Don Shurley, UGA Professor Emeritus of Cotton Economics

“Profit” = (Price x Yield) – Costs. Price is always an important part of the equation. A good year, production-wise, can be offset by low price, or higher than expected costs.

Costs for 2022 will be extremely high. Also, farmers will be doing what they can to trim inputs and costs in hopes that yield can still be maintained. Weather is also a concern, as usual, but input management now creates a degree of added uncertainty.

A high price is needed for 2022 production. Pricing low can be costly financially. But in markets, we don’t know what’s low and what’s high until after the fact. Case in point, some growers priced a portion of expected 2021 production at 85 to 95 cents and felt good about it—but then watched price go to $1.20. For this reason, growers are reluctant to jump in too early this year for fear of making the mistake again. They know price is going to be especially important, because any profit margin is going to be slim.

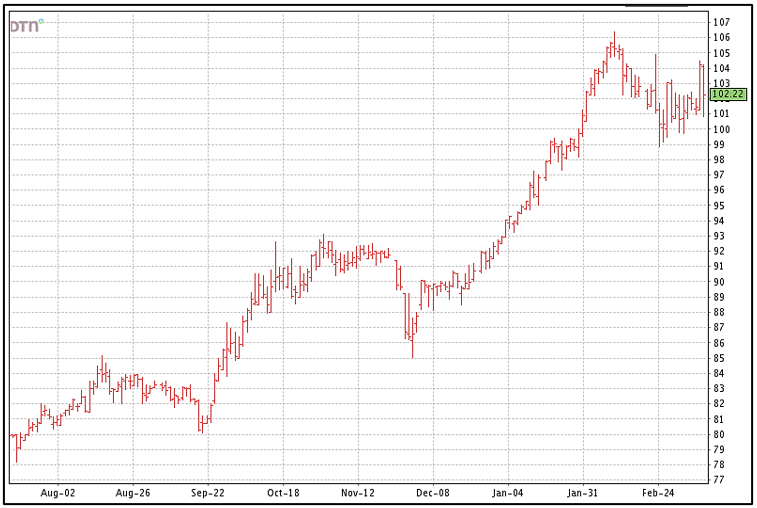

New crop December futures has thus far made a run to $1.06 before retreating back to the $1.00 area. December futures presently stands at about $1.02. Some producers have already priced a portion of expected 2022 production. I sense those who have not are waiting on another run and those who have already priced a portion are uncomfortable doing more.

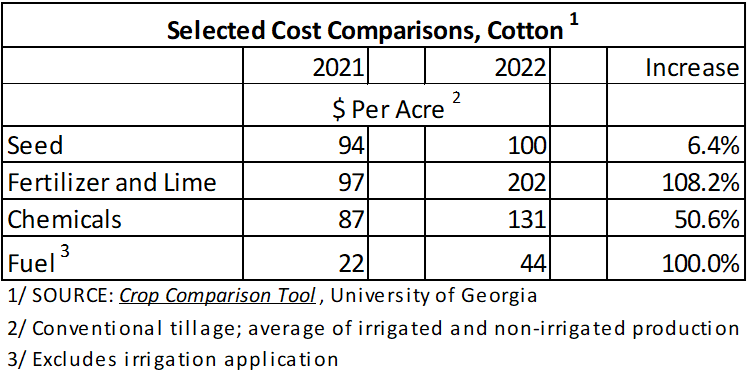

University of Georgia Extension estimates are used to compare costs this season to last season. The estimates show the increases for seed, fertilizers and lime, chemicals, and fuel. Assuming a generous 2-bale (1,000 lbs) average yield, these cost increases alone add an extra 17.7 cents per lb to the price needed for cotton.

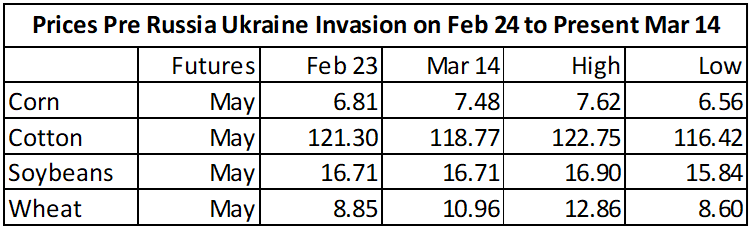

Events of the Russia-Ukraine situation seem to often override other factors in the market. It is not at all clear, however, if these events are positive or negative for cotton and for what reason. Using Feb 23rd (before the Russia invasion began) as the baseline, corn and wheat have increased. Cotton and soybeans have not.

–

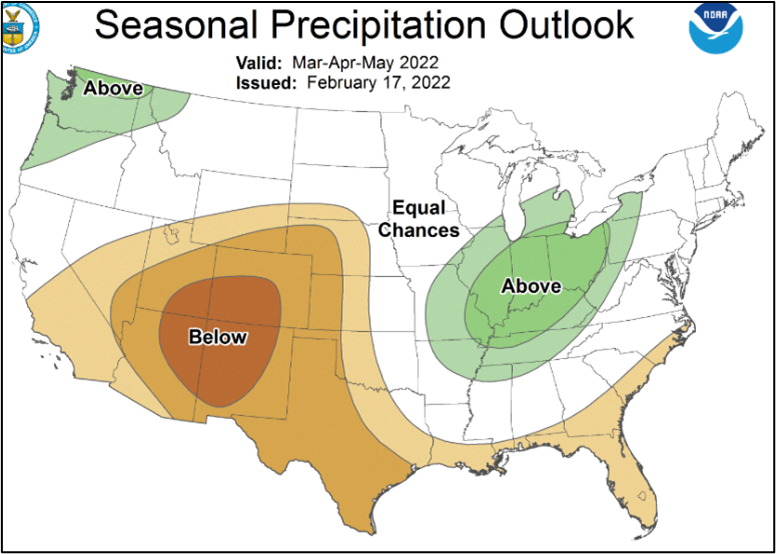

USDA’s March supply/demand numbers last week were mostly bullish. This market continues to ride on the expectation of strong demand continuing for the 2022 crop and underlying uncertainty in US production, due to expected continued drier than normal conditions.

–