Don Shurley, UGA Professor Emeritus of Cotton Economics

The remaining outlook for old crop, and near term outlook for new crop got dimmer this week with release of USDA’s supply/demand numbers/projections on Thursday, June 11. We’ve still got a long way to go with new crop but, yesterday’s numbers raise some caution flags.

We’re coming off a tough 2019 crop year. To come out better in 2020, we’ve clearly got some challenges ahead. Yesterday’s report, at least in my mind, seemed to reinforce that and solidify the direction for prices, and the hurdles we face toward a more healthy cotton outlook for the 2020 crop year and beyond.

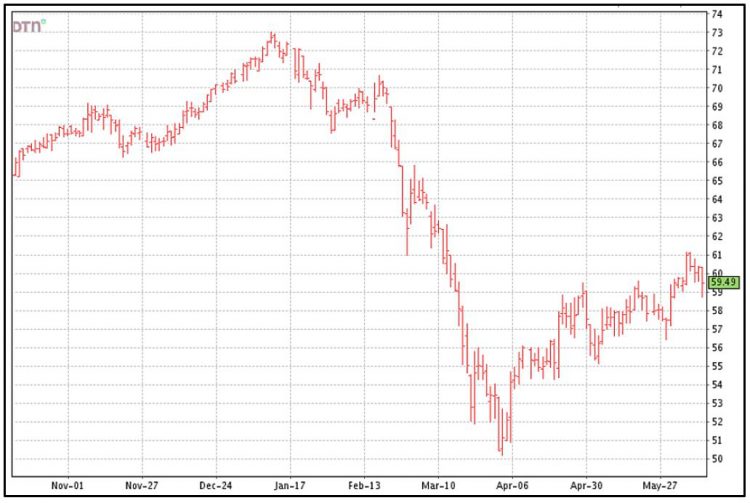

New crop December futures, after flirting with 61 cents, have since fallen back to the 59 to 60 cents area. There is clearly “resistance” now at 61 cents and “support” at 55 to 56. Price direction will hinge on demand, exports, and US crop size and condition. The first USDA estimate of actual acres planted will be released on June 30.

The main highlights and takeaways from Thursday’s report are:

-

The 2020 crop is still projected at 19.5 million bales.

-

US exports for the 2019 crop year remain at 15 million bales although we are not on target to meet that level.

-

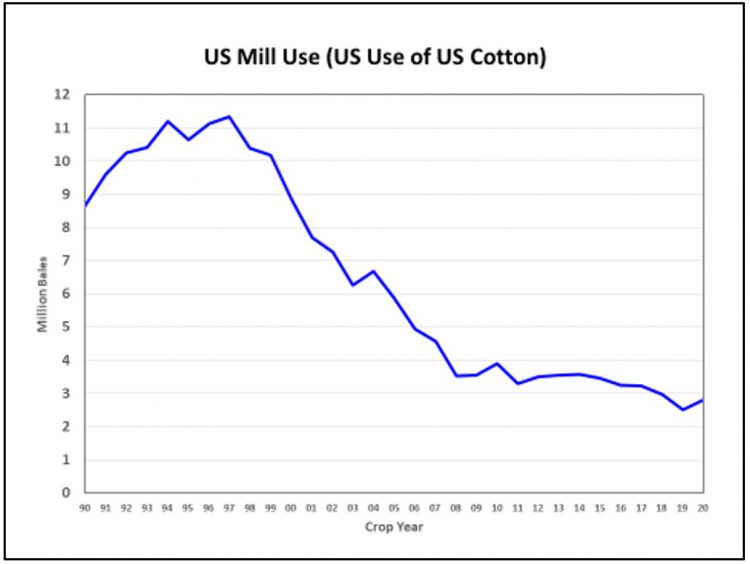

US mill use for the 2019 crop year was lowered 200,000 bales.

-

2020 crop year projected Beginning Stocks was raised 200,000 bales due to the downward revision in use for the 2019 crop.

-

US mill use for the 2020 crop year was also revised downward by 100,000 bales.

-

World demand (Use) for the 2019 crop year was revised down by 2.35 million bales to now only 102.65 million bales—17% less than 2018 and the lowest Use since 2003.

-

As a result of lowered Use, 2020 carry-in stocks will be higher than earlier projected.

-

World Use is expected to rebound for the 2020 crop year but yesterday’s report lowered that increase by 2 million bales.

-

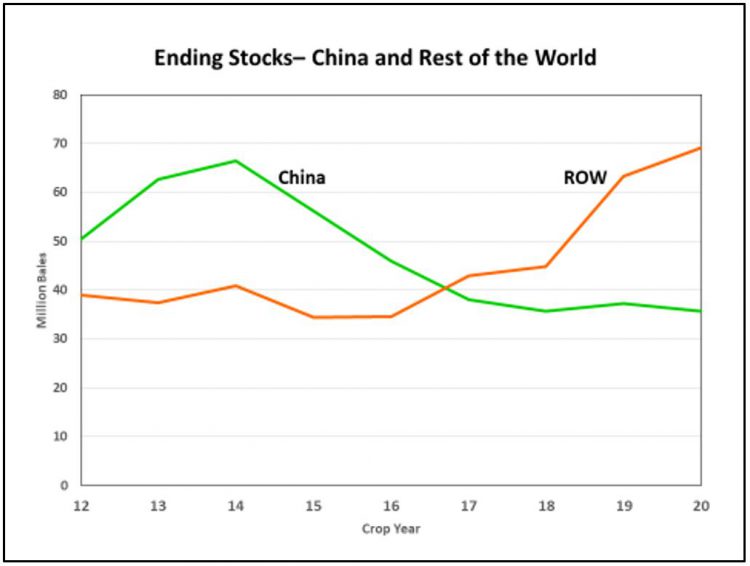

Ending stocks for the 2020 crop year are now projected to top 104 million bales—almost 5 million bales higher than for 2019 and the largest stocks since 2014 and second highest on record.

Yesterday’s report suggests that rebound in demand/Use from the coronavirus pandemic may be slower than earlier projected. I also wonder what can be done to invigorate the US textile mill industry, so we are not as dependent on exports. Large stocks in China used to be the problem. Stocks in the rest of the world (ROW) are now the problem.