by Ray Bodrey | Jan 12, 2024

The Agriculture Improvement Act of 2018, also known as the 2018 Farm Bill, made producer funds available for emergency assistance (ELAP). This program provides financial assistance to eligible producers of livestock, honeybees and farm-raised fish for losses due to...

by external | Jan 5, 2024

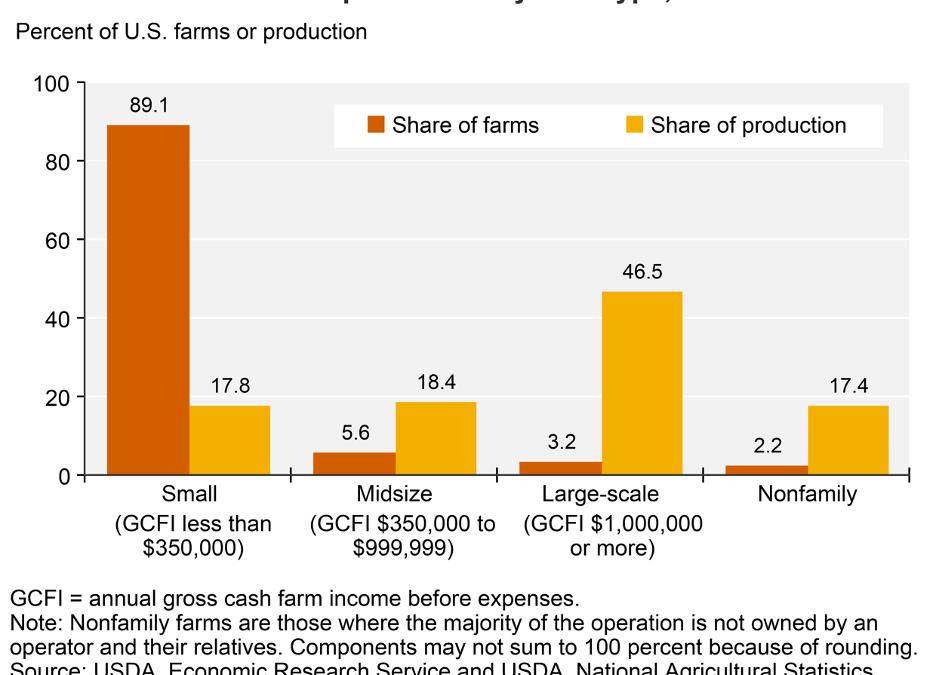

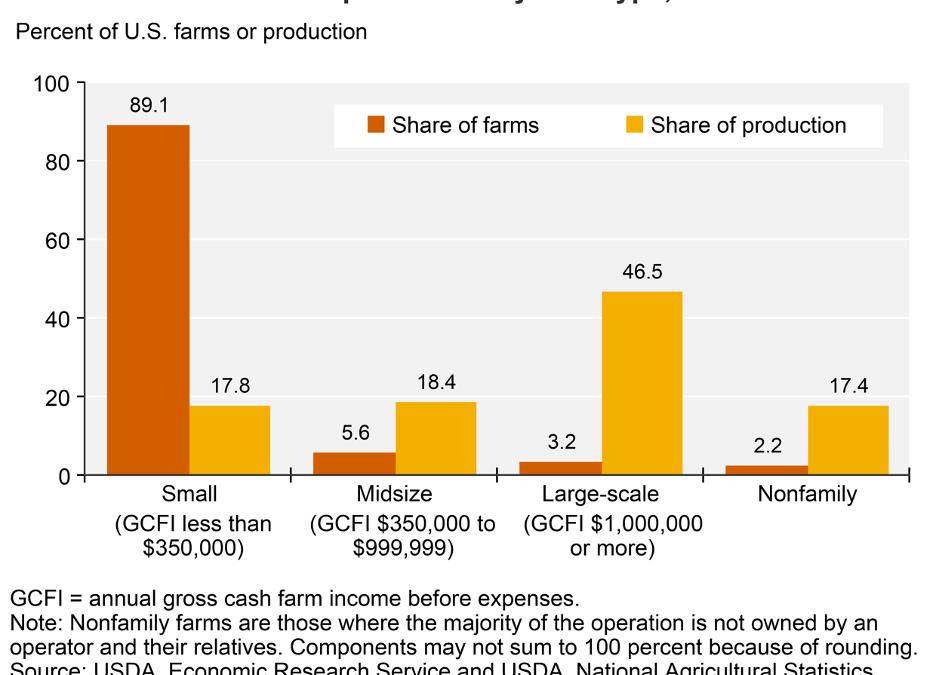

Source: Southern Ag Today – Joe Outlaw and Bart Fischer, Texas A&M Food Policy Center In remarks during a March 16, 2023, hearing before the Senate Committee on Agriculture, Nutrition, and Forestry, Secretary Vilsack testified that while “our policies have...

by external | Feb 7, 2020

Source: FEBRUARY 4, 2020 by Farmers for Monarchs The February 28 deadline for open enrollment in the USDA Farm Service Agency Conservation Reserve Program (CRP) is fast approaching in a year that will feature one of the largest program acreages ever offered to...

by Doug Mayo | Jun 21, 2019

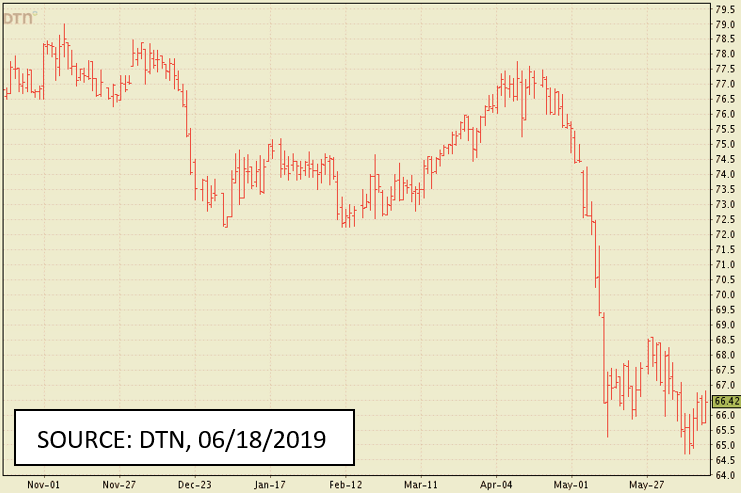

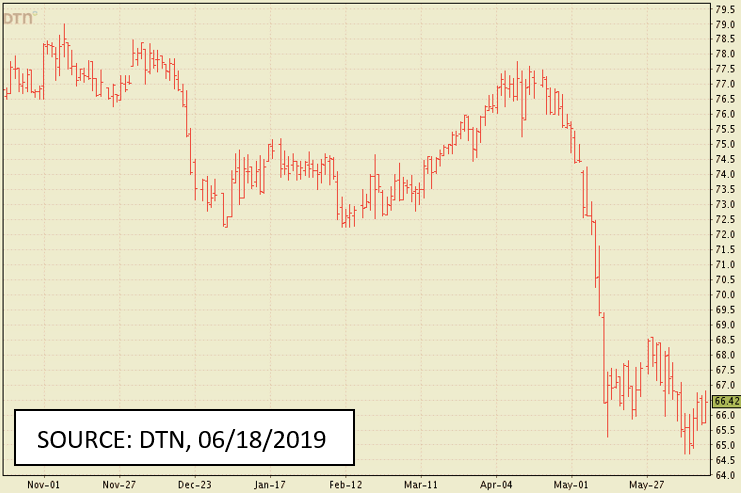

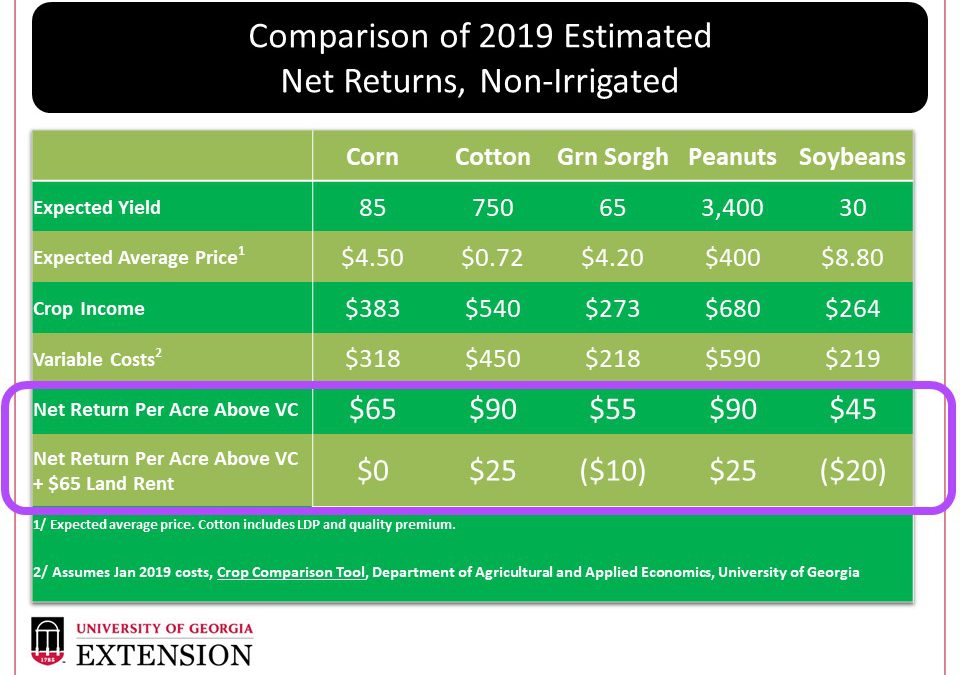

Don Shurley, UGA Professor Emeritus of Cotton Economics New crop December futures have rallied from the recent new low below 65 cents. December futures are currently at 66+ and are likely to track in the 65 to 69 cent range in the near term, unless a major unforeseen...

by Ethan Carter | Mar 15, 2019

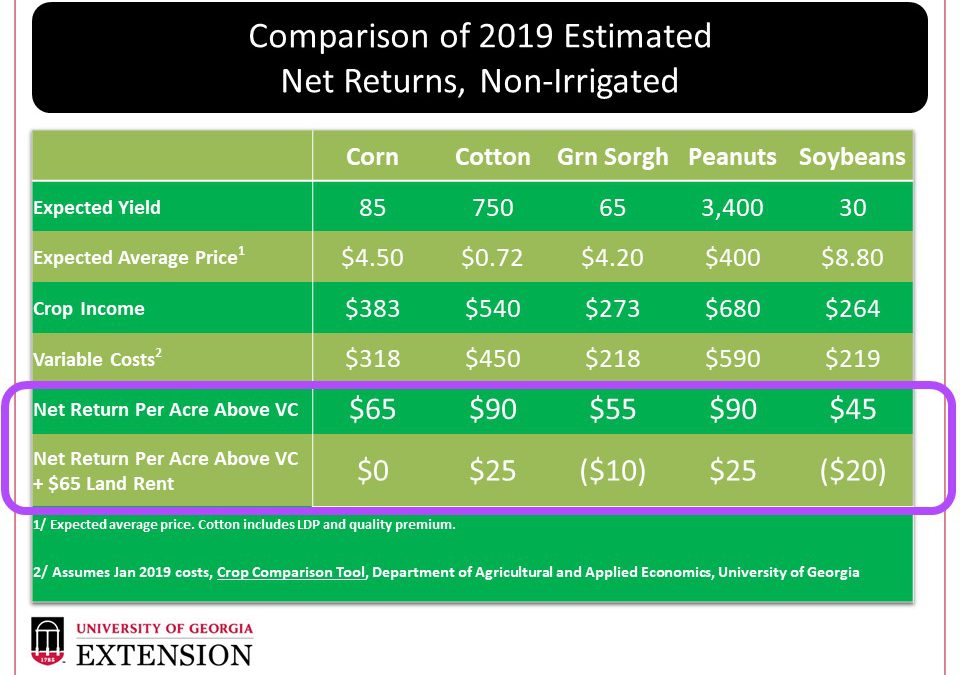

The 2019 Panhandle Row Crop Short Course was Thursday, March 7, 2019. Extension Specialists from Florida and Georgia spoke to attendees providing production recommendations and various management tips for row crops farmers. Continuing education units (CEUs) were...

by Ethan Carter | Sep 14, 2018

On September 7, 2018, courtesy of Clover Leaf and Sowega Cotton Gins, the Jackson County Extension Office hosted a two-hour meeting for cotton growers. Don Shurley Professor Emeritus of the University of Georgia and John VanSickle with the University of Florida shared...