Don Shurley, UGA Professor Emeritus of Cotton Economics

Don Shurley, UGA Professor Emeritus of Cotton Economics

–

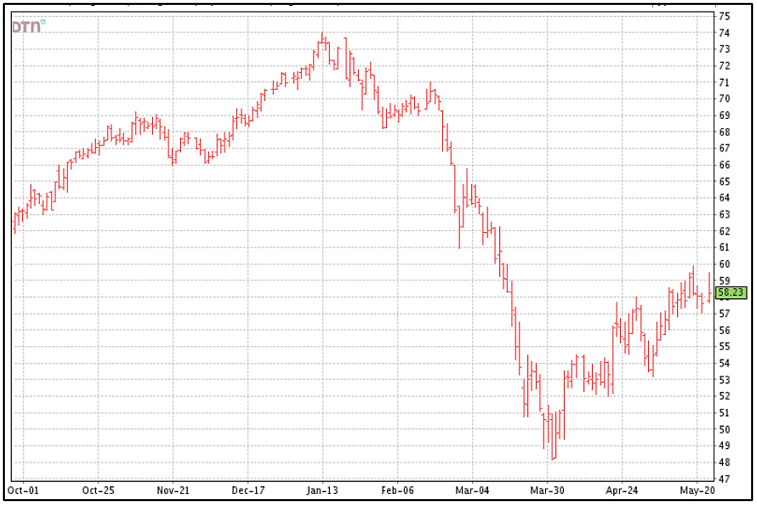

Prices (July futures) continue in a range of 54 to 59 cents. We’ve seen a decent uptrend since the most recent low of 53½ on May 5, and with a few hiccups, since the low near 48 on April 1.

The market (July) on May 26 had a chance at near 60 cents, but fell back and closed just above 58 cents. Now, today’s news might be old news by the time you read this but the point is—this could be further evidence that 59 to 60 cents might be the wall we bang our head against for now.

–

I hope I’m wrong, and sooner, rather than later, we break the resistance at 60 cents. But also, it appears the market should have support—2 levels at 54 cents and again at 52 cents.

Price is hindered by reduced and uncertain use and increased stocks due to this lower demand. This will also increase stocks going in to the 2020 crop marketing year. Prices for the 2020 crop depend on many factors, including US and World production and demand/use. Will use rebound? USDA is projecting it will.

As of May 14th, export sales totaled 17.34 million bales—116% of USDA’s projection for the 2019 crop marketing year. Shipments totaled 11.56 million bales—77% of the projection. As of May 14th, 11 weeks remain in the marketing year. Shipments must average 313,000 bales per week to reach the projection. For the 4 weeks ending May 14th, shipments averaged 285,000 bales.

All eyes will be on several things going forward, and prices will take direction based on what happens.

- Will shipments be sufficient to meet the 15 million bale projection? If not, the result will be higher US ending stocks.

- USDA has sharply reduced World demand/use in recent months, due to COVID-19. Will monthly reports for the remainder of this marketing year continue to slide, or will we see some recovery?

- The May reports were the first estimates (non-survey based) for the 2020 crop year. The May projections were for higher World Use and higher US exports for 2020. Will the higher numbers continue in future reports?

- US acreage and production for 2020 are currently projected to be not much different than 2019. Most expected the March estimate of planting intentions to be lower than it was. The first estimate of actual acres planted will be out June 30th.

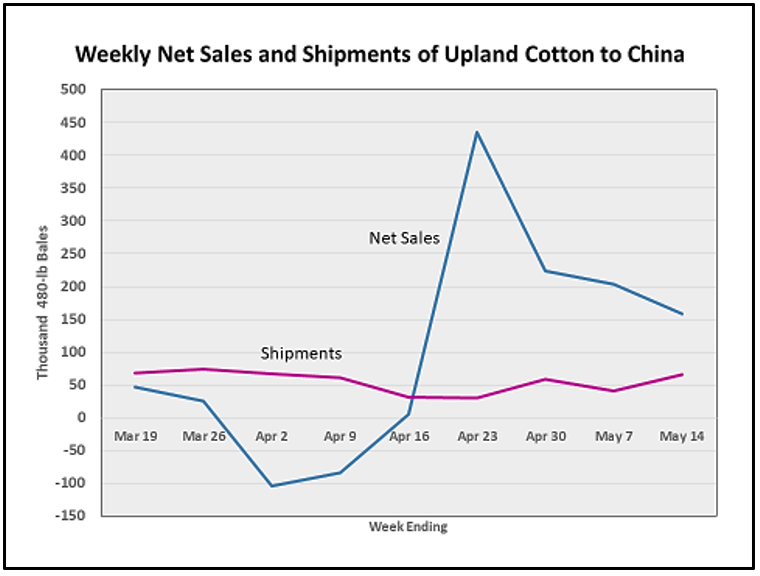

Sales to China have increased over the past month. Huge sales of over 400,000 bales (after weeks of very poor sales) were reported for the week ending April 23rd. Sales have since cooled off a bit, but still at a relatively good level. Shipments have been steady at about 55,000 bales weekly.

As of May 14th, total upland sales to China were 3.21 million bales but shipments were only 1.42 million bales. There are concerns being raised, and uncertainty whether or not China will follow through on its sales and the pace of shipments. Shipments for the remainder of the marketing year would need to average roughly 162,000 bales—almost 3x the current rate and time is running out.

–

Let’s hope not, but if 2020 turns out to be another year below 60 cents, producers should hone their understanding of the Loan, LDP/MLG program, and be prepared to evaluate this as part of a marketing plan.

–

- Precision Technology Weed Control Sprayer Demonstration - November 22, 2024

- Ed Borgato is the New UF/IFAS Weed Scientist in West Florida - November 22, 2024

- What Horse Show Organizers Should Know about the Horse Protection Act Revisions – Effective February 1, 2025 - November 22, 2024