The 64-cent area (Dec16 futures prices) seems to be the limit that this market is willing to go at this point. Additional positive market factors could take us to 66 cents—but 64 cents has been tested twice over the past month or so and the market shows no ability, or reason quite yet to push higher.

The 64-cent area (Dec16 futures prices) seems to be the limit that this market is willing to go at this point. Additional positive market factors could take us to 66 cents—but 64 cents has been tested twice over the past month or so and the market shows no ability, or reason quite yet to push higher.

As we are now nearing the end of planting season and looking ahead over the summer months, factors that will impact prices include crop conditions, China’s reserve sales, and global cotton use or demand. For the grower, the challenge will be if and when to take price protection, and if so, how to do it. Just looking at the Dec16 chart, we can see potential for prices to fall to the 56 to 60 cent area under negative outlook scenarios.

As we are now nearing the end of planting season and looking ahead over the summer months, factors that will impact prices include crop conditions, China’s reserve sales, and global cotton use or demand. For the grower, the challenge will be if and when to take price protection, and if so, how to do it. Just looking at the Dec16 chart, we can see potential for prices to fall to the 56 to 60 cent area under negative outlook scenarios.

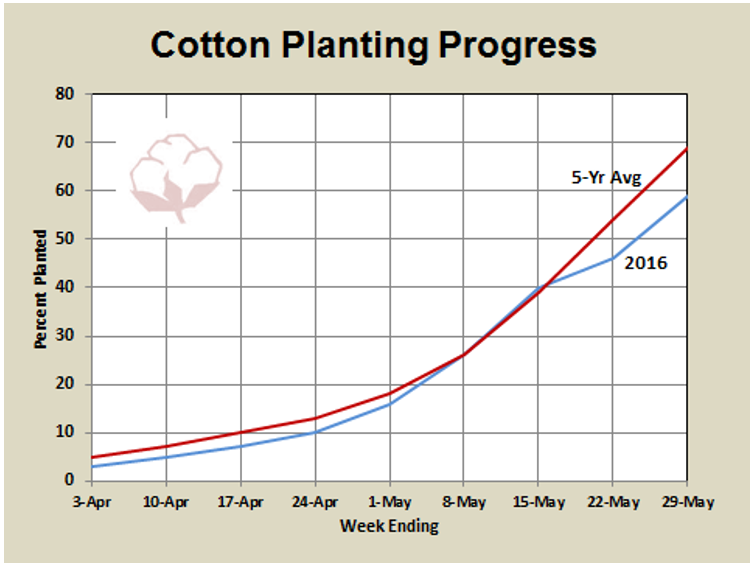

After having caught up, planting is again running behind normal. As of May 29, planting was 10 percentage points behind average for that date. Texas (56% of expected US acres) was 15 points behind normal; North Carolina, South Carolina, and Virginia (6% of expected acres) were an average 13 points behind. Georgia (12% of expected US acres) was just slightly behind normal.

After having caught up, planting is again running behind normal. As of May 29, planting was 10 percentage points behind average for that date. Texas (56% of expected US acres) was 15 points behind normal; North Carolina, South Carolina, and Virginia (6% of expected acres) were an average 13 points behind. Georgia (12% of expected US acres) was just slightly behind normal.

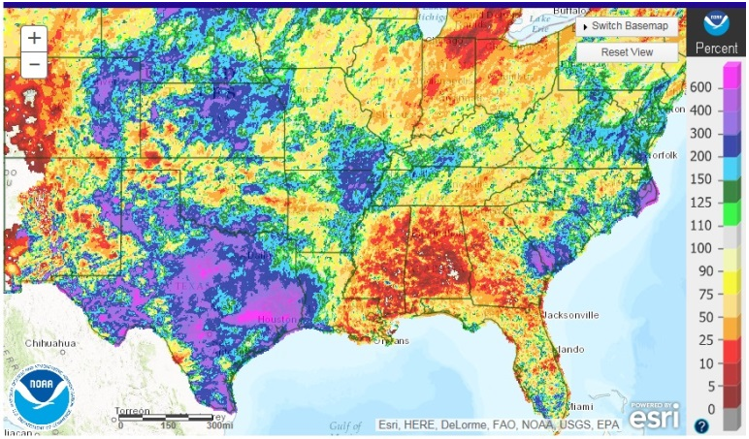

Rainfall over the past two weeks has been well below normal for most of the cotton area in Georgia, Florida, and Alabama; well above normal for the some areas of the Carolinas and Virginia, which has slowed planting but growers are getting caught up; and well above normal for most of Texas which has also slowed planting. A large area of the Mid-South has also been above normal on rainfall, but planting has been on schedule.

Chinas government reserve sales now (as of June 2) total an estimated 2.75 million bales (equivalent 480-lb bales)—30% of the targeted total of 9.3 million bales through August. This consists of approximately 1.3 million bales (47%) imported cotton and 1.45 million bales (53%) of China’s own cotton.

The proportion of sales consisting of imported cotton has declined. This is because the volume of imported cotton offered for sale has dwindled to almost nothing. One report suggests that sales of imported cotton from reserve would be limited to 300,000 metric tons—the equivalent of 1.31 million 480-lb bales. Of the 2.75 million bales sold—74% has been bought by spinners, 24% by “local traders”, and 2% by “international traders”.

As these sales proceed further, if the limit has been reached of imported cotton, sales will be determined in part by the quality of and demand for domestic cotton in reserve and prices will respond accordingly.

William Don Shurley, University of Georgia

229-386-3512 / donshur@uga.edu