The climate for marketing feeder calves over the last decade has been nothing short of breath taking. The amount of economic information that is available and must be taken into account on a daily basis can be simply overwhelming.

I think it is safe to say that when looking back over the past ten years there has been significant volatility. That we can all agree on. Volatility can be both good and bad. Very bad in some cases and very good in others. There have been times of significant price increases, such as the five-year bull run from January 2010 to the summer of 2015, the recoveries that occurred from October 2016 through 2017, and April 2020 through August 2020. There have also been downward price swings like the summer of 2012, the second half disasters of 2015 and 2016, and the pandemic price collapse from January 2020 through early April 2020.

In fact, every year during the last decade there has been at least a $20/cwt. move in the CME Feeder Cattle Futures August Contract. To put this in perspective for Florida cattle producers, that amounts to a minimum price movement of $100/head for a 500 lb. feeder calf.

–

A Tool for Risk Management

One of the most basic, yet crucial, tools for risk management in a cattle operation are knowing and understanding short-term and long-term price projections.

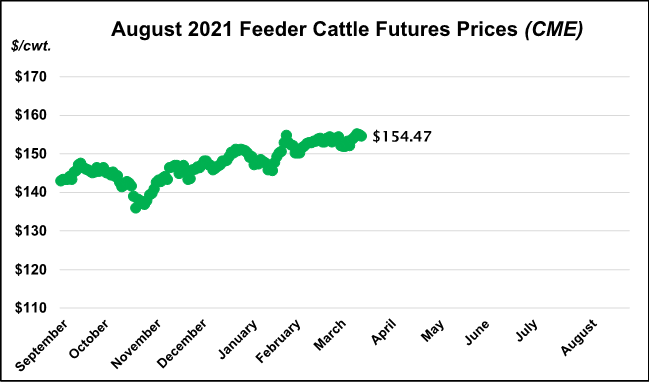

The chart below looks at August CME Feeder Cattle Futures for 2021. In terms of short-term price projections, CME Feeder Cattle Futures provides us with the market’s expectation for an 800-lb. Feeder Steer (Basis: Northern and Southern Plains) at a future date, which in the case of this example, is August 2021.

–

Comparing the future price (CME Feeder Cattle Futures) to the current market price (U.S. Feeder Cattle Price Index) will provide us with the expectation of the market’s price movement in the near-term. To evaluate the current market price the U.S. Feeder Cattle Index Price provided by the USDA’s Agricultural Marketing Service is utilized. It is made up actual sales of feeder cattle via auctions, direct trade, video sales, internet sales within the 12-state region of Colorado, Iowa, Kansas, Missouri, Montana, Nebraska, New Mexico, North Dakota, Oklahoma, South Dakota, Texas, and Wyoming. These prices are a computed 7-day weighted average price and provides a proxy for the current U.S. feeder cattle cash market based on an 800-pound feeder steer.

For March 10, 2021, the August 2021 CME Feeder Cattle Futures Contract price is $154.47/cwt. and the U.S. Feeder Cattle Index Price is $133.85/cwt. The provides producers with the expectation that Feeder Cattle prices between today and the end of August are expected to increase from today’s cash price $133.85/cwt. (basis Northern and Southern Plains) to $154.48/cwt. That’s an improvement of $20.62/cwt., $164.96/head, and $10,310/truckload over the next 5 months. Thus, the current short-term expectation for the feeder cattle market is for improvement.

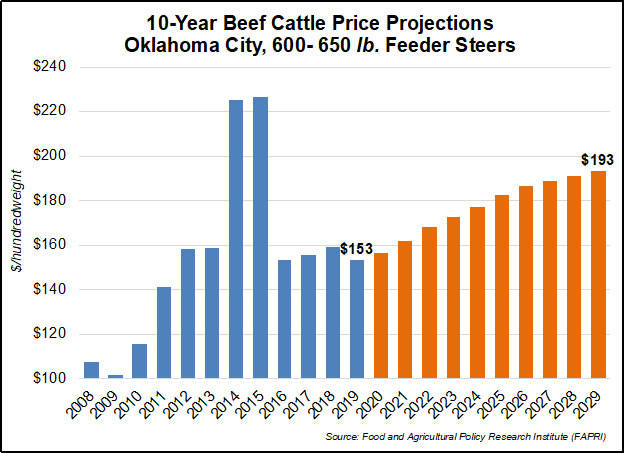

The Food and Agricultural Policy Research Institute (FAPRI) released the chart below in March 2020. It provides long-term price projections for 600-650 lb. Feeder Steers (Oklahoma City, OK) over the next decade.

–

One significant takeaway from this chart is that the long-term trend is higher. Knowing and understanding that prices are poised to move higher, in general, over the next decade provides guidance with which management decisions can be made. With the lows projected to occur during 2019 and 2020 near $153/cwt., these price projections share with us the expectation that 600-650 lb. Feeder Steers (Oklahoma City) are projected to increase to $194/cwt. over the next ten years. This projects a price increase from 2019 to 2029 of $40/cwt., $250/head, or $20,000/truckload.

Looking forward, I would expect market prices to increase, as we move further through the pandemic to greener pastures, and move deeper into the next decade. However, even as market prices continue to move higher annually, given recent history, they will likely also continue to be volatile. With that said, there will continue to be windows for marketing feeder calves near the high-end of the market each year, but will also be times where holding and adding additional weight could be to your advantage. In the short-term, the futures market is predicting an increase in feeder calf prices from now through the end of summer. This suggests a need to hold cattle and add additional weight. Long-term projections are also positive, so this represents an opportunity to keep a few extra replacement heifers with the expectation of higher prices over the next eight years.

- Grazing Stocker Cattle on Warm-Season Annual Forages - August 19, 2022

- Che Trejo wins 2022 UF Top Rancher Challenge at FCA Convention - June 17, 2022

- Marketing Feeder Cattle at 6-Year Highs in 2022 - February 25, 2022