Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

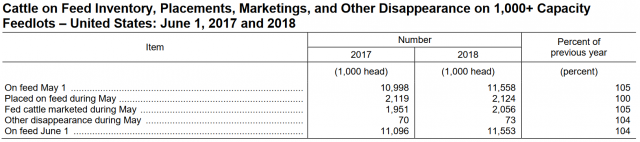

On June 22, USDA’s National Agricultural Statistic Service released their Cattle on Feed report that showed a feedlot inventory of 11.553 million head of cattle in feedlots of more than 1,000 head capacity. This is the largest June 1 feedlot inventory in the data series that began in 1996. It is the eighteenth straight month of year over year increases and, in fact, feedlot inventories have been increasing year over year for 26 of the last 28 months. Using a twelve month moving average of feedlot inventories (which removes seasonality and allows month to month comparisons of feedlot totals) shows that the current monthly average feedlot inventory is the highest since November 2012.

The on-feed total for June 1 was 104.1 percent of last year. The rapid buildup in feedlot inventories last fall and early 2018 peaked in March compared to last year with a feedlot inventory 108.8 percent of one year earlier. As was noted at the time, early placements fueled by poor winter pasture conditions doesn’t change to overall number of cattle and is offset later with smaller placements. May placements were just fractionally higher than last year and followed two months of year over year decreases. May placements were higher than average analyst expectation but not out of the range of guesses. Longer term, cattle numbers are still increasing and a general trend of growing feedlot inventories is expected for several more months at least. Placement patterns the last few months have impacted the timing of feedlot production and the fed cattle market has been struggling a bit under the weight of bunched fed cattle supplies in the second quarter.

The on-feed total for June 1 was 104.1 percent of last year. The rapid buildup in feedlot inventories last fall and early 2018 peaked in March compared to last year with a feedlot inventory 108.8 percent of one year earlier. As was noted at the time, early placements fueled by poor winter pasture conditions doesn’t change to overall number of cattle and is offset later with smaller placements. May placements were just fractionally higher than last year and followed two months of year over year decreases. May placements were higher than average analyst expectation but not out of the range of guesses. Longer term, cattle numbers are still increasing and a general trend of growing feedlot inventories is expected for several more months at least. Placement patterns the last few months have impacted the timing of feedlot production and the fed cattle market has been struggling a bit under the weight of bunched fed cattle supplies in the second quarter.

May marketings were 105.4 percent of last year, in line with pre-report expectations. Annualized monthly average feedlot marketings began increasing in late 2015, following the herd expansion that began in 2014. Current twelve month monthly average feedlot marketings are at the highest level since November, 2011. Increased feedlot marketings translate into increased cattle slaughter and increased beef production Increased beef production in the second half of the year will depend on the how much cattle slaughter increases and on how much carcass weights rebound from last year’s decline. At the current time, annual beef production is projected to be up 4.0-4.5 percent year over year.

May feedlot placements included a 9.8 percent year over year increase in placements under 700 pounds, likely augmented by poor summer grazing conditions in some areas that likely deflected some cattle into feedlots. At the same time, placements of cattle over 700 pounds were down 4.6 percent from last year. This suggests that feedlot cattle supplies will tighten relatively in the third quarter. Fed cattle prices are expected to be lower year over year in the second half of the year but the timing of fed cattle marketings will reduce the price pressure relative to the second quarter.

Use the following link to access the full report: Cattle on Feed

- Surprise!January WASDE Report Moves Corn and Soybeans Lower – Cotton Flat - January 16, 2026

- Don’t Ignore Cow Size When Comparing Calf Weaning Weights - January 9, 2026

- Federal Estate Tax and Gift Tax Limits Announced For 2026 - December 19, 2025