Maybe it’s just me, but this year’s USDA Acreage report seems to be on the back burner. Usually there is pre-report speculation on the June number and how it might compare to the March Prospective Plantings number. I’m not seeing or hearing much this year. For what it’s worth, in March US farmers said they intend to plant 9.56 million acres—11.4% above last year, but still the second lowest acreage since 2008. If realized, this would be the lowest 2-year acreage since 2008 and 2009.

Maybe it’s just me, but this year’s USDA Acreage report seems to be on the back burner. Usually there is pre-report speculation on the June number and how it might compare to the March Prospective Plantings number. I’m not seeing or hearing much this year. For what it’s worth, in March US farmers said they intend to plant 9.56 million acres—11.4% above last year, but still the second lowest acreage since 2008. If realized, this would be the lowest 2-year acreage since 2008 and 2009.

During the planting season cotton prices increased 6 to 7 cents/lb, corn was steady to about 10 cents higher, and soybeans were 50 cents to $1 higher. The increase in the price of cotton likely had little impact on possible shifts in acreage—the increase for the most part just traded higher price for less LDP. The increase in soybean price could be a factor, however.

Cotton acreage could be impacted by the revised AWP calculation which effectively lowers the LDP/MLG by 2 cents from what it otherwise would be. LDP/MLG, a strong basis, and quality premiums were significant factors in the profit equation last season. It’s important that prices increase or these things continue to help cotton be profitable and competitive.

USDA’s June crop production and supply and demand estimates were not expected to change much from the May estimates, but there were several things worth noting. These things may come in sharper focus with the July report (the first report based on June acreage numbers) and more important moving forward.

World stocks are projected to decline 7.35 million bales during the 2016 crop marketing year. China stocks are projected to decline 7.6 million bales. That means the important “stocks outside of China” number is expected to increase 250K bales.

But hold on a minute—stocks in the US are projected to increase 700K bales—so, if you take the US out of the “outside of China” picture, that means stocks elsewhere are expected to decline by 450K bales. It seems this could be important and prices could be somewhat sensitive to US production and conditions.

China’s cotton production for 2016 is projected to be the lowest level since 2000. China’s use of cotton in its spinning industry has declined almost one-third since 2009—cotton imports have decreased but yarn imports have increased, and China will increase use it’s stocks.

US exports to China are expected to be remain very low. But this is old news by now; just as significant will be US exports to markets like Vietnam, Bangladesh, Turkey, and Indonesia. China is importing much less yarn so far this year, compared to 2015. This could show up as increased mill use (spinning) for China, and/or reduced imports and use for Vietnam, India, and Pakistan.

By most accounts, China’s sale of government reserve stocks has gone well. Recently, sales have been mostly, if not entirely, domestic cotton. Does this indicate that quality is good? Not necessarily. I suppose if price is low enough, any cotton can find a home. At the end of the 2016 crop year, its projected China will have 55 million bales of stocks—still 25 to 30 million bales above “normal.” It’s uncertain how far China can dig into its stocks and age and fiber quality not become an issue. We’ll see.

For the 2015 crop year, prices were constantly under pressure due to weakening demand. World Use is currently projected at 110.6 million bales for the 2016 crop year—1.4% above last season. While this isn’t much, it’s important that we start to see some stability and growth on the demand side. Keep an eye on this number, if projected use begins to erode that spells trouble.

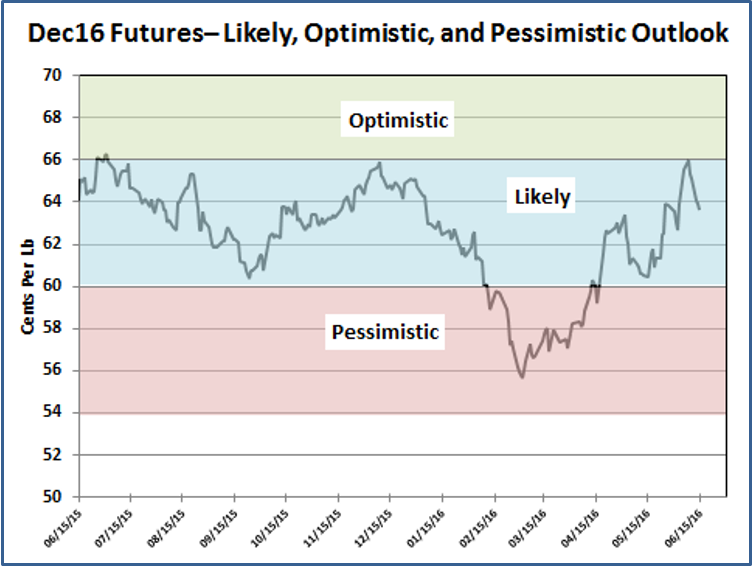

This week’s declines have, for me, solidified that 66 cents seems to be the top for now. Prices are most likely to range from 60 to 66 cents with above 66 possible on optimistic (price positive) news and less than 60 on pessimistic (price negative) news.

Protection on some portion of the crop could be considered at 66 or better. Avoid the pessimistic scenario with a large portion of your crop, but the LDP/MLG will help if prices get to that area.

William Don Shurley, University of Georgia

229-386-3512 / donshur@uga.edu