Don Shurley, UGA Professor Emeritus of Cotton Economics

Don Shurley, UGA Professor Emeritus of Cotton Economics

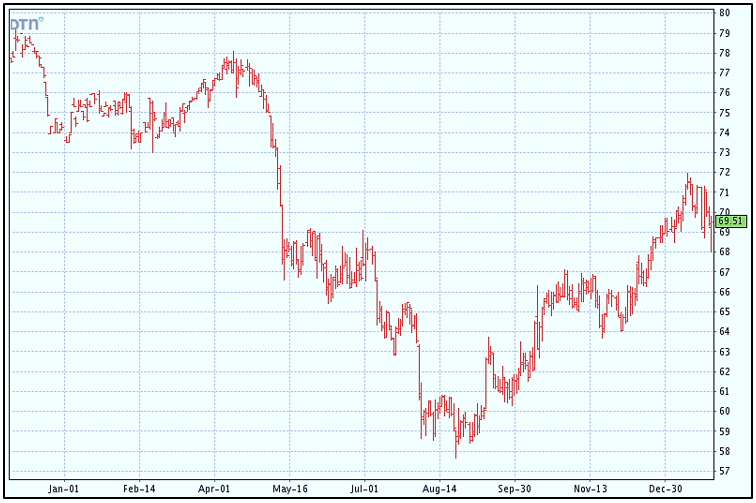

Last winter and spring, cotton futures prices were above 75 cents for most of that time and nearer 80 cents. Some growers took advantage and priced a portion of expected 2019 production. Some growers did not and, hindsight being 20/20, there’s not a grower out there who now doesn’t wish he/she had done more.

From that lofty level, prices fell below 60 cents before finally, and thankfully, beginning to recover in September. The market (now nearby March futures) has made a nice recovery (although sometimes a bumpy one), but we have seen some weakness over the past week.

Old crop futures now hover just below 70 cents, and threaten to move lower. But there is “support” at 69 cents, and lower at 67. The market has some pretty well established “floors” to break through if it’s going to move much lower.

For both the remaining old crop and the coming crop, there’s not a grower out there who doesn’t dream of a chance at 80 cents. We have said repeatedly in this space to set targets and price portions of the remaining old crop on this recovery upward. The 70 to 72 cents area is proving to be one of those targets as suspected.

Recent reports are saying the market is being impacted by the situation with spread of the Wuhan virus. Really? Seriously? Reports also link a decline in agricultural markets in general to the decline in global stock markets. It appears that emotion has run rampant for the time being.

Getting back to reality economics and supply/demand, the market is nervously waiting to see what happens to Chinese purchases of cotton and other commodities under Phase 1. The agreement contained very little, if any specifics. It will take time, but the market will be cautious and wait to see if export numbers or news reports signal any reasons for optimism.

Among other things, the improvement we’ve seen in this market has been fueled by trade deal optimism. Now that we have a Phase 1 in place, we need to see actual prices back up the optimism that has been fueled. The numbers and the amount of time it takes until that occurs will determine which direction this market takes from here.

The most recent report shows strong sales of almost 338,000 bales and shipments at almost 298,000 bales. These are not yet reflective of the Phase 1 agreement.

December 2020 futures are still (barely) holding above 70 cents—after being in the 72 cents area. Most growers are probably hoping for 75 cents or better before beginning to price. We were there for a good while early on for the 2019 crop, so that’s where the sights will be set for 2020. The 73 cents area seems a reasonable place to start with at least some portion of expected 2020 production.

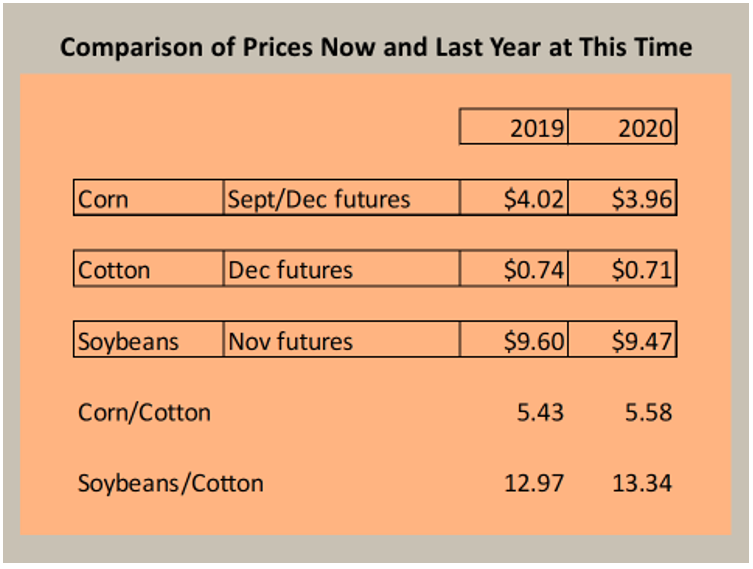

These numbers are a few days old, but show price ratios currently favor corn and soybeans vs. cotton compared to this time last year. Current industry thought is that cotton may lose some ground to corn and soybeans. But, that won’t hold everywhere and lower acreage doesn’t necessarily translate into lower 2020 production.

–