Remembering the Fundamentals Amidst Chaos

The last few weeks of October brought no shortage of headlines for the cattle industry — from concerns over beef prices being “too high” and increasing imports from Argentina. The ongoing government shutdown disrupted market reports and the meeting between Mexico’s Minister of Agriculture and U.S. Secretary Rollins. We have seen repercussions of all of this in the markets, because if there is one thing markets hate, it is uncertainty and talk about trying to “fix” it. However, I want to use this article as a reminder that the fundamentals have not changed: tight supplies, strong demand, and slow expansion efforts.

Widespread drought and high input costs encouraged heavy herd liquidation that started in 2019. This resulted in a short-term increase in beef production as more cattle were being sold into beef production. As of January, the U.S. cattle herd was the smallest it has been since 1951, consisting of 86.7 million head with 27.9 million head of beef cattle. The 2025 calf crop is estimated to be 33.1 million head, the smallest calf crop since 1941, with feeder cattle supplies estimated at 24.5 million head, the smallest in available data.

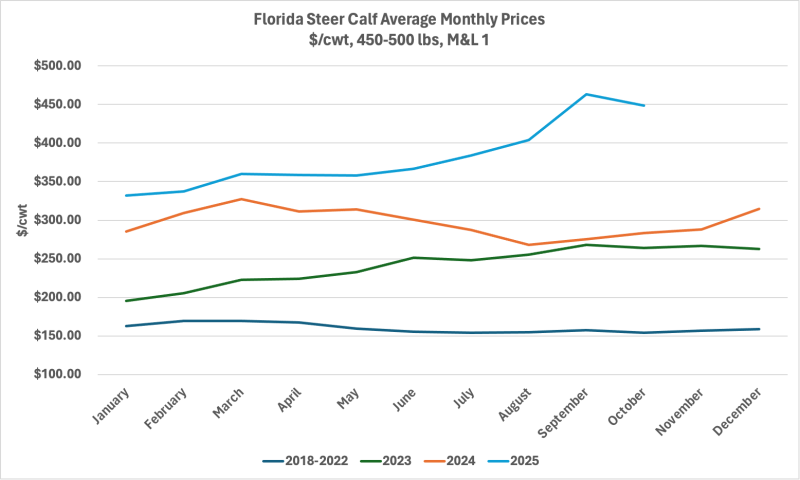

As cattle supplies continued to decrease, beef production followed suit, bringing us to the point we are at today. Strong consumer demand (strongest in over a decade) coupled with low supply results in high cattle and beef prices. As we approach expansion, more heifers will be kept for the breeding herd rather than being sold at weaning, further limiting beef production. Over time, the calves raised by those retained heifers will contribute to increasing beef production. There is heavy emphasis on time. A heifer retained in the fall of 2025 and bred in 2026 will calve in 2027 with that calf entering beef production in 2028-2029. With little signs of heifer retention so far in 2025, this is the earliest we could see increases in beef production. As of July 2025, the percentage of heifers on feed is 38.1%. During the last expansion, this percentage was in the lower 30s.

Also contributing to the decline in beef production, specifically lean trimmings, is the decrease in cow slaughter. Beef cow slaughter has dropped roughly 18% so far in 2025 due to producers both potentially reducing culling and there being hardly anything left to cull after several years of heavy liquidation. While imports have increased due to limited domestic supplies (mostly lean trimmings to meet ground beef demand), increasing imports specifically from Argentina would have little, if any, effect on beef prices. Even if Argentina could meet the raised 80,000 mt tariff-rate quota (unlikely), that amount of beef would still be less than 1% of total U.S. disappearance (consumption).

Beef production, while expected to continue declining, has been larger than anticipated due to heavier carcass weights. The average dressed weight for a steer so far in 2025 is 945 pounds. Beef production in 2024 reached 27 billion pounds, a less than 1% decrease from 2023. However, heavier carcass weights can only mask tight supplies for so long. Beef production for 2025 is estimated to decline by 4%. Due to bigger cattle and heavier carcass weights, we may not rebuild to the herd numbers we were previously at, but expansion will still happen and will be driven by higher prices, future profitability, and forage availability.

The takeaway here is that the answer to “lowering beef prices” is higher cattle prices. Eventually, high prices will incentivize rebuilding, meaning fewer heifers entering the market, resulting in peak cattle prices. As cattle numbers increase, beef production will increase, and cattle and beef prices will decrease. Supply and demand 101. The reality of consumers balking at the meat counter is still a real concern that could influence beef and cattle prices, but so far, that has not been the case. These last few weeks have been an important reminder of two things: the importance of risk management in a highly volatile market, and the dynamics of how cattle cycles and markets work.

–

Questions, contact Hannah at h.baker@ufl.edu

See this update and other helpful resources online at https://rcrec-ona.ifas.ufl.edu/about/directory/staff/hannah-baker/

- The Economic Influence of Intentional Management of Your Cow Herd - December 19, 2025

- December 2025 Florida Cattle Market Update - December 19, 2025

- October 2025 Florida Cattle Market Update - November 7, 2025