by Ethan Carter | Jun 20, 2025

Ethan Carter, Regional Crop IPM Extension Agent; Hardeep Singh, Cropping Systems Specialist; Michael Dukes, Director of UF/IFAS Center for Land Use Efficiency; and Lakesh Sharma, State Ag BMP Coordinator In recent years, the University of Florida has worked...

by external | Jun 20, 2025

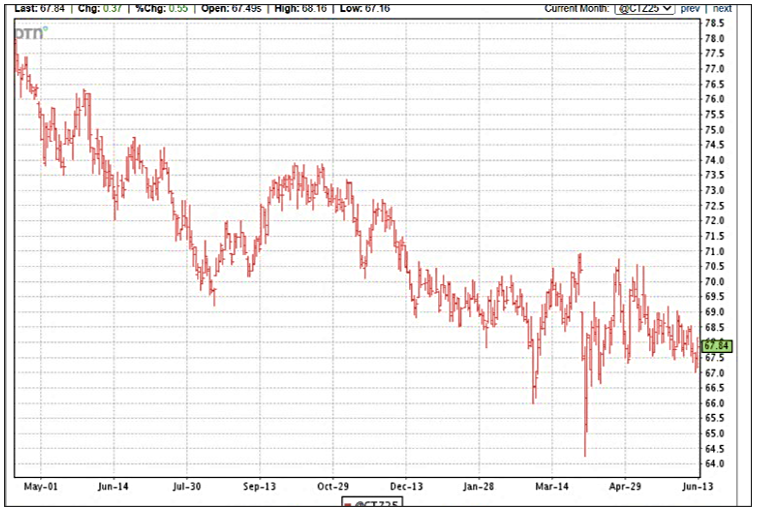

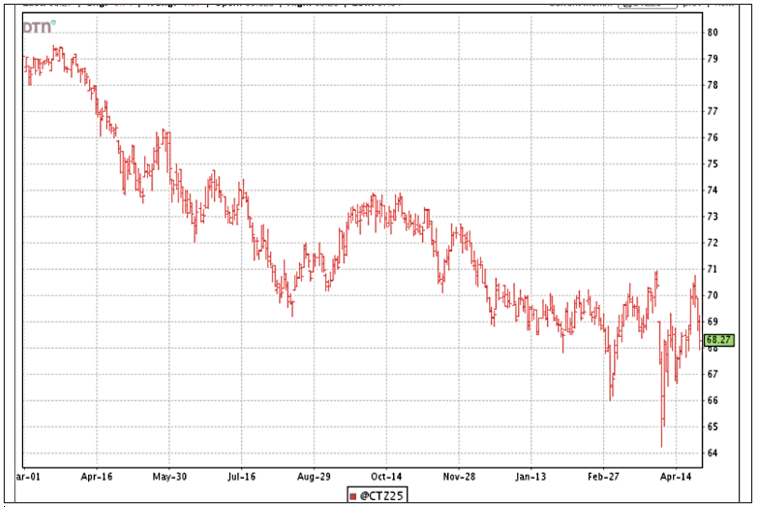

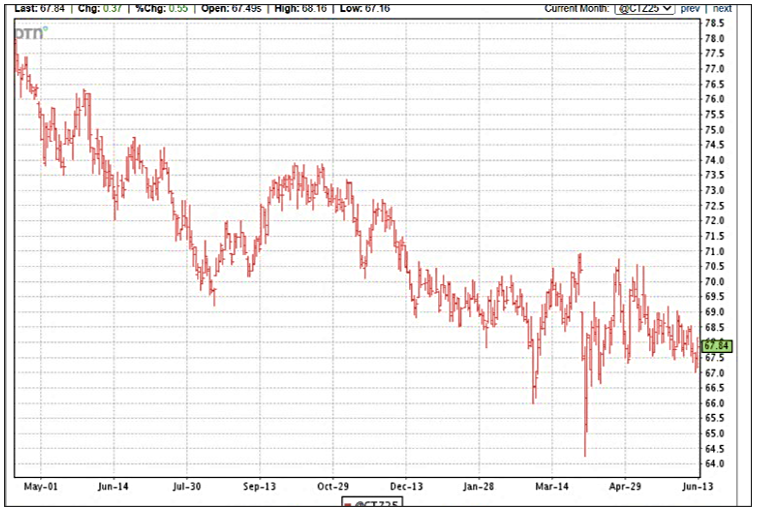

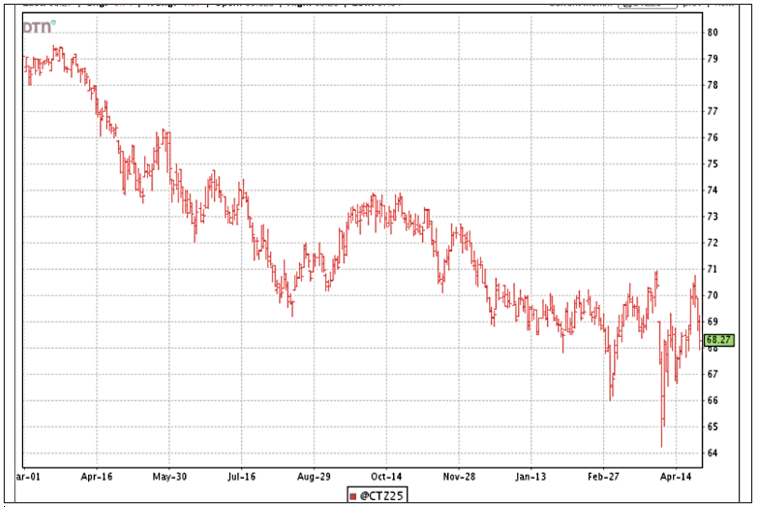

Don Shurley, UGA Emeritus Cotton Economist Last week’s USDA monthly supply/demand estimates for June do not contain enough good news to support higher prices. But also, there’s not enough negative news to call for price to move lower. So, prices (December 2025...

by Ethan Carter | Jun 20, 2025

UF/IFAS is hosting a Row Crop Field Day on July 21st at the North Florida Research and Education Center in Quincy (155 Research Road, Quincy, FL-32351). The field day will be held from 9:15 AM to 3:30 PM (8:15 AM to 2:30PM CDT) and will focus on cotton and...

by external | Jun 6, 2025

Ed Borgato, UF/IFAS Weed Scientist, West Florida Research and Education Center – Jay A suitable variety planted in the appropriate window, with fertilizer applied in the appropriate timing, at the required rate for desired yield, plus weeds, insects, and diseases...

by external | May 2, 2025

Don Shurley, UGA Emeritus Cotton Economist In USDA’s March 31 Prospective Plantings report, farmers said they intended to plant 9.87 million acres of cotton this year—down 12% from last year. Some industry observers expected as much as a 15% decline. I wonder now...