by external | May 2, 2025

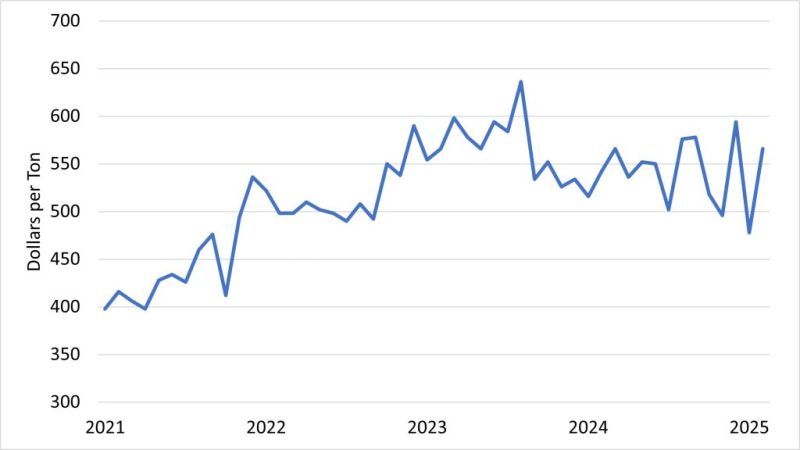

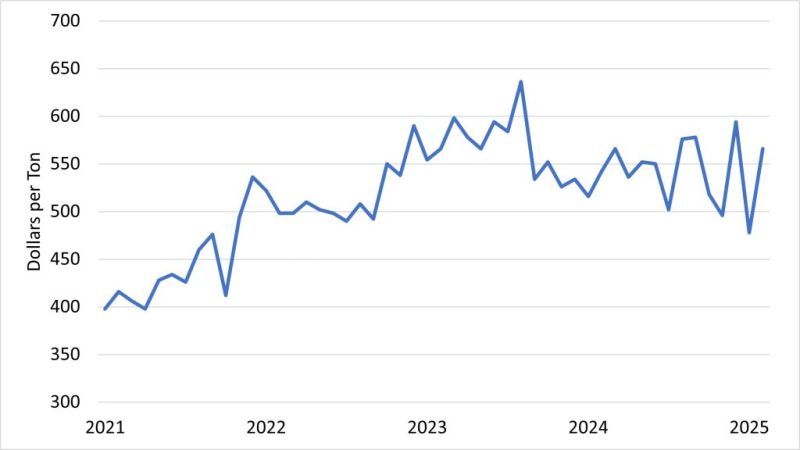

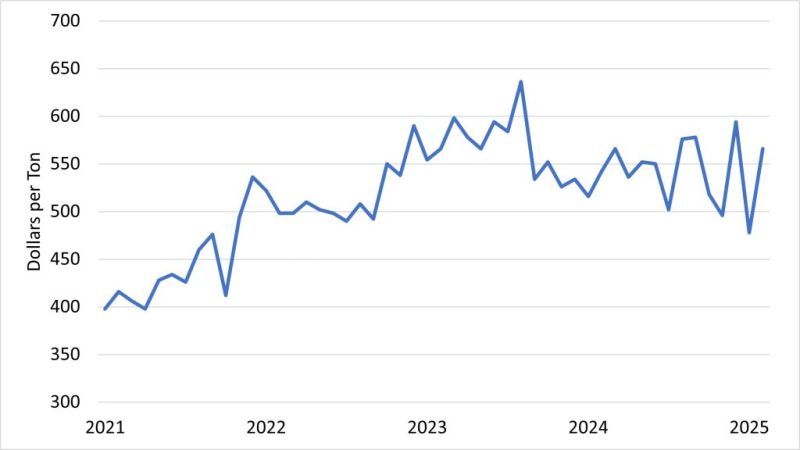

Kevin Athearn, UF/IFAS Regional Specialized Agribusiness Agent, North Florida Research and Education Center – Suwannee Valley Prices for stored peanuts remain relatively strong, but projected increases in peanut acreage this year dampen the outlook for the 2025...

by Nicholas Dufault | Apr 11, 2025

Dr. Nicholas Dufault and Rezel Borines, UF/IFAS Plant Pathology Department With potato and watermelon seasons underway in North Florida, growers are keeping a close eye on disease risk. One way to get ahead of potential problems is with the Spore Report—a new...

by external | Nov 22, 2024

Source: American Horse Council Bulletin – 10/7/24 Revisions to the Horse Protection Act Effective February 1, 2025. The American Horse Council (AHC) is releasing this advisory to inform members of important changes to the Horse Protection Act (HPA). AHC asks...

by external | Oct 25, 2024

Paul Goeringer, Ag Legal Risk Management Extension Specialist, University of Maryland – Southern Ag Today, October 25, 2024 Each state has a right-to-farm law that protects agricultural operations from lawsuits that imply a farm as a nuisance. In many...

by Doug Mayo | Oct 4, 2024

This week’s featured video was published by U.S. CattleTrace, which is a non-profit organization, formed by multiple state cattlmen’s associations and private industry, with the mission of securely maintaining and managing the data collected for disease...

by external | Sep 13, 2024

Source: Rusty Rumley, Senior Staff Attorney, The National Ag Law Center, Southern Ag Today As fall approaches, so does hunting season. As hunters are scouting for the best locations, landowners may be searching for opportunities to generate additional...