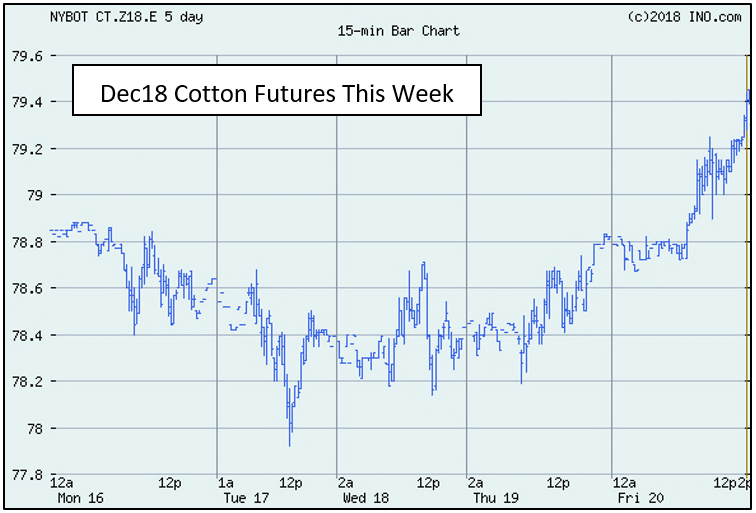

Eighty-cent cotton is within sight. Prices (December futures) trended down last week, but rebounded on Thursday and Friday—closing at 79.43 cents. December 2018 futures broke 79 cents for the first time, and gained 52 points for the week.

Eighty-cent cotton is within sight. Prices (December futures) trended down last week, but rebounded on Thursday and Friday—closing at 79.43 cents. December 2018 futures broke 79 cents for the first time, and gained 52 points for the week.

Some producers began and priced some of their expected 2018 production between 72 and 75 cents. Others waited or added more at 75 to 78 cents. Now, here we are within a chip shot of 80 cents. This will be an opportunity to add further to previous sales or make it your first opportunity. It’s all good.

Some producers began and priced some of their expected 2018 production between 72 and 75 cents. Others waited or added more at 75 to 78 cents. Now, here we are within a chip shot of 80 cents. This will be an opportunity to add further to previous sales or make it your first opportunity. It’s all good.

USDA released its April crop production and supply and demand numbers earlier this week. The highlights include:

- As expected, projected US exports for the 2017 crop year were increased 200,000 bales to 15 million bales. There were no other changes from the March estimates; ending stocks were lowered by 200,000.

- A 900,000 bale reduction in beginning stocks for the 2017 crop year due to revisions from prior years

- A net 240,000 bale increase in 2017/18 marketing year World production, including a 700,000 bale increase in the Brazil crop. All other major producing countries were unchanged from the March estimate.

- A 400,000 bale reduction in expected World use, with 300,000 of this in India.

- This 300,000 bale reduction in use for India was offset by an equal increase in exports. Exports for Australia were increased 200,000 bales.

- No changes in China from the March report.

- Imports for Vietnam were increased 100,000 bales, Pakistan increased 200,000, and Indonesia reduced 100,000 bales.

Exports continue to do well, although the latest weekly report showed a slowing of shipments. For the 7-day period ending April 12, sales were 304,000 bales. This compares to 185,700 bales for the prior week, and 311,775 bales average for the prior 4 weeks. Shipments were 342,400 compared to 527,500 bales for the prior week, and 486,950 bales for the prior 4 weeks.

Cumulative sales for the 2017 crop marketing year are 16.4 million bales, as of April 12. Shipments total 9.5 million bales—63% of USDA’s projection of 15 million for the marketing year ending July 30. With a little over 15 weeks remaining in the marketing year, shipments need to average about 360,000 bales per week to reach USDA’s projection.

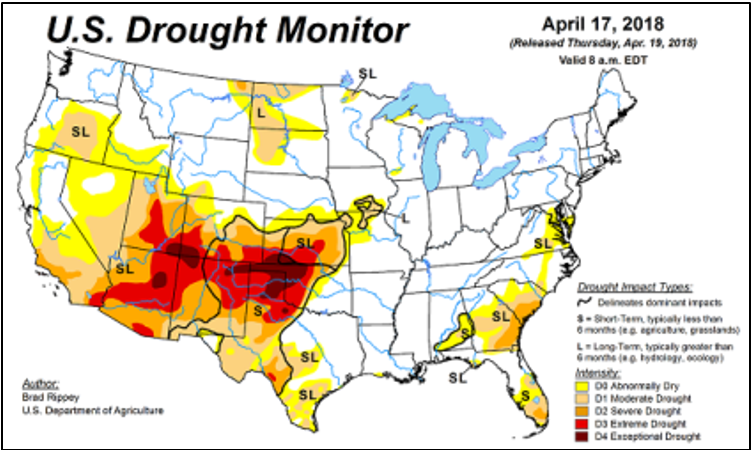

Drought conditions continue on the Texas Plains, and conditions are getting dry across some areas of the Southeast. Rainfall is expected in both areas over the weekend, but may be light and not enough to change conditions measurably.

US growers are expected to plant 13.5 million acres this year—up 7% from last year and acreage could end even higher. For the moment, the market is focused on good exports, World use, and a wait-and-see attitude on the increased acreage, due to the uncertain situation in Texas.

US growers are expected to plant 13.5 million acres this year—up 7% from last year and acreage could end even higher. For the moment, the market is focused on good exports, World use, and a wait-and-see attitude on the increased acreage, due to the uncertain situation in Texas.

The move this week should add to support at 77-78 cents. The 400,000 bale decline in use is a little concerning, but such a revision was also made a couple of months ago, only to be followed by a revision back up. But this is worth keeping an eye on. Price depends on crop condition, exports, and demand.

—

—

donshur@uga.edu

229-386-3512 or 229-386-7275

www.facebook.com/don.shurley.5

- June 2025 Weather Summary and Three-Month Outlook - July 11, 2025

- Friday Feature:Pipeline Farming Accident - July 11, 2025

- May 2025 Weather Summary and Summer Outlook - June 20, 2025