Don Shurley, UGA Professor Emeritus of Cotton Economics

Don Shurley, UGA Professor Emeritus of Cotton Economics

–

The Coronavirus Aid, Relief, and Economic Security Act (CARES) was passed by Congress and signed into law by President Trump on March 27th. This legislation provides over $2 trillion in economic assistance.

On April 17th, USDA Secretary Sonny Perdue announced the Coronavirus Food Assistance Program (CFAP), which includes $19 billion in funding through the CARES program. Of this amount, $3.9 billion will be paid as direct payments to row crop farmers.

The details on how this $3.9 billion is expected to be proportioned among eligible crops, and how these payment amounts will be determined is unknown. It is expected that one payment will be made. This single payment will be for 85% of the price loss from January 1 to April 15, plus 30% of the expected loss from April 15 for the remaining two quarters. Many details are unknown and yet to be worked out, but it was announced that signup could begin in early May, and payments could begin to go out in late May or early June. It was also announced that the limit will be $125,000 per crop and $250,000 per entity.

–

Also as part of CARES, the Farm Service Agency (FSA) announced on April 9th that the Marketing Loan is being extended from 9 months to 12 months. The extension would apply to the crop already in loan with maturity of March 31 or later, and 2019 crop loan yet to be requested, but in loan by May 31.

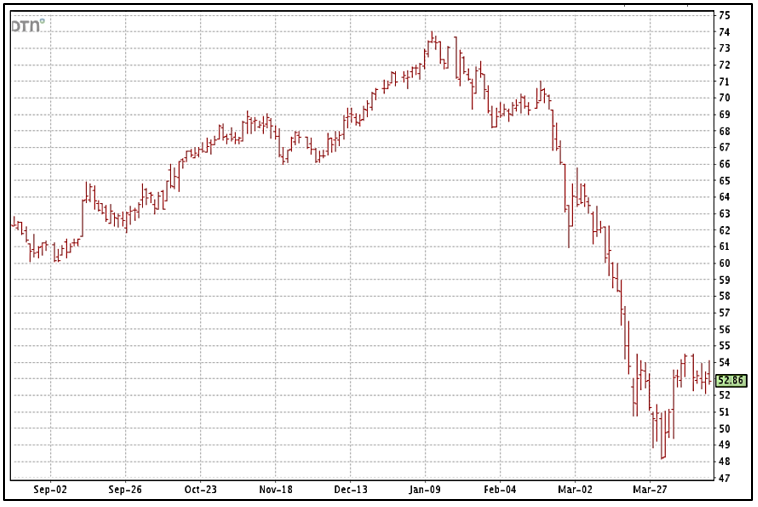

The price of cotton (July futures) has declined from 71.34 cents on January 1 to 52.8 cents on April 15—18.54 cents, down 26%.

The Southeast producer likely has little experience with the Marketing Loan Program. Unlike other parts of the cotton belt, it’s just not the way we handle the business of marketing cotton. Marketing associations are users of the Loan and handle a good portion of production in the Southeast—but the producer has little direct experience.

Most producers have taken the LDP/POP before, even though they perhaps didn’t completely understand the ins and outs of why and how that works. It’s been a while since we had an LDP/POP in effect, but this year’s price decline has created an LDP situation again, and many producers are asking questions about the Loan.

Most situations I’m presented with are that the crop is in storage, but not in Loan. The LDP has not been taken. Because cotton price has improved and stabilized a bit lately, the weekly LDP has been declining. It’s currently 7.22 cents until the close of business on Thursday, April 23rd. This has only added to the producer’s quandary about what to do.

There is no clear path that leads us to the Promised Land. No matter which way you go, each is an uncertain road. Here’s a quick synopsis of how I see your choices from this point forward.

- Do Nothing, Hold On. The most risky strategy to take. You’re storing, not in loan, haven’t taken the POP. If prices go up, you’re ok, but you have no protection from price going back down and you’re still paying for storage.

- Deferred Price or On-Call Contract. You will typically not pay storage, but still have no protection from price going down. The cotton would no longer be eligible for LDP/POP.

- Take the POP. If you are willing to take the risk that price has set its bottom and will trek back up, you take the POP while you’ve still got one, hold and hope. But once you take the POP, that cotton is no longer eligible for Loan and you have no protection if prices head south again. Plus, you’re still paying for storage.

- Take the POP, Sell, and Buy a Call Option. Compared to #3, this would at least limit any further downside losses to just the Call premium. But you have to pay the premium.

- Loan. Forgo the POP/LDP and take the Loan. It’s important to understand, you are not giving up anything. If prices go down, you will realize a Marketing Loan Gain (MLG) greater than the LDP that you gave up. Also, as long as there’s a MLG In effect, that also means that interest and storage charges are forgiven.

–