The Hot Topic of Tight Supplies Going into Summer

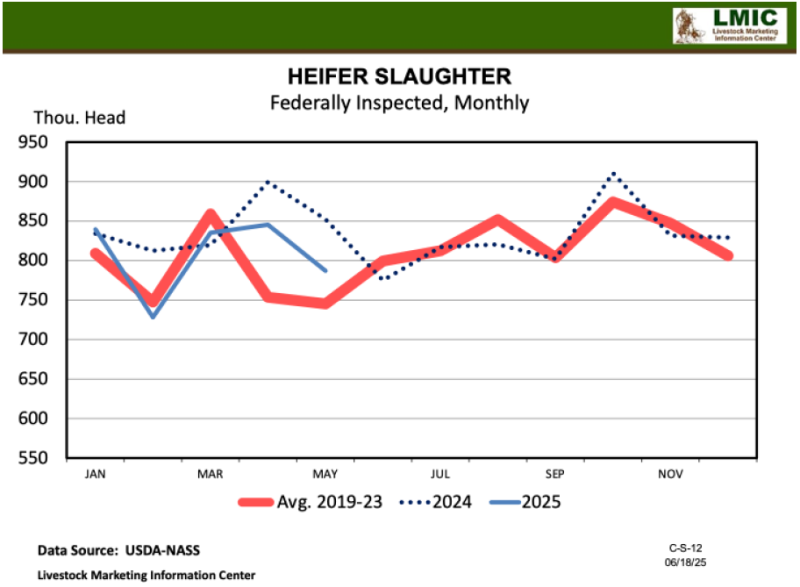

In the first half of 2025, non-fed beef production has been a “hot topic” as we watch for signs of reduced cow culling. Non-fed beef production is down over 13% so far in 2025 compared to 2024. With strong demand for ground beef and tight supplies, average monthly prices for cull cattle are 11 percent higher year over year across the country. Prices for cull cows typically increase going into the summer months due to not as many cows being culled in the spring compared to the fall months. Simultaneously, as we are getting into the heart of grilling season (at the time of this writing), demand for beef products (i.e., hamburgers) will increase, potentially driving beef and cull cow prices higher.

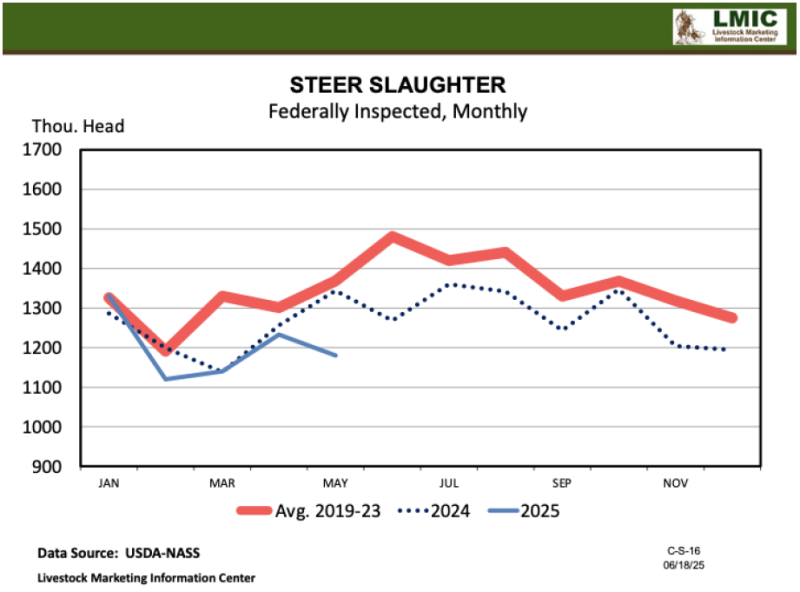

Additionally, fed beef production has recently been declining as well, and will become a ‘hot’ topic in the coming months and over the next year. Tight cattle supplies mean less cattle entering the beef production system. The reproductive limitations of the cow herd (1 calf per year rather than multiple litters from one sow, for example) coupled with slow expansion mean it will be a few years before we start seeing increases in beef production. In the first 5 months of the year, fed beef production declined by 3.9 percent compared to the same period in 2024. Even with average dressed weights being 948 pounds for steers so far in 2025, heavier carcass weights can only mask limited supplies to a certain degree. Beef production is 2 percent below production levels last year and is forecasted to decline by 5 percent in 2026.

On the topic of heavier carcass weights, the percentage of cattle that graded choice in 2024 (72.7 percent) was higher than the 5-year average (2019-2023, 72.4 percent). The average percentage of beef graded choice as of June 26th, 2025, is 72.8 percent. However, the weekly percentage dropped to 70.9 percent in the week of June 21st. The choice-select spread for the week of June 27th was $13.30/cwt, 32 percent below the same week in 2024. This is not to say the quality of the carcasses is declining but is likely more evidence of declining supplies. With declining supplies, prices for feeder cattle are expected to remain favorable, especially since expansion efforts have hardly started. As we approach the fall months when more weaned calves will be entering the market, we may see the seasonal trend of declining prices like we saw in 2023. The severity of prices declining will depend on continuous strong consumer demand for beef and heifer retention efforts this fall.

Questions, contact Hannah at h.baker@ufl.edu

See this update and other helpful resources online at https://rcrec-ona.ifas.ufl.edu/about/directory/staff/hannah-baker/

Written June 2025

- The Economic Influence of Intentional Management of Your Cow Herd - December 19, 2025

- December 2025 Florida Cattle Market Update - December 19, 2025

- October 2025 Florida Cattle Market Update - November 7, 2025