The purpose of this report is to provide “across-the-board” information about the beef cattle industry as we head into 2026. Throughout the year, monthly reports will be published highlighting certain sections based on what is happening at that time of year. The annual report tells the whole story of how inventory levels, prices, cattle on feed, and other segments are all intertwined and how they affect the Florida producer.

–

INVENTORY

–

National

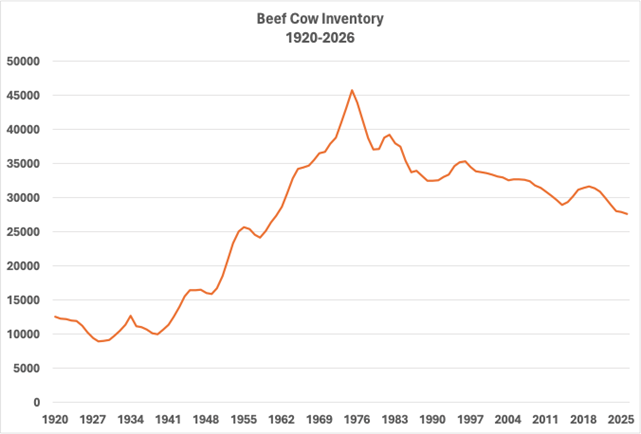

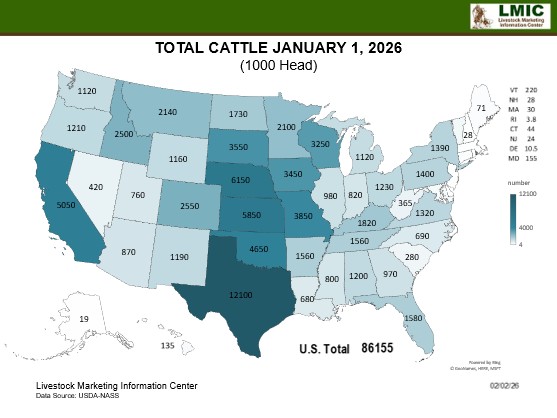

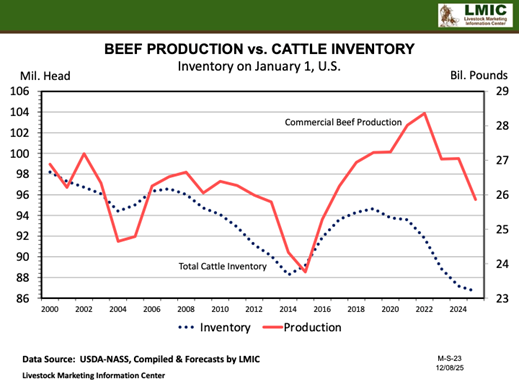

On January 30th, 2026, the USDA released the Cattle Inventory Report. All cattle and calves in the U.S. totaled at 86.2 million head, 0.4 percent below 2025’s January inventory. The U.S. cattle inventory has declined by 9 percent (8.5 million head) since the last cyclical peak in 2019, and is the smallest inventory of cattle in the U.S. since 1951 (75 years). 2026 will mark year 12 in the current cycle and could possibly be the bottom. But we will not know for sure if we are finished contracting until the January 2027 Inventory report.

On January 30th, 2026, the USDA released the Cattle Inventory Report. All cattle and calves in the U.S. totaled at 86.2 million head, 0.4 percent below 2025’s January inventory. The U.S. cattle inventory has declined by 9 percent (8.5 million head) since the last cyclical peak in 2019, and is the smallest inventory of cattle in the U.S. since 1951 (75 years). 2026 will mark year 12 in the current cycle and could possibly be the bottom. But we will not know for sure if we are finished contracting until the January 2027 Inventory report.

The national beef cow herd totaled at 27.6 million head, down 1 percent from 2025. This decline came as a slight surprise considering the sharp decline seen in beef cow slaughter in 2025. Compared to 2014, the beef cow herd in 2026 is smaller by 1.3 million head or 4.7 percent. The beef cow herd has declined by 4 million head since the last peak in 2019 and is the smallest beef cow herd since 1961 (65 years). Dairy cow numbers, however, increased by 187,500 head to bring the 2026 herd to a total of 9.5 million head, the largest dairy herd since 1994.

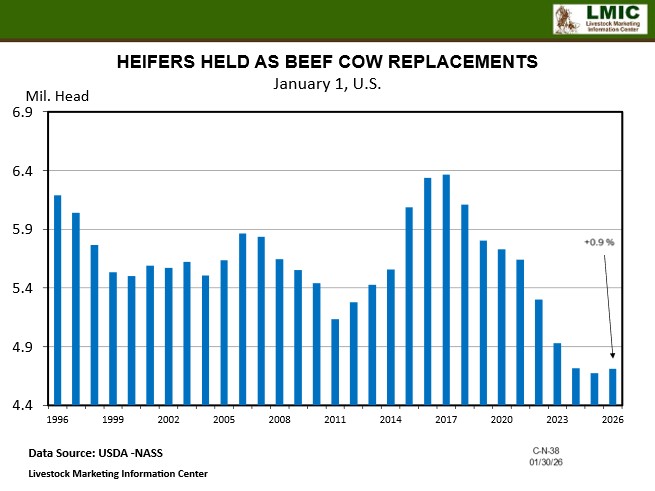

The number of heifers intended for beef cow replacement increased by 0.9 percent year over year to 4.7 million head. The number of heifers expected to calve in 2026 also increased by 1.4 percent. These increases allude to small efforts towards heifer retention, but not a significant shift. These heifers will likely be replacing cull cows in 2026 which paints a picture of stabilization rather than expansion. The calf crop in 2025 was estimated at 32.9 million head, decreasing by 2 percent or 520,900 head from 2024’s calf crop. This is the smallest calf crop since 1941 (85 years) and further confirms tighter supplies heading into 2026.

Florida

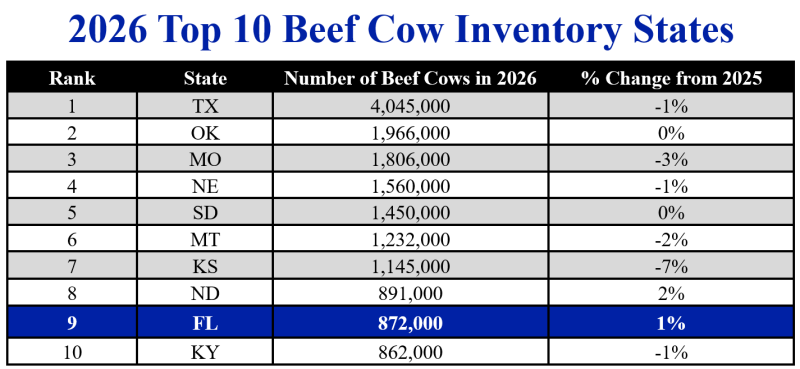

Florida’s beef cow herd is smaller by 47,000 head since the state’s cyclical peak in 2021, and is smaller by 33,000 head compared to the state’s last cyclical low in 2016. However, in 2025 (to start 2026):

- total cattle inventory increased by 20,000 head (1.3%) to 1.58 million head

- beef cow numbers increased by 7,000 head (0.8%) to 872 ,000 head

- dairy cow numbers increased by 3,000 head (3.1%) to 98,000 head

Following a 7,000-head increase in 2025, Florida beef producers appear to be moving towards herd stabilization in 2026. Florida now ranks 9th in beef cow numbers compared to 10th in 2025. The number of heifers intended for beef cow replacements in Florida was unchanged from 2025 at 115,000 head. We did not see an increase in replacement heifers in 2025 from 2024 either, after seeing a 4 percent decline from 2023 to 2024. So again, it appears Florida is moving towards stabilization but is still slow in rebuilding through heifer retention. Florida’s calf crop increased by 1 percent to 780,000 head.

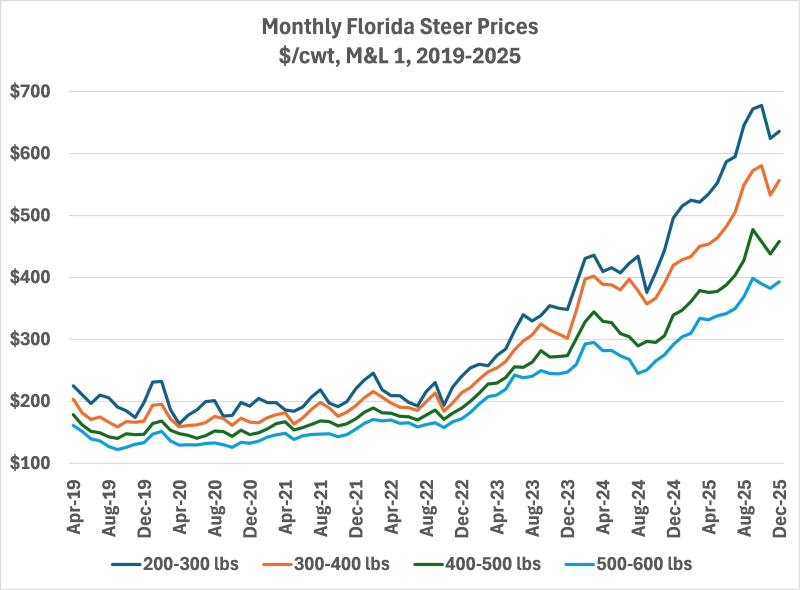

PRICES

As of January 30th, 2026, average prices for 500-545-pound steers in Florida are 54% higher than they were in January of 2025 and 78% higher than January 2024. A series of events starting in October 2025 triggered negative responses from the market, but both the futures and cash markets have since recovered almost fully, while still battling against uncertainty. Prices in 2026 are expected to remain favorable. They may not rise as fast as seen in 2025, but they are expected to continue rising none-the-less as we approach a rebuilding period.

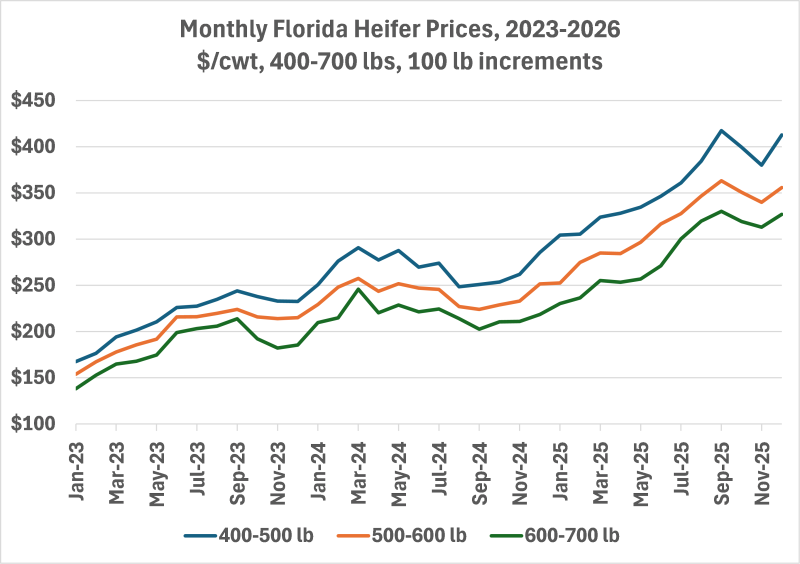

Prices for weaned heifers in Florida (500-545 lbs) are 64% higher than they were in the last week of January 2025 and are 74% higher than January of 2024. The value of young, female cattle will continue rising until we start expanding as more producers start retaining rather than selling heifers, which will decrease the supply of calves being sold. Since the number of heifers intended for beef cow replacement remained unchanged from last year in Florida, it will be interesting to see if 2026 will be the year producers start holding more heifers back. Forage availability, input costs, a heifer’s long-term projected returns, and consumer demand will all be factors that affect this decision.

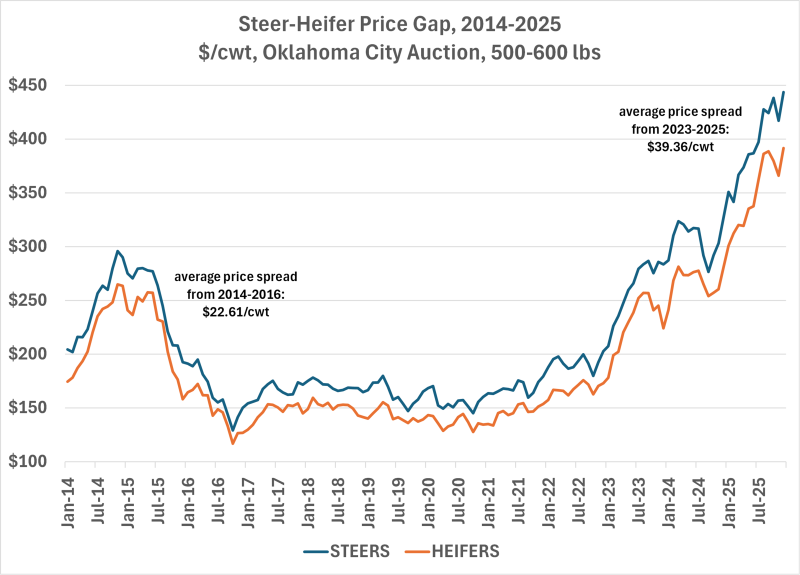

As of now, the steer-heifer spread has not narrowed enough to indicate heifer retention. As less weaned heifers enter the market, their value will increase as buyers will still be looking to fill loads, causing the spread to narrow. Using Oklahoma City prices, (Florida data only available back to 2017), the average steer-heifer price spread from 2014-2016 was $22.61/cwt. From 2023-2025, the price spread was $39.36/cwt. In Florida, the spread the week of January 31st, 2026, was $67.43/cwt between 500-600-pound steers and heifers.

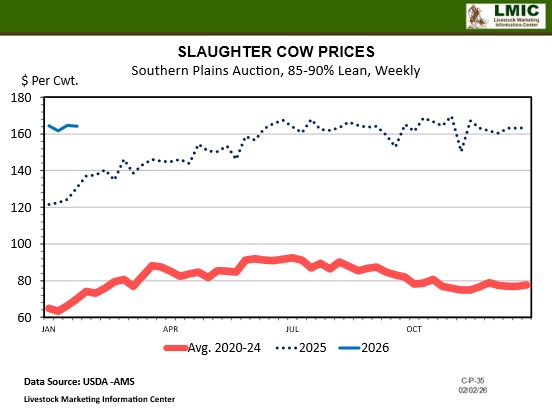

Cull cow prices in Florida have increased by 27% year-over-year, and by 54% since January 2024. With strong demand for ground beef products along with increased fat trimmings from heavier fed cattle carcasses, prices for cull cattle have increased as the need for lean trimmings has increased. We saw a large decline in beef cow slaughter in 2025, likely due to producers wanting one more high-priced calf out of older cows. Additionally, liquidation was so heavy over the last several years that there may not have been much left to cull. Producers will be making the decision this year on if those older cows will be kept for another year or replaced with younger females.

Cull cow prices in Florida have increased by 27% year-over-year, and by 54% since January 2024. With strong demand for ground beef products along with increased fat trimmings from heavier fed cattle carcasses, prices for cull cattle have increased as the need for lean trimmings has increased. We saw a large decline in beef cow slaughter in 2025, likely due to producers wanting one more high-priced calf out of older cows. Additionally, liquidation was so heavy over the last several years that there may not have been much left to cull. Producers will be making the decision this year on if those older cows will be kept for another year or replaced with younger females.

–

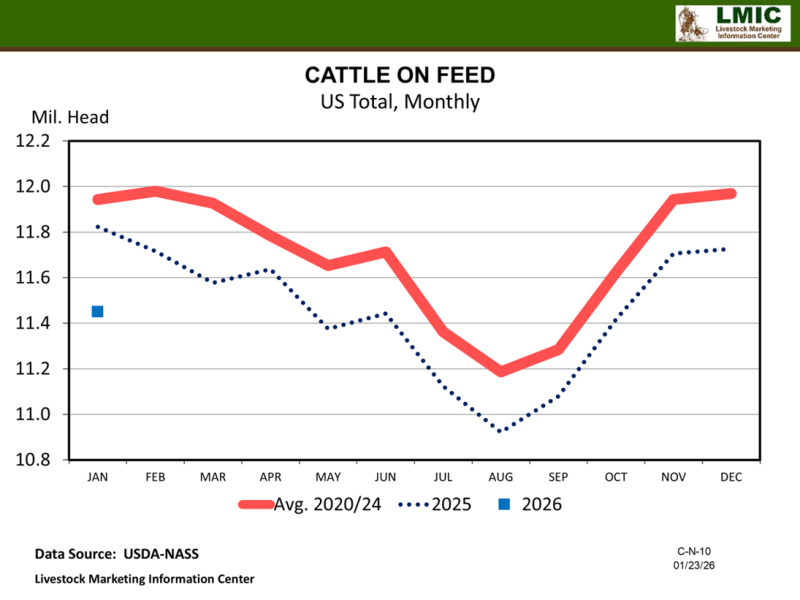

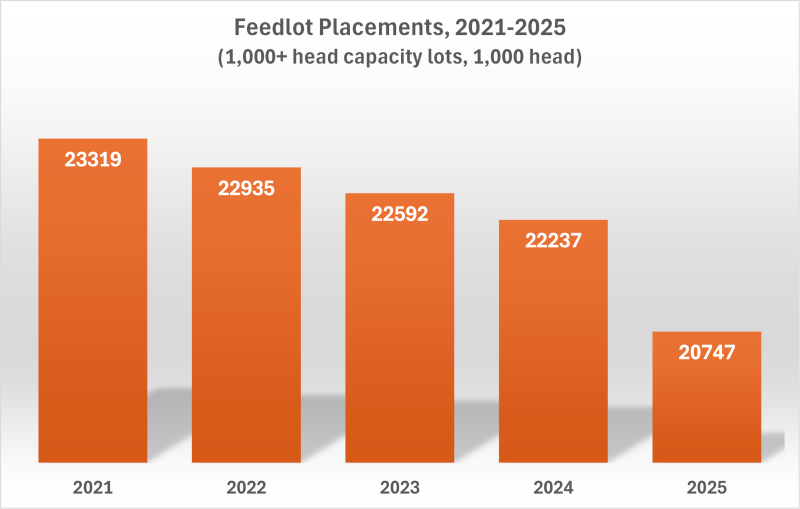

CATTLE ON FEED & CATTLE SLAUGHTER

As of January 1, 2026, the total number of cattle on feed was 13.8 million head, down 3% year over year. A total of 20.7 million head were placed in feedlots in 2025, compared to the 22.2 million placed in 2024. A large contributor to lower placements is due to the closure of the Mexican border. Mexican cattle make up roughly 5% (~1 million head) of placements in the U.S. each year. In 2025, 228,00 head crossed the border. The border closure has certainly influenced already tight supplies (specifically in Southwest feedlots), but domestic supplies are expected to continue tightening.

Domestic cattle placements were down 2.3% (488,000 head) from 2024 to 2025 compared to being down by 12.9% (2.87 million head) from 2014 to 2015. The decline in domestic placements, specifically heifers, is expected to be slower in this cycle as the cost of expanding is higher and forage availability remains a concern. Marketings were also down by 5.4% in 2025. This is due to tight supplies as well but also due to cattle having more days on feed. Corn is still relatively cheap, so the value of gain per day (up to a certain live weight which is roughly 1,463 pounds currently) is higher than cost of gain.

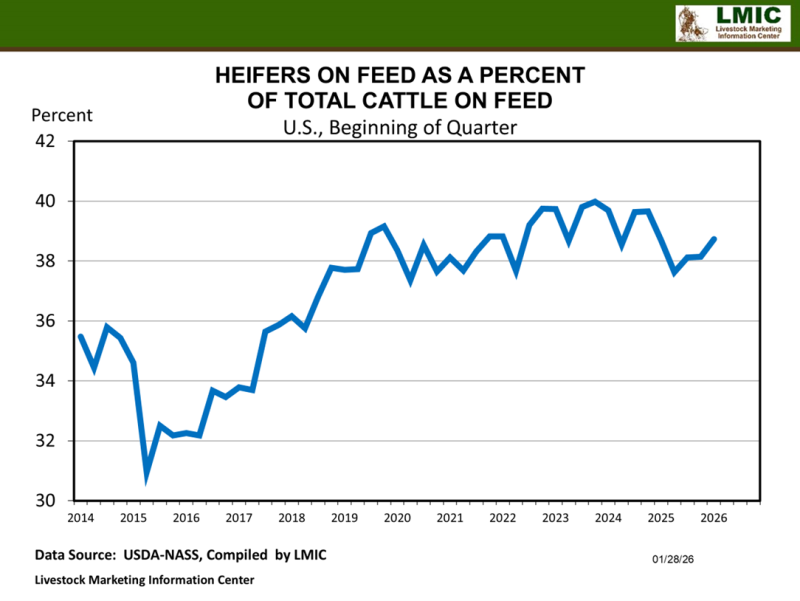

The percentage of heifers on feed as of January 1, 2026, was 38.7%, up 0.6% from October and unchanged from last January. Zero heifers from Mexico were placed in the fall months leading up to January 1, 2026, compared to the 145,585 head of Mexican heifers placed in the fall of 2024, before the closure in December 2024. The takeaway here is that even though the total number of heifers on feed has declined, that can likely be attributed to the lack of heifer placements from Mexico in 2025. The percentage of heifers on feed indicates that domestic heifers are not being largely retained as of now.

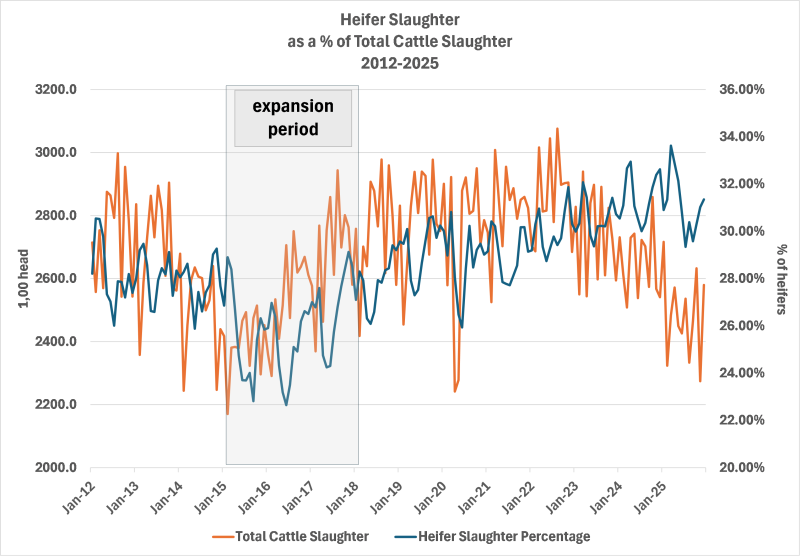

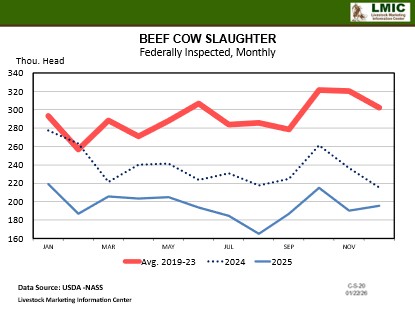

Total cattle slaughter in 2025 was 29.8 million head, down 6.4% (2 million head) from 2024. Beef cow slaughter declined sharply by 18% in 2025. When looking at beef cow slaughter, relative to 2025 beef cow supplies, the culling rate in 2025 dropped to 8.4%, which alludes to movement toward herd expansion. During the last expansion period, the culling rate dropped to below 8%. Additionally, heifer slaughter accounted for 31.1% of all cattle slaughter in 2025 compared to 32% in 2024. During the last expansion, this percentage was in the mid-twenties. While beef cow culling has slowed, the percentage of heifers being harvested will need to drop significantly this year to signal signs of heavy retention.

Total cattle slaughter in 2025 was 29.8 million head, down 6.4% (2 million head) from 2024. Beef cow slaughter declined sharply by 18% in 2025. When looking at beef cow slaughter, relative to 2025 beef cow supplies, the culling rate in 2025 dropped to 8.4%, which alludes to movement toward herd expansion. During the last expansion period, the culling rate dropped to below 8%. Additionally, heifer slaughter accounted for 31.1% of all cattle slaughter in 2025 compared to 32% in 2024. During the last expansion, this percentage was in the mid-twenties. While beef cow culling has slowed, the percentage of heifers being harvested will need to drop significantly this year to signal signs of heavy retention.

–

BEEF PRODUCTION, PRICES & CONSUMER DEMAND

Average dressed weights reached new highs in 2025: 955 pounds for steers (931 in 2024) and 871 pounds for heifers (848 in 2024). Increased weights in 2024 helped to offset the overall decline in cattle slaughter, which resulted in 2024 beef production being slightly higher than 2023. But in 2025, increased weights were not enough to offset the overall decline in supplies. Beef production in 2025 declined by 4% to 26 billion pounds. The forecast for 2026 is another 1% decline, as supplies continue to tighten. A point to make though is that the industry is producing more beef with fewer cattle. Average production from a beef cow in 2025 was 928-pounds compared to 840-pounds in 2014, and 800-lbs in 2000.

Average dressed weights reached new highs in 2025: 955 pounds for steers (931 in 2024) and 871 pounds for heifers (848 in 2024). Increased weights in 2024 helped to offset the overall decline in cattle slaughter, which resulted in 2024 beef production being slightly higher than 2023. But in 2025, increased weights were not enough to offset the overall decline in supplies. Beef production in 2025 declined by 4% to 26 billion pounds. The forecast for 2026 is another 1% decline, as supplies continue to tighten. A point to make though is that the industry is producing more beef with fewer cattle. Average production from a beef cow in 2025 was 928-pounds compared to 840-pounds in 2014, and 800-lbs in 2000.

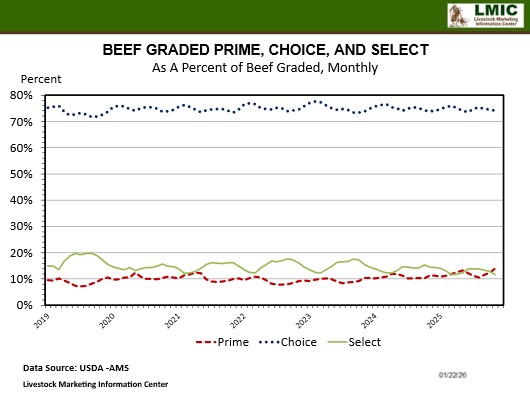

While quantity of beef has declined, quality and price have done the opposite. As of the end of November 2025, beef graded prime increased to 12.03% from 10.86% in 2024 of all beef graded. In 2025, there were four months when the prime percentage was higher than the select percentage which has not historically been the case. Yield grades have also seen some changes with increases year-over-year in 4s (by 1.4%) and 5s (by 1.02%).

While quantity of beef has declined, quality and price have done the opposite. As of the end of November 2025, beef graded prime increased to 12.03% from 10.86% in 2024 of all beef graded. In 2025, there were four months when the prime percentage was higher than the select percentage which has not historically been the case. Yield grades have also seen some changes with increases year-over-year in 4s (by 1.4%) and 5s (by 1.02%).

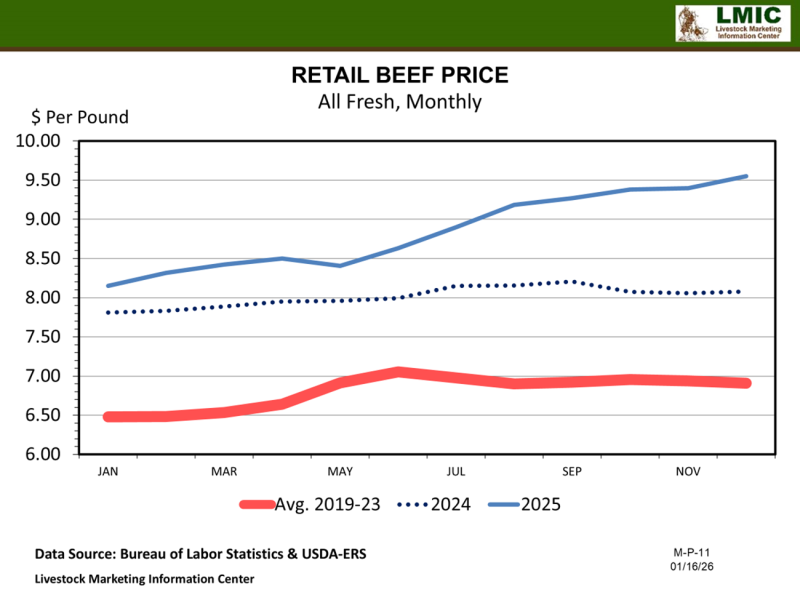

The all-fresh retail price for beef reached $9.55/lb in December 2025 (up 18% year-over-year) and averaged $8.84/lb for the year. Tight supplies are certainly playing a role in beef prices, but the real driver is consumer demand. Consumers are continuously showing their willingness to pay for high-quality beef products, despite rising prices. In every quarter of 2025, consumer demand was higher than the previous year. Overall, demand is higher than it has been in decades for beef products. Strong demand for beef results in strong demand for cattle. Strong demand for cattle coupled with tight supplies results in higher cattle prices. Specifically, ground beef demand (~50% of U.S. consumption) is a strong driver of cull cow prices, as lean trimmings are needed to combine with fat trimmings from fed cattle. Demand for lean trimmings has also played a role in the increase of imports, as U.S. beef imports mainly (not all) consist of lean trimmings from Australia, Brazil, and New Zealand.

MANAGEMENT COSTS & PROFITABILITY OUTLOOK

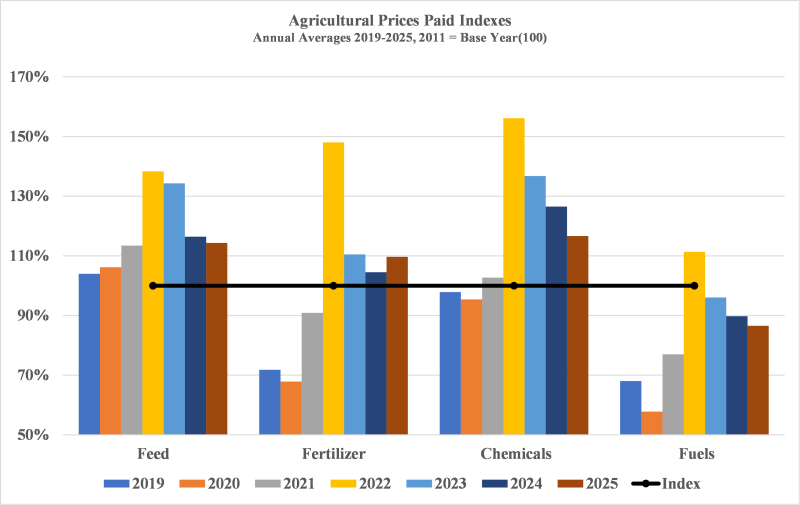

The “Agricultural Prices Paid Indexes” graph shows percentage changes in production costs in the U.S., according to the prices paid by farmers index estimated by USDA. The base year is 2011 (2011=100%). The prices paid index is a measurement of price change over time. For example, the average annual price index for feed in 2025 in the U.S was 114.3, meaning feed prices have increased by 14.3% since 2011. Average prices in 2025 for feed, chemicals, and fuels declined compared to 2024, except for fertilizer which increased by 5.2%. However, overall input prices are still above where they were pre-pandemic and the Russia-Ukraine war that began in 2022.

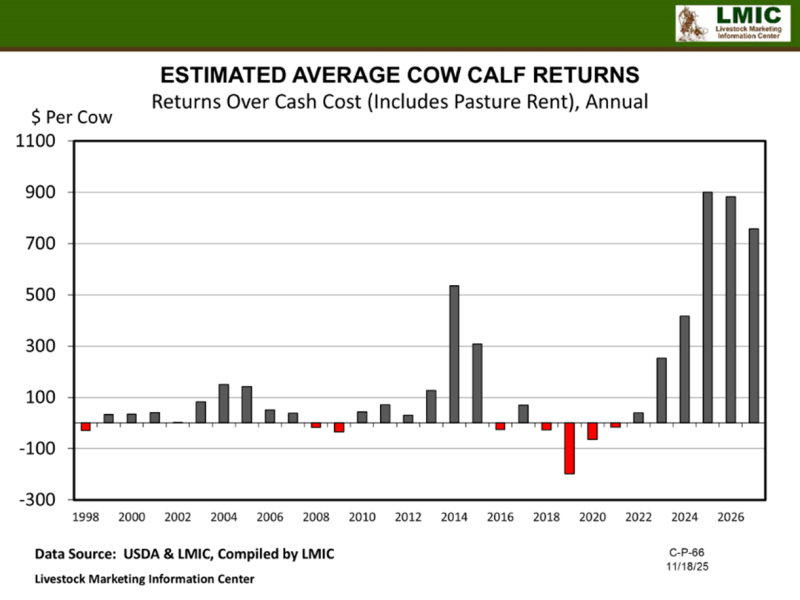

Even with cattle prices at record-levels, high input prices are affecting profit margins. On a national basis, average cow-calf cash costs + land rent were estimated at $1,119 per cow in 2025. Granted, this will likely be closer to the $600-$900 range for Florida and the Southeast. Cash costs do not include fixed costs (depreciation, loan payments, taxes, etc.), so it is always important to factor those costs in as well.

Maintaining accurate records, managing input costs, and marketing cattle efficiently to maximize profitability still remain top priorities even in a high market. It should also be a priority to take advantage of this opportunity to invest in making changes on an operation that may improve future productivity (i.e., purchasing scales, improving nutrition programs, investing in new genetics, etc.). The year 2026 is expected to be another favorable year for cow-calf producers with returns currently estimated at $882 per cow.

–

Questions, contact Hannah at h.baker@ufl.edu

See this update and other helpful resources online at https://rcrec-ona.ifas.ufl.edu/about/directory/staff/hannah-baker/

- Annual Cattle Market Update January 2026 - February 6, 2026

- January 2026 Florida Cattle Market Update - January 30, 2026

- The Economic Influence of Intentional Management of Your Cow Herd - December 19, 2025