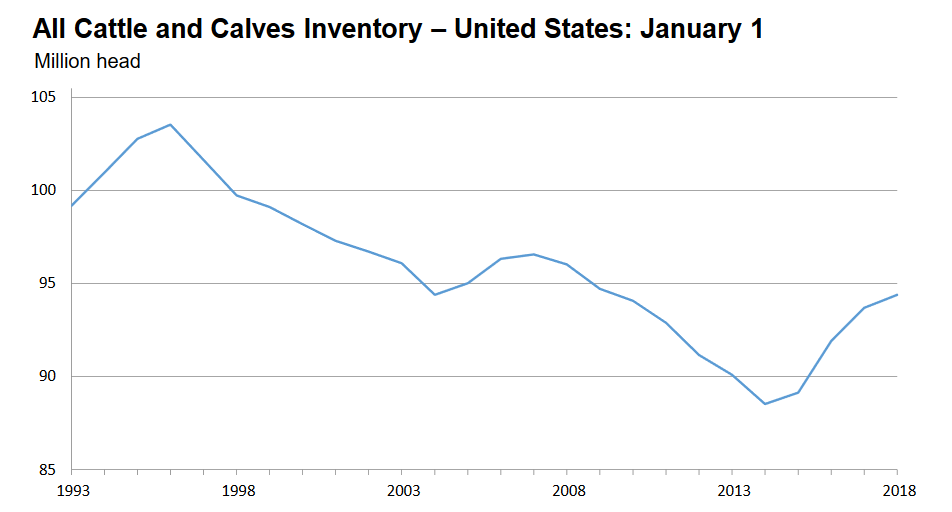

January All Cattle Inventory 1993-2018. Cattle (January 2018) USDA National Agricultural Statistic Service – ISSN: 1948-9099

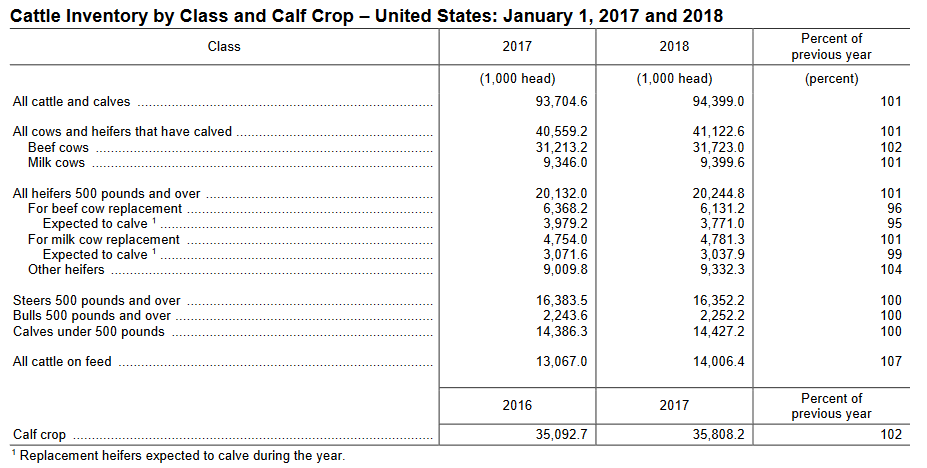

On January 31, 2018 the USDA’s National Agricultural Statistics Service (NASS) released their annual January 1 Cattle Inventory Report. The total U.S. cattle inventory was estimated to be 94.4 million head, which was a 1% increase as compared to 93.7 million on January 1, 2017. Since January 1, 2014 the total cattle inventory has risen from 87.7 million to 94.4 million head, a 7% increase. The U.S. beef cow herd increased to 41.1 million head, up 2% last year, and the dairy herd increased 1%, up to 31.7 million head.

Source: NASS Cattle January 2018

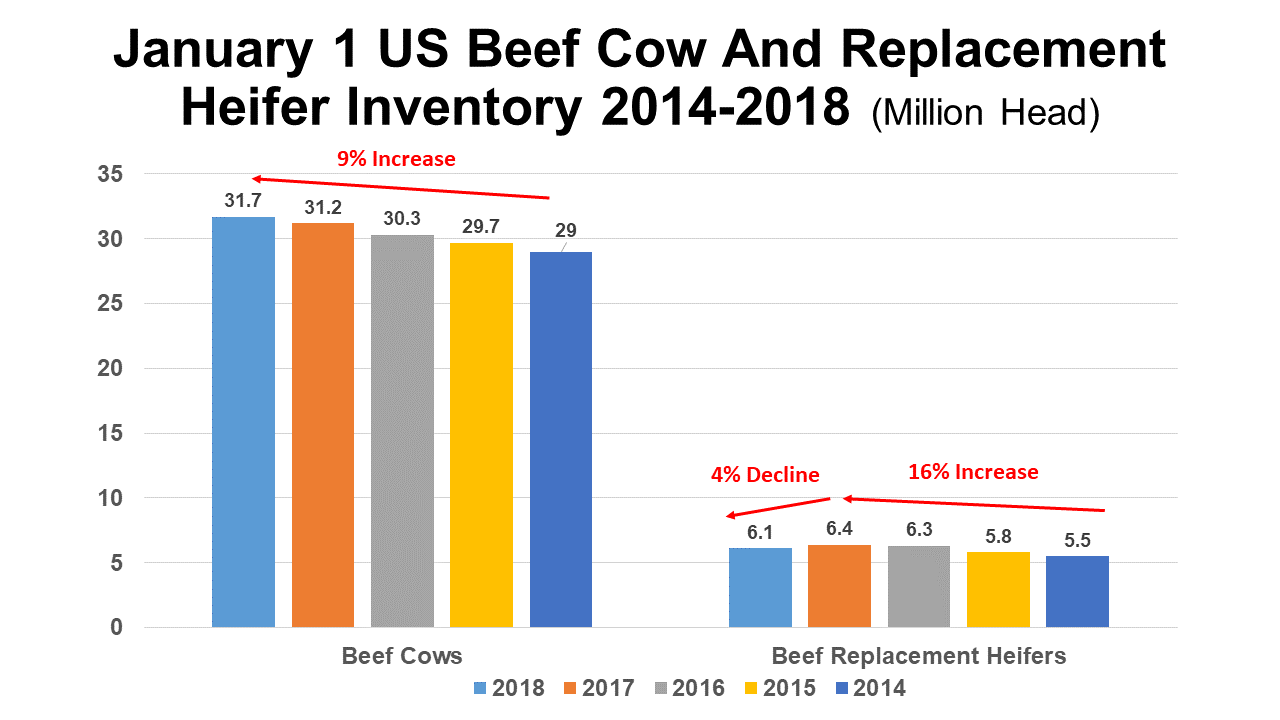

While the total number of cattle in the U.S. has steadily increased, there were some classes of cattle that declined in 2017. This may be a signal that expansion has peaked? Beef replacement heifers declined 4%, and two year old beef heifers that are expected to calve in 2018 declined 5%. Dairy replacements grew 1%, while bred dairy heifers declined 1%. Since 2014 the U.S. beef cow herd has increased 9%, but 2017 was the first year since 2014 with a reduction in the number of replacement heifers being added to the U.S. herd.

Since 2014 the U.S. beef cow herd has increased 9%, but 2017 was the first year since 2014 with a reduction in the number of replacement heifers being added to the U.S. herd. Source: NASS Cattle January 2018

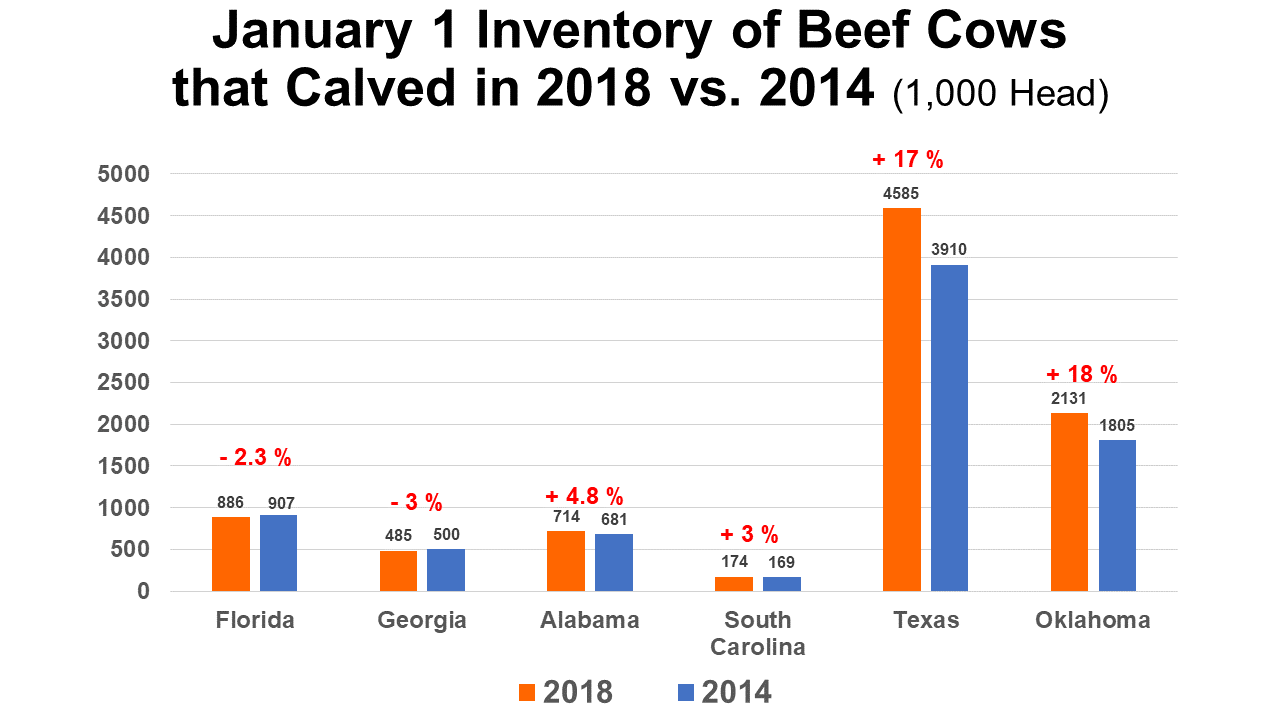

Much of this increase in national inventory has not taken place in the Southeast, however. The chart below compares beef herd expansion in five Southeastern states to expansion in Texas and Oklahoma. Only Alabama has seen significant beef herd increase over the past four years. Much of the herd expansion in other parts of the country relates to long-term weather condition improvement.

So What?

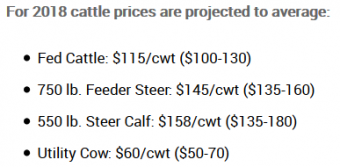

Why is there so much focus and discussion about U.S. cattle herd expansion? It is the old economic principles of supply and demand. Typically as supply increases market prices fall. Last year was somewhat unique in that cattle prices actually improved later in the year, even though there were more cattle to sell. The basic reason was the export and domestic demand improved as the economy improved. As supply continues to increase, many experts are predicting lower returns for cow-calf producers with each increase in supply. Randy Bloch, Cattle Fax CEO recently shared his best estimates for 2018 at the NCBA Convention in Phoenix, Arizona. CattleFax expects the national average price for a 550 pound weaned steer in 2018 to be $1.58 per pound with a range of $1.80 this spring to a low of $1.35 this fall. Remember that Southeastern cattle are discounted due to freight going west, so these predictions don’t directly relate to local prices. He also said, “2018 will be the largest beef production year in our history. That will build as we go into the end of the decade.” As supply increases, prices will adjust, unless there is an equal increase in domestic or export demand.

The Bottom Line

Cow-calf ranchers will need to find ways to reduce costs and be even more efficient in the years ahead to remain profitable. As the U.S cattle herd continues to expand, market prices will continue to fall, unless demand increases significantly. Eventually these lower prices will force herd liquidation, but it may take a while. Expansion appears to be slowing down, but the herd is still very large compared to four years ago.

So as a cow-calf rancher what should you do to fine-tune your management? This is the exact focus of the Northwest Florida Beef Conference & Trade Show that was held on Wednesday, February 14, 2018 in Marianna. Five experts shared ideas to make suggestions on how cow-calf ranchers can reduce costs or improve the efficiency of their operations. For more information, use the following link:

Highlights, Presentations, and Decision Aids from the 2018 Northwest Florida Beef Conference

Sources used for the information in this article include:

SSN: 1948-9099 USDA Cattle January 2018

Highlights from CattleFax’s 2018 Outlook Seminar

- Making the Most of High Cattle Prices – Grow More of Your Own Feed - July 18, 2025

- Friday Feature:1960 Corn Farmer - July 18, 2025

- June 2025 Weather Summary and Three-Month Outlook - July 11, 2025