A report summary from the USDA Economic Research Service, James M. MacDonald, Robert A. Hoppe, and Doris Newton

What Is the Issue?

What Did the Study Find?

- Farm production has continued to shift to larger farms. By 2015, 51 percent of the value of U.S. farm production came from farms with at least $1 million in sales, compared to 31 percent in 1991 (adjusted for price changes).

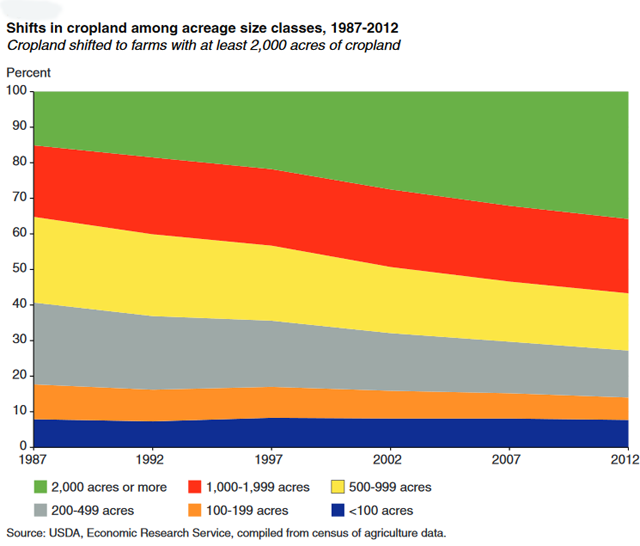

- Consistent with the shift in the value of production, cropland acreage has also concentrated into fewer, but larger, farms. By 2012, 36 percent of all cropland was on farms with at least 2,000 acres of cropland, up from 15 percent in 1987. The midpoint for cropland acreage, at which half of all cropland is on larger farms and half is on smaller farms, nearly doubled from 650 acres in 1987 to 1,201 acres in 2012.

- Consolidation in crop production has been persistent, increasing in each 5-year Census of Agriculture between 1982 and 2012. It has also been widespread across crops, with midpoint values for harvested acreage increasing in 53 of the 55 field, vegetable, melon, fruit, tree nut, and berry crops reviewed.

- In contrast to crops, consolidation in livestock appears to be episodic, with little change over some periods, interspersed with dramatic changes in farm/industry organization and farm size. Such dramatic shifts have occurred in the last 25 years in U.S. dairy, egg, hog, and turkey production; consolidation has continued to occur in broiler and fed cattle production, within an industry organization that was set in earlier decades.

- Bucking the general trend of consolidation in agriculture, cattle cow-calf operations exhibit little consolidation. On a related note, 44 percent of pasture and grazing land (primarily used for cattle) was on ranches with at least 10,000 acres in 2012, down from 51 percent in 1987. These sectors are important because permanent pasture and grazing land accounts for over 400 million acres (45percent) of U.S. farmland, and because over 700,000 U.S. farms have beef cows.

- The long-term shifts toward agricultural consolidation have occurred in tandem with a shift toward greater farm specialization. While few farms specialize in a single crop, field crop operations increasingly grow just 2 or 3 crops, versus 4-6 crops previously. Livestock production continues to shift toward farms that produce no crops, and instead rely on purchased feed.

- The pace of farm consolidation appears to have slowed after 2007. In livestock, only dairy shows continued rapid consolidation. In field crops and in vegetable/melon crops, land continued to consolidate onto larger farms after 2007, but at a slower pace than in previous years. However, financial considerations still favor larger operations, as their profits (rates of return on assets) considerably exceed those for smaller operations.

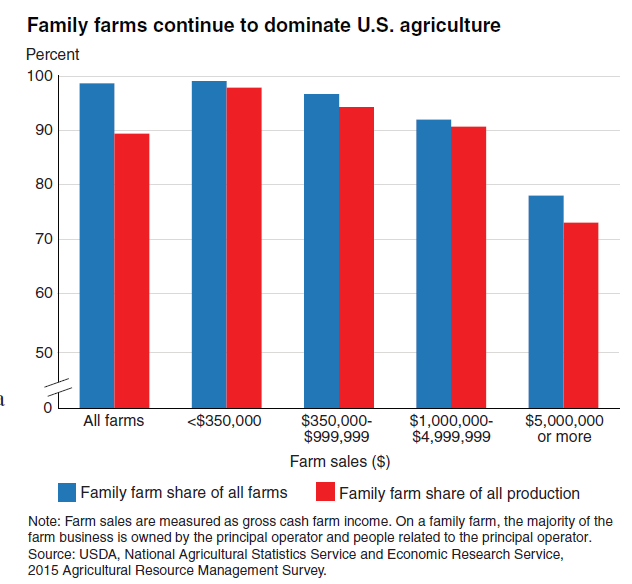

- Despite increased consolidation, most production continues to be carried out on family farms, which are owned and operated by people related to one another by blood or marriage. Family farms accounted for 90 percent of farms with at least $1 million in sales in 2015, and produced 83 percent of production from million-dollar farms.

- Large corporate firms play a coordination role in U.S. farming through the use of contracts, particularly in hog and poultry production. Some firms—for example, in specialty crops, cattle feedlots, poultry, and hogs—operate multiple farms. USDA data track contract production, but do not currently link the farm operations of multi-farm businesses.

How Was the Study Conducted?

The study drew upon data from two primary sources. The Census of Agriculture, conducted by the USDA’s National Agricultural Statistics Service (NASS), provides comprehensive, historical, and publicly available data on consolidation and specialization trends. The study also relied on confidential farm-level census records—accessed in a secure environment to ensure confidentiality—to generate measures of consolidation and farm size for the United States, the 50 States, and major commodities for 1982-2012.

The second primary source of data is the annual Agricultural Resource Management Survey (ARMS), jointly administered by NASS and ERS (Economic Research Service). The ARMS covers U.S. farming operations and their operators in the 48 contiguous States. The survey was used to supplement historic census data on consolidation with more recent annual developments, and to provide data on farm financial performance, business organization, and specialization.

For more detailed information on this topic, use the following link to the full report:

Three Decades of Consolidation in U.S. Agriculture

- May 2025 Weather Summary and Summer Outlook - June 20, 2025

- Friday Feature:The History of Angus Cattle - June 20, 2025

- Friday Feature:High Quality Legume Hay Production – Virtual Tour of Conrad Farms - June 6, 2025