Thursday—June 18, 2020

Here’s the situation and the question on everyone’s mind. It’s now past mid-June. Typically by this time, the market has presented growers with at least one “decent” opportunity to market/price a portion of the upcoming crop. Well, I doubt “decent” or “good” has been in the vocabulary yet for most producers. December futures at 60 cents or less doesn’t excite anybody.

Cotton prices are being influenced primarily by demand/Use, export sales and shipments (specifically to China), US crop weather, and political and economic unrest here and elsewhere. New crop December futures have flirted with 61 cents and gotten everybody excited that the market might finally trek higher and break out of the 55 to 60 cents range it’s been in for 3 months. Not yet.

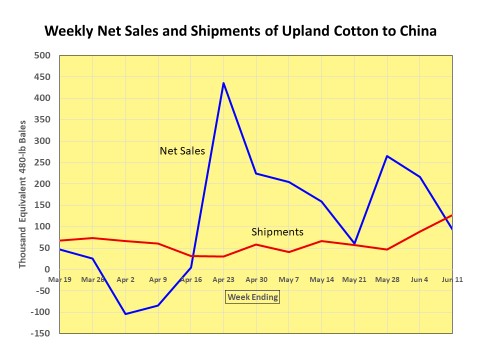

Among other factors, the better prices recently have been the result of improved export sales and shipments to China. This has given hope that Chinese mills would now finally become the buyers we hoped they would be. But after good numbers for the week ending May 28th, net sales have declined for the last two weeks. Today’s report for the week ending June 11, shows the lowest sales since May 21, and the second lowest since April 16. So, how much faith does the market put in the recent good numbers? It’s hard to say.

Shipments have trended up, and today’s report for the week ending June 11 was relatively strong. Purchases of cotton with destination China have totaled 3.58 million bales—1.74 million bales have been shipped and 1.84 million bales are outstanding. With 7 weeks remaining in the 2019 crop marketing year, shipments would have to average 262,000 bales per week. This is unlikely, which leads us to believe that some sales will be carried forward to the 2020 crop year and/or cancelled.

Shipments have trended up, and today’s report for the week ending June 11 was relatively strong. Purchases of cotton with destination China have totaled 3.58 million bales—1.74 million bales have been shipped and 1.84 million bales are outstanding. With 7 weeks remaining in the 2019 crop marketing year, shipments would have to average 262,000 bales per week. This is unlikely, which leads us to believe that some sales will be carried forward to the 2020 crop year and/or cancelled.

As of June 14, overall the crop was 17% poor to very poor condition—compared to 15% last year. Texas is 25% poor to very poor, South Carolina 25%, and Missouri 38%. Rainfall over much of Texas is forecast to be good for the next 10 days, but then turning dry again after that.

USDA will release its first estimate of actual acres planted on June 30. It’s hard to say how much that may influence the market, but a number less than the March intentions number could support prices—but we all know production has greater influence from abandonment and yield. If demand improves and if exports are good, then an uncertain US crop should be supportive. If demand and exports are not good, then a lower than expected US crop may not be enough to move cotton to higher prices.

This analysis and commentary is not affiliated with the University of Georgia

–

Don Shurley

Marketing and Policy Analyst

Cotton Economist- Retired

Professor Emeritus of Cotton Economics, University of Georgia – Tifton Campus

- Cotton Marketing News:Acreage Numbers are a Surprise – What Now? - July 11, 2025

- Gulf Coast Cattlemen’s Conference – August 8 - July 11, 2025

- Cotton Marketing News:USDA June Numbers—Neutral, Not Good but Not Bad - June 20, 2025