From: farmers.gov/cfap

The Coronavirus Food Assistance Program (CFAP) will provide vital financial assistance to producers of agricultural commodities who have suffered a five-percent-or-greater price decline or who had losses due to market supply chain disruptions due to COVID-19 and face additional significant market costs. Eligible commodities include:

-

Non-specialty Crops: malting barley, canola, corn, upland cotton, millet, oats, soybeans, sorghum, sunflowers, durum wheat, and hard red spring wheat

-

Wool

-

Livestock: cattle, hogs, and sheep (lambs and yearlings only)

-

Dairy

-

Specialty Crops

-

Fruits: apples, avocados, blueberries, cantaloupe, grapefruit, kiwifruit, lemons, oranges, papaya, peaches, pears, raspberries, strawberries, tangerines, tomatoes, watermelons

-

Vegetables: artichokes, asparagus, broccoli, cabbage, carrots, cauliflower, celery, sweet corn, cucumbers, eggplant, garlic, iceberg lettuce, romaine lettuce, dry onions, green onions, peppers, potatoes, rhubarb, spinach, squash, sweet potatoes, taro

-

Nuts: almonds, pecans, walnuts

-

Other: beans, mushrooms

-

Eligible farmers and ranchers will receive one CFAP payment, drawn from two possible funding sources. The first source of funding is $9.5 billion in appropriated funding provided in the CARES Act and compensates farmers for losses due to price declines that occurred between mid-January 2020, and mid-April 2020 and for specialty crops for product that was shipped and spoiled or unpaid product. The second funding source uses the Commodity Credit Corporation Charter Act to compensate producers for $6.5 billion in losses due to on-going market disruptions.

–

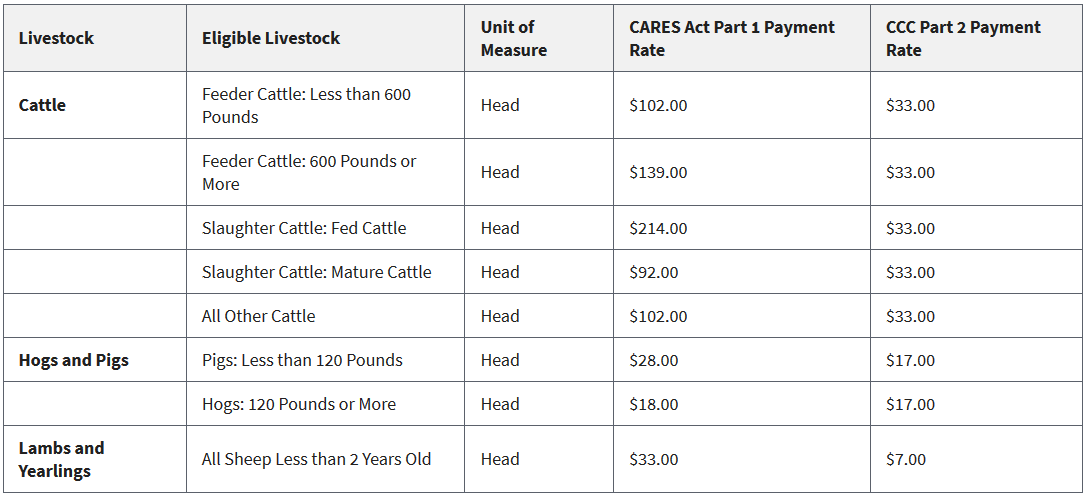

CFAP Payments for Livestock

A single payment for livestock will be calculated using the sum of the producer’s number of livestock sold between January 15 and April 15, 2020, multiplied by the payment rates per head, and the highest inventory number of livestock between April 16 and May 14, 2020, multiplied by the payment rate per head.

Producers must provide the following information for CFAP:

- Total sales of eligible livestock, by species and class, between January 15, 2020, to April 15, 2020, of owned inventory as of January 15, 2020, including any offspring from that inventory; and

- highest inventory of eligible livestock, by species and class, between April 16, 2020, and May 14, 2020.

The following table lists eligible livestock and payment rates for CFAP.

CFAP eligible livestock and payment rates. https://www.farmers.gov/cfap/livestock

–

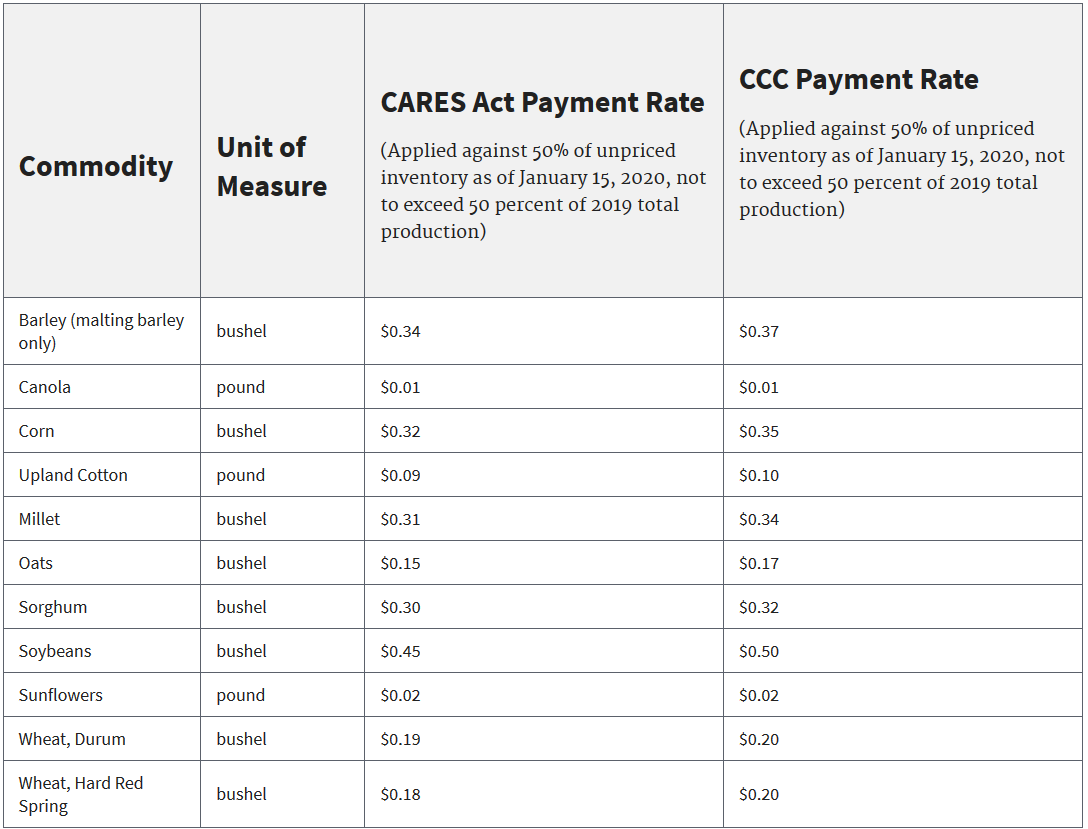

CFAP Payments for Non-Specialty Crops

Producers will be paid based on inventory subject to price risk held as of January 15, 2020. A single payment will be made based on 50 percent of a producer’s 2019 total production or the 2019 inventory as of January 15, 2020, whichever is smaller, multiplied by 50 percent and then multiplied by the commodity’s applicable payment rates.

Producers must provide the following information for CFAP:

- Total 2019 production for the commodity that suffered a five percent-or-greater price decline, and

- Total 2019 production that was not sold as of January 15, 2020.

The following table lists eligible non-specialty commodities and payment rates for CFAP.

CFAP payment rates for eligible non-specialty commodities. Table from: https://www.farmers.gov/cfap/non-specialty

–

Additional CFAP Information

Beginning May 26, USDA’s Farm Service Agency will be accepting applications from agricultural producers who have suffered losses. The application form and a payment calculator for producers will be available online once signup begins. A video preview of the payment calculator is provided below.

–

USDA is also establishing a process for the public to identify additional commodities for potential inclusion in the program. Visit farmers.gov/cfap for additional information on the Coronavirus Food Assistance Program, other eligible commodities, CFAP eligibility, payment limitations and structure, and how to apply.

Coronavirus Food Assistance Program website

Coronavirus Food Assistance Program FAQ

CFAP Rules and Regulations from the Federal Registry

- Cotton Marketing News:Acreage Numbers are a Surprise – What Now? - July 11, 2025

- Gulf Coast Cattlemen’s Conference – August 8 - July 11, 2025

- Cotton Marketing News:USDA June Numbers—Neutral, Not Good but Not Bad - June 20, 2025