Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

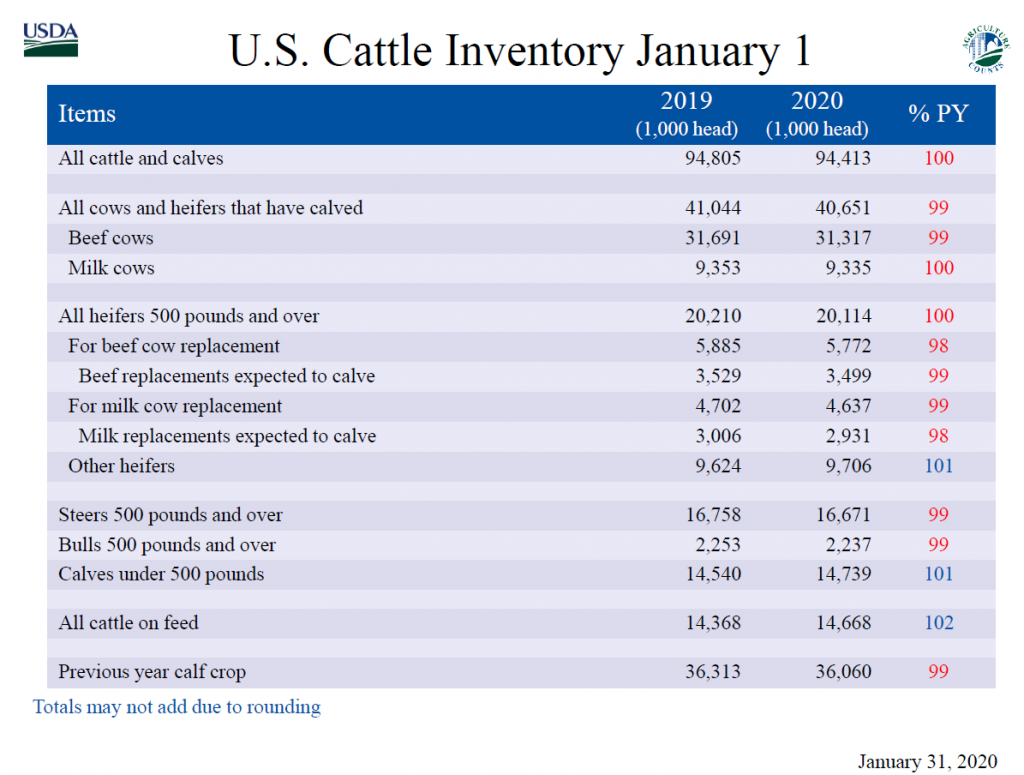

The latest Cattle report issued by USDA confirms that cyclical herd expansion in the U.S. is over. The total inventory of all cattle and calves on January 1, 2020 was 94.413 million head, down 0.4 percent from one year ago. The numbers indicate that, while cattle inventories have stopped growing, no major liquidation is underway.

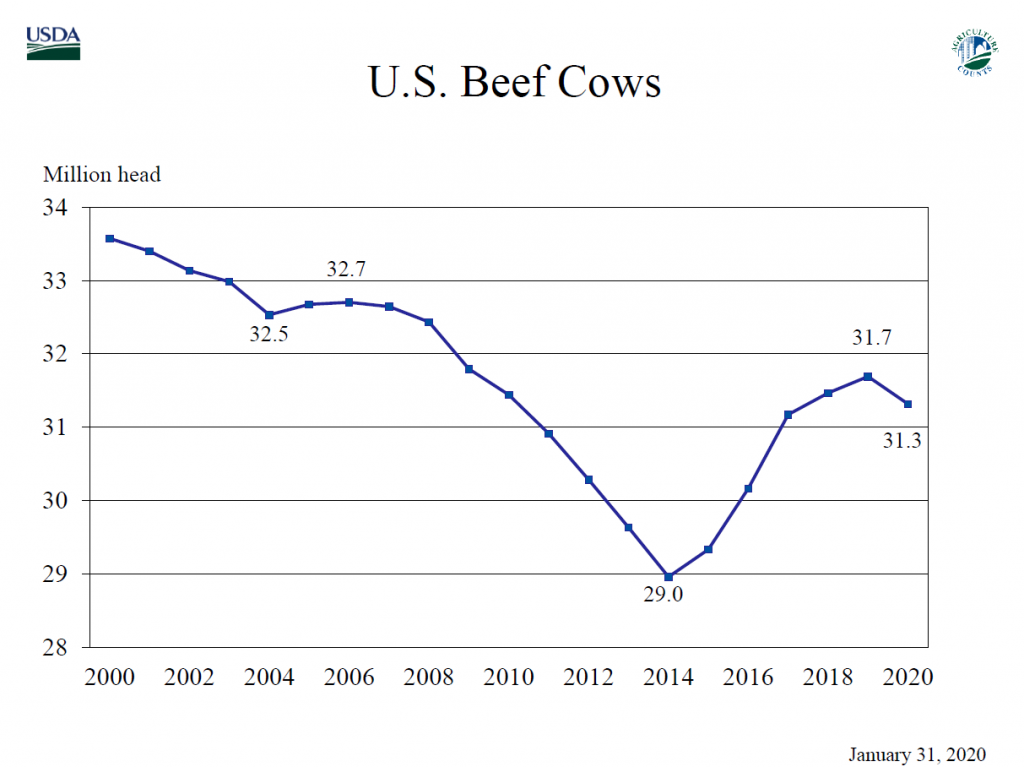

The beef cow inventory is 31.3 million head, down 374,000 head or 1.2 percent lower year over year. The peak beef cow inventory for 2019 was 31.7 million (revised down by 75,000 head from the previous report). This means that the total herd expansion in this cycle was an increase of 2.73 million head from the 2014 low of 29.0 million cows. That is a total cyclical expansion of 9.4 percent or an average of 1.9 percent per year for the five years of expansion.

–

Beef replacement heifers were pegged at 5.77 million head, down 1.9 percent year over year. The inventory of beef replacement heifers is 18.4 percent of the beef cow inventory, a level that historically has not indicated significant liquidation. However, in 2019, replacement heifers were 18.6 percent of the beef cow inventory but sharply higher beef cow slaughter at the end of the year pushed the culling rate fractionally over 10 percent and resulted in modest reduction in the herd inventory. The number of beef heifers expected to calve in 2020 is 3.5 million head, 0.8 percent lower year over year.

The dairy cowherd on January 1 was 9.33 million head, down a scant 18,800 head from last year. Dairy replacement heifers were 4.64 million head, down 0.9 percent year over year. The dairy replacements heifer inventory is 49.7 percent of the dairy cowherd, slightly lower than the average of the last decade. The number of dairy heifers expected to calve this year is down 2.5 percent year over year.

The 2019 calf crop was 36.06 million head, down 0.7 percent year over year. The cyclical peak 2018 calf crop of 36.3 million was the largest calf crop since 2007 when the total calf crop was 36.8 million head.

The January 1, 2020 inventory of other heifers was 9.71 million head, up 0.9 percent year over year; the inventory of steers over 500 pounds was 16.67 million head, down 0.5 percent; and calves under 500 pounds had an inventory of 14.74 million head, up 1.4 percent year over year. The total of other heifers, steers, and calves minus the cattle on feed inventory leads to an estimated supply of feeder cattle outside of feedlots of 26.45 million head, down 0.4 percent from one year ago.

The cattle on feed inventory of 14.67 million head, up 2.1 percent year over year, is the largest since the 2008 level of 14.8 million head. These numbers show that the last pulse of larger cattle numbers are currently in feedlots and cattle slaughter will be up in the first quarter before declining through the second half of the year. However, higher carcass weights are projected to offset a slight decline in cattle slaughter and push total 2020 beef production higher to new record levels. Beef production is likely, however, to be lower year over year by the fourth quarter of the year.

–

Market conditions in 2020 will determine the trajectory of the cattle industry from this point forward. Modestly higher prices are projected in 2020, combined with improved international market potential, could restart herd expansion. Alternatively, continued political and economic turbulence or shocks, such as coronavirus, could drag markets down and hold cattle inventories flat or fall into more liquidation.

- Surprise!January WASDE Report Moves Corn and Soybeans Lower – Cotton Flat - January 16, 2026

- Don’t Ignore Cow Size When Comparing Calf Weaning Weights - January 9, 2026

- Federal Estate Tax and Gift Tax Limits Announced For 2026 - December 19, 2025